Reader Steven Kopits, who as recently as a couple weeks ago argued strenuously that a recession occurred in 2022H1, writes of the Economic Policy Uncertainty Index graph shown in this post:

Lines up very nicely with your VMT analytics. And it clearly shows recessions, a depression and suppression.

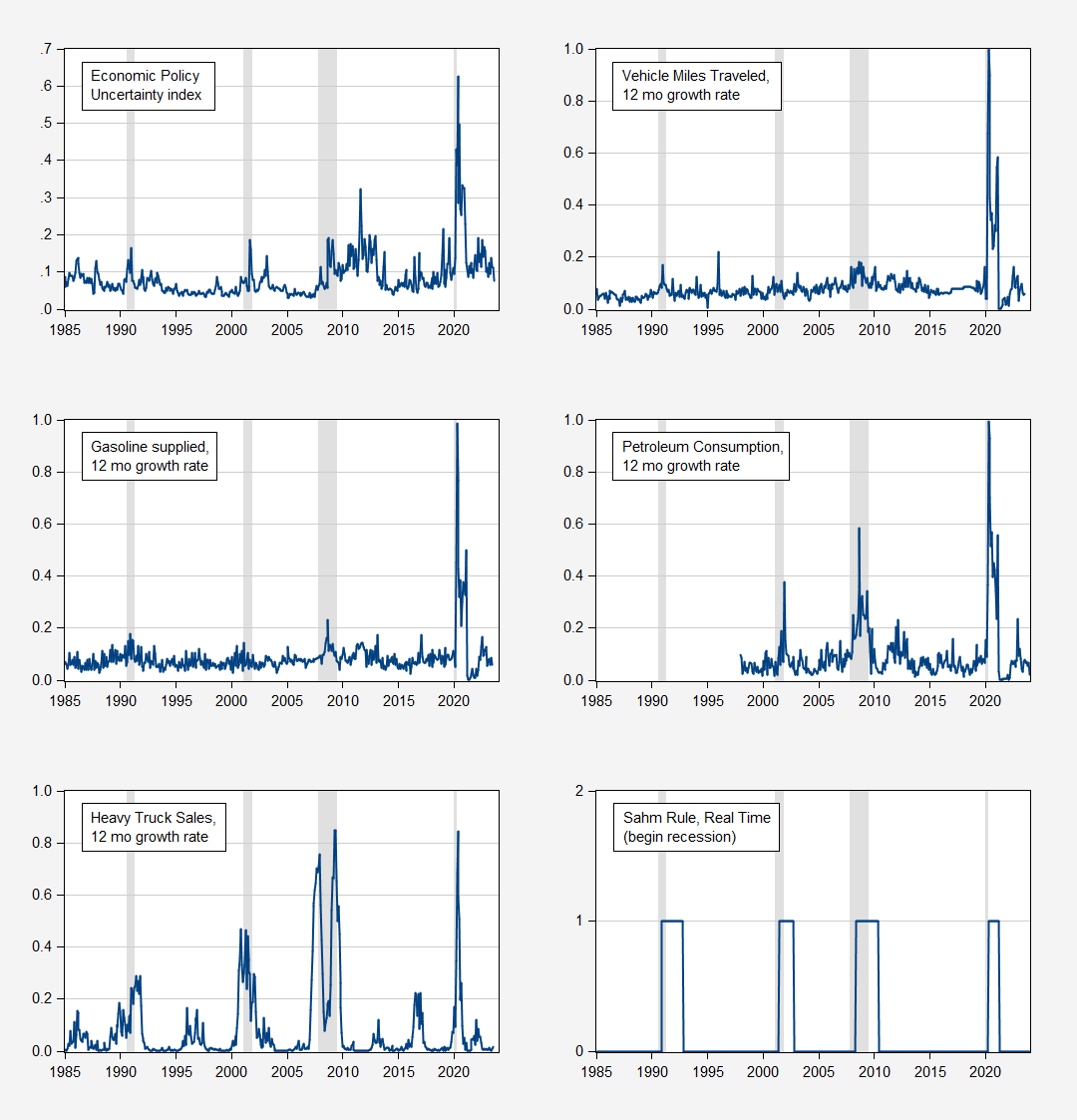

It amazes me how Mr. Kopits can return time and time again to conclusions that are at variance with consensus, despite being provided data to the contrary. In the graphs below, I show how well VMT, gasoline supplied, petroleum consumption, and the Baker-Bloom-Davis Economic Policy Uncertaint (EPU) news-based index does in identifying NBER defined (peak-to-trough) recession dates, as compared to heavy truck sales, and the Sahm Rule (the last one formally identifies the beginning of a recession, not all the recession dates).

Figure 1: Probit regression based estimated probability of recession (NBER peak-to-trough), using level of Economic Policy Uncertaint (top left), using 12 month growth rate of vehicle miles traveled (top right), using 12 month growth rate of gasoline supplied (middle left), using 12 month growth rate of petroleum consumption (middle right), using 12 month growth rate of heavy truck sales; and Sahm Rule for beginning of recessions. NBER defined peak-to-trough recession dates shaded gray. Source: policyuncertainty.com, NHTSA via FRED, EIA STEO, Census via FRED, Claudia Sahm via FRED, NBER, and author’s calculations.

EPU captures recessions, but provides a false positive for a 2011 recession using a 30% threshold (apropos, these spikes were associated with government shutdowns and a debt ceiling crisis). Using a 12% threshold, VMT growth rate captures all recessions at the cost of three false positives. A similar story is told for gasoline supplied. For a truncated sample (3 recessions), petroleum consumption has no false positives and no false negatives using a 38% threshold. Using a 30% threshold, heavy truck sales have no false positives and no missed recessions, for 4 recessions.

The Sahm Rule, which requires a 0.5% increase in 3 month moving average unemployment rate over the minimum rate in the previous 12 months always tags the beginning of recession.

Even using the VMT, gasoline supplied, petroleum consumption variables, I do not see a recession in 2022H1 unless using a very low threshold. In addition, the Sahm Rule indicated no recession.

“It amazes me how Mr. Kopits can return time and time again to conclusions that are at variance with consensus, despite being provided data to the contrary.”

Indeed. It amazes me that this Know Nothing pushes his suppression ‘hypothesis’ while ignoring an application of basic macroeconomics to Russian interest rate data. After all – those of us who get macroeconomics are out of his league. Yea – his league was the crew in One Flew Over the Cuckoo’s Nest.

The difference between pursuing a hypothesis to gain insights and pursuing data to prove an already decided narrative, is the difference between a scientist and a political hack. Real progress and new insights are not produced by those who doggedly go out to prove their ideas, but by those who are open and ready to accept evidence that disprove them. Always start with the open question not the answer and narrative.

Notice that Stevie cites an outlier forecast for oil prices which the authors themselves heavily qualify, then uses that forecast as the basis for a political forecast which flatters his own preference. Not that Stevie’s political forecasts count for much.

But then, in the same comment, Stevie rather blatantly cited an outlier political poll which also flatters his own preferences. Stevie not only lives in bubble-world, he inflates the bubble.

Let’s remember that the process of generating the whole “stolen election” lie involved creating an alternate “reality” for MAGA cultists, a looeytoons belief that Trump could not lose an election. Here’s Stevie, creating a looneytoons world in which oil prices increase by 66% and in which Biden is trailing Trump badly in the polls, as predicate for a forecast that Biden will lose the 2024 election. Let’s also note that in Stevie’s made up world, either Biden loses the presidency because oil is at $150/bbl or because we’re in recession. In Stevie’s looneytoons world, Biden winning a second term is inconceivable.

Wonder what Stevie will be saying next November, if Biden wins and Democrats take the House. Who know? Maybe Stevie will storm the Capitol Building in some future January.

Well, JPM is saying oil prices could go to $150. I noted something similar in The Andurand Thesis, which put oil prices to $140.

There are reasons why this might not happen: recession, release of excess crude inventories in China and India; or a decision by OPEC to increase production.

Nevertheless, we see declining US shale output, with the EIA effectively call a peak for July 2023 and an expected decline of 82 kbpd to October. This is consistent with rig counts, which have been falling since last December, with frankly no end in sight at this point. That puts OPEC and Russia firmly in control, and the last time OPEC was in control, oil prices were $110 / barrel, which is $140 / barrel in inflation adjusted terms.

Further, oil demand remains well off of long term trends, and if it closes faster than expected, then yes, oil price increases could be stiff indeed.

It’s really simple. If you think oil prices do not matter to US consumers and will not affect their voting preferences, then you have nothing to worry about and can ignore the issue. If, on the other hand, you think Americans will vote their pocketbooks come next November, then you have every cause to be worried. An WaPoABCnews poll puts Trump up 51-42 over Biden. I am no Trump fan, but if pump prices go up to $5-6 / gallon, I think Biden will have to be very lucky to be re-elected.

And if you think that Urals above $100 would be no problem for Ukraine, then again, you have nothing to worry about. On the other hand, if you think Russia’s announced increased of 70% in its war spending next year is a problem, then maybe you’re concerned.

https://finance.yahoo.com/news/jpmorgan-forecasts-energy-supercycle-brent-151922761.html

https://www.princetonpolicy.com/ppa-blog/2023/1/13/xyvxrimfc7cdkzjmqpnuprihu1encv

https://www.princetonpolicy.com/ppa-blog/2023/9/23/rigs-and-spreads-sept-22-peak-shale

https://www.princetonpolicy.com/ppa-blog/2023/2/2/why-us-shales-matter-for-ukraine

https://www.msn.com/en-us/news/politics/post-abc-poll-biden-faces-criticism-on-economy-immigration-and-age/ar-AA1hagYp

https://news.yahoo.com/russia-increases-war-spending-nearly-154908688.html#:~:text=Russia%20is%20set%20to%20increase,(roughly%20US%24113%20billion).&text=In%202023%2C%20RUB%206.4%20trillion,trillion%20(US%2437.5%20billion).

https://www.msn.com/en-us/money/companies/american-labor-s-real-problem-it-isn-t-productive-enough/ar-AA1gZgKJ?ocid=msedgdhp&pc=U531&cvid=f365e5ccdf7a4d759304934399970d7d&ei=1

American Labor’s Real Problem: It Isn’t Productive Enough by Greg Ip

I’m linking to this anti-union BS ala a WSJ type hoping others can help me take this down. Ip is pretending labor markets are perfectly competitive as if he agrees with Princeton Steve that monopsony power cannot exist. Of course labor economists know better. Ip pretends that real wages have captured all of past productivity increases, which is clearly not true. Ip just ignores the rise in profit margins for companies like GM and Ford.

But otherwise a good article if one is trying to impress the fat cats who worship the WSJ.

Best I can tell, US labor productivity appears to be on its long-term trend. It was pretty clear that the pandemic and related policy responses had raised labor productivity — probably by withdrawing lower paid labor from the workforce. When they went back to work, productivity declined and returned to its long-term trend.

https://fred.stlouisfed.org/series/OPHNFB

By contrast, Manufacturing Sector: Labor Productivity (Output per Hour) for All Workers, looks pretty grim. In essence, by this measure, labor productivity has actually declined since 2011.

https://fred.stlouisfed.org/series/OPHMFG

This is about 6 weeks old:

https://www.reuters.com/markets/us/us-productivity-surges-second-quarter-labor-costs-growth-slows-2023-08-03/