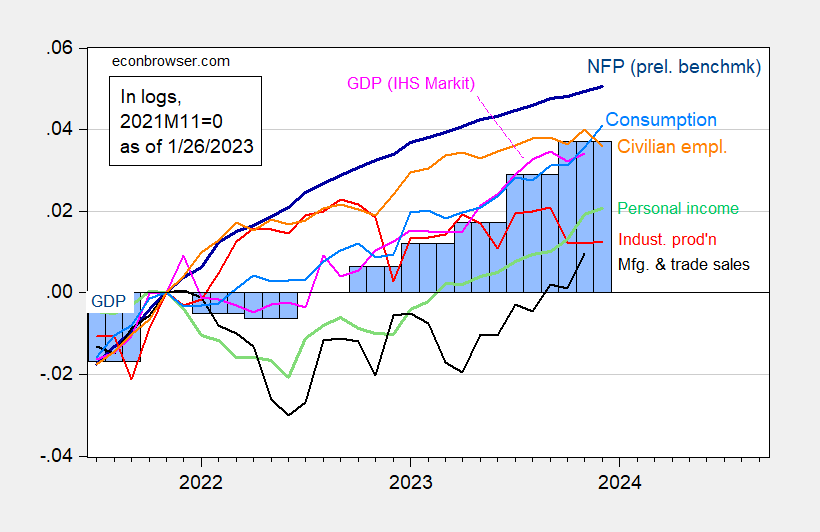

On the back of yesterday’s GDP release (discussed by Jim), real personal consumption continues to rise, beating consensus (+0.5% m/m vs. +0.3% Bloomberg), while nominal personal income hits consensus at +0.3%. Here’s the picture of some key indicators followed by the NBER Business Cycle Dating Committee, plus monthly GDP.

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 1/3 (blue +), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (1/2/2024 release), and author’s calculations.

Aside from industrial production, it’s hard to see the downturn in data reported thus far.

For data pertaining to the new year, the Lewis-Mertens-Stock NY Fed Weekly Economic Index (WEI) for the week ending January 20, the reading stands at 1.90%. The Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index reads -0.10%. If trend US GDP is 2%, then this implies 1.90% growth as well.

Melanie Safra

Peter Schickele

Mary Weiss

Tough week for music lovers.

I have to confess to not being a regular fan of Schickele’s but I seem to faintly remember a couple times he was on NPR or something and he struck me as fascinating. Kind of sort-of put me in the mind of Victor Borge. Although the styles might not quite match up.

It looks like Mr. Chinn’s former colleague is going to spend four months in the pokey. Peter Navarro was sentenced yesterday for contempt of Congress. We’ve never heard the background on what he was like in the old days. Was Navarro was always a crazy person or did something terrible happen to him along the way?

I had kind of queried this on the blog before. My sense was Menzie didn’t know. Or maybe he was being polite and kept it under his hat out of respect to Navarro’s privacy. One gets the sense Navarro was a much better person back when Menzie knew him. People do “regress” sometimes.

Great powers have long been in the business of protecting international shipping. This often means suppression of pirates, and in times of war, suppressing privateers. Rome did it. The Arab states did it before the Crusades. Great Britain did it. The U.S. does it.

Look who is putting a toe in the water:

https://www.reuters.com/world/middle-east/china-presses-iran-rein-houthi-attacks-red-sea-sources-say-2024-01-26/

Houthi attacks on shipping aren’t piracy, but they are interrupting international shipping, and putting oil shipments from Iran to China in harms way, if not under direct attack.

So, here’s a question – If voter approval of Biden depends on inflation, and attacks on shipping threaten renewed inflation, what’s Biden’s best move?

There seems to be a fairly widely held view that the U.S. can’t stop Houthi attacks with aerial bombardment. There is some risk of wider regional conflict in the Mid-East. Israel’s war on the Palestinian population is the trigger for Houthi attacks and the potential trigger for a widening of the conflict.

Naked Capitalism insists that:

https://www.nakedcapitalism.com/2024/01/biden-must-choose-between-a-ceasefire-in-gaza-and-a-regional-war.html

This is the same error committed by those who insist the U.S. in in charge of Ukraine’s behavior in defending itself against Russia; Biden isn’t the president of Israel.

Still, Biden has influence. Can he do enough to prevent inflation-inducing warfare, so that he has a selfish reason to intervene with Israel?

The answer is, of course, nobody knows. Netanyahu is certainly not going to tell Biden that it’s Biden’s decision whether the killing of Palestinians continues, bit enough pressure from Biden might change Israeli behavior. Will Houthis tone down their attacks if the U.S. withholds artillery shells, but the killing of Palestinians continues? I don’t think so:

https://www.ft.com/content/b7d3b990-bd1d-4a06-b029-2fa6c92d6de4

In fact, growing support for the Houthis is exactly the sort of result that Hamas might have foreseen in deciding to attack Israel last October.

So Joe is loosing support among the young and among progressives over his support for Israel. He might face a fresh inflationary increase as an indirect consequence of Israel’s war on the Palestinians. He may have some weak tools to reduce that risk, but no strong ones that I can see.

Will China pull Joe’s fat out of the fire? Netanyahu certainly won’t.

“So, here’s a question – If voter approval of Biden depends on inflation, and attacks on shipping threaten renewed inflation, what’s Biden’s best move?”

Shut off delivery of US” 2000 anf 5000 pound bombs as well as guidance kits for same to Israel!

War is inflationary, and all the SM-2’s in the US Navy won’t dent the missile firings.

To me, Gaza is a horrid shame on the US!

From your lips…

I have strong mixed feelings on this. America crossed a lot of red lines after 9-11. But then I suppose the argument could go “two wrongs don’t equate to a right”. People also have to recognize the feeling Israelis have of constantly being under threat from Palestine. That can get aggravating and “builds up” a lot of anger in people. How would say south Texans feel if there were missiles being launched from far north Mexico as their children took the bus to school?? If the threat is continual, it becomes more anger building.

Tricky Ducky asks : “ Will China pull Joe’s fat out of the fire?” Is Ducky suggesting that China has become the “indispensable nation,” territory that the US once claimed when it was still King of the Mountain? If so, it’s a remarkable climb-down!

Now why would China hep the US? China’s ships still deliver their merchandise via the Red Sea. And the US’ support of yet another potential quagmire only degrades its power and prestige, a humiliation which the world’s most expensive military is ill-prepared to counter.

I try not to think in terms of cliches.

Can you be idiotic? Oh wait. You will be

“Now why would China hep the US? China’s ships still deliver their merchandise via the Red Sea.”

Are you so effing stupid to not realize your second sentence here undermines the stupid question ala your first question here? China is helping itself. Now I get you are one lazy turd but READ the Reuters story. These disruptions are hurting China by slowing its imports of Iranian oil which as your 2nd sentence notes goes through the Red Sea.

Come on dude – we get you don’t like Macroduck. After all his IQ is about 10 thousand times your microscopic I. But do you have to remind us on an hourly basis of how utterly mentally retarded you are?

What a hoot! pgl claims that Chinese oil exports to China pass through the Red Sea. Pgl needs to look at a map…but he probably won’t be able to locate either Iran or China on it.

Pgl is a real idiot!

Wait YOU said they pass through the RED Sea. DAMN how retarded are you

“Chinese oil exports to China pass through the Red Sea.”

China is exporting oil to itself? No oh mentally retarded one – the issue was Iranian oil exports to China which do travel through the Red Sea.

I predicted you would make an even more idiotic statement and little Jonny boy delivers. Pat yourself on the back MORON.

The Houthis have bitten off a little more than they can chew. Sure we cannot stop them 100% for firing missiles at ships but we can make them pay a price for doing it. In the end they have to deal with the fact that they are in a war with the other half of Yemen. The more weapons and equipment they lose to this publicity stunt, the easier for their enemies to overrun them. The west may even decide to begin arming the enemies of Houthis.

Although this is supposed to hurt the west it actually hurts China more than the west. This will increase the cost of items running from Asia to Europe. So China will find their products less competitive. This will continue to impress on companies outsourcing production that there are some risk that may not be worth the benefits.

Shiver me timbers!!! Jaime “Dimon Says Rich Should Pay More to Fund Low-Income Tax Cuts… Cutting taxes for lower-income Americans would improve their upward mobility, health and lives overall, and CONTRIBUTE TO GROWTH of the US economy — even if doing so means raising taxes for wealthier people…

“This is, I think, as much of a no-brainer policy as any I’ve ever seen,” Dimon said Friday at a panel discussion in Washington hosted by the Bipartisan Policy Center. Tax reductions for lower-income people would be used for food, taking care of children and education. “

https://news.yahoo.com/dimon-says-wealthy-pay-more-170741322.html

What a concept—boosting economic growth by Taxing the wealthy, whose propensity to spend their income is relatively low, and redistributing it to people who need it and spend it. Steve Roth has been all over this issue for more than a decade. But where have mainstream economists been? Heck, some of them even refuse to confirm that they talk about inequality and its impact on economic growth in their courses.

Talk about no Brainard!

Correcting Spell-checker: “It’s a no-brainer.”

This seems to be the position of democrats, and their economists, for decades. Not sure what country you grew up in, but democrats have always tried to increase taxes on the wealthy. Republicans have always tried to give tax cuts, primarily to the wealthy. Johnny you are simply ignorant, not insightful.

Baffling…Democrats have indeed increased taxes on the wealthy…and the economy has grown. So why do mainstream economists generally refuse to explicitly make the connection? What economist have concluded and endorsed Jaime Dimon’s assertion that “ Cutting taxes for lower-income Americans would improve their upward mobility, health and lives overall, and CONTRIBUTE TO GROWTH of the US economy — even if doing so means raising taxes for wealthier people…?”

It’s a no-brainer!

So Jonny is claiming economists have never noticed the booming economy under Clinton. Yea Jonny boy has no brains

Jury finds Trump should pay $83.3 million to E. Jean Carroll

Tax evasion: nothing yet

Insurection: nothing yet

Election tampering: nothing yet

Theft of classified materials: nothing yet

Theft of wages: nothing

Rape: nothing

Other charges, for a total of 91: nothing yet

Running his mouth: $5 million

No learning his lesson the first time: $83.3 million

Determined by a jury of his peers. Not a political case. Shows you how much he has corrupted the political process.

https://www.msn.com/en-us/money/other/larry-kudlow-there-is-too-much-money-chasing-too-few-goods/vi-BB1hk6PA

Someone at Faux News drew an accurate graph that undermined Kudlow’s claim that Biden is increasing government purchases too much. Sure real government purchases did rise over the last 6 quarters as Kudlow claimed and the graph shows. But look closely at the previous 6 quarters in the graph where it clearly shows the DECLINE in real government purchases during Biden’s first 1 and a half.

Poor little Larry – lying all the time but he can’t find someone at Faux News to draw a graph to support his dishonesty?

Looks like Putin is tiring of war. Still asking the wrong country, though:

https://www.bloomberg.com/news/articles/2024-01-25/russia-ukraine-putin-signals-interest-in-discussing-end-to-war

Of course, this may simply be Putin throwing dust in the air while Congeess dithers over aid to Ukraine.

Anyhow, the “sources” say NATO membership is on the table. So this was never about Russia’s security? Just a land grab?

Tricky Ducky obviously could not be bothered to read the headlines: “ Putin Sends US Signal on Ukraine Talks, Seeing War Advantage

– Russia may be open to talks on Ukraine security, sources say

– US officials skeptical, see NO sign Putin wants to end the war”

More likely, it’s a classic case of projection—US projecting its tiring of a pointless and futile war onto Putin. Moreover, it’s a typical stage of the US’ pointless and futile wars of the past 75 years. Plus, there’s the allure of a new, irresistible quagmire in the Middle East…

The usa is not fighting the war in Ukraine. Russia is. In fact, the usa is not even funding the war in ukraine. Stop blaming the usa johnny. Russia is the one at fault here, and they continue their immoral invasion to this day.

Baffling must be an ostrich. The US has been doing everything it can to fight Russia but put boots on the ground and nuke Moscow. Baffling obviously has no clue of what constitutes a proxy war— sending someone else to do your own dirty work.

Shorter Johnny: The U.S. is doing everything to fight a war except fight a war.

That’s what baffling said. The difference is, Johnny slathers on the spin Tomales it sound like not fighting IS fighting.

Putin must be so proud.

Now you have interrupted little Jonny boy while he was engaged in the only pleasure in life this worthless troll has left – watching film of Russian soldiers torturing Ukrainian children.

Tiring of projecting a pointless, futile war ONTO Putin? Your most idiotic comment yet (and you’ve made plenty).

Who ordered the invasion of Ukraine? Biden? Obama? Gavin Newsom? Sean Penn?

With that comment, you’ve topped the late—but not lamented—CoRev for proud stupidity.

You’ve done a marvelous job of making a complete ass of yourself with your nonstop tongue twisting. There’s no stopping you now. Blather on, jeenyus.

“Who ordered the invasion of Ukraine? Biden? Obama? Gavin Newsom? Sean Penn?”

No – Jonny boy thinks it was Oprah Winfrey that started this war!

There may be feelers about end of hostilities due to genuine desires, but it could also be a political game trying to influence the west. This war is not what Putin want, but he cannot afford to end it before the Russian election.

Putin has been running a desperate all out winter offensive trying to capitalize on the current supply problems faced by Ukraine. This suggests that he at some level understand that time is not on his side. I saw one estimate that he is currently spending 40% of Russias GDP in the war, that is about the upper limit for money. On the other side, Ukraine’s supplies will only get better – and so will their domestic and partnership military production; so the pendulum can only swing back. In the midst of artillery shell shortages Ukraine has dropped them individually from drones. Talk about dirt cheap smart artillery shells, now every shell is directly guided to the exact square foot where you want it to explode – and not used (wasted) unless the target is directly visible.

I think Putin understands that he will be faced with the next generation of autonomous drone swarms (partially designed and produced in Ukraine), equipped with anti jamming technology, automated heat signature target systems, and able to continue the mission even as communication to the operator breaks down. With one smart shell being more destructive than 10 dumb ones, the balance will shift in favor of Ukraine. Russia is not going to be able to keep up with the west in the drone wars. If Putin understands that, he has every incentive to seek peace negotiations as soon as his winter offensive runs out of steam. From then on his negotiation position will only get weaker and weaker.

Can we get JohnH some serious professional help? After all, he is the dumbest, most dishonest, and otherwise most pathetically worthless little creature on God’s green earth. First of all this clown has been conned by Jamie Dimon thinking that Dimon just proposed some progressive change in the tax code. Take a look folks – expanding EITC is not a bad idea but even conservative Milton Friedman was in favor of it. And taxing the rich a little bit more? Seriously?

https://www.aol.com/finance/jamie-dimon-says-lower-income-212731062.html

But of course Jonny boy’s real agenda is to continue his lies that “mainstream economists” oppose raising the taxes on the rich. Now we have pointed out repeatedly that Jonny boy’s claim is a lie that would even embarrass Trump. But Jonny boy persists. Why – because this worthless POS has no life and has no prospect of ever having a life.

So come on people – let’s be good people and show a little mercy on the most dishonest, stupidest, and worthless snake in the grass God ever created.

Well, pgl, I asked commenters many times to show that mainstream economists support raising taxes on the wealthy for economic reasons–to boost economic growth.

Steve Roth has been at this for more than a decade, and he notes: “curiously, you don’t find much nuts and bolts economic theory supporting that view (raising taxes boosts growth) of how economies work. There’s been lots of research on the sources and causes of wealth and income concentration. There’s been a lot of important work on the social and political effects of inequality. But unlike the steady stream of “incentive” theory from Right economists over decades, economists have mostly failed to ask or answer a rather basic theoretical (and empirical) question: what are the purely economic effects of highly-concentrated wealth, held by fewer people, families, and dynasties, in larger and larger fortunes…Downward redistribution results in more spending, more economic activity, and makes everyone quite a lot wealthier, faster ” https://angrybearblog.com/2024/01/how-redistribution-makes-us-all-richer

Now even Jaimie Dimon is OK with raising taxes on the wealthy to boost economic growth. Of course, liberal, mainstream economists often talk about raising taxes to fund their favorite social programs, a position based on values, not economics. But curiously, economists appear to be the last people to even explore the idea–a no-brainer according to Jaime Dimon–that growth can be increased by raising taxes on the wealthy and redistributing the proceeds to fund social programs like EITC.

Where’s the beef, pgl? Where are the mainstream economists who care enough about economic growth to propose raising taxes on the wealthy to realize it? [Democrats sure could use such a coherent message, based on economics, to support the VERY popular idea that the wealthy need to be taxed more and to counter Republicans deceptive message that cutting taxes on the wealthy is what drives growth.)

Two problems with your argument.

1) Burden of proof. When younmake a claim, it’s your job to support that claim with evidence. You keep pretending that anything you say must be dorrect nless evidence is presented against it.

2) Your lying by weaseling. I presented you a long list of economists who called for higher taxes on the rich, and you objected that they hadn’t specified a reason for those tax cuts.

Johnny, we’ve seen your routine before. All trcks. All lies. All n service or your masters in Moscow.

Can you be idiotic? Oh wait. You will be

” I asked commenters many times to show that mainstream economists support raising taxes on the wealthy for economic reasons–to boost economic growth.”

And we answered many times. But you repeat this insulting and stupid question over and over again? Thanks for making my simple point which is that you are a mentally retarded worthless little liar who has no other purpose in life but proving over and over again that you are a mentally retarded worthless little liar.

We have asked you to grow up but it seems your mother has told us that you are incapable of being anything more than a worthless little child.

“Steve Roth has been at this for more than a decade”

Roth is suggesting that redistributing income to low income households who are borrowing constrained raises consumption. That is a proposition many economists have noted.

But here’s the thing that a mental midget like you does not get. Roth’s story says national savings is reduced by such redistribution towards lower income folks which might raise real GDP back to potential ala Keynesian forces assuming we are in the middle of a depressed economy. Roth’s posts are clear about this.

But the point that alludes a dumba$$ like you is that a reduction in national savings in a full employment economy lowers long-term growth. It also lowers the growth of real wages. Basic long-term economics which of course a mental retard like JohnH will never get because Jonny boy is too lazy to take an economics class and too stupid to understand it if he did take the class.

Pgl is flat out lying. Roth talks about neither savings nor recession. He focuses on increasing demand. One of the benefits of increased demand is that it drives increased investment.

Though Roth doesn’t mention it in his latest piece, increased demand is particularly critical when there is a shortfall in demand (recession.) As a result, increasing taxes on the wealthy to fund economic stimulus would be particularly appropriate in recessionary times, especially since the wealthy are unlikely to reduce their spending and because they spend a relatively small share of their income. Redistributing the money to those who live hand to mouth would be spent, boosting demand.

It’s truly remarkable that mainstream economists refuse to talk about these dynamics, which were standard fare in entry level economis courses years ago.

JohnH: As I understand it, if Roth is talking about deficient demand, he must be by definition talking about saving. I thought that his point was that saving does not result in increments to wealth, including capital.. I’m not sure you understand his model (I’m not sure I understand his model either, since it’s not written down in equations, as far as I can tell), so I’d be a bit wary of citing his conclusions. Unless I fully understood his model.

@ Prof Chinn,

I’m guessing you’re not THAT interested. But if Roth has a model I would presume it’s on his subtsack. I used to read his “asymptosis” blog a few years back and thought his writing/reasoning was pretty good overall. But then there’s some things about MMT I like, so take it for what it’s worth.

https://wealtheconomics.substack.com/

The lying turd known as little Jonny boy tells us that this paper (which I have noted many times) does not exist:

Effects of Income Tax Changes on Economic Growth

William G. Gale Brookings Institution and Tax Policy Center

Andrew A. Samwick Dartmouth College and NBER

February, 2016

https://www.brookings.edu/wp-content/uploads/2016/07/09_Effects_Income_Tax_Changes_Economic_Growth_Gale_Samwick_.pdf

This paper examines how changes to the individual income tax affect long-term economic growth. The structure and financing of a tax change are critical to achieving economic growth. Tax rate cuts may encourage individuals to work, save, and invest, but if the tax cuts are not financed by immediate spending cuts, they will likely also result in an increased federal budget deficit, which in the long-term will reduce national saving and raise interest rates. The

net impact on growth is uncertain, but many estimates suggest it is either small or negative. Base-broadening measures can eliminate the effect of tax rate cuts on budget deficits, but at the same time, they reduce the impact on labor supply, saving, and investment and thus reduce the direct impact on growth. They may also reallocate resources across sectors toward their highest value economic use, resulting in increased efficiency and potentially raising the overall size of the economy. Results in the literature suggest that not all tax changes will have the same impact on growth. Reforms that improve incentives, reduce existing distortionary subsidies, avoid windfall gains, and avoid deficit financing will have more auspicious effects on the long-term size of the economy, but may also create trade-offs between equity and efficiency.

Why does the little lying mental retard who calls himself JohnH deny the existence of such research? Maybe this troll is too lazy to read it. Or maybe he read it but he is so effing stupid he has no idea what it means.

Pgl can’t find a piece that focuses on the impact of tax increases in the wealthy, so he trots out the usual canard that tax increases will make people in general work less…as if all those rentiers work at all! Maybe if rentiers were taxed more, they would work—engage in productive activity and contribute to the economy, something that pgl obviously finds appalling!

Bottom line: pgl loves low interest rates which drive up stock prices and hates policies that could boost economic growth by taxing the Fed-generated wealth increases of the rich. Trump must love pgl’s economic policies!

Macroduck has already called you out on this garbage. And you repeat the same garbage? Damn dude – I get you are mentally retarded but come on.

Jonny boy’s claim that Steve Roth never mentions savings shows Jonny boy never read Roth’s actual paper. I did. OK it starts with “A model is constructed based on two monetary series: household wealth and consumption spending, and their distributions between top-20% and bottom-80% income groups.”

Whoa – “savings” does not appear here. But even a preK student would know the concept of savings has to be included on such a model. And had my mentally retarded stalker read Roth’s actual paper, he would see Roth noted the basic identities implicit in the very first sentence of the paper.

I have suggested Jonny boy has an IQ in the single digits. Apparently that we an overestimate.