From a new paper, NBER WP No. 32084, by myself and Laurent Ferrara, out today.

Abstract: In recent years, there has been renewed interest in the moments of the yield curve (or alternatively, the term spread) as a predictor of future economic activity, defined as either recessions, or industrial production growth. In this paper, we re-examine the evidence for this predictor for the United States, other high-income countries, as well as selected emerging market economies (Brazil, India, China, South Africa and South Korea), over the 1995-2023 period. We examine the sensitivity of the results to the addition of financial variables that measure other dimensions of financial conditions both domestically and internationally. Specifically, we account for financial conditions indexes (Arrigoni, et al., 2022), the debt service ratio (Borio, et al., 2020), and foreign term spreads (Ahmed and Chinn, 2023). We find that foreign term spreads and the debt service ratio in many cases yield substantially better predictive power, in terms of in-sample fit using proportion of variance explained. Overall, the predictive power of the yield curve, as well as other financial variables, varies across countries, with particularly little explanatory power in emerging market economies.

For the United States, we have the following results, where we assume no recession has occurred by 2023M02: In a parsimonious regression with only term spread or term spread with short rate, the coefficients have expected sign. A financial conditions index also enters with significant and expected sign when added to this specification. However, addition of a debt-service ratio (DSR) and a foreign term spread eliminates the significance of the term spread and FCI.

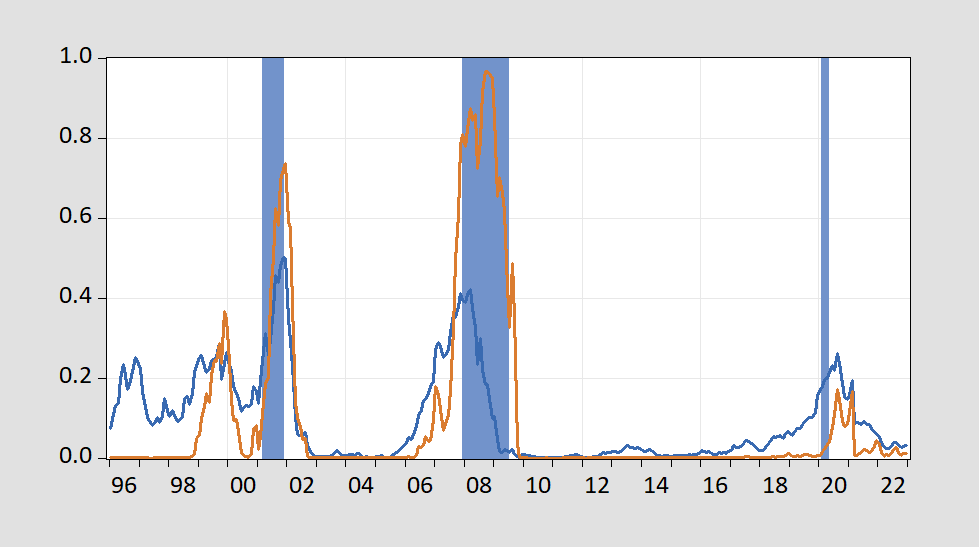

In-sample prediction using the terms spread only and all variables in Figure 1.

Figure 1: Estimated probability of recession from term spread only (blue), term spread, short rate, FCI, DSR, foreign term spread (tan), and NBER peak-to-trough recession dates shaded blue. Source: excerpt from Figure 2 of Chinn and Ferrara (2024).

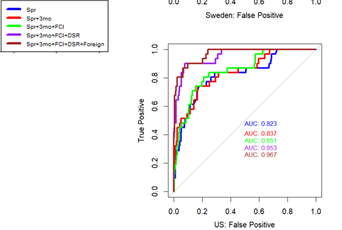

The AUROC for the various models is shown in Figure 2.

Figure 2: AUROC for US specifications. Source: excerpt from Figure 3b of Chinn and Ferrara (2024).

Note the AUROC is pretty high for the simple term spread specification. However, addition of the debt-service ratio increases prediction substantially. Interestingly, the foreign term spread (as suggested by Ahmed and Chinn (2023)) augments prediction even after addition of the DSR.

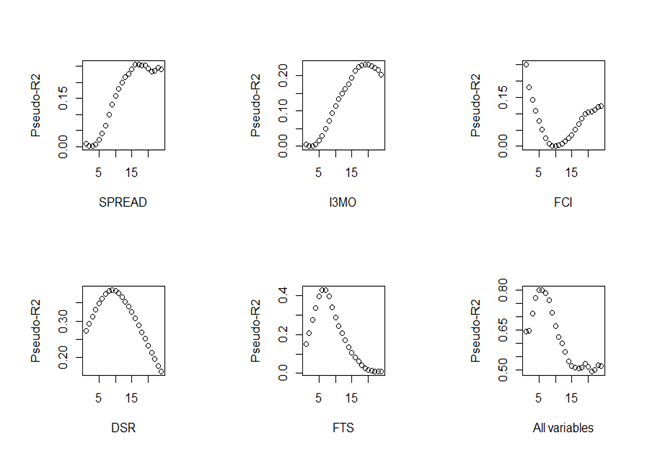

We assessed the predictive power of the individual variables at the different horizons.

Figure 3: Psuedo-R2s for US. Source: Figure 4 from Chinn and Ferrara (2024).

The spread and short rate evidence peak prediction at about a year and a half. In contrast, the foreign term spread has peak role at about 6 months. The DSR has maximum prediction at about a year. All five variables, peak prediction at about 6 months, with pseudo-R2 at 0.8 (compared to 0.6 at 12 month horizon).

Ungated version of Chinn and Ferrara (2024).

For the apparently few number of people as mentally slow as I am “FCI”= Financial Conditions Index

Also, AUROC apparently is sort of a data science term: https://towardsdatascience.com/understanding-auc-roc-curve-68b2303cc9c5

If I have screwed this up somehow (highly possible) I invite Mr. Ferrara or whoever to set me straight.

Moses Herzog Yes, it’s a data science term. The “R” packages that I use for accuracy, specificity, sensitivity, ROC, AUC, etc. can be found here:

https://cran.r-project.org/web/packages/ROCR/index.html

with vignette: https://cran.r-project.org/web/packages/ROCR/vignettes/ROCR.html

and

https://cran.r-project.org/web/packages/WVPlots/index.html

with vignette: https://cran.r-project.org/web/packages/WVPlots/vignettes/WVPlots_examples.html

I am interested to see how quickly this new evidence percolates into academic and financial market awareness. Predicting economic turns is a big deal, for policy formulation and for investment, but that doesn’t guarantee people will change their thinking.

Excellent work, by the way.

I am actually understanding more of Menzie’s and Ferrara’s paper than I thought I might going into it. Anything that could “fine tune”/”improve upon” the yield curve you would think would attract some attention. I had thought since the yield curve has “less predictive power” for emerging market economies that Menzie and Ferrara’s work would attract attention in that sphere of the work being done. I’m not exactly an expert on what defines seminal economic papers, but I have read a few research papers in my day, and seems this has some hints at that type work.

Economists at the Banca D’Italia have taken up the challenge of assessing the degree of Italy’s reliance on “foreign dependent products” (FDPs). The impetus for carrying out this research is the risk of trade fragmentation – loss of access to some foreign inputs.

Some of the key findings are entirely predictable:

“We find that the impact of geoeconomic fragmentation largely depends on two dimensions: (1) the degree of substitutability between FDPs and non-FDPs, and (2) firm-level characteristics (i.e. exposure to the shock and expenditure on FDPs).”

The data used are from a survey unique to Italy, so duplicating this research for other economies may be difficult. Within the EU, Italy is second only to German in industrial output, which suggests other countries would suffer smaller direct effects from trade fragmentation. However, since other countries rely on Italy (and German) for manufactured goods, the indirect effects can’t be ignored.

Anyhow, good yeoman work on assessing the effects of increasing barriers to trade. I’d be curious to see similar assessments based on imposing Pigouvian taxes on the petroleum products that drive global goods trade.

Here’s a Vox EU article describing the reseach:

https://cepr.org/voxeu/columns/inputs-geopolitical-distress-risk-assessment-based-micro-data

Here’s the paper itself:

https://www.bancaditalia.it/pubblicazioni/qef/2023-0819/index.html?com.dotmarketing.htmlpage.language=1&dotcache=refresh

Austin Texas has joined the ranks of jurisdictions which has tinkered with Guaranteed basic income:

Austin Guaranteed Income Pilot: Participant Outcomes at 12 Months

https://www.urban.org/research/publication/austin-guaranteed-income-pilot-participant-outcomes-12-months

Austin’s results were in line with those reported from other basic income projects:

-Employment was generally stable, with some recipients extending work hours because of reduced commute times. Some undertook additional training in preparation for a better job.

– Mental health was generally improved, with the exception of some participants who reported increased worry because, you guessed it, things could get worse once the program ended.

– Food security improved.

– Housing access and stability improved.

– Nothing on physical health, family stability or violance which is unfortunate. Many such programs report improvement in all of these.

Not terribly surprised. Austin has had problems with homeless in tents etc, and you know when the riffraff starts hanging around too close to the Kardashians, all those “really dumb” ideas like UBI start to look like the work of a genius. Strange how those wrinkles in the sheets just magically work themselves out when they inconvenience the “appropriate parties”.

I was also going to say, and then got scatter-brained like usual, Austin doesn’t want to become as bad as Senator McCarthy’s Bakersfield California. Do a search of that city on Youtube and look for the ones where the “nightcrawler” police scanner chasers get bored and put the camera on the local junkies. Not really that humorous if you have any empathy in your soul, but semi-entertaining in a jaded kind of way. The type of thing that probably gives Rick Stryker, Peter J. Wallison, and Bruce Hall incurable giggles.

My brief understanding was that most of the folks spent the extra money on housing.

We have a homeless problem in America today. We have a substance abuse problem in America today. We need solutions to these social problems.

One problem with building prediction models for recessions is that there are very few actual recession events from which to create/test a model and there are a lot of parameters that can influence the GDP changes. So sure you can make a model that looks great and is a perfect fit for the data which created the model. But where can you get a completely independent dataset on which to test and make sure that it is not a clusterfog of confirmation bias.

So, EverGrande went “splat”. The commonplace take is that this will induce capital outflows, that domestic investors will be paid before foreign investors and so on.

But this has been coming for some time. Sure, realized losses are harder to fudge than potential losses, but everybody has been braced for this. Households are screwed, because the thing the “own” either doesn’t exist or isn’t finished and probably never will be. Which is a pretty obvious explanation for the weakness of household demand – the wealth effect, China style. If China actually wants to paly with the big kids in international finance, screwing foreign investors is a poor choice.

Back in October, EverGrande’s problems caused a bank run:

https://asiatimes.com/2023/10/evergrande-bankruptcy-fears-spark-a-bank-run-in-china/

Which is kinda interesting, to me anyhow, since Moses was hearing about a bank run (?) in China a day or so ago. I can find anything about bank runs intheusual places, but there’s this:

https://finance.yahoo.com/news/china-removes-article-merger-bad-044027873.html

China either is or isn’t merging three bad debt management firms into a state-run bad debt firm. That seems pretty sure to be EverGrande related, even without the liquidation order.

A different topic but shipping is often discussed here:

Containers Lost at Sea – 2023 Update

World Shipping Council, May 2023

https://static1.squarespace.com/static/5ff6c5336c885a268148bdcc/t/646cf5b50ba5a260052b1b66/1684862389529/Containers_Lost_at_Sea_2023_FINAL.pdf

In total 661 containers lost at sea in 2022, out of 250 million transported.

• This represents the lowest losses in % since the start of the survey in 2008.

Doesn’t fci includes term spread as one of the factors?

User: For advanced economies, the FCI we use does not include the term spread. Many others do.

Here is some guy supporting Nikki Haley.

https://www.bloomberg.com/news/articles/2023-10-31/gary-cohn-to-co-host-new-york-city-fundraiser-for-nikki-haley

He looks familiar. Didn’t he and another Jewish guy provide moral support for Nazi groups not terribly long ago???

https://www.politico.com/story/2017/09/13/conservatives-worry-trumps-tax-writing-democrats-lack-credibility-with-congress-242640

Oh wait, in that photo, Cohn and Mnuchin were just protecting journalists from the extremely bright glare coming from the elevator doors. I forgot, how silly of me.

Interesting writing by Steve Randy Waldman:

https://drafts.interfluidity.com/2023/11/30/obama-was-the-most-destructive-political-figure-of-my-lifetime/index.html

Failure to stump speech or jump on the soapbox for the mortgage cramdowns was when it became brutally clear President Obama was a great orator, but a narcissistic orator who was only willing to make the effort to orate only if and when it served himself. The people who voted him into office were an after thought. And I’m not just referring to Blacks on that last part.

So Waldman didn’t vote “for” Jimmy Carter? Hard man to satisfy.

Yes, Obama made mistakes. The truth, as I see it, is that while we have had a long string of candidates running as outsiders, the winners have all been insiders, with the exception of Trump. They pretty much have to be. They are the choice of, a reflection of, our political culture, our culture writ large.

Before you can change things, you have to get elected – that’s the rule politicians live by. And once they’re elected, they have to get re-elected, and that turns out to be a massive constrain on what they can do. Summers didn’t tell Obama that a trillion dollar ARRA would be bad economics; even he knew that wasn’t true. Summers said a trillion dollar ARRA would be bad politics. Perhaps a misjudgement – Summers is often wrong – but based on a view of who the voters were.

Waldman seems bitter that his countrymen do not provide him with better candidates, even if he’s not clear that that’s his actual beef. I’m bitter about that, too. But our culture, a culture veering awfully close to re-electing Trump, won’t allow me better alternatives than Joe Biden or Hillary Clinton. Or Barack Obama.

Interesting question posed by the NY Times: “Why Cut Rates in an Economy This Strong? A Big Question Confronts the Fed…Fed officials themselves projected in December that they would make three rate cuts this year as inflation steadily cooled. Yet lowering interest rates against such a robust backdrop could take some explaining.” https://www.nytimes.com/2024/01/30/business/economy/fed-interest-rates.html

And what would the rationale be for shifting returns from savers and bondholders back to stockholders? Among other things, interest income is realized and taxable while much of stock appreciation is not.

Since the article you link is behind a paywall, I can’t address the author’s argument. I can, however, respond to the question posed in her title and to your odd set of points.

The simple answer is that the Fed has a three-part mandate, including price stability, low unemployment and financial stability. If, in the judgement of FOMC members, that mandate is best served by cutting rates, then they should cut rates. Period. Not much wiggle room. That should be obvious to anyone pretending to understand Fed policy decisions. You haven’t mentioned the Fed’s mandate, and none of the issues you’ve raised are included in that mandate, but I’m not surprised.

And, just to be clear, the Fed doesn’t have an income distribution mandate. Period. No wiggle room. Johnny is once again arguing for taking money from average folks (borrowers) to give it to the well off (savers/lenders).

For those who are curious as to why Fed officials might think they will need to cut rates, poke around with the Atlanta Fed’s Taylor rule utility:

https://www.atlantafed.org/cqer/research/taylor-rule#Tab1

Conventional settings for the rule mostly show that rates are currently too high. That is to say, the FOMC is already erring on the side of caution against inflation, and against economic growth. The Fed doesn’t have an anti-growth mandate, so the premise of the article’s title isn’t valid – the Fed’s mandate is pro-growth, not anti-growth.

The Fed is behaving as if it’s members fear a backlash should inflation recur. Fair enough, they probably would. But as time elapsed, there will be less excuse for maintaining tight policy.

Now, Johnny has made two arguments in past comments about interest rates which are both incorrect. One is that high interest rates don’t slow investment. When shown evidence that rates do affect investment, he wiggles and weaves, but the fact is that rates affect investment and spending.

His other argument is that higher interest rates are good for income. That’s so obviously untrue that I can’t believe he tried it. Interest payments are zero sum in a static sense – every dollar of interest received by one person is paid by another. In a dynamic sense, income is lost to the extent that high rates slow growth.

When Johnny talks about “savers” losing income, he is arguing that one group of people – savers – should be given an advantage over another group – borrowers. And since the rich save more, he is arguing for a policy which gives money to the rich by taking it from the rest.

By the way, anyone who pretends to know enough to express an opinion about Fed policy ought to know about the Fed’s mandate and out to know about the Taylor rule. Anyone who doesn’t is faking. Anyone who ignores the mandate and the Taylor rule is selling bull plop.

And if you don’t like the Fed’s mandate, hop down off your soap box and write your Congress Critter.

and let me follow up with another observation that has been told to Johnny, but he conveniently ignores. yes, if you have savings, then you have money in the bank that can earn interest. however, for the average person that Johnny acts like he is protecting, they have very little in savings. so when rates are high, johnny’s preferred mode, they get a few more dollars in at best is $10k in savings somewhere. and that is only if they are sophisticated enough to have their money in a good interest bearing savings account. not a checking account. on the other hand, those average folks Johnny is so concerned about typically have quite a bit of debt from mortgages, heliocs, and credit cards. those costs increase substantially in a higher interest rate environment. most average folks do not gain in the way that Johnny makes you believe. on the other hand, wealthier households have quite a bit of cash sitting in banks, bonds, etc. the payouts for those assets is much greater than in low interest rate environments. it is simply foolish for Johnny to argue that high rates are good and low rates are bad for the average Joe. the opposite is more true. I have made more money from my savings cash in the past year than in the previous two decades.

the average Joe retires on social security and not much else. those folks do not do well in a high interest rate environment. the wealthy do well in a high interest rate environment.

https://dnyuz.com/2024/01/30/why-cut-rates-in-an-economy-this-strong-a-big-question-confronts-the-fed/

This will get you past the paywall. Please read the whole thing as Jonny boy did not. Especially

“Increasingly steep real rates could squeeze the economy just when it is showing early signs of moderation, and might even risk setting off a recession. Because the Fed wants to slow the economy just enough to cool inflation without slowing it so much that it spurs a downturn, officials want to avoid overdoing it by simply sitting still.”

Yes, speculatively, “Increasingly steep real rates could squeeze the economy.” But that has been predicted for some time now and has yet to happen.

Yes, the Fed has a maximum employment mandate and a price stability mandate. A major, practical result of that mandate during the 2010s was to lower interest rates and boost asset prices, (the wealth effect). This sucks income from those who get their investment returns from relatively secure, taxable investments and transfer the returns in the form capital gains to wealthy shareholders who just get richer while shielding their increasing wealth from taxes.

Given that inflation is getting is getting into the target range, unemployment is very low, and the economy is humming along, why would the Fed want to mess with a formula that is proving successful. Why promote capital gains and asset appreciation over returns from interest bearing assets, whose holders (people on fixed incomes, saving for retirement, or saving for a new home, their kids college education, or a health savings account) were starved of positive, real after-tax returns for a decade?

(I fully understand why the Wall Street shills here prefer capital gains to interest incom…)

Here is part of that story we know Jonny boy did not read (and even if he had – he would not understand):

‘The neutral interest rate is key.

Another important tool for understanding this moment in Fed policy is what economists call the “neutral” interest rate. It sounds wonky, but the concept is simple: “Neutral” is the rate setting that keeps the economy growing at a healthy pace over time. If interest rates are above neutral, they are expected to weigh on growth. If rates are set below neutral, they are expected to stoke growth. That dividing line is tough to pinpoint in real time, but the Fed uses models based on past data to ballpark it. Right now, officials think that the neutral rate is in the neighborhood of 2.5 percent. The Fed funds rate is around 5.4 percent, which is well above neutral even after being adjusted for inflation.’

If expected inflation is near 2.4%, the inflation adjusted Fed funds rate is 3% which is indeed above the Wicksellian neutral rate. But wait – we are now doing actual economists which we know is WAY above Jonny boy’s little excuse for a brain.

Yadda, yadda, yadda…the neutral rate…another nice economics theory built with lots of pretty assumptions that current performance of the economy is disproving. Let’s not forget that in most of the 1980s and 1990s, the economy did very well, even though interest rates were considerably higher than they are today.

I said you wouldn’t understand it and there you go acting like the moron you are

I recall the 1980s to be pretty miserable economically. The 1990s boom was the result of demographics. Baby boomers and women entering the workplace. It was not because of interest rates.

It might help if we go back 24 years. Well I get that little Jonny boy is incapable of thinking about even 24 seconds ago but the adults here should get this. Back in 2000 we had interest rates higher than they are today and a very strong economy. Now people with a functioning boy (which excludes little Jonny boy) may remember the ICT (internet, computer, telecom) boom.

A lot like the semiconductor boom we have today which has increased business investment so much that the economy has weather the fall in residential investment from the high interest rates. And yea we have seen many times how dumba$$ Jonny boy cannot begin to grasp this simple idea. So yea a strong economy for now from this investment boom.

But wait the ICT boom did not last and the FED did lower interest rates a lot in 2001. We had a recession in part because the FED back then was not quick enough to act. And of course little Jonny boy wants a repeat of that mistake as he is cheering on a recession the same way Donald Trump is. Go figure.

The IT boom was a phenomenon of the late 1990s. The economy grew at a good rate in the midst of relatively high interest rates from 1983 -2000, with the exception of 1990-1991. https://fred.stlouisfed.org/graph/?g=1f2B1

pgl has a very selective memory.

Gee little Jonny boy never heard of the Bush41 recession or Reagans 1982 fiasco

Interest rates were high in the early 80s. And yet I remember that to be a particularly hard time for the working class johnny. It invalidates your argument that high interest rates are good for the non wealthy. Demographics were more important during the time period you note johnny.

Why the deficit increasing when economy is so strong?

https://fred.stlouisfed.org/series/FYFSD

Little Jonny boy is on a tear trying to dismiss the concern that high interest rates could risk an economic downturn. The problem with his little tear is that all little Jonny boy has done has been to show the obvious – little Jonny boy is a moron.

First of all little Jonny boy thinks the recent episode has gone on for a long time. Short term interest rate have been elevated for an entire 18 months. Not 18 years. 18 months. I bet Milton Friedman is laughing from his grave at little Jonny boy.

And my favorite is how little Jonny boy claims we have 18 years of a booming economy (1983 to 2000) sort of forgetting that the first few years came after a very deep recession with the FED lowering interest rates to get us back to full employment eventually. And of course there was that Bush41 which I guess little Jonny boy pretends never happened.

Come on Jonny boy – keep the stupidity coming and I’m just warming up.

This is because johnny would like to see economic mistakes and a weakened economy. That is his long term goal. Goad you into a mistake. He wants the usa to do poorly, not have success. Why else would one argue for high interest rates in a low inflation environment.

Didn’t I say Trump’s attorney Alini Habbi is a bimbo?

‘Bogus motion by the Trump team’: Legal experts mock Habba’s latest ‘nonsense’ filing

https://www.msn.com/en-us/news/politics/bogus-motion-by-the-trump-team-legal-experts-mock-habba-s-latest-nonsense-filing/ar-BB1huKFb

Alina Habba — who represented former President Donald Trump in writer E. Jean Carroll’s defamation suit — is getting roasted for her most recent filing challenging US District Judge Lewis Kaplan’s impartiality. Salon reported that in the 1990s, both Judge Kaplan and Carroll attorney Roberta Kaplan (no relation) worked at the same white shoe law firm. An unnamed source claiming to be a partner at the firm told the New York Post that the fact that Lewis Kaplan mentored Roberta Kaplan was “insane” and “incestuous.” Habba used that to argue that there was an undisclosed conflict of interest and that there should new a trial.

“If Your Honor truly worked with Ms. Kaplan in any capacity — especially if there was a mentor/mentee relationship — that fact should have been disclosed before any case involving these parties was permitted to proceed forward,” Habba wrote, requesting more information about the relationship between Judge Kaplan and Carroll’s attorney. She also argued that Carroll’s other attorney, Shawn Crowley, once clerking for Judge Kaplan was an additional conflict of interest. CNN legal analyst Elie Honig said Habba’s filing was “a bogus motion by the Trump team,” and that the fact that older, more established attorneys often mentor new lawyers doesn’t prove the need to convene a new trial. “There’s nothing there,” Honig said. “Every judge in that courthouse knows, socializes with, has worked with, sometimes maybe mentored, dozens, hundreds of attorneys in this city. I used to practice in that courthouse in front of judges who used to be my colleagues, my supervisors. If anything, they were tougher on me as a result of it. That is not enough for a conflict of interest.”