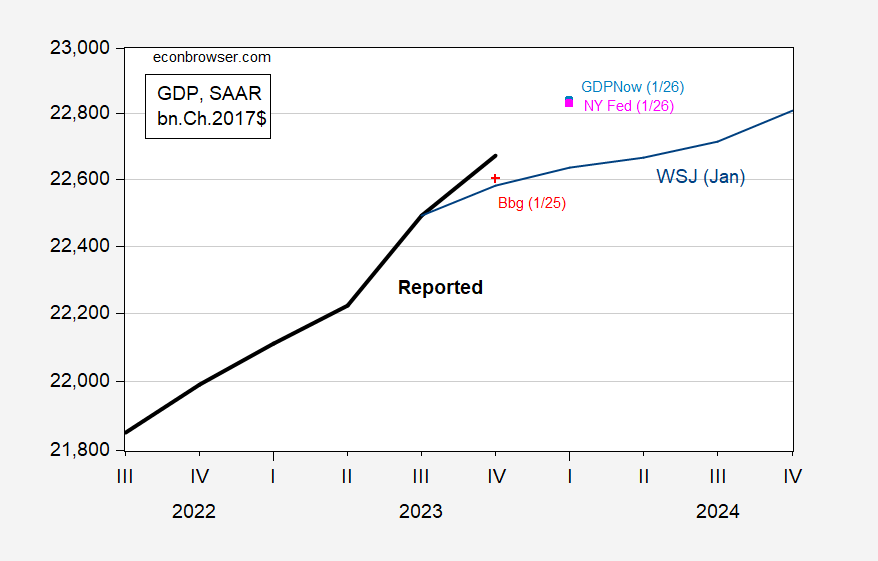

GDPNow and NY Fed nowcasts as of today:

FIgure 1: GDP (bold black), WSJ January survey mean forecast (blue), Bloomberg consensus (red square), GDPNow (light blue square), NY Fed nowcast (pink square), all in bn.Ch.2017$ SAAR. Source: BEA GDP 2023Q4 advance release, WSJ January survey, Bloomberg, Atlanta Fed, NY Fed, and author’s calculations.

GDP released yesterday far outstripped the WSJ mean forecasts, as well as Bloomberg consensus. GDPNow and NY Fed nowcasts are for 3% and 2.8% respectively for Q1 growth (q/q AR).

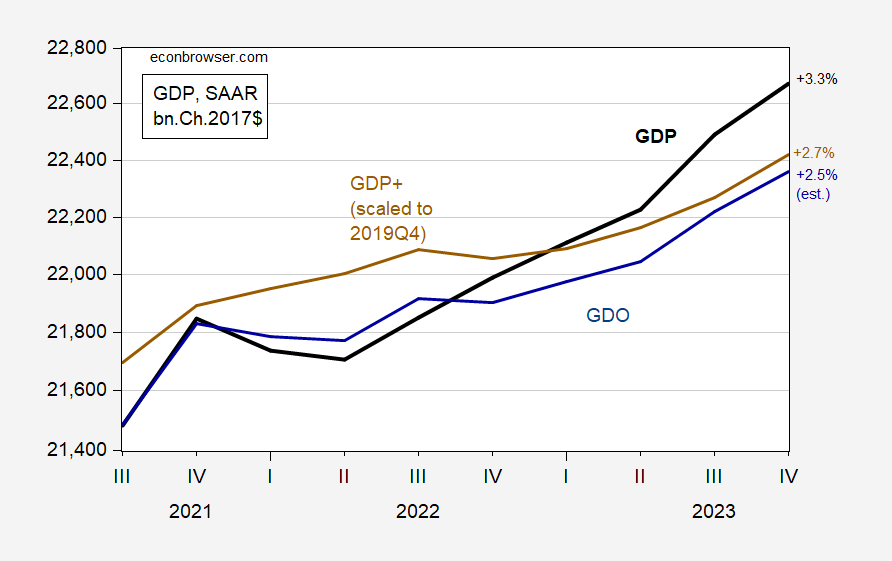

One could ask whether the growth rate reported in the advance release is plausible, or alternatively, if the level of activity is accurately tracked. Figure 2 reports GDO and the level of GDP implied by GDP+.

FIgure 2: GDP (bold black), GDO (blue), GDP+ (brown), all in bn.Ch.2017$ SAAR. Figures on right are q/q AR growth rates. GDO estimate for 2023Q4 assumes nominal profits are at 2023Q3 levels. Source: Philadelphia Fed, and author’s calculations.

Clearly, output measured alternatively is not growing as rapidly as GDP, but still remains higher than 21Q4, when some observers worried about a downturn. What is true is output measured alternatively does not turn down in Q4.

So trump now found liable for $83 million dollars in his disparagement case against carroll. That is what you get for relying on legal advice from rick stryker, our resident lawy expert. His economics is even more astounding .

Well I got GDPNow wrong by a mile. I expected 1.2%

Anyhow, GDPNow anticipates continued strong consumer spending growth, and there are a couple of things which could help with that. One is the labor market, of course. The other, which is less certain, is tax refunds. Tax brackets for 2023 include a big inflation adjustment, but withholding was probably done mostly based on old tax brackets, so lots of W2 folk may have over-paid through withholding. So refunds may be big, and refunds are often treated like windfalls. The other thing refunds are used for is paying down debt, which is a really good idea right now.

I’d mention improving consumer moods, but moods and spending have been disconnected recently. Of course, when moods are driven by inflation fear, there should be a disconnect.

Does anyone know anything about Chinese depositors not being able to get their money back or withdraw their money in China?? I know there was something back in July 2022, but I had heard some things, and wondered if they were just recirculating old video and calling it “new” or was something real going on here within the last month or so??

The only recent mention I can find looks fishy. The source recycles all kinds of unsubstantiated “China bad” news.

The source I found identifies the Agricultural Bank of China as denying customer withdrawals, but there are few signs of trouble (available to little old me, anyhow) with the Ag Bank. In fact, there has been a decline in short interest:

https://www.marketbeat.com/instant-alerts/otcmkts-acgby-options-data-report-2024-01-27/

The timing of “bank run” news is also odd, since the cut in the reserve requirement means banks need to hold fewer deposits to support outstanding loans.

If there really is a problem, we’ll see more reports. Absent more reports, I don’t like this one.

Notice how I’m not naming the source I found? Don’t want to add to the problem. Don’t want more stinkers muddying things up. There are enough Johnnys in the world.

I tend to think you are correct. I had to check though. I guess if something was going on Pettis would be ahead of it. Or Brad Setser, and I haven’t seen much from them lately. I don’t know…… I just had to check. I remember seeing something about a virus spreading, I think it was on youtube or a twitter comment, and ignoring it, and then like 2 months later the Covid story broke. And it kinda killed me I could never remember where, the exact link I had read it. And this one seemed “fishy” also, so I just had to put some “feelers” out there. I can’t remember the dates now, but I read it like early the early November before Covid broke, it was so weird and I remember thinking how oddball it was when first reading it, then, what early January it hit?? It still is in the back of my head wondering where ti came from?? That doctor?? But it was on an English site.

So it appears that trump and maga republicans really dont want immigration solutions. When given a chance to solve the problem, they say no, i would rather let it fester as a campaign issue this fall. Tragic, immoral and treasonous. If you support trump, you are against democracy and the rule of law. Its like dealing with an elementary school kid who cant handle losing.

I am now seeing pushback on Trump’s other big lie that his economy was better than Biden’s – ( Biden’s Economic Record is Much Better than Trump’s ://washingtonmonthly.com/2024/01/26/data-dont-lie-bidens-economic-record-is-much-better-than-trumps/ )

But besides the everyday corruption of Trump admin and Trump’s failed “trade war” and criminal immigration policy – something the GOP would like us to forget about – the Trump admin failed/corrupt response to the Covid pandemic leading to hundreds of thousands of needless deaths and dramatic lowering of the U.S. life expectancy https://www.cleveland.com/news/2023/02/covid-19-cuts-american-life-expectancy-to-lowest-in-nearly-three-decades.html

But the GOP and Ron “Covid ain’t real” DeSantis think this is good thing. https://floridapolitics.com/archives/631089-desantis-life-expectancy/

I think it would be fun if we saw some TV commercials showing the complete havoc at airports when donald trump announced his dictatorial immigration policy with donald trump’s image in the backround of the airport footage. Wow, are Americans’ memories really that short?? It was pandemonium and very hurtful to business travel and families’ travels at the time (not that Jamie “Head in the Clouds” Dimon noticed)

Pretty interesting, isn’t it, how recent economic growth has been quite compatible with “high” interest rates! Could it be that people spend some of their additional income from positive real earnings from CDs and money market accounts, thereby driving demand, growth, and investment? Who knew? Certainly not trolls like pgl, who only cheer low interest rates and see no reason to give people living on fixed incomes a positive real return on their secure savings.

Also interesting is that, now that inflation has come down, real wages have started to rise. So the Fed’s policy to reduce inflation is finally benefiting working America! Of course, this is totally contrary to the notion that you need low rates to help working America!

Finally, nominal wages have been growing at rates only slightly higher than during the pre-pandemic period. After the anomalies of the pandemic period, they neither rose much when inflation was hottest nor slowed much as inflation cooled. In other words, labor was unable to DEMAND wages to drive inflation nor to DEMAND wage increases to catch up in the immediate aftermath of real wage declines. The notion that the “hot” labor market drove wages up is belied by the fact that nominal wage increases have been dropping back to pre-pandemic levels, even though the labor market has remained “hot.”

A more plausible explanation for the small changes in the wage growth rate is that Corporate America budgets and grants wage increases at a steady rate, largely independent of inflation. Instead, the wage budgets increase only very slightly during times of high inflation and decrease only very slightly during periods of lower inflation. This is consistent with data published from surveys by benefit management companies.

The inflation rate was the main factor in whether real wages rose or fell. The Fed was right to cool inflation and protect American workers’ purchasing power.

“Pretty interesting, isn’t it, how recent economic growth has been quite compatible with “high” interest rates!”

Episode 5 million and 35th of Jonny boy who cannot get cause and effect straight. Hey Jonny boy – even the 2 year olds at your play school understand the following.

Fiscal stimulus shifting aggregate demand curve out raising interest rates via what some call an outward shift of the IS curve and others calling an inward shift of the national savings schedule. Either way the rise in interest rate is the effect not the cause.

Oh wait – national savings, IS-LM, cause and effect. None of these terms little Jonny boy understands even though they are basic principles of economics terms. Which is why even the 2 year olds are laughing at poor little Jonny boy.

“The Fed was right to cool inflation and protect American workers’ purchasing power.”

Here little Jonny boy goes again trying to claim weak aggregate demand leads to higher real wages. Like how this Cameron stooge defended his fiscal austerity when the UK economy was below full employment. Jonny boy tried to tell us that this was good for UK real wages even after our host showed how much real wages declined under Cameron.

I wonder if Simon Wren Lewis reads this blog. We need his wisdom to rebut the incessant stupidity Jonny boy has been spewing for over a decade.

Paul Krugman Counters Nikki Haley’s ‘Economy In Shambles’ Comment: ‘2023 Was A Miraculous Year’

https://www.msn.com/en-us/money/markets/paul-krugman-counters-nikki-haley-s-economy-in-shambles-comment-2023-was-a-miraculous-year/ar-BB1hoBzy

Krugman takes on Nikki Lightweight on economics? This is not a fair fight as she is almost as stupid as JohnH. Hey – maybe Faux News can invite JohnH to debate Nikki on the economy. After all, Faux News appeals to the mentally retarded!