Growth prospects in short term are being revised up. But how long can that persist when policy rates rise, oil prices stay low?

First, the policy rate was moved up in December. They now rival the rates achieved at the beginning of Russia’s invasion of Ukraine:

Source: TradingEconomics.com accessed 1/16/2024.

As the same time, oil prices that Russia obtains remain at about the level of the cap, $60/bbl.

Source: TradingEconomics.com accessed 1/16/2024.

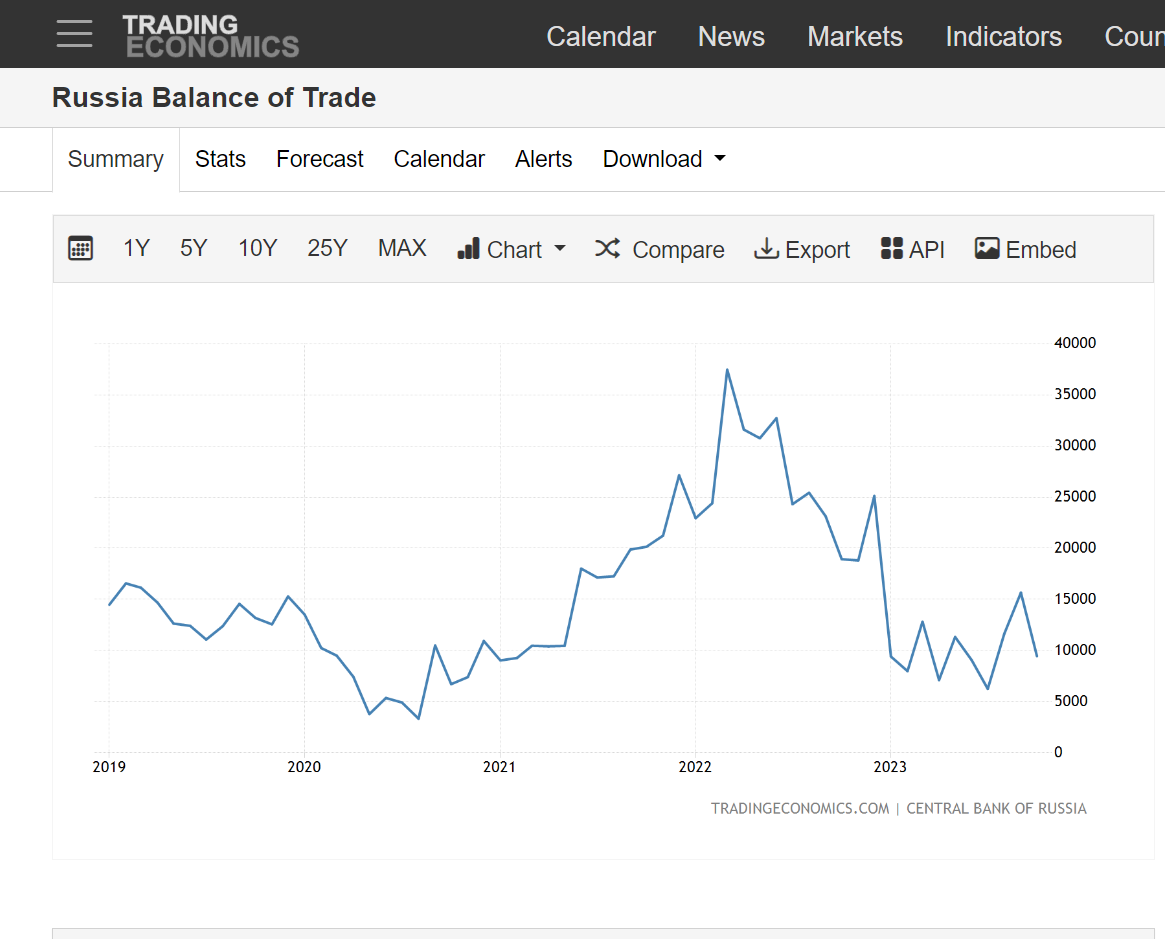

Russia’s trade balance has collapsed to about a quarter of what it was in the immediate aftermath of Russia’s expansion of its invasion.

Source: TradingEconomics.com accessed 1/16/2024.

This result suggests financing of critical imports will become more difficult over time, given inability to borrow (and lack of access to frozen assets).

This is especially good news in light of Republican’s refusal to help Ukraine protect itself from Russian aggression.

So, we need happy news in these times of watching a true fascist win the state of Iowa (my native state). Iowans are smart enough to know better. It really almost makes me physically ill. But, again, thanks for the happy news. I’m gonna get some drinks this late afternoon. Maybe a large bottle of wine and some little bottles of Bud Ice will make a fascist being a hero in my country feel “not so bad”. What do you think?? I’m grasping to the edge of hope folks, don’t burst my bubble…or my bottle.

Moses – lowest turnout – about 110,000 compared to 186,000 in 2016) in decades – Trump got 56,000 votes – in a small city that would not even win a school board election. About half of the remaining GOP voters said they would vote third party or for Biden in general. GOP Governor endorsed Trump opponent. To me – this says more about the current dysfunction of the Republican party than anything else.

I put together several links from Trading Economics and press reports showing that China is keeping Russia afloat by allowing Russia to run a growing trade deficit, while India’s deficit with Russia is ballooning. I did the writing right here in comments and the window went “blooooie”. So go find your own data, but here’s the gist –

From Reuters:

“Imports from Russia rose 13% last year from 2022.”

“Chinese shipments to Russia jumped 46.9% in 2023 from a year earlier,…”

From the Hindustan Times:

“Two-way trade has exceeded $50 billion, driven largely by India’s purchases of Russian oil since the start of the Ukraine conflict in 2022. The trade is skewed towards Russia as there has been negligible growth in Indian exports.”

Kinda like you’d figure if you keep up with the back-and-forth over Russia and India’s disputes over what currency to use for payments. Russia doesn’t want any more rupees.

I think I know what you mean “the window went blooie” uh, not with long math but just a long winding train of thoughts in a long long long text comment and lost it, so I know what you mean. And I am not angry at Menzie or whatever because of that, you can just tell the “internet Gremlins” ran off with it, and maybe wasn’t even related to Menzie’s server, and it makes you INCREDIBLY angry at first, and then you just have to shrug your shoulders and go “Internet Gremlins” like “I could have had a V-8”

“Russia doesn’t want any more rupees.”

Maybe they should. The exchange rate has been near 82 rupees to a US dollar for over a year now. And India’s nominal interest rate is less than half of the Russian rate. It seems India has gotten its inflation issues behind them.

Hey, pgl, where is the data you wanted me to look at? Any fool can post a web link and claim that there’s valuable data somewhere in there…but pgl doesn’t have any clue as to where it is…otherwise he would have linked to it or summarized it. What an idiot!!!

https://fred.stlouisfed.org/series/DEXINUS/

Oh my – my mentally retarded stalker does not know FRED! Hey Jonny boy – we get you are an imbecile but do try to learn to tie your own shoes.

https://fred.stlouisfed.org/release/tables?rid=53&eid=15372&od=#

Table 1.12. National Income by Type of Income: Quarterly

At times using http://www.bea.gov requires a little effort which of course my mentally retarded stalker refuses to do. But once again FRED comes through.

Of course little Jonny boy will still not get this. After all – this troll is as mentally retarded as it gets!

This performance from the Hang Seng:

https://www.cnbc.com/quotes/.HSI

…may have something to do with the timing, but probably not the substance, of this:

https://www.bloomberg.com/news/articles/2024-01-16/china-weighs-more-stimulus-with-139-billion-of-special-bonds

Back in November, it was reported that this bond program was likely to be introduced early this year:

https://www.bloomberg.com/news/articles/2023-11-28/china-may-grant-319b-of-local-bond-quota-early-to-juice-economy

January 16 is a pretty early. Anyhow, China is cooking up a fair-sized stimulus program.

The fact that they have been sending and losing all those young men in the war has apparently created serious labor shortages. The xenophobes are adamantly resisting the idea of using immigration to help deal with that labor shortage. That would be predicted to create a fair amount of supply/labor shortage driven price increases. But how effective is rate increases at reducing inflation that is driven by a shortage of labor and supply?

To me – war criminal Putin is destroying Russia to maintain a land bridge to Crimea-approaching 400,000 causalities and millions have fled Russia to avoid death in a ditch in Ukraine – millions $$$ in military equipment destroyed – all to become an economic vassal state of China – meanwhile Russia has lost – probably forever – their most profitable commodity sale – natural gas to EU.

The damage is done and Putin is trapped. He will almost certainly make some changes after he is reelected in March. He either goes boldly after the expanded war goals or he backs down for a peace agreement. If Putin truly knows where he is at, he will do the back down and work out a peace agreement.

I think he understands now that he was duped when told back in Jan 2022 that Russian troops would be greeted as liberators. He still has the bitter memories of occupying a hostile nation (Afghanistan) where the opposition is armed by the west. He should understand that occupying a hostile Ukraine would be 10 times worse. So even if he got the impossible win (of all of Ukraine), he would still lose.

It is possible that Putin will try to increase the war effort in order to force Ukraine to accept a peace agreement that is better for Russia. Last time he was in a strong position (April 2022) they were talking about an agreement that would pull Russia back to the borders of 3 months before, but with Ukraine giving up NATO membership and its military. That was such an obvious case of “we will come back later” that it never was taken serious anywhere (except for right wing & Russian troll spaces).

There has been some back-and-forth about corporate profits here. On the assumption that profits will remain a subject of discussion, I offer an observation –

Using the example of individual firms, rather than relying on aggregate data, can be misleading. Firms sell to each other. If a firm increases its profit margin at the expense of other firms, that may have no impact on aggregate profits across businesses, and no impact on aggregate pay or consumer prices.

I’m reminded of this because I’ve been reading about commercial real estate. Here’s an example:

https://www.cfo.com/news/office-rents-2024-cbre/703509/

A 4% rent decline tyo be driven by a further increase in vacancies. Inward shift of the demand curve, Q and P both fall.

While this saving on rent might be good for consumers or workers (same people, divided into two of their economic functions), we can’t know that ahead of time. What we can know is that firms which have been leasing more space than they need at higher rents, and shed some of those costs this year, will enjoy higher profits, all else equal. Commercial real estate firms, on the other hand, will suffer further erosion of profits.

This happens all the time for all kinds of reasons, but the oddity of the commercial real estate sector in the Covid era provides a fun example.

So let’s not have any of this “Oh, look! Profits at Z Corporation* went up/down. That means workers/consumers are worse/better off.” You don’t know that unless you know why profits did what they did. Talking to you, Johnny.

* Curse you, Elon! Can’t use “X” as a generic placeholder anymore. X Corp is unusable. Yuck. He probably thinks the X-men work for him. X-wing fighter, brought to you by Elon. X rated entertainment, all his. Dos XX – lost my taste for it.

I X’ed Elon years ago when he turned out to be a vicious union buster. Twitter never really made sense to me, but if it had, then I would have X’ed it after Elon took over.

‘Talking to you, Johnny.’

We all know Jonny boy is incapable of looking up the corporate profits data provided by BEA. Then again Jonny boy has accused BEA of understating recent inflation as they allegedly have been taken over by the Biden crime family.

So Jonny boy chooses to blatantly misrepresent the corporate profits data of individual corporations instead. When we challenge him to source this data from http://www.sec.gov this moron has no clue how to do that either.

Hey, pgl, where is the data you wanted me to look at? Any fool can post a web link and claim that there’s valuable data somewhere in there…but pgl doesn’t have any clue as to where it is…otherwise he would have linked to it or summarized it. What an idiot!!!

Oh – my mentally retarded stalker meant to ask for corporate profits data. Dude – try

http://www.sec.gov for company data like I told you a thousand times.

And http://www.bea.gov has factor income by source as we have repeatedly told you.

Come on dude but a retarded rock knows this but not Jonny boy.

“Any fool can post a web link and claim that there’s valuable data somewhere in there”

You should know as you often misrepresent what your links say. I read your little stories and point out what they really said which contradicts your stupid lies. And for that I get to have a mentally retarded lying stalker (JohnH of course). Oh joy.

Now when I link to http://www.bea.gov or http://www.sec.gov I accurately report what the data says. Have done so many time on this specific issue. That you are too stupid to follow the conversation is nothing new but I am not to blame for the fact that my stalker is mentally retarded.

https://citylimits.org/2022/10/18/the-rent-is-still-too-damn-high-catching-up-with-jimmy-mcmillan/

I wonder what my man Jimmy McMillan would say about this news about falling lease payments. After all the rents in Manhattan are still too damn high!

“High interest rates and declining rent income means borrowers are beginning to have trouble staying on time with loan payments. As of the end of last year’s third quarter, 5.1% of the balance of office property loans was delinquent, said the Mortgage Bankers Association, up from 4% the previous quarter. The delinquency rate for U.S. commercial mortgage-backed securities (CMBS) in the office sector rose to 3.48% in November 2023, up 64 basis points, according to Fitch Ratings, which projects U.S. CMBS office loan delinquencies will skyrocket to 8.1% in 2024 and 9.9% in 2025.”

I would love to see the financials for a company that buys and leases this type of property. Consider a company that purchases says $1 billion in property that it would lease out at an expected return = 6% of the value of the property (after depreciation and ongoing expenses borne by the landlord) financed by $600 million in debt at 4% interest. All of this during normal times. Have rents go down and/or interest rates go up and its thin pretax income quickly goes to zero or less. A highly capitalized enterprise with thin profit margins is rather vulnerable to market swings such as we are witnessing.