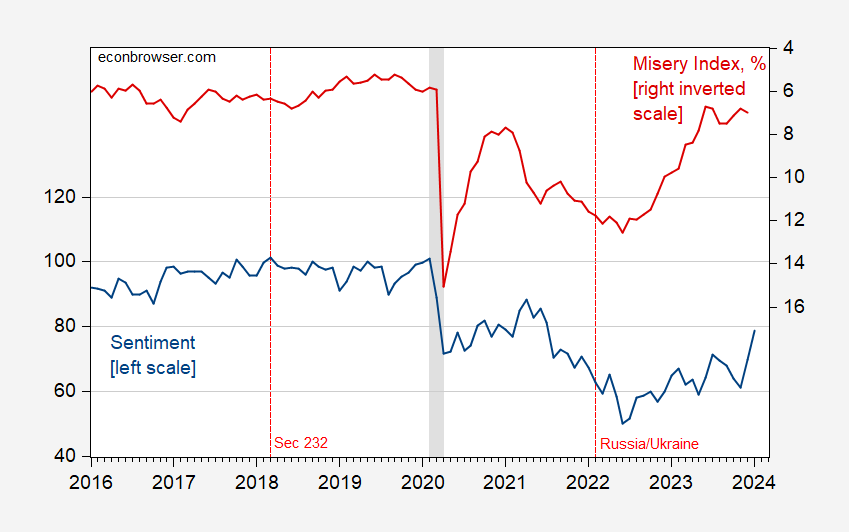

One of the mysteries of recent times has been the divergence between conditions (say, as measured by the Misery Index) and measured consumer sentiment. Figure 1 shows the U.Michigan sentiment index (FRED variable UMCSENT) vs. the sum of inflation and unemployment rates over the 2016-24M01 period. The jump in UMCSENT of 9 was about 2 standard deviations (for the 2016-23 period), on top of the nearly two deviation jump in December, and goes some way to redressing the gap.

Figure 1: University of Michigan Consumer Sentiment ) (FRED series UMCSENT) (blue, left scale), and Misery Index, % (red, inverted right scale). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, BLS, NBER, and author’s calculations.

The Misery Index is inverted so higher values indicate lower misery. The Misery Index starts rising around mid-2022, relative to measured economic sentiment. Using a standard OLS regression of sentiment on misery over this period, residuals are significantly different from zero starting around mid-2022. Another way to put this is that as of December 2023, the predicted reading for UMCSENT is 88, while the actual was about 70.

One interesting stylized fact is that the correlation between inflation expectations from U.Michigan and UMCSENT is high, rising from zero 2016-2019 to 0.70 for 2020-2024M01. This suggests an outsize impact of inflation. Another way to look at this is to compare the standardized betas pre- and post-pandemic. The betas for unemployment rate and inflation are about equal pre-pandemic. From 2020M01 onward, the inflation beta coefficient is about 4 times that of the unemployment beta coefficient.

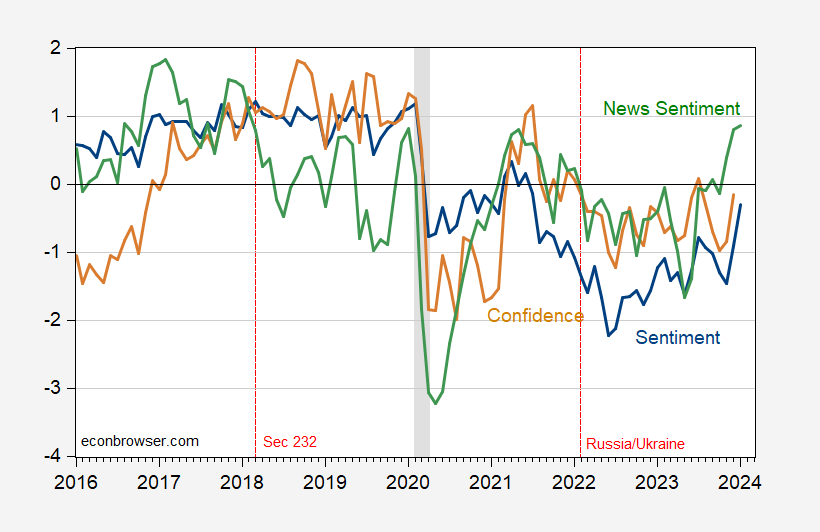

What about other indicators of sentiment? The SF Fed News Sentiment index is a text based indicator. In Figure 2, I show (demeaned, normalized by standard deviation) UMCSENT, the Conference Board’s Confidence Index, and the News Sentiment Index.

Figure 2: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Shapiro, Sudhof and Wilson (2020) Daily News Sentiment Index (green), all demeaned and normalized by standard deviation (for the displayed sample period). Michigan December observation is preliminary. The News Index observation for December is through 1/7/2024. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, SF Fed, NBER, and author’s calculations.

While the Michigan Sentiment index tracks the news index, there is a partisan divide. Over this sample period, the adjusted R2 of a regression of Democratic sentiment on the news index yields is about 0.35. The analogous regression using Republican sentiment has an adjusted R2 of 0.04. (A regression of the Confidence Board’s Index of Consumer Confidence on news sentiment has an adjusted R2 of 0.19). So essentially none of the Republican sentiment is explained statistically by text-based news sentiment. This is consistent with either Republican sentiment being impervious to economic information, or Republicans interpret economic news in a different fashion than Democrats (or Independents, for whom the adjusted R2 is 0.19).

More on the partisan divide in sentiment, here.

If Republicans live in a different world from everyone else, only visiting the real world to vote and answer sentiment questions, then there is no mystery.

If the world in which Republicans live exists within a right-wing echo chamber (faux, brightbart, Tuck), then the direction of bias is also no mystery. The big question is why a large chunk of the population departed the real world, and why it happened when it did.

I have the quick and, yes, abbreviated answer to your latter big question: Republicans at state and national level defunding public education. And Republicans will keep doing it as long as it gives them the desired result. Easy control and leading around by the nose of the mass population.

You guys haven’t forgotten “Digby” from the golden era of blogging, have you?? Get her back into your RSS feed if you lost track of her and the team:

https://digbysblog.net/2024/01/19/greedflation/

OK, maybe I am “cherry-picking” data. Everyone else is.

I was going over this report:

https://groundworkcollaborative.org/wp-content/uploads/2024/01/24.01.17-GWC-Corporate-Profits-Report.pdf

But you are wise to remind us to read Digby more often.

“One prime example of this is the diaper industry, which is highly concentrated – Procter & Gamble Co. (P&G) and Kimberly-Clark Corp. control 70 percent of the domestic market. Diaper prices have increased by more than 30 percent since 2019 from, on average, $16.50 to nearly $22. Wood pulp is a major input in diapers and other paper products, like toilet paper and paper towels. Wholesale wood pulp prices soared by 87 percent between

January 2021 and January 2023. Yet between January and December 2023, prices declined by 25 percent.”

The diaper market is indeed a duopoly. Which may explain why JohnH’s mom does not change his diapers. Speaking of little Jonny boy – could someone please tell him wood prices have fallen.

Wait, wait – this report noted Pepsi’s operating margin rose a bit over the last 2 quarters? Well yea after it dropped to just over 10%!

https://www.macrotrends.net/stocks/charts/PEP/pepsico/operating-margin

Look – this report makes a few points but it times it’s a reminder of the dumbest things JohnH has written.

Not to quibble but take a look at this FRED graph behind:

‘Corporate profits as a share of national income has skyrocketed by 29 percent since the start of the pandemic.’

The legend clearly shows that they deducted the part of corporate profits accruing to bank. They also picked a quarter where this ratio had fallen by 10% over the previous quarter.

With record low unemployment and record high stock markets, who honestly can claim economic misery? It must be dishonesty.

It’s called Faux News starring Lawrence Kudlow. Been lying for over 25 years.

In 2023 ev’s had 15% share of global passenger car sales. I remember kopits ridiculing that Ev’s would never work out a few years ago, citing market share as a reason. Seems he was wrong, AGAIN. The inevitable will occur. Why are people in denial? Kind of like those who distort the misery index during record positive economic environment. Strange or ignorant?

Let’s see. Total sales = 84 million. EV sales = 13.6 million. Yes – you are correct even if our favorite morons (Bruce Hall and JohnH) cannot handle the arithmetic.

I remember those same “can’t do” and “will NEVER happen” fools doing fancy calculations about solar power vs NG power cost – and telling us it just wasn’t EVER going to be competitive. Then cost of solar dropped to less than half, and last year 80% of new power in US was alternative. I guess its always been true that if you turn your back to the future it will come up on you and slap your stupid neck

This has nothing to do with Economics. Just thought it was a fun little story that kinda brightened my day while I was waiting on some bakery bread. Eleven minutes long audio, link in the upper left. I hope it brings cheer to your day like it did me.

https://www.kgou.org/2024-01-19/jewish-puppet-theater-reconsiders-intercultural-mission

Those who like practicing their “Listening German” can try the YT link.

Make America Gullible Again. Coming to a place of learning near you:

https://www.esquire.com/news-politics/a43635292/north-dakota-books-ban/