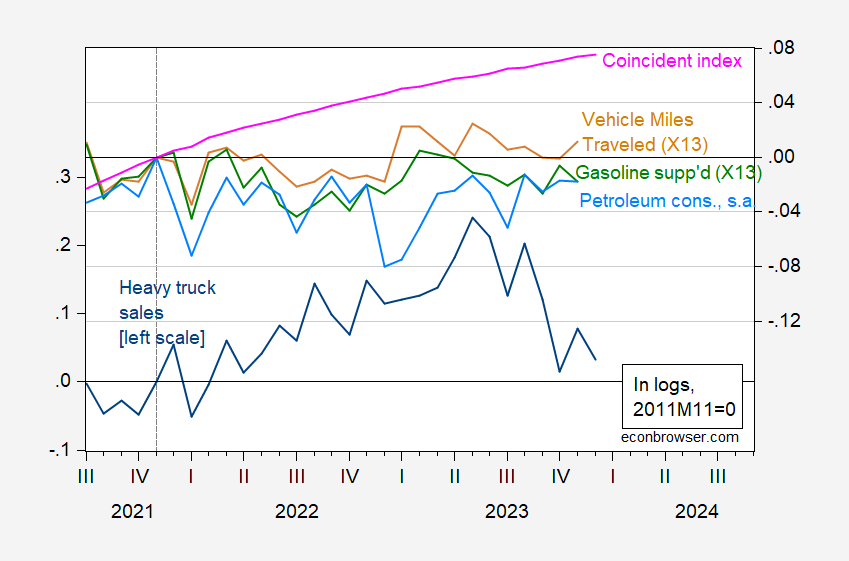

The key indicators followed by the NBER Business Cycle Dating Committee, in light of today’s employment release, is discussed here. However, several alternative indicators have been proposed (some of dubious usefulness, like Vehicle Miles Traveled and gasoline consumption). Here’s a graph over the corresponding time period, normalized to 2022M11.

Figure 1: Heavy truck sales (blue, left scale), coincident index (pink, right scale), vehicle miles traveled seasonally adjusted using X13 (tan, right scale), gasoline supplied seasonally adjusted using X13 (green, right scale), petroleum consumption seasonally adjusted (sky blue), all in logs, 2022M11=0. Source: Census, Philadelphia Fed, NHTSA via FRED, DoE EIA, and author’s calculations.

While petroleum products supplied, and gasoline consumption have trended sideways, I think these are indicators of limited usefulness in these times. Vehicle miles traveled have been somewhat higher over 2023, and are rising through November. The coincident index, based primarily on labor market indicators, continues to rise, so that buttresses the case for no downturn in December. What is falling is heavy truck sales, although it has not plumbed negative rates of growth consistent with a recession.

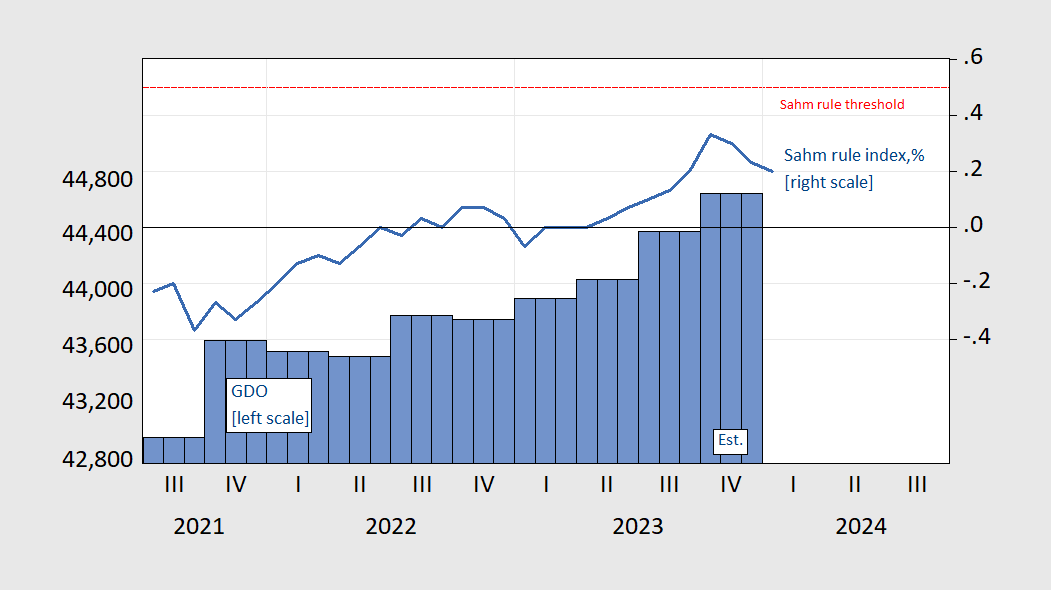

In addition, one can look to GDO and the Sahm rule for further confirmation of no-recession. We don’t have GDO for 2023Q4 (because we don’t have GDI for that quarter). However, if we assume the net operating surplus is the same in Q4 as Q3 in nominal terms, we can guesstimate GDI and hence GDO.

Figure 2: GDO in bn.2017$ SAAR (blue bar, left scale), and Sahm rule index, real-time, % (blue line, right scale). 2023Q4 value for GDO is based on assuming nominal net operating surplus is constant at 2023Q3 levels. Horizontal dashed red line is threshold for recession. Source: BEA, FRED, and author’s calculations.

The Sahm rule indicator suggests that we are not in a recession as of January 2024; furthermore, the indicator is moving away from the threshold. Of course, it’s possible to retrace upwards and the economy go into a recession, but in the past 50 years, this has only happened once (hits threshold in 1969M10, falls and then breaches the threshold in 1970M02. NBER dates the peak at 1969M12).

Off topic? Maybe, but it’s a cyclical indicator, so…

The recent improvement in reported consumer confidence is consistent with stock market performance, and financial market performance has in the past been positively correlated with consumer confidence, particularly as reported in the U. Michigan confidence data. Conference Board confidence, on the other hand, is more strongly correlated with labormarket conditions than are U. Michigan data. And whataya know, job gains are roaring just as confidence measures improve.

If you take a look at Conference Board labormarket charts, you’ll find a sharp rise in “jobs easy to get” and a similar drop in “jobs hard to get” in the latest report:

https://www.conference-board.org/topics/labor-markets-charts

BLS data show that “jobs easy to get” is a reality, as well as a perception. Questionis, what happened? Why are firms hiring at a much faster rate in the past two months? The Conference Board’s data do suggest that faster hiring is more than a seasonal anomaly or something that will be revised away.

Business confidence is not particularly strong, and hiring plans have deteriorated. However, lots of firms still report openings and difficulty hiring:

https://www.nfib.com/foundations/research-center/monthly-reports/jobs-report/

Are hiring plans cooling off in part due to frustration at the lack of qualified applicants? Dunno. But hiring unqualified applicants and whipping them into shape is a time-honored way of creating skills and boosting productivity.

Anyhow, financial performance and labor market performance both help explain the return toward normalcy in consumer confidence indicators.