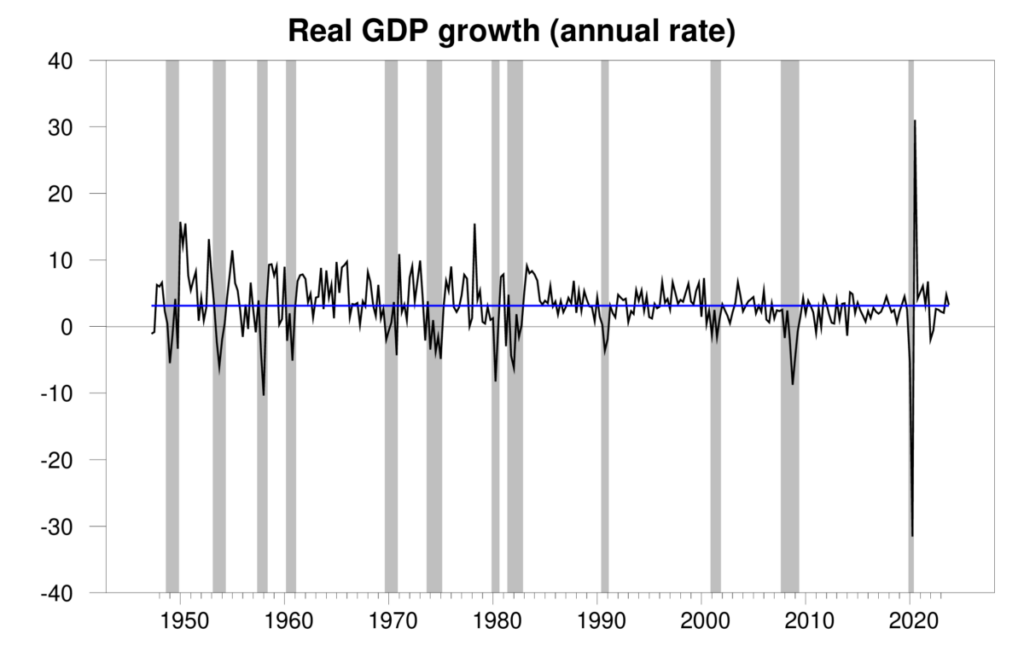

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 3.3% annual rate in the fourth quarter. That growth brings the level of GDP 3.1% above the value a year ago. Those numbers are right at the historical average GDP growth over the last 70 years of 3.1%, and well above the 2% average over the last 20 years. The year 2023 ended up far better than many people expected.

Real GDP growth at an annual rate, 1947:Q2-2023:Q4, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

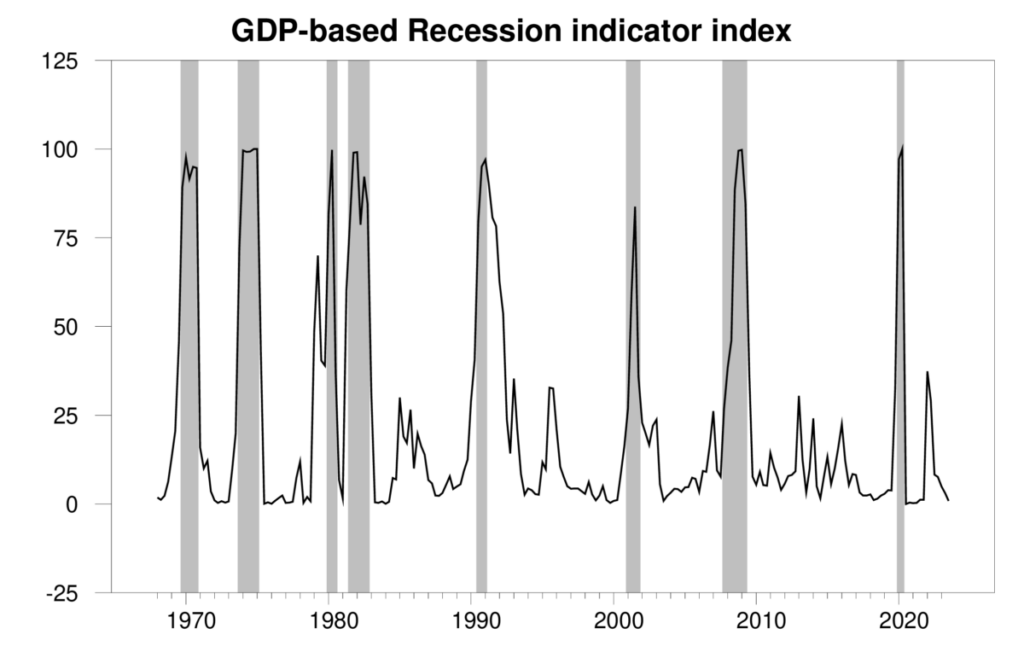

The strong growth of the last two quarters brought put the Econbrowser recession indicator index all the way down to 0.9%. The current U.S. expansion has now continued for 3-1/2 years, despite hitting a rough patch in the first half of 2022.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2023:Q3 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

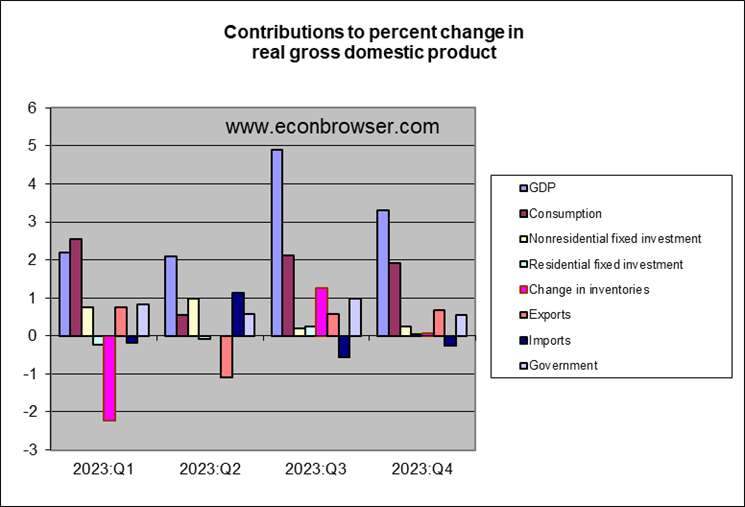

Inventory accumulation contributed the the strong Q3 numbers. By contrast, Q4 all comes from growth in final sales. Even residential fixed investment, which we might have expected to bear the brunt of the Fed’s tightening moves, continues to make a small positive contribution to GDP growth.

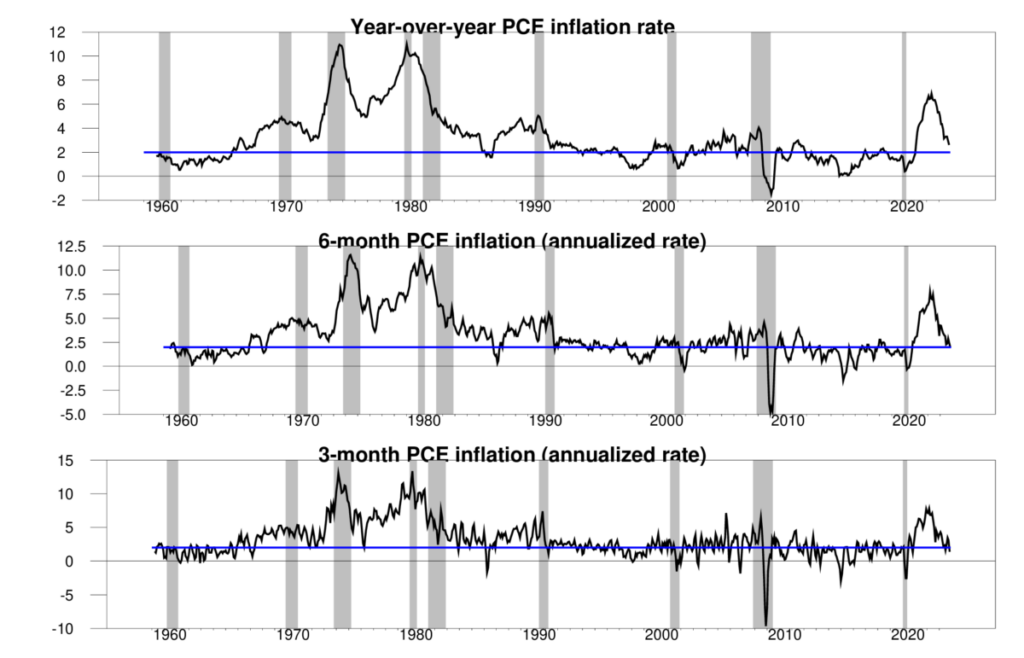

The year-over-year inflation rate as measured by the implicit PCE deflator is still above where the Fed wants it. But it’s been coming down, and if we were judging just by the 6-month or 3-month rate, we’d say mission accomplished.

Three measures of the annual inflation rate. Top panel: 100 times the year-over-year change in the natural logarithm of the implicit price deflator on personal consumption expenditures. Middle panel: 200 times the 6-month change. Bottom panel: 400 times the 3-month change. Blue lines correspond to a 2% inflation rate.

So far, so good.

The American economy grew 2.5% in 2023, well above the previous year’s 2.0% and even with the 2019 and 2017 numbers. 2023 was also a tenth of a point above the pre-covid 10 year average.

Private consumption led the charge (+2.2%), spearheaded by higher volumes of durable goods purchases. Capital investment, however, was a drag on growth, falling 1.2% due to a stunning g 10.7% drop in residential construction. Exports were up 2.7% but imports fell 1.7%.

Remarkably, inflation (as measured by the headline CPI) fell by nearly half (from 8.0% in 2022 to 4.1% last year) while unemployment held steady, at a modest 3.6%.

The final quarter of the year was up 3.1% year-on-year, and 3.3% on a quarter-to-quarter annualized basis. Private consumption ticked up from 2.2% in Q-3 to 2.6% in October-December; capital investment remained in positive territory, at +1.8%.

The broad GDP deflator rose 2.6% in the final period, the slowest pace in 11 quarters. The Fed’s preferred private consumption deflator dropped below 3% (to 2.7%), again for the first time since Q-1 2021.

And, current federal government spending dropped to 23% in the fourth quarter, the lowest share of GDP in four years. Revenue data have yet to be released.

[cue childish insults]

Another solid blog post on the data from the GDP report. Especially loved the summary of PCE inflation.

I presume the FED will be paying attention to this good news when debating whether the doves like me advocate lowering interest rates to avoid a recession that has no sign of hitting yet v. the hawks who are still saying keep interest rates high to fight that inflation that seems to have dissipated.

You go Joe!!!

an annualised rate is not an annual rate. I read the annual rate was 4.9%.

It would be good if you yanks simply did stats at an annual rate like the rest of the world

No, it wouldn’t. Most of the thinking about U.S. GDP at a casual, intelligent level is done by people who are aware of how the data are reported inthe U.S. Anyone outside the U.S. who is at all serious about playing along can easily familiarize themselves with U.S. conventions.

It isn’t “better” to change conventions to accommodate a smaller group, at the expense of greater effort and confusion for a larger group. That’s just silly.

Ahem. Kudlow greets the GDP report with a flurry of partisan distortions:

https://www.msn.com/en-us/money/markets/larry-kudlow-this-is-unhealthy-and-inflationary/ar-BB1hgUsI

A little challenge for the gang – how many distortions can you spot here. So many lies, so little time.

kudlow is a partisan hack that typifies why the country has some of its problems. just like trump, he is desperate to show that Biden and the democrats have a poor economy, even when the facts say otherwise. just like trump, kudlow is willing to tank the economy if it gives an advantage to his republicans. no matter how many honest, average workers it will hurt. treasonous behavior by kudlow.

OK – I take one Kudlow distortion on with this:

Real Government Consumption Expenditures and Gross Investment

https://fred.stlouisfed.org/series/GCEC1

Yes for the last 6 quarters under Biden real government purchases rose but why did Kudlow forget to mention that real government purchases fell during the first 6 quarters under Biden? And of course Kudlow forgot to mention what happened to real government purchases under Trump. Of course Kudlow’s job at Faux News is to spread partisan distortions.

There is a tendency for recession to follow on a positive widening of the output gap:

https://fred.stlouisfed.org/graph/?g=1eFvf

This year’s growth has made the output gap fairly wide – no guarantees, though.

Inventories as a contributor to GDP growth tend to oscillate between adding and subtracting:

https://fred.stlouisfed.org/graph/?g=1eFwg

Inventories added to growth in H2 of 2023, but not by much in Q4, so we can look for a modest drag in Q1 2024, unless the Suez/Panama Canal problems become more problematic, in which case inventories could be a bigger drag, not just an artifact of GDP math.

Real PCE growth was healthy in Q4, though slower than real GDP growth, and disposable income through November looks supportive of continued PCE growth:

https://fred.stlouisfed.org/graph/?g=1eFy1

The same can be said for the payroll index through December:

https://fred.stlouisfed.org/graph/?g=1eFzQ

So I’m gonna guess that the next GDPNow estimate is around 1.2% for Q1. Not even back-of-the-envelope. No envelopes were harmed in generating this WAG.

Heard Wendy Edelberg from the Hamilton Project on Marketplace, talking about the GDP report. Asked about a soft landing (’cause that’s such a clearly defined term), she mentioned the rapid pace of immgration as making continued strong job and output growth possble. I have the impression she recently ran across some data that changed her thinking about the ace of immigration. She attributed 25% of recent upside consumer spending surprises to immigration.

If she’s right about the impact of immigration on job growth and spending, it suggests immigrants are making a substantial contribution to the economy – the “burden” story isn’t rght.

Nothing here on the subject, but this is Edelberg:

https://www.hamiltonproject.org/people/wendy-edelberg/

Running the numbers on Kudlow’s claim that real government purchases have exploded under Biden. In his first 3 years (2020Q4 to 2023Q4), they are up 4.95%. But wait – real GDP is up by more.

Now run the same comparison for Trump’s first 3 years (2016Q4 to 2019Q4), real government purchases rose by 7.74%.

I guess in Larry’s world, 4.95% is greater than 7.74%. MAGA!

In discussing the impact of immigration on jobs and spending, Edelberg may have in mind something like Figure 1 here:

https://cis.org/Camarota/JustReleased-Data-ForeignBorn-Population-Above-46-million-July-2022

Figure 1 shows three different estimates of immigrant population growth. All three show fairly strong immigration, but the high estimate is quite dramatic.

I generally do not praise anyone appointed by St. Reagan but this judge is spot on:

Judge slams “preposterous” claims by some in GOP on Jan. 6 “hostages”

https://www.axios.com/2024/01/26/reagan-appointed-judge-jan-6-trump-republicans

A Reagan-appointed federal judge said Thursday he’s been “shocked to watch some public figures try to rewrite history” in regards to the Jan. 6 U.S. Capitol riot. The big picture: U.S. District Judge Royce Lamberth was referring to comments by former President Trump and other Republicans including Rep. Elise Stefanik (R-N.Y.) who have described imprisoned Jan. 6 rioters as “hostages.”

What he’s saying: “The Court is accustomed to defendants who refuse to accept that they did anything wrong. But in my thirty-seven years on the bench, I cannot recall a time when such meritless justifications of criminal activity have gone mainstream,” Lamberth said during sentencing proceedings in D.C., without naming those who’ve used such language.

“I have been dismayed to see distortions and outright falsehoods seep into the public consciousness,” the judge added.

Reagan was OK with the idea of a peaceful transfer of power after elections. Trump and his mob are not. (Gingrich is an open question, but he didn’t appoint any judges.)

“I have been dismayed to see distortions and outright falsehoods seep into the public consciousness,” the judge added.

as I have been saying, this insidious creep of misinformation brought on by trump is dangerous. and will have negative consequences in this country for a generation. too many people now believe it is ok to simply make up a faux reality in order to get what you want. most people pass through this stage while leaving childhood. its a problem when a significant part of the adult population embraces misinformation as a way of life. trumps negative legacy will have long term implications.

Menzie – i was reading Vanguard’s economic outlook for 2024 called, “A return to sound money” and thought – gee whiz – should they call this “Bidenomics works.” https://corporate.vanguard.com/content/dam/corp/research/pdf/isg_vemo_2024.pdf

Also I think the Biden administration/Democrat “Inflation Reduction Act” does not get enough credit for fixing our supply chains and helping to reduce inflation price pressure https://en.wikipedia.org/wiki/Inflation_Reduction_Act

Again, from Wendy Edelberg – she suggests that the recent rise in state and local hiring and spending reflect the arrival of federal money from the Act.

I see a pickup in local government hiring in Q4, not so much for states:

https://fred.stlouisfed.org/graph/?g=1eHBt

Part of the problem is that government budgets are slow to respond to rising wages, so hiring in a tight market is tough.

State and local spending growth had been good under the Act, but slowed in Q4:

https://fred.stlouisfed.org/graph/?g=1eHBR

That slowing could easily be a one-off. We’ll see in 3 months.

From the Vanguard report:

“Sound money—the persistence of positive real interest rates—provides a solid foundation for long-term risk-adjusted returns.”

Translation, Part 1: Once the Fed has changed the interest rate regime, the losses from that change have happened, and so can’t happen again.

That’s true – it’s math.

Translation, Part 2: The distortions created by low yields are dissipating.

Also true, and not just an implication of math. Really important.

“Vanguard has said for more than a year that a return to sound money was underway. In the meantime, the transition to a higher interest rate environment no doubt has challenged investors, who have endured historical losses in bonds

and high volatility in stocks. But make no mistake: This structural shift, which will endure beyond the next business cycle, is the single best economic and financial development in the last 20 years.”

“Sound” money to Vanguard means owners of capital get more of the economic pie? Not exactly a progressive stance which is why the Kudlow-Laffer-Moore Three Stooges want “sound” money. Of course the Three Stooges seems to be the heroes of faux progressive JohnH.

Really laughable! pgl asserts that “owners of capital get more of the economic pie under the new, “sound money” policy! Of course, pgl conveniently ignores the fact that that is exactly what happened under pgl’s beloved low interest rate regime–asset prices rose and wealthy investors benefitted enormously, exacerbating wealth inequality. Under the so-called “sound money” regime, asset prices temporarily fell…which has driven pgl nuts (which, truth be told, he already was.)

Of course, the ‘trickle-down’ monetary policy of the 2010s was designed by the Fed to lower interest rates first and foremost to gigantic banks and their trading operations. Lower rates then trickled down to the banks’ preferred customers–stock speculators and corporations who bought back their own shares, to the delight of investors such as pgl. Of course, affluent homeowners benefited as well, though many less affluent ones got foreclosed on instead of being refinanced at lower rates. Many small and medium enterprises got starved for credit instead of receiving lower rates. Very little in the way of interest rate reductions got passed along to holders of credit cards and student loans, although the latter did eventually see some rate reductions.

Meanwhile, pgl kept advocating for even lower rates for the big banks and Wall Street investors!

And, of course, pgl strenuously objects to the new “sound money” regime in which people on fixed incomes get a positive real return on their secure investments along with people saving for their first home, for their kids’ college education, or for their own retirements. Imageine that…positive real returns on secure investements!

By saying this I suppose I’m exposing my own ignorance, but I am wondering if there’s not a more intuitively logical word than the word “deflator”. I suppose I’m splitting hairs here, but it doesn’t strike me as an easy word to understand, even though I think I get what it means. What about “ITRO” or something?? “Index to rectify output”?? or “ITRC” “Index to Rectify Consumption” Honest to God I almost think a longer term would actually be easier to grasp.

it’s a tough one to explain simply, Moses…here’s my usual way:

In current dollars, our fourth quarter GDP grew at a 4.85% annual rate, increasing from what would work out to be a $27,610.1 billion a year rate in the 3rd quarter to a $27,938.8 annual rate in the 4th quarter, with the headline 3.3% annualized rate of increase in real output arrived at after annualized inflation adjustments averaging 1.5%, known in aggregate as the GDP deflator, were computed from the price changes of the GDP components and applied to their current dollar change…

there were rather large revisions in this morning’s construction spending report, which came in way above the BEA’s estimates…

Construction spending in December was higher than was estimated by the BEA in their advance estimate of 4th quarter GDP last week, while October’s and November’s annualized construction spending figures were revised $16.4 billion and $28.2 billion higher respectively…The BEA’s key source data and assumptions(xls) accompanying last week’s 4th quarter GDP report indicates that they had estimated that December’s residential construction would increase by an annualized $5.6 billion from previously published figures, that nonresidential construction would increase by an annualized $1.2 billion from last month’s report, and that December’s public construction would increase by an annualized $1.0 billion from the figures shown in November’s construction spending report….hence, by totaling the changes of those BEA estimates, we find the BEA had estimated December construction spending would be $7.8 higher than previously reported November levels, which have now been revised $28.2 billion higher…since this report indicated that total construction spending for December was $17.7 billion higher than the revised November figure, that means the net of the annualized construction figures used for December in the GDP report was $38.1 billion too low…averaging the differences between the monthly annual rates in this report and those used in the GDP report for the three months of the 4th quarter would mean that this report suggests that the nominal construction spending figures used as source for the 4th quarter GDP report was underestimated by $27.6 billion (at an annual rate), implying an upward revision to the related GDP components at a rate that should result in addition of about 0.24 percentage points to 4th quarter GDP when the 2nd estimate is released at the end of the month, an estimate that should be considered very rough, since we have only allowed for an average aggregate deflator for the revisions, rather than one addressing the specific components revised…