In this post from Monday, I recounted the US results from Chinn-Ferrara (2024), using debt-service ratio data up to end-2022. The BIS has now released debt-service ratio data up to Q2. I use a regression of DSR growth rate on changes in AAA and 3 month Treasury yields, and 2 lags of DSR growth to forecast 2023Q3 DSR. I then obtain the following estimate of recession probability through 2024M09.

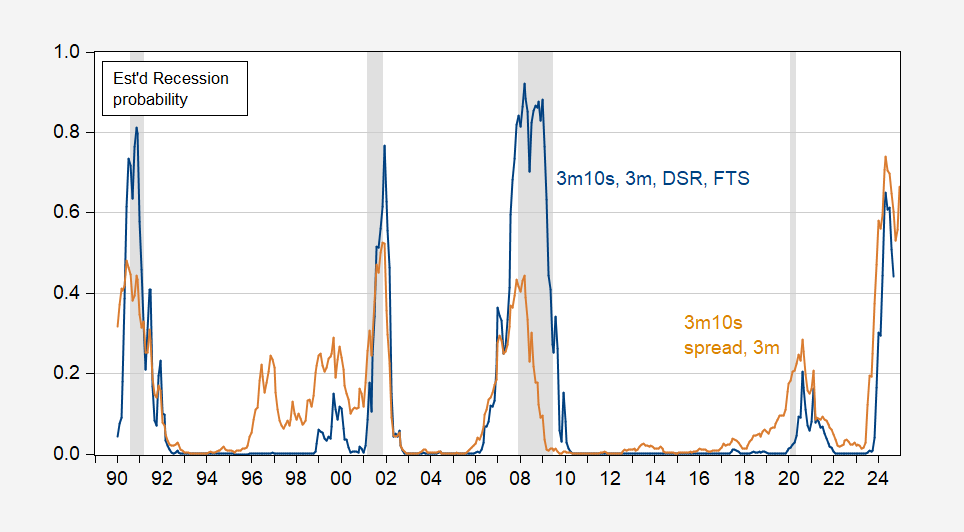

Figure 1: Probability of recession from term spread and short rate (tan), and term spread and short rate, debt-service ratio, foreign term spread (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

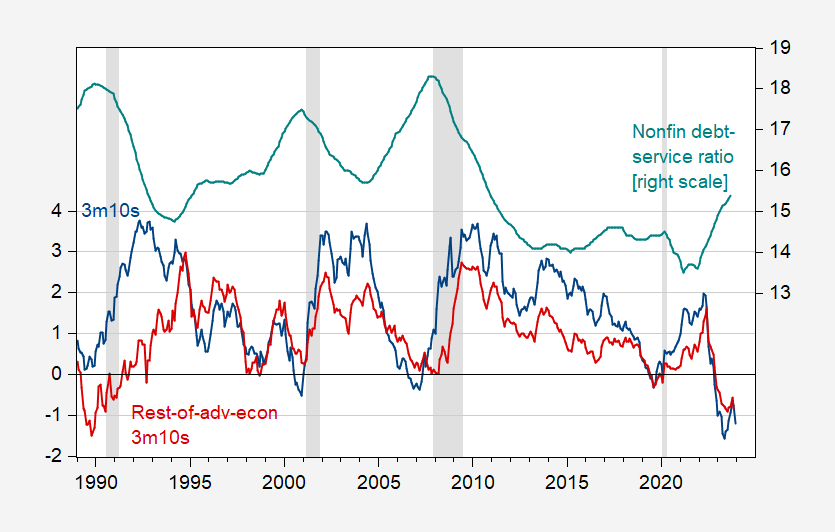

These probability estimates are based on these series.

Figure 2: Ten year – three month Treasury term spread (blue, left scale), and long term-short term sovereign spread in rest-of-advanced economies, GDP weighted, both in % (red, left scale), and debt-service ratio for nonfinancial corporations, % (teal, right scale). Monthly DSR linearly interpolated from quarterly data; 2023Q3 data extrapolated as described in text. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Dallas Fed DGEI, BIS, NBER, and author’s calculations.

The probability of recession according to either specification is quite high. A simple term spread plus short rate model indicates 56% in February, while the full specification indicates only 29%. In other words, if the full specification is the more accurate (as suggested in Chinn-Ferrara), then the absence of an obvious recession onset thus far should not be taken as proof positive a recession is going to be avoided. Peak estimated probability of recession is May 2024 (65% according to full specification).

Last sentence of first paragraph should read “I then obtain the following estimate of recession probability through 2024M09”??

Moses Herzog: Yes! Thanks for catching that.

I was pretty certain, in the weird machinations of my mind, we wouldn’t have recession in ’23. Now I am perplexed. Not “frustratingly perplexed” really. Maybe even “entertainingly perplexed”. I put strong weight to Menzie’s and Ferrara’s scholarly work above. And yet….. yield curve prescience has been less reliable recently, and the limited data (limited due to my laziness) on WSJ, FT etc, just doesn’t scream anything recession like to me, other than, rates are probably too high now. I know the tradition has been for the Fed to make quarter point moves. I’m wondering if a 1/8th ( .125 ) move in the rate might not be a good decision here. There’s nothing written in the statutes that says they can’t make a 1/8th move down is there?? Would it be “so crazy”?? Honestly like anyone’s thoughts here. Even from our trump bobbleheads.

I look at that data and expect recession. Then I look around and see no signs of it in employment, rush-hour traffic, construction, or much of anything else that my limited view can take in. If there’s a recession, it’s probably going to be regionalized somehow. That’s my cloudy plastic crystal ball’s take on it.

Maybe off topic? Maybe not. James got me thinking about productivity and hiring.

Here are two presentations of private employment and labor productivity. You can see that productivity tends to lead hiring. I’ve tossed in two presentations because some folks may find it easier to identify the lead in one, some in the other:

https://fred.stlouisfed.org/graph/?g=1f9UN

https://fred.stlouisfed.org/graph/?g=1f9Xm

There are two obvious causes for the lead. One is that when productivity is high, employers can hope to make more money by hiring more people (all else equal). The other is that economic shocks, good and bad, mostly transmit through demand to production, then to hiring. Firms scramble to meet demand, and then hire (or fire) to get capacity back on a sustainable footing.

Look at what’s happening with productivity lately. It’s above the trend from the prior expansion and rising. All else equal, that predicts an acceleration in hiring. Hiring is still strong (unless tomorrow’s data say otherwise), but decelerating. So all else isn’t equal. But consumer demand has driven growth, and hiring has driven demand, so if productivity is signaling continued good hiring, the expansion should continue. (See? Not off topic.)

Maybe the lead time between productivity and hiring hasn’t been long enough. Maybe there aren’t enough job applicants to keep job growth at its earlier pace. Maybe the Fed, trade tensions, the election, something, is keeping firms cautious. Here’s the OECD’s business confidence indicator for the U.S. as a possible “something” indicator:

https://fred.stlouisfed.org/series/BSCICP03USM665S

Anyhow, the disconnect between productivity and hiring looks like another Covid-era anomaly. And it looks supportive for growth, all else equal.

You gave us a lot of inter-connectivity stuff that is important to notice but easy to miss.

These two numbers are not horrific, but could be early early dark clouds?? Something to watch in the peripheral vision anyway.

https://tradingeconomics.com/united-states/jobless-claims

https://tradingeconomics.com/united-states/business-confidence

U.S. PMI contracting “but at a slower pace”. Jobless claims increasing 2 weeks in a row.

Wouldn’t mind hearing from New Deal Democrat on this question. I follow leading indicators, but NDD does some pretty precise thinking about when indicators are just making noise and when they are making a point.

I will say, we know that the factory sector is a mess and that the economy has done OK despite that. How long that can continue is an open question. As to jobless claims, ther have been big swings in both directions recently, so a little smoothing is in order. Here’s the 4-week average:

https://fred.stlouisfed.org/graph/?g=1fbBA

Looks OK for now.

In-between haranguing with the ape brain in Michigan I can’t remember if I posted this already. If I did I can live with the double post:

New Deal Democrat, relatively recent thoughts—–>> https://seekingalpha.com/article/4665416-weekly-indicators-the-economy-hits-an-air-pocket

By the way, I’m sure most folks know this, but it’s a big deal when thinking about the data, so I’m gonna toss it out there again. A big part of the factory slowdown in late 2022 and early 2023 was because the level of goods consumption had gotten extremely high. And goods demand remains high, but hasn’t grown because it had already gotten so high:

https://fred.stlouisfed.org/graph/?g=1fbEJ

But look what has recently started to happen. Goods demand is climbing again. The recent climb in consumer goods demand hasn’t yet been enough to boost orders for consumer goods at domestic factories, though:

https://fred.stlouisfed.org/graph/?g=1fbIp

The first part of your comment reminds me of an argument I had with a doctorate in Harrisonburg. Only yours being the “reverse situation”—“from extremely high, back down to…..”. He was certain a dramatic rise in either retail sales or personal consumption (I cannot recall which) meant a “V” recovery was near certain. It hadn’t dawned on him that going from incredibly low personal consumption or incredibly low retail sales back to “normal” personal consumption, would create a “drastic” “increase” but in reality meant nearly nothing, when all it was doing was returning back to the “normal” level at the “tail end” of the Covid stretch of time.

When there are drastic increases and decreases in economic barometers, the next question should be “from where??, from what level??”

I’ve felt for awhile now that TIPS are a lousy protection against inflation. There are better vehicles for the same purpose.

https://www.ft.com/content/f9cf6d1a-0313-4c1f-aeb2-df1f64bd5d3e#comments-anchor

So, by the numbers, we have reason to be concerned about recession. This is not the first presentation of elevated recession risk that Menzie has provided. Yet Johnny keeps making what are really quite silly, backward-looking arguments for the Fed to keep rates high, to increase the risk of recession. Over and over, reasons to think the Fed should ease are presented, and over and over, Johnny pretends those reasons haven’t been presented, and repeats his poorly-founded argument for the Fed to keep rates high.

Johnny has also repeatedly argued that real wage gains have been weak. Why would Johnny argue that workers aren’t getting their fair share of income, and then argue for the Fed to put an end to wage gains by maintaining high interest rates?

Well, let’s remember that Johnny was cheering for recession prior to the mid-term elections. Let’s remember that Johnny supports Putin’s war in Ukraine. Johnny isn’t really making honest arguments about the economy. He’s making incoherent arguments aimed at generating disaffection mong voters.

Russian propaganda includes an effort to drive wedges between various groups in the U.S. Remember when the internet was crawling with attempts to stir up racial resentment while Obama was president? Russia was a part of that.

If one’s goal is to drive wedges, then it makes perfect sense to tell workers on the one hand that they should be angry about their wages while on the other hand arguing for economic policy that slows wage gains. That’swhat Johnny is doing. Johnny’s goal is to drive wedges.

Johnny has an agenda. It is Putin’s agenda. Weaken U.S. cohesion. Weaken U.S. support for Ukraine. Weaken the U.S.

Tricky Ducky rewrites what I have written. First, I was not cheering a recession in mid-2022. What I was doing is pointing out how certain Democratic-leaning economists’ were obsessed with using technicalities to spin the data to prove that “we’re not in recession,” and providing cover for the fact that economic growth was incredibly weak, borderline recession. Kicking the can down the road to NBER, despite two months of negative growth meant that a determination could be made only months later, preferably after the election. Who knew that the word ‘recession’ was such a politically and emotionally charged word ? And who knew that a supposedly disinterested and impartial bunch of “scientists.” would waste a lot of time over whether the soon-to-be-revised data was a few tenths of a point this side of the line or the other. You would think that they were NFL referees, not “scientists!”

As for the “backward-looking arguments for the Fed to keep rates high, to increase the risk of recession.” Yes, the data released yesterday is “backward looking (by a month), but it is the best data we have. Instead of the most recent data, Tricky Ducky seems to advocate that we should rely on his preferred unreliable forecast. Or may we should dig out the telescope and read the stars?

As I pointed out, the most recent data shows that real wages are rising coincident with falling inflation, unemployment is near historic lows, and economic growth has been great. But Tricky Ducky wants to mess with success because his star gazing tells him that a recession must be imminent.

I mean, if wealthy investors are going to realize enormous capital gains, the best way to achieve that is for the Fed to reduce interest rates under the pretext that recession must be imminent because Tricky Ducky’s reading of the stars says it must be so! Fortunately, Powell seems to have decided that he is not going to let “the market” decide his interest rate policy anymore…and if he did, the market has been doing very well, thank you, having risen 25% in 2023, so where is the need for lower rates to stimulate it more?

Macroduck calls this mumbling, which is too kind for such incoherent and dishonest word salad. But it’s what we expect from a mentally retarded dork. And our host wasted a post calling out your latest waste of time?

Nikki Lightweight never figured out that the Civil War involved slavery and now this?

https://www.msn.com/en-us/news/us/nikki-haley-says-texas-can-secede-from-the-united-states-that-s-their-decision-to-make/ar-BB1hCRcM

Former South Carolina Gov. Nikki Haley stumbled through a question about whether the state of Texas has a right to secede from the United States, and she claimed that it is “their decision to make.” During an interview on “The Breakfast Club” podcast, Charlamagne tha God asked the 2024 presidential hopeful if she would “use force against Texas if they would try to secede from the Union over the border issue?” Charlamagne referenced a 2010 interview with Haley saying the U.S. Constitution allows for states to secede. “I believe in states’ rights. I believe that everything should be as close to the people to decide,” Haley said, adding that she supported Gov. Greg Abbott’s razor wire fencing measure to protect his state amid the growing border crisis. When pressed about the issue of secession, Haley said that, “If Texas decides they want to do that, they can do that. If that whole state says we don’t want to be part of America anymore. I mean, that’s their decision to make.”

She wants to be the Presidential nominee for the “Party of Lincoln”?

In Texas v. White, the Supreme Court found that:

“Considered as transactions under the Constitution, the ordinance of secession, adopted by the convention, and ratified by a majority of the citizens of Texas, and all the acts of her legislature intended to give effect to that ordinance, were absolutely null. They were utterly without operation in law. The State did not cease to be a State, nor her citizens to be citizens of the Union.”

Lots more where that came from. Haley was just making stuff up to please Texas primary voters. She may or may not have any understanding of the Constitutional issue she was addressing, but her answer makes clear she doesn’t care one bit about the Constitution.

Just coincidentally, today is Freedom Day, the anniversary of Lincoln’s signing of a joint Congressional resolution which became the13th Amendment.

Haley certainly has an affection for the antebellum South, before all that freedom stuff. Happy slaves, singin’ in the fields, whippin’ up tasty vittles for the overseers, gettin’ on with another rewarding day of enforced, life-long servitude.

The WSJ has an article behind the paywall raising a question about freedom of navigation. Is the period of U.S. leadership an anomaly in terms of freedom of the seas? Houthi attacks and Russia’s effort to dominate the Black Sea are what inspires the question. Because of the paywall, I don’t know if China’s attempts to dispossess South East Asian nations of their law-of-the-sea rights is also part of the article. Here’s the twit, though:

https://twitter.com/WSJ/status/1752912199440298281

I know the answer to this one. Whenever there is relative calm, navigation rights are generally guaranteed, though not necessarily on a basis that everyone likes. Rome guaranteed navigation rights. Great Britain did, too. But when Great Britain and the Netherlands, or Great Britain and Spain, or Rome and Carthage were disputing navigation rights, those rights have not been guaranteed for others. The Barbary Prirates were an exception; European powers were willing to pay bribes when they could have defeated the pirates (more accurately, the privateers, since they operated under a government mandate).

China and Russia are revisionist nations, in the sense that they do not support the existing international order, and want to “revise” it. To the extent that they make progress toward that goal, freedom of navigation will be reduced. If either country become dominant, globally or regionally, then history suggests they will establish and enforce some set of rules for the use of the oceans, not necessarily to everybody’s liking.

@ Macroduck

If it’s in today’s WSJ hardcopy or tomorrow’s WSJ hardcopy, I can access it and will pass that data nugget on to you by 1pm eastern Friday.

They mention the Taiwan Straight, South China Sea, and the China’s “fortifying of artificial islands”. A retired U.S. Navy admiral said he thought the illegal actions of fortifying the artificial islands would continue, even though against international law. South China Sea discussion does not dominate the WSJ article though as they mention other locations and areas of the high seas being under attack or being contended for shipping commerce.

Interesting…

Supreme Court Justice Gorsuch concurred in the opinion of a 3-judge panel in 2012 that states have the right to exclude candidates from the ballot if they are constitutionally disqualified from holding office:

https://casetext.com/case/hassan-v-colorado

In the case in question, it was Colorado’s secretary of state who had excluded a wannabe presidential candidate from the ballot.

Colorado, secretary of state, presidential candidate, Gorsuch. Nuff said.

It is perplexing. But then, as long as a recession is only ever on the horizon, I’m happy enough.

Payroll employment rises by 353,000 in January; unemployment rate remains at 3.7%

https://bls.gov/news.release/empsit.nr0.htm #JobsReport #BLSdata

https://www.bls.gov/news.release/empsit.nr0.htm

THE EMPLOYMENT SITUATION — JANUARY 2024

Total nonfarm payroll employment rose by 353,000 in January, and the unemployment rate remained at 3.7 percent, the U.S. Bureau of Labor Statistics reported today.

Following up on something Macroduck noted in terms of real compensation. He had compared the rise in nominal PCE over the last year to the 2.6% increase in the personal consumption expenditures price index over the same period.

Today BLS noted only told us about the 353 thousand increase in payroll employment and a rise in the household survey’s employment to population ratio but also the 4.5% increase in hourly earnings over the past 12 months. Yea – that’s a nominal increase but in real terms real earnings rose by almost 2%.

It all may sound like goods news but Larry Kudlow’s staff is enlisting the help of JohnH to figure out someway to spin all of this as bad news. Stay tuned later today for what little Jonny boy cooks up for Kudlow!

“Mexico’s economic growth is disappointing and no one knows when will the “miracle” happen,” said [the clearly flummoxed] Nobel laureate Paul Krugman [back in 2015]….”People are tired of waiting. I am tired of waiting.” Krugman explained that 30 years have lapsed after the (economic) opening and it is clear that it was not enough.” https://archivo.eluniversal.com.mx/in-english/2015/krugman-mexico-disappointing-103617.html

Last December El Pais wrote, “Defying forecasts: Why is Mexico’s economy growing?…

“The year 2023 marks the third consecutive year that Mexico’s economic growth has outpaced market analysts’ early-year forecasts. Looking ahead to 2024, the economic outlook remains cautiously positive.

This vigorous growth largely stems from a set of supply-side public policies launched at the onset of President López Obrador’s administration…This vigorous growth largely stems from a set of supply-side public policies launched at the onset of President López Obrador’s administration. These policies, including comprehensive labor reforms and strategic financial management, have cultivated an environment conducive to investment, resulting in a robust labor market and a marked increase in both public and private investments.

The fiscal strategy of the current administration has successfully kept the country’s debt-to-GDP ratio at a low level by international standards, enhancing Mexico’s appeal to global investors. Simultaneously, this administration has broken with the economic dogma that social spending and public investment are inversely related, managing to boost both while keeping debt levels stable.

In particular, labor reforms and a redesign of the social protection network have bolstered the incomes of Mexican families, contributing to a reduction in poverty and inequality and generally improving quality of life. These reforms have achieved the lowest average unemployment rate in the country’s history.

https://english.elpais.com/economy-and-business/2023-12-19/defying-forecasts-why-is-mexicos-economy-growing.html

What happened? For one thing, Mexico elected a leftist President, AMLO, who was elected in 2018 and heralded as the Bernie Sanders of Mexico. In November 2022 “Tens of thousands marched with Mexican President Andres Manuel Lopez Obrador in a massive demonstration through the center of the country’s capital to show their support for the head of state before a 2024 general election.

“MEXICO IS NO LONGER RUN BY OLIGARCHY, NOW THERE IS A DEMOCRATIC SYSTEM WHOS PRIORITY Is THE POOR ,” the president told people crowding the vast Zocalo square at the city’s center.

Lopez Obrador, whose administration has made double-digit minimum wages hikes for the past four years, proposed that the 2023 increase could land around 20%, and forecast the country’s economic growth would beat expectations.” https://www.reuters.com/world/americas/tens-thousands-march-mexico-city-support-president-2022-11-27/

Instead of being run by a bunch of corrupt, senescent and sclerotic politicians, Mexico has a dynamic leadership that has delivered for its people and is very popular as a result.

Have Democrats noticed? Has Krugman noticed? After trashing Bernie, could he possibly accept Mexico’s counterpart, a practical, leftist?

I was hoping that you were right about Mexico’s economy but as usual I had to check on your general fact free babble:

https://knoema.com/atlas/Mexico/topics/Economy/National-Accounts-Gross-Domestic-Product/Real-GDP-per-capita#:~:text=In%202022%2C%20real%20GDP%20per%20capita%20for%20Mexico,growing%20at%20an%20average%20annual%20rate%20of%200.98%25.

In 2022, real GDP per capita for Mexico was 10,077 US dollars. Real GDP per capita of Mexico increased from 6,436 US dollars in 1973 to 10,077 US dollars in 2022 growing at an average annual rate of 0.98%.

Of course real GDP is measured in terms of 2010$ so if you tell us that the US has been running 10% inflation for over a decade then maybe you have a point.

“After the global crisis unleashed by the Covid-19 pandemic, Mexico has sustained an annual economic growth of between 3% and 4%.”

Huh! Jonny boy did not understand the very first sentence of his own damn link. I guess Jonny boy does not realize how far Mexico’s economy declined in 2020.

BTW – Krugman’s discussion was well before the events that Jonny boy sort of mentioned but still somehow botched. Maybe had Jonny boy read the entire (short) discussion, he might have noticed how Krugman noted Mexico was building up its manufacturing base.

The double face of Mexico: the economy grows, poverty remains

https://english.elpais.com/international/2024-01-27/the-double-face-of-mexico-the-economy-grows-poverty-remains.html

From your favorite Mexican newspaper – it seems this account of the Mexican miracle admits Mexico has a lot of poverty but Wall Street is happy with the latest developments. I guess little Jonny boy has indeed turned into another Kudlow!