Taking place on January 16th in Rotterdam, this is the second part of the symposium at the Erasmus School of Economics & Rotterdam School of Management on this topic, organized by Mary Pieterse-Bloem and Sylvester Eijffinger. The first part took place last July.

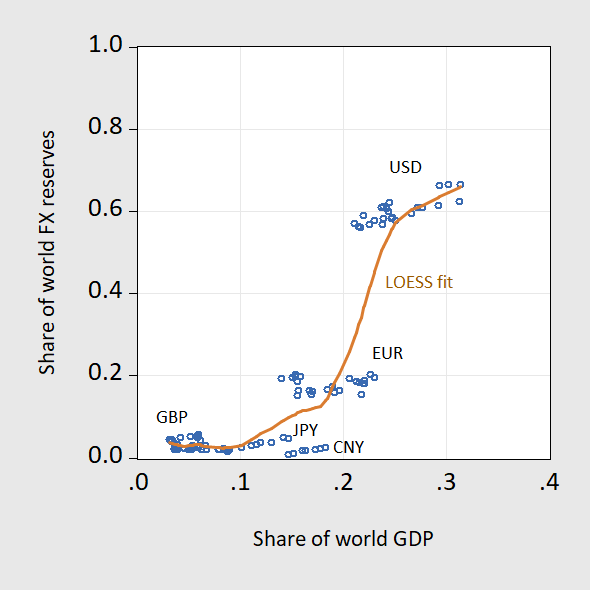

The symposium will cover many aspects of the euro and eurozone, but my presentation will be on the euro’s international role, so here’s a graphic apropos of that topic (fx currency reserve share and GDP share).

Figure 1: Estimated share of central bank foreign exchange reserves versus share of world GDP (market exchange rates), 1999-2022. LOESS (NN) fit, window=0.3. Source: Chinn, Frankel, Ito (2024) from COFER and WEO.

Here’re the presenters and papers for Tuesday:

- Paul De Grauwe – The evolving operating procedures of the ECB (with Yuemei Ji)

- Charles Goodhart – Beyond the Great Moderation

- Menzie Chinn – The Dollar versus the Euro as International Currencies [slides] (with Jeffrey Frankel and Hiro Ito)

- Panel Discussion led by Sylvester Eijffinger.

Papers/presentations not online yet. I’ll post our slides when available (you can see related posts here and here.

The first session in July included:

- Nout Wellink – Crises have shaped the European Central Bank

- Mary Pieterse-Bloem – Eurozone government bond spreads: A tale of different ECB policy regimes (with Sylvester Eijffinger)

- Jakob de Haan – ECB communication policies on monetary policy: An overview and comparison with the Federal Reserve (with Lex Hoogduin)

- Panel discussion led by Sylvester Eijffinger

Addendum, 1/16/2024.

Slides for Chinn-Frankel-Ito here.

Off topic, a bit of tax-policy history from the late 1970s:

https://talkingpointsmemo.com/cafe/how-1978-shifted-power-in-america-and-laid-the-groundwork-for-our-current-political-moment

The standard tool for encouraging investment at the time was the investment tax credit. Carter had campaigned for president partly on tearing down the tax code and rebuilding it on a fairer footing, including taxing labor and capital at the same rate. His Congressional caucus began to ignore him before the mid-term, so that his version of tax reform faltered, leaving an opening for business lobbyists. Enter the notion of “capital formation” as a solution for all economic ills*.

Carter had set the stage for changes to the tax system, but he lost control of the discussion. Politics abhors a vacuum? Something like that. Anyhow, instead of the tax code tilting back toward a fair shake for workers, lobbyists tilted it further toward benefiting investors, by working to cut the capital gains tax rate.

So, it turns out, there is one more policy often credited to Saint Reagan which actually happened under Carter. Along with hiring Volcker to kill off high inflation and deregulation transportation, Carter inadvertently helped bring about tax cuts and increased capital gains preferences in the tax code.

As of 2024, the top capital gains tax rate is 20%; the marginal income rate for those earning $44,726 to $95,375 is 22%, with the top rate for income at 37%.

*Please don’t quote from pre-1977 economics texts mentioning “capital formation”. The TPM article is about political, not economic history, and the claim is that “capital formation” became a political shibboleth in the late 1970s.

Bloem/Eijffinger do an interesting job of covering a “now that you mention it, it makes perfect sense” feature of the European market. The shift to quantitative easing (and risk absorption) had a clear impact in the U.S. It should have a similar effect in Europe.

off-topic

How many rural red dunce cap wearers who avidly pay their NRA dues would you guess will never read this story??

https://www.dailykos.com/stories/2024/1/12/2216756/-Secret-recording-shows-NRA-treasurer-plotting-to-conceal-expenses-involving-Wayne-LaPierre?pm_campaign=front_page&pm_source=top_news_slot_8&pm_medium=web#comment_87811393

LaPierre living like a King on rural bumpkins’ NRA dues when they probably haven’t paid off half their pickup truck. Their kids will never go to college, but they can pay their annual NRA fee and take the family out for bowling night.

Ukraine is preparing to become independent of US military supplies by building up military industries both in Ukraine and with European partners.

https://www.understandingwar.org/backgrounder/ukraine’s-long-term-path-success-jumpstarting-self-sufficient-defense-industrial-base

Among the important capabilities is the production of HIMARS equivalents, with bigger payloads and almost twice the range. Drones and cruise missiles that can reach Moscow is also being developed by Ukraine. Biden and Europe is making sure that if Trump takes over, the defense against Russia will continue uninhibited.

Putin thought Russia would take over Ukraine in less than a month and be greeted as liberators. At this time he must begin to understand that there is no winning even if he by some miracle took over all the territory of Ukraine (like Russia did in Afghanistan and US later did in Afghanistan and Iraq). A hellish occupation of the whole country would be a disaster and a decade long continuation of the current war would be worse. Biden has Putin by the balls and is not letting go.

By building weapons capable of reaching Moscow, Ukraine is:

1) Rejecting NATO/U.S. limits on the geographic range of Ukraine’s response to Russian aggression. Not proxy behavior.

2) Letting Russia know that the easy period of “heads, I win, tails, you lose” fighting will come to an end. This is, among other things, preparation for the prolonged era of harassment that is part of Russian war-fighting doctrine, no matter the outcome of the “official” war.

If Ukraine can pull this off, it will be an important feature of the geopolitical landscape. Iran’s example shows it’s possible, but it sounds expensive. One way to pay the cost of development and maintenance of an advanced weapons industry is to sell weapons, as Iran, Russia, the U.S., UK, Israel, China and France do, among others. It would be unfortunate if yet another national economy were to devote both material and intellectual resources to high-tech killing, but Russia leaves Ukraine little choice.

There is a geopolitical tactical advantage of letting Ukraine become a big high-tech military producer. It may allow them to become forever beyond what Russia would dare to attack again. One of the fears of any peace agreement with Russia has been that they would just rebuild and attack again in a decade or two. Not if Ukraine is strong enough to defend itself. They may even be able to stay strong enough without official NATO membership. Right now Ukraine cannot become member of NATO because they are at war with Russia, and Russia cannot stop the war because that may allow Ukraine to become a member of NATO.