Interesting recent article from the Carnegie Endowment, entitled “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role”, by Robert Greene.

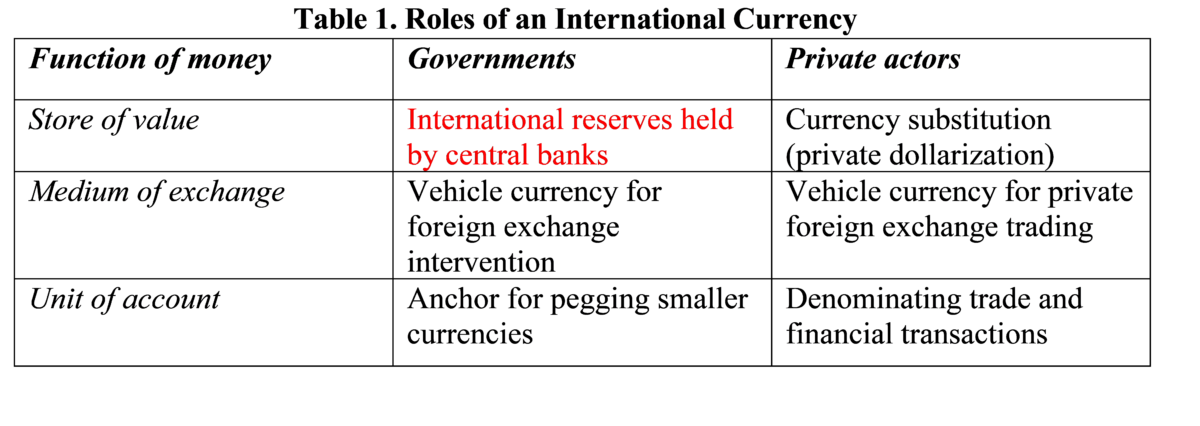

The article covers a lot of dimensions of de-dollarization, and the nature of international currencies. De-dollarization could involve increased local currency use, but I’ll focus on relying on alternative foreign currencies. In this context, this table is useful.

Source: Cohen (1971).

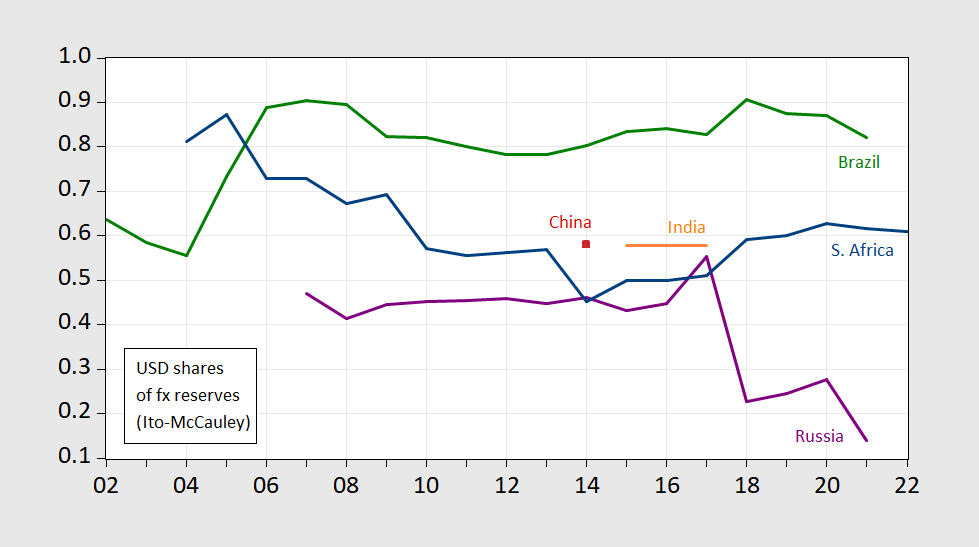

Here are some pictures of key reserve currencies held by the BRICS.

Figure 1: Share of foreign exchange holdings in USD, by central bank. Source: Ito-McCauley database,.

Next, EUR holdings shares; note the change in scale.

Figure 2: Share of foreign exchange holdings in EUR, by central bank. Source: Ito-McCauley database,.

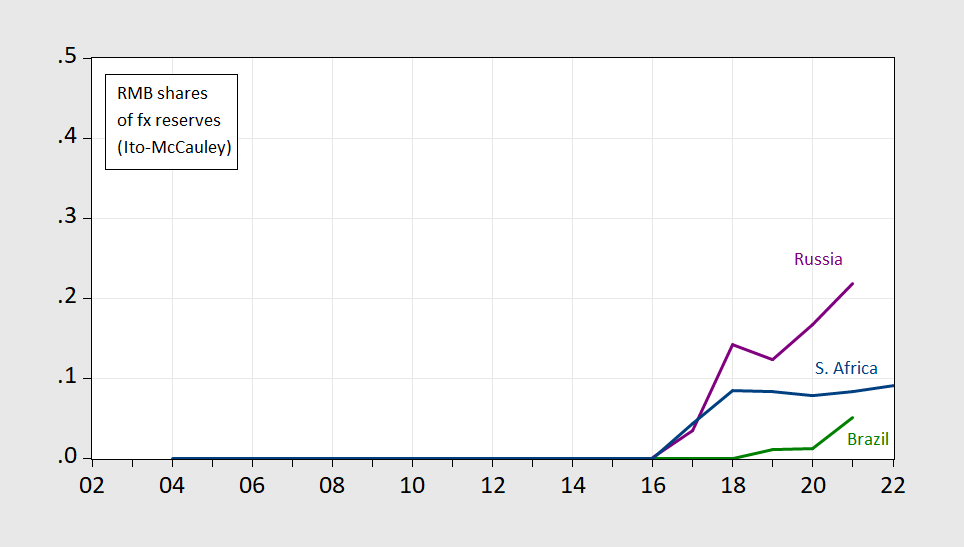

The holdings of USD exhibit a sharp drop only for Russia. What about the RMB? We have quite limited information here.

Figure 3: Share of foreign exchange holdings in RMB, by central bank. Source: Ito-McCauley database,.

How far do their holdings deviate from the ratios implied by the standard empirical determinants like reserve currency country GDP, relative inflation, exchange rate standard deviation, fx turnover by location, anchor currency, trade share, and geopolitical variables? More to come in ongoing work with Jeffrey Frankel and Hiro Ito.

You know that China would be down to 0% dollar-denominated if there was any way possible under the sun. So the fact they are still deep into it tells a person how hard it is to vanquish usage.

Yes. Network effects are destiny.