SPGMI monthly GDP m/m growth for December shoots up at an annualized 12.2%, after 9.8% in November.

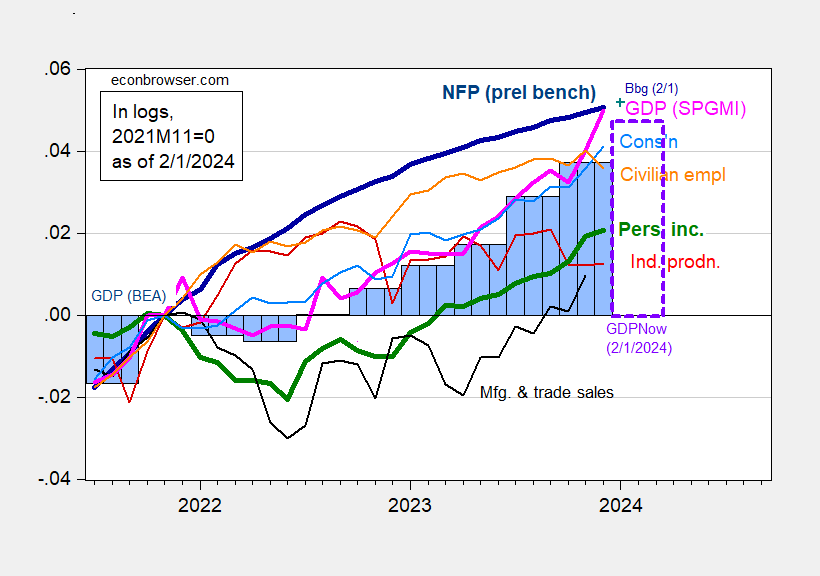

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 2/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 3rd release (blue bars), GDPNow for 2024Q1 as of 2/1 (lilac box), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/1/2024 release), and author’s calculations.

From SPGMI

Monthly GDP rose 1.0% in December following 0.8% growth in November that was revised higher by 0.6 percentage point. The robust December gain was mostly accounted for by solid growth of personal consumption expenditures, a large increase in the pace of nonfarm inventory-building, and an increase in net exports.

Final sales grew at 7.0% and 7.9% in November and December (m/m AR).

I feel certain I am missing something here because the 12.2% number and 9.8% number just seem monstrously high to me. Because Christmas?? Can someone once again clue the slow guy in the room (me) what is going over my head here on those two numbers being so ungodly high??

Here’s the explanation, from the source:

“Monthly GDP rose 1.0% in December following 0.8% growth in November

that was revised higher by 0.6 percentage point. The robust December

gain was mostly accounted for by solid growth of personal consumption

expenditures, a large increase in the pace of nonfarm inventory-building,

and an increase in net exports. The level of GDP in December was 3.7%

above the fourth-quarter average at an annual rate, implying that flat

readings for monthly GDP over January, February, and March would

imply 3.7% GDP growth in the first quarter. Our current expectation is that

monthly GDP will reverse a portion of the December gain in January and

that GDP will advance at a 2.0% annual rate in the first quarter.”

Hit the “commentary” link here:

https://www.spglobal.com/marketintelligence/en/mi/products/us-monthly-gdp-index.html

By the way, notice the bit about flat performance through Q1 producing 3.7% SAAR GDP growth. That’s a heck of a running start.