Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its January 2024 meeting. With falling inflation, the December 2023 Summary of Economic Projections (SEP) projected a range for the FFR between 4.5 and 4.75 percent by the end of 2024. At the press conference following the January 2024 meeting, Fed Chair Jerome Powell said that the FOMC was not likely to cut rates in March. In contrast, futures markets summarized by the CME FedWatch Tool on the day following the meeting predicted a range for the FFR between 3.75 – 4.00 percent by the end of 2024.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In the latest version of our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. We analyze four policy rules that are relevant for the future path of the FFR in the post:

The Taylor (1993) rule with an unemployment gap is as follows,

where Rt is the level of the short-term federal funds interest rate prescribed by the rule, πt is the inflation rate, πLR is the 2 percent target level of inflation, ULRt is the 4 percent rate of unemployment in the longer run, Ut is the current unemployment rate, and rLRt is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where p is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set p as in Bernanke, Kiley, and Roberts (2019). Rt-1 equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

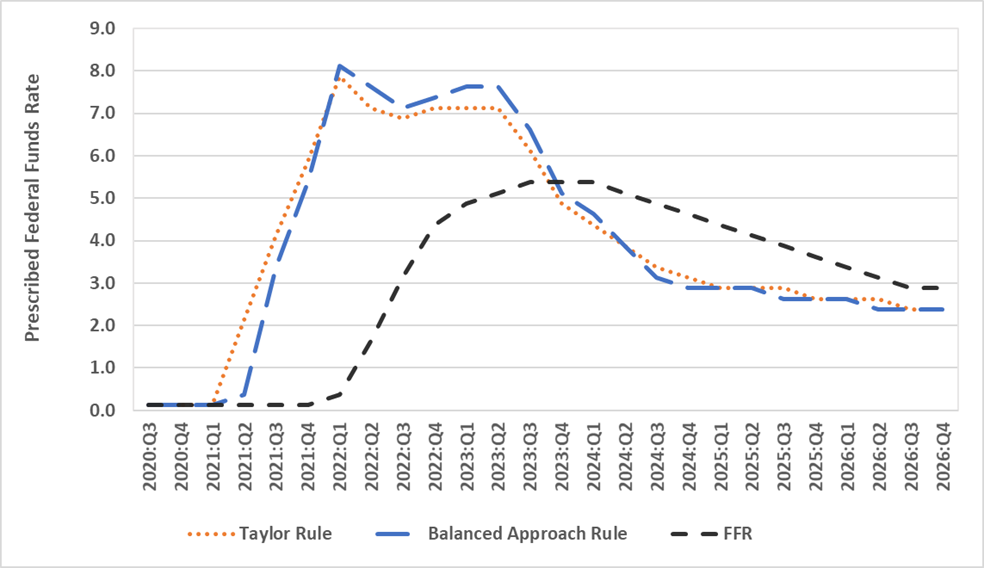

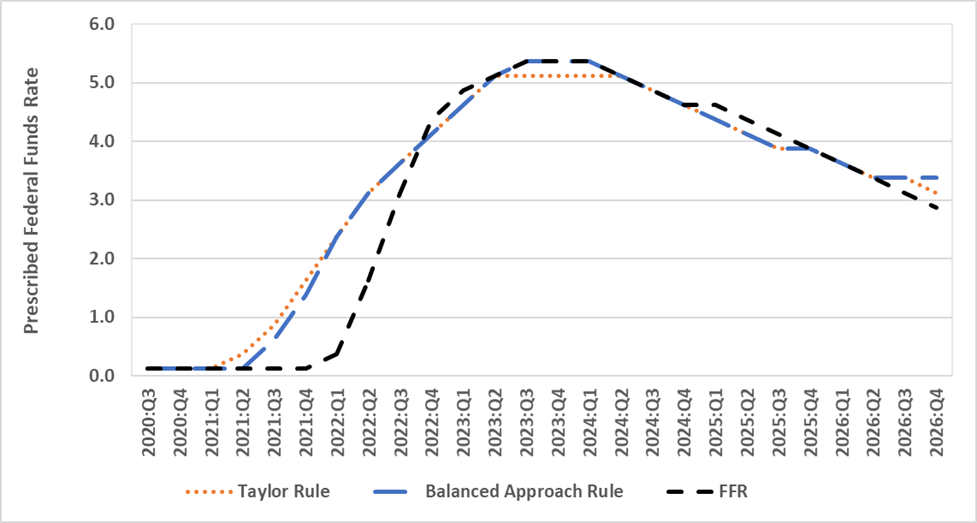

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to December 2023 and the projected FFR for March 2024 to December 2026 from the December 2023 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 5.375 in September 2023 and is projected to fall to 4.625 in December 2024, 3.625 in December 2025, and 2.875 in December 2026. Based on Jerome Powell’s answer to a question at the press conference following the January 2024 meeting that it is unlikely that the FOMC will cut the FFR in March, we assume that there will be 25 basis point rate cuts in June, September, and December 2024. Figure 1 also depicts policy rule prescriptions. Between September 2020 and September 2023, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between December 2023 and December 2026, we use inflation and unemployment projections from the September 2023 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel A. Non-Inertial Rules

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in June 2021 when the prescribed FFR increased from the ELB of 0.125 to 2.625 for the Taylor rule and to 0.375 for the balanced approach rule while the actual FFR stayed at the ELB. The policy rule prescriptions sharply increased through 2021 and peaked in March 2022 at 7.875 for the Taylor rule and 8.125 for the balanced approach rule when the FFR first rose above the ELB to 0.375. The gap also peaked in March 2022 at 750 basis points for the Taylor rule and 775 basis points for the balanced approach rule. The gap narrowed considerably between March 2022 and September 2023 as the FFR rose from 0.375 to 5.375 while the Taylor rule prescriptions fell to 6.125 and the balanced approach rule prescriptions fell to 6.625. Looking forward, the gap between the FFR projections and the policy rule prescriptions reverses in December 2023 and the FFR projections are above the policy rule prescriptions through December 2026.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel B. Inertial Rules

Panel B reports the results for the inertial Taylor and balanced approach rules. They are much more in accord with the FOMC’s practice of raising the FFR slowly when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in September 2021 when the prescribed FFR increased to 0.875 for the Taylor rule and 0.625 for the balanced approach rule while the actual FFR stayed at the ELB. The gap between the policy rule prescriptions and the FFR peaked in March 2022 at 200 basis points when the prescribed FFR was 2.325 for both rules while the FFR first rose above the ELB to 0.375.

The inertial rules prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the December 2023 SEP are very close to the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

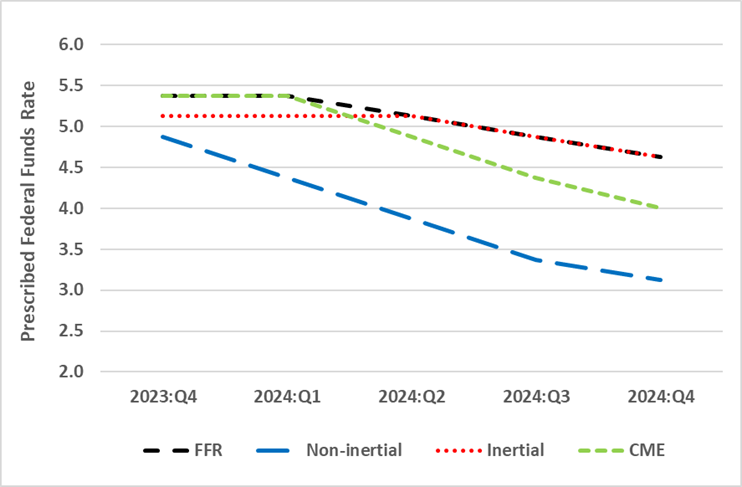

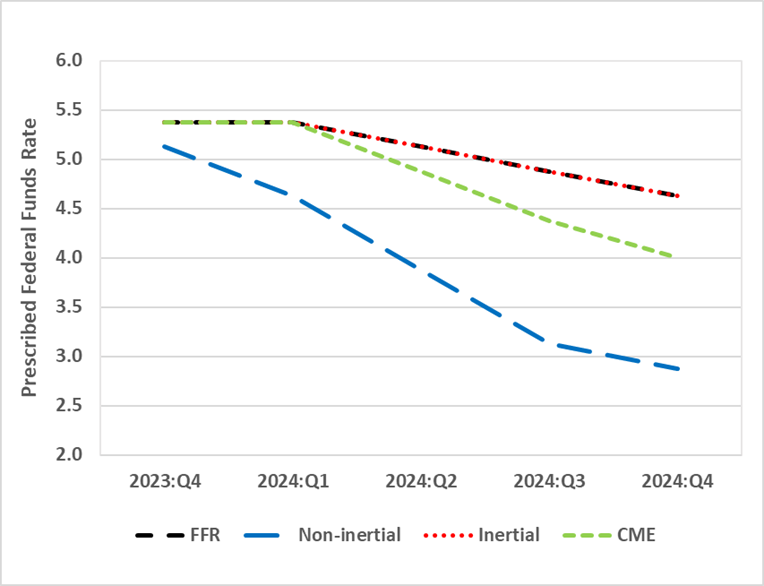

It has been widely reported that market participants have been predicting a steeper downward path for the FFR than the SEP. Figure 2 depicts the median predictions from futures markets described in the CME FedWatch Tool on February 1, 2024, the day following the January 2024 FOMC Meeting, through the end of the prediction horizon in December 2024. The FFR is predicted to fall from 5.375 in March 2024 to 4.875 in June 2024, 4.375 in September 2024, and 3.875 in December 2024. The futures market predictions are equal to the FFR projections from the December 2023 SEP for March 2024 and fall below the projected FFR from June 2024 through December 2024.

Figure 2: The Federal Funds Rate, CME FedWatch Tool, and Policy Rule Prescriptions. Panel A. Taylor Rules

Figure 2: The Federal Funds Rate, CME FedWatch Tool, and Policy Rule Prescriptions. Panel B. Balanced Approach Rules

We add to this discussion by including prescriptions from policy rules. For both the Taylor and balanced approach rules, the futures market predictions equal the FFR and are below the prescriptions from the inertial policy rules for June 2024 through December 2024. In contrast, the futures market predictions are above the prescriptions from both non-inertial policy rules from December 2023 through December 2024. Comparison between futures market predictions and policy rule prescriptions depends on the choice between inertial and non-inertial rules but not on the choice between Taylor and balanced approach rules.

<

This post written by David Papell and Ruxandra Prodan-Boul.

No offense to the post authors, but I can’t get to rapped up in this kind of thing. Because Fed Governors are going to make up their own rules as they go along. Jerome Powell knew when he lowered rates under trump that he was encouraging and putting a stamp of approval on donald trump’s trade policy and Chinese tariffs. Powell did that for job security and to appease trump.

https://www.cnbc.com/2019/10/31/trump-rails-against-powell-day-after-fed-cuts-rates-for-a-third-time-this-year.html

Georgetown Jerome was useless to me from the point on, as is most of this Fed post-op conjecture. I just hope as illiterate as America has become now that Jerome Powell hasn’t thrown away his red MAGA dunce hat. Because donald trump will give him the same treatment he gave James Lankford who voted against impeachment, and Georgetown Jerome should have the correct fashion statement to indicate his hypocrisy on the Fed being “non-political” when trump fires his A$$.

So the Fed didn’t smooth on the way in, but seems intent in smoothing in the way out. History doesn’t offer much reason to expect symmetry in policy, so that’s no surprise. History does, however, show that rate cuts tend not to be smoothed because Fed rate hikes preceed recession and recessions aren’t anticipated with any accuracy. Rate cuts tend to be sudden and rapid, because the Fed, until the great Recession, behaved as if the price-stability side of its mandate is more important than the full-employment side.

Interest rates are no longer near zero and inflation has been at or above target since the Covid-recession rebound. And it looks like the Fed is back to behaving as if the price-stability mandate is more important than the full-employment mandate.

And, yes, Johnny will repeat his “why should the Fed cut rates when growth is strong?” mumble. We’ve already answered that, but he ignores it. So, the Fed doesn’t have an anti-growth mandate, only an anti-inflation mandate. The Fed does have a full-employment mandate. Monetary policy is not the right tool to remedy wealth distribution problems, but it does have a tacit income-distribution mandate in the form of the full-employment mandate. And the Taylor rule, unsmoothed, indicates that lower rates are appropriate.

If you see Johnny post his usual unenlightened “why should the Fed cut rates?” mumble, remember, the answer is right here and he’s pretending it isn’t.

Exactly how has Tricky Ducky answered the question: “why should the Fed cut rates when the economy is doing so well?” Why mess with success?

As for the Fed’s full employment mandate, how much lower unemployment can unemployment go? (Tricky Ducky won’t answer.)

Remarkably, the Fed has fully expectations expectations at both end of its mandate. Trade-off be damned!

Now consider the question which Tricky Ducky refuses to answer: What will the benefits of a rate cut be, and who will benefit? Most glaring is an explosion in stock prices, benefitting the usual suspects. Then we have a rise in new housing construction, which represents only about 6% of GDP in normal times. Any wealth effect from mortgage finance will have to wait until mortgage rates drop below 4%–inconceivable for the foreseeable future. Other capital investment may rise a bit but not a lot since a much corporate investment is driven by opportunity and need. Interest rates on credit card debt and student loans won’t be affected. The combination of these factors suggests that the transmission of a rate cut is likely to be smaller…except for Wall Street.

Tricky Ducky also won’t address the question of the negative effects of reducing rates. But like any policy, interest rate reduction has costs as well as benefits. Apart from the impact on insurance rates and pension fund earnings, any rate cut will have huge impact is on people who are living on fixed incomes, trying to save for retirement, or putting money into HSA health savings accounts, 529 college savings plans, or just trying to save for a house or whatever. There are currently almost 100 million Americans age 55 or older. $13 Trillion has been put into IRA accounts, most of it for that cohort. And much of that has been wisely invested in relatively risk free investments, such a bonds, which have yielded negative real returns over the past decade. Any rate cut will do nothing to rectify the negative real earnings of savers over the last decade.

With meager, poorly defined benefits to cutting rates, why continue to punish savers? After all, with a spiraling federal deficits, and Social Security in politicians’ cross hairs, people are going to need all the savings they can get.

I told y’all Johnny was going to do this, and here he is. Johnny is lying again. Here’s one lie:

“Tricky Ducky won’t answer”.

I’m answering, and Johnny had no reason to think I wouldn’t.

Here’s another lie, in the form of Johnny wilfully misconstruing my argument:

“…, how much lower unemployment can unemployment go? ”

I did not say that the Fed intends to nor should push the unemployment rate lower. Johnny had to make up this strained definition of “full-employment” because otherwise, he’d have nothing to say. Holding the unemployment rate steady requires continued job gains, because the labor force is growing. Pretending that a policy of full employment is identical to an ever-falling jobless rate is as stupid as it is dishonest.

Here, too, Johnny makes an argument based on a dishonest claim:

“With meager, poorly defined benefits to cutting rates,…”

Johnny keeps pretending that the benefits of appropriately low rates, rates at neutral when the economy is not overheated, are “meager and poorly defined”. That is Johnny’s story, oft repeated and often rebutted. Johnny is dishonest to pretend that his bias amounts to truth. He is dishonest to claim that I either cannot or will not answer his lies. I have done so repeatedly. Johnny, in the best tradition of propagandists and hacks, simply claims things that I’ve repeatedly shown to be untrue, Ignoring what he can’t answer.

Johnny doesn’t want what’s best for the U.S. economy, because a strong U.S. economy is not what is best for Putin’s war in Ukraine, nor for Xi’s territorial aspirations in the South China Sea. Johnny is cheering for rich lenders to take more from middle-class borrowers. That’s the entire implication of his cheering for inappropriately high interest rates.

I have repeatedly pointed out that households are in debt to the tune of trillions of dollars, so that they pay out more in interest than they receive. Johnny has never responded. I have repeatedly pointed out that households borrow at higher rates than they earn. Jonny has never responded. He only talks about household interest income, pretending households have no interest expense.

Jonny boy’s comments remind me of Trump rallies. The same lies over and over again with no apparent purpose.

Johnny wants the impossible. Johnny wants a high rate of return on a risk free investment. he thinks economies operate by those rules? he either does not believe in a capitalist system, or he believes in a Ponzi system. but Johnny is not playing in reality.

Good news, but should it be this hard to protect us from corporate toxins?:

https://www.theguardian.com/environment/2024/feb/07/us-weedkiller-ban-dicamba-epa

A chemical, dicamba, is identified as hazardous for use in agriculture, and banned. Trump’s EPA overturned the ban. The EPA is found to have violated the law in overturni g the ban, so the ban is reinstated, but it took nearly four years.

“Ruling, specific to three dicamba-based weedkillers, is major blow to Bayer, BASF and Syngenta”

This excellent discussion talks about Monsanto which merged with Bayer a few years ago with part of its crop science business being sold to Bayer. I raise this simply to note that these Big 3 dominate the crop science market which of course is very anti-competitive. But hey – BASF and Bayer are German so our little Jonny boy turns his back on this anti-competitive nonsense as he hearts the demise of the German economy.

For you Swifties who can’t enjoy the SuperBowl without Taylor Swift, be cheerful as her flight from Tokyo (the Football Era) just landed at LAX for re-fueling. It seems she had a 2nd plane ready just in case, which they called the Backup Quarterback.

Yea – you can’t make this up!

Whew!!!! [ wipes the sweat off my forehead ]

Can someone please explain to me the excitement surrounding a woman with the body of a 12 year old who uses Auto-Tune for >85% of her performances?? And her “great lyrics writing”?? Again, roughly 14 year old’s personal diary they normally hide under their mattress. Her lyrics are “special” because…… ??

Maybe Menzie’s musically well-educated better half can tell us, honest to God I’d like to know.

I’ve never been a Taylor Swift fan. But the way she and her boyfriend tick off the MAGA crowd makes me laugh.

Now as far as the game – I thought SF had it. But giving the ball pack to Patrick M. with 2 minutes left is not a recipe for victory.

https://www.espn.com/nfl/story/_/id/39511676/49ers-players-say-know-super-bowl-rules

The SF players did now know the overtime rules? What a lame excuse.

because she started out doing this as a teenager, better than many who were in the business for a decade. and she succeeded despite the misogynistic business world that is country music and entertainment. and she did it her way. she is a great role model for all the little girls who live in a world where “girls can’t do that”.

just because you cannot get her, does not mean she is wrong. maybe it’s just you? not saying that in a way to pick a fight. just saying appreciate the phenomenon that is taylor swift. she tries to make the world a better place. gotta be better than kuwtk’s.

All this breathless reporting about is she gonna make it! and page after page of pixels spilled over the international date line (!!!) etc and here she made it with about 24 hours to spare.

Don’t get me wrong, I am just loving this whole Taylor Swift sticks it in the magats eye spectacle. And yeah, I will watch the Superbowl which I fail to watch more often than not. But honestly….

Well she made it to LAX by 3:30PM PST on Sat. but no one seems to know how she traveled the last 270 miles.

One of the key features of the Covid-era economy has been the strength of household goods consumption. Goods demand skyrocketed in 2021 and 2022; in H1 2023, goods consumption remained high, though it didn’t grow much.

One consequence of that pattern of goods demand was that net exports took a big chunk out of GDP in 2021 and 2022, but in 2023, the net exports’ share of GDP returned to its pre-Covid range:

https://fred.stlouisfed.org/graph/?g=1gmNr

That demand-induced drag from net exports was one reason that the troll choir’s ” pleeeease, let’s say we’re in recession!” back in 2022 was nonsense; strong goods demand isn’t any more consistent with recession than strong is job growth.

Notice what happened to goods consumption in H2 of 2023 – it rose again, and hit a new high in December. If the pattern of goods demand driving the trade component of GDP persists, and assuming goods demand accounts for roughly the same share of household demand as in December, we should expect to see net exports return to being a drag on GDP.

Smarter people than me at the Atlanta Fed don’t think that’s happening so far in Q1. Among GDPNow subcomponents, personal consumption adds 2.2% to real GDP, while net exports add 0.2%:

https://www.atlantafed.org/cqer/research/gdpnow#Tab3

Private inventories are also a 0.2% addition to GDP, despite gains in consumption and net exports.

But that’s just a nowcast and just for Q1. Renewed growth in goods demand, if it persists, seems likely to widen the trade deficit and create a drag on growth. That drag could show up first in inventories.

Strange how things work out at institutions that actually care for and protect their depositors’ money, rather than be Jamie Dimon style parasitic predators:

https://www.clevelandfed.org/publications/working-paper/wp-2403-interest-rate-risk-at-us-credit-unions

I guess NCUA member credit unions are under the “rather odd” impression they are there to protect savers and investors rather than to pretend to be “masters of the universe”. Rent-seeking of middle class savers is not “financial innovation”.

I have long marveled at the insistence that financial innovation is urgently needed, or even beneficial. Innovation often leads to financial crisis. Who benefits from innovation? The financial industry. Are mortgages much cheaper because of MBS? Yes, a bit. Are they much cheaper because of tranching? Yes, but by far less than the benefit of simple securitization. Are hedge funds and private equity superior to other, more regulated sources of finance? Not in any way that I know of.

Ya got savers. Ya got borrowers. Ya got firms and stakeholders. Intermediation shouldn’t be an end in itself, but rather a handmade to enterprise.

Taylor Swift makes it to the Super Bowl and will share a box with Ice Spice, Blake Lively, and Jason Kelce the brother of Travis Kelce. It’s nice that Taylor’s mom gets to join them. But come on – they could not ask mother Kelce to join them in the luxury box? She is sitting in the regular seats.

Not to be outdone Donald Big Baby Trump is whining something about how he was the one who made Taylor all that money. Ahh – no invited Donald to the game.