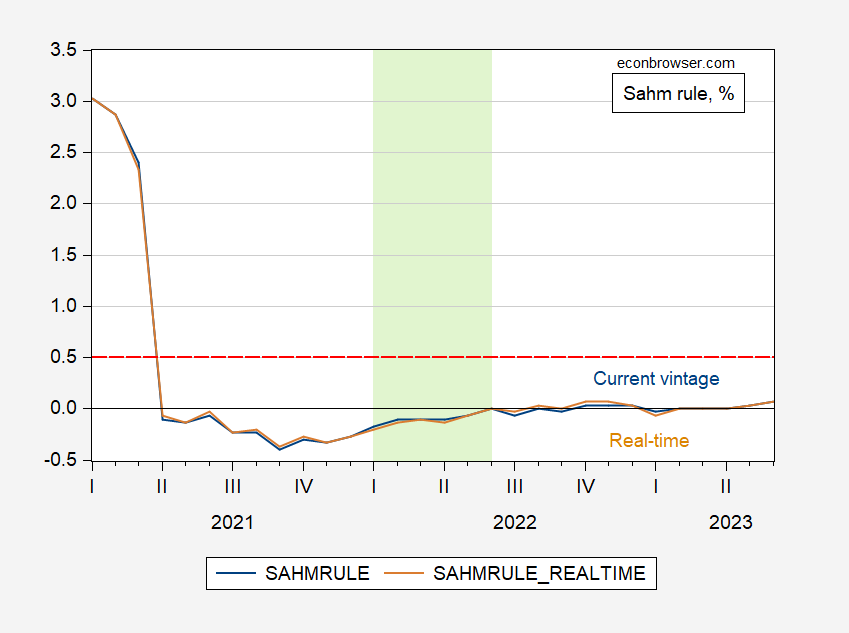

Using the Sahm rule:

Figure 1: Sahm rule index using current vintage of data (blue), using real time data (tan), both in %. Threshold for recession is horizontal red dashed line at 0.5%. Light green shading denotes 2022H1. Source: FRED.

The Sahm rule is a pretty good indicator of when a NBER defined recession starts. Now, if you want to define a recession as when VMT goes down, gasoline consumption goes down, or the U.Michigan sentiment goes down, or when real wages go down, or when GDP in the current vintage is negative for two consecutive quarters, or the output gap i is negative, or when GDI is negative for two consecutive quarters, then you might find a recession in 2022H1. Just understand that it might not be a recession as other people define it.

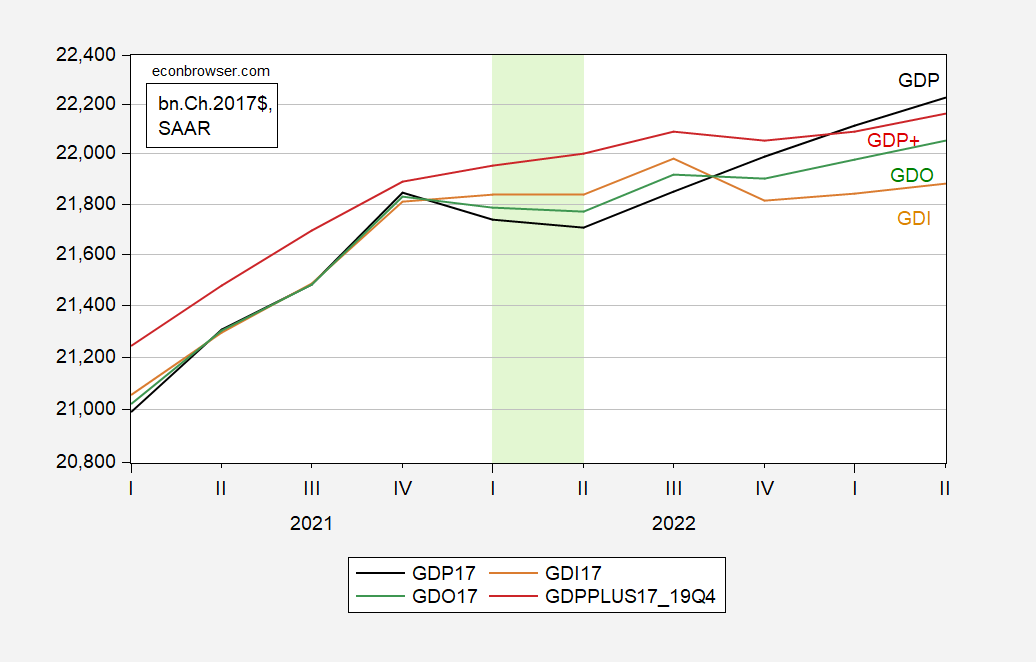

By the way, here’s a picture of GDP, GDI, GDO, and GDP+. GDO is down, but GDP+ is up over 2022H1…

Figure 2: GDP (black), GDI (tan), GDO (green), GDP+ indexed to 2019Q4 (red), all in bn.Ch.2017$ SAAR. Light green shading denotes 2022H1. Source: BEA, Philadelphia Fed, and author’s calculations.

It only works sahmtimes!!

Menzie – since you sometimes post on Russia’s war on Ukraine and with the Republican Putin Lackeys in Congress refusing to help Ukraine and our NATO allies in Europe – you may find this U.S. Treasury report on how devastating Putin’s war is on the Russian economy of value – 1. Export market for fossil fuels is completely destroyed; 2 Estimated 400,000 causalities and deaths in Ukraine and another 1.5 to 1.8 million have left Russia to avoid war; and 3 – no other country in the world will except Russian ruble (China demands payment in Yuan, etc.) https://home.treasury.gov/news/featured-stories/sanctions-and-russias-war-limiting-putins-capabilities

BTW- Tucker Carlson (America’s Lord Haw Haw) – is now over in Russia – kissing Putin’s behind – I am sure the Russians will gladly exchange vodka, caviar and nighttime entertainment for U.S. dollars.

“The economic outlook for Russian households has soured. An uptick in emigration predated Russia’s full-scale invasion of Ukraine, but the war mobilization effort in 2022 accelerated the trend in young and educated people leaving for opportunities abroad. As Russia mobilized its war effort, emigration has reached historic highs; around 668,000 people left Russia in 2022 — a 71 percent increase over the prior five-year average (Figure 3). In the long-term, this permanent loss in human capital with further weaken Russia’s growth potential; the Russian government is acutely aware of this, offering subsidized mortgages to get skilled workers to stay.”

All this emigration and no one has invaded Russia. Now Putin’s pet poodle JohnH peddled the emigration from Ukraine as some sort of evidence that Putin’s war crimes were noble events. Imagine that – leaving one’s home land temporarily to avoid being raped or killed. How inconsideration as little Jonny boy gets all excited when watching film of Putin’s war crimes.

pgl thinks that the US Treasury is an unbiased source of information. What a hoot!

Ukrainians are evidently smarter than the neons here: “‘It’s State Propaganda’: Ukrainians Shun TV News as War Drags on. A government-approved news program intended to counter Russian disinformation and boost morale is coming under criticism for painting a rosy picture of the war.”

https://www.nytimes.com/2024/01/03/world/europe/ukraine-war-tv-news-telemarathon.html

That said, with stories like this, the NY Times is showing signs of becoming a more reliable news source.

Are youand Tucker Carlson enjoying Putin war crimes movies together

Is pgl enjoying watching the official US narrative that Ukraine is winning, despite the massive corruption that siphons off money for shells?

johnny, if ukraine defeats russia even with corruption, so what? will happily pay that price for the defeat of such a noxious regime. you seem to think that ukrainian corruption is more dangerous than putins war mongering. wrong.

baffling

February 7, 2024 at 10:13 am

I appreciate your comments on this matter. Do note when Jonny boy talks about alleged Ukrainian corruption – he is doing what Jonny boy always does. He’s lying. Of course if he did not lie on Putin”s behalf then the Kremlin would not let little Jonny boy to date Tucker Carlson.

pgl, you just love parroting American propaganda…and now you’ll get to enjoy some Russian propaganda!

Fortunately, media like the NY Times have moved beyond just parroting Ukrainian propaganda, which even Ukrainians see through, and are finally started to report some real news now…so sad for pgl!

“Five Ukrainian civilians were killed on February 5 when Russian forces shelled the southern city of Kherson and the northeastern region of Sumy, Ukrainian officials said, amid a dramatic increase of the intensity of Moscow’s bombardment of civilian areas.”

See Moses for the link to this story. Hey Jonny boy – did you and Tucker get all excited over these war crimes?

Hey, pgl, did you see that Ukraine shot down a Russian plane carrying 65 Ukrainian POWs using a US supplied Patriot missile system? Did pgl get excited over Ukrainian friendly fire?

JohnH: Why would Ukraine use a valuable Patriot anti-missile missile on a lumbering transport aircraft? Doesn’t this make the credibility of the story a little dubious?

JohnH

February 7, 2024 at 5:56 pm

pgl, you just love parroting American propaganda…and now you’ll get to enjoy some Russian propaganda!

Given the fact that I very rarely comment on the Putin war crimes, It is interesting that you accuse me of things I do not engage in. But thanks for admitting all of your incessant trash is a pack of lies.

The short term damage to Russia is pretty bad – the long term is devastating.

They are already losing population because birth replacements rates are very low (199 out of 227 in the world). Now smart people are leaving in droves. Russias main source of income has been hydrocarbons (“gas station with nukes”) and those are on the way out as an energy source (even if sanctions were to be lifted). Xenophobia is getting to a boil as the white Arian Russian right wing is getting paranoid and want to restrict “the others” in Russia. Clearly Russia is a shitshow waiting for curtain call.

I have some pretty good friends who happen to be Russian. They decided to move back to Moscow because he was offered a job opportunity he didn’t think he could turn down. They moved in early February 2022. Bad timing.

I’m in very careful touch with them. They are friends and I would rather not say anything that will get them killed by the security apparatus there. They say they are currently OK, but the shelves are mostly bare and the things they were used to in the US just aren’t available at all in Moscow. They don’t have utility problems where they live, but those issues are happening elsewhere in Moscow. They are fully aware of all that. Nothing has exploded around them. Yet.

They don’t say so, but it’s clear that it’s not all roses even in Moscow these days. Moscow is coddled, and being educated and productive (ie sober) ethnic Russians, my friends are being coddled, relative to others in Moscow. Their economy will not hold out forever.

If Ukraine can hold on, and to do so they need a whole lot of help, then Putin’s regime will collapse due to economic problems if for no other reason. It could take a long time, unfortunately, since Putin seems to be spending the national wealth on the invasion and on repression. Not much else.

This is why johnny is so anxious to try and end the war. In long run, russia will whither. He refuses to admit that. Tries to make you believe russia is getting better by the day. All misinformation from johnny.

This war and a lot of Putin’s other aggressions are part of the violent dying throes of the sclerotic Muscovite empire. It had its day. That day is over. It’s not going to go peacefully, but it will break up. We had best be prepared when it happens. You know Xi and the Chinese leadership are prepared.

Very shocked. He was living royalty in this state, right up there with Garth Brooks, Reba McEntire and on and on. I guess I should not be that surprised because he did a local TV interview recently and he had very unusual skin color. That was a cue. Still it’s pretty shocking. People tie in music with special times in their life or getting through tough spots and I know many people will be rocked by this news. I wasn’t a personal fan of his, I’m very picky on the country music I like, but I know some fans will be heart-broken. He had a bar in a major city here and he would sometimes “cold court” there. He was very much a local fixture.

https://www.wsj.com/arts-culture/music/country-music-star-toby-keith-dies-at-62-080187b1?mod=hp_lead_pos8

I liked him until he went all mysoginistic on the chicks. my understanding was he was actually a democrat. but he let that tough guy persona get out of control. he had a problem with a women who spoke her mind. I don’t have much room in the world for folks who act like that. he was very disrespectful on that front.

As I said, I wasn’t personally a fan. But a lot of people liked him. This is a red state, so generally that type thing doesn’t bother people as much. But he was on “The Today Show” on NBC which is for the most part aimed at American housewives and they lapped it up. The women anchors there adored him and heaped praise on him. He was interviewed by the lead female anchor for KWTV9 here and treated like a god. They fawn over him. This has been my point with women out there, if you want respect you can’t pick and choose when it offends you. If it offends you from one man it should offend you from all men. But they get these rap stars that say “B**ch” this and “B**tch” that and they purchase the CDs or the streams in droves. It either bothers women or it doesn’t, but you can’t get respect when one source of misogyny makes you scream and you play the other source of misogyny at your red solo cup party. They’re never going to get the respect they want because a certain ratio of women thinks “it’s cute” when the Toby Keiths do it.

@ baffling: Stephen Colbert did a tribute to Toby Keith on his show last night. It won’t be hard to find with a key word search on YT or just the most recent posts on Colbert’s YT channel. You might find it interesting. I did.

Just by associating with President Obama Toby Keith could have lost many of his core fans. He took that risk, and I think it says something about him. What that “something” is—you can decide.

* “hold court” there. Sorry.

In the happy news department:

https://www.cnbc.com/2024/02/06/trump-election-case-appeals-court-denies-ex-president-immunity.html

So donald trump is not a British King after all. Who knew??

yeah, his argument is that since he was not impeached while in office, then charges could never be brought against him once out of office. he could kill somebody, and if congress chose not to impeach and convict, then he gets away with murder. sounds like some absurd law theory taught in one of rick stryker’s law classes. the judges laughed him out of the courtroom. that is what happens when you take law advice from a porn star.

https://www.imdb.com/name/nm0835444/

This says the last porn movie Rick got credit for was back in 1990? Maybe he is appearing on OnlyFans these days.

British King? Trump prefers being considered a German Dictator!

Court rules Trump does not have immunity from 2020 election subversion prosecution

https://www.cnn.com/politics/live-news/trump-court-ruling-immunity-election-subversion-prosecution/index.html

The verdict was rather obvious but the ruling should be read as it shreds the BS from Team Trump.

So what was the key takeaway from the data as experienced in 1H2022 without 20-20 hindsight?

a} That the US was absolutely, positively in recession?

b) That the US was absolutely, positively NOT in recession?

c) That economic growth was very weak, borderline recession–absolutely, positively ambiguous?

D is the answer, Jonny boy is a moron

so republicans in congress were given just about everything they wanted on border security. and they have chosen not to fix the problem. fascinating. shows you that border security is not really a concern for republicans. they just want continued chaos.

“Just gobsmacked,” Senator Brian Schatz, Democrat of Hawaii, wrote on social media. “I’ve never seen anything like it. They literally demanded specific policy, got it, and then killed it.” couldn’t have said it any better myself.

given a chance to improve the country, republicans chose to let the damage continue. for political purposes. treasonous.

More Sahm’s rule discussion.

https://www.zerohedge.com/economics/inside-most-ridiculous-jobs-report-recent-history

Yeah, mock it all you want; I don’t care. Just providing a link.

“average hourly earnings, which unexpectedly spiked from 4.1% (pre-revision) to 4.5%, the highest since last September, and a slap in the face to the Fed’s disinflation narrative”

More from this pathetic MAGA rant. Gee if nominal wages grow faster than consumer prices, Zero Hedge has a problem with that? Good to learn he is against workers enjoying a real wage increase. Then again Trump’s idea of supporting auto workers is to go to a nonunion shop at the invitation of the owners.

Later this MAGA clown told his moronic readers that any drop in the average work week was due to the bureaucrats at BLS slashing this figure. Yea Bruce Hall knows how to celebrate the dumbest garbage from the MAGA morons.

JohnHh has been on a tear misrepresenting all sorts of stuff in his absurd contention that the FED should not even consider cutting interest rates (which sounds a lot like Donald Trump of late). His latest was a complete misrepresentation of something Austan Goolsberg wrote back during the summer of 2019. But let’s look at what Dr. Goolsberg said just this week:

https://www.marketwatch.com/story/feds-goolsbee-nothing-needs-to-change-in-the-data-to-justify-rate-cuts-dbcbd988

The economic data doesn’t have to change in order to justify interest-rate cuts — there just has to be more of it, Chicago Fed President Austan Goolsbee said on Monday. “If we just keep getting more data like we’ve gotten … we should be well on the path to normalization,” Goolsbee said in an interview on Bloomberg Television. The Chicago Fed president wouldn’t get into the timing of the first rate cut, repeating that he doesn’t like “tying our hands” when there are seven weeks of data before the next policy meeting. Goolsbee noted that there have been seven months of “really quite good inflation reports.” Tim Duy, the chief U.S. economist at SGH Macro Advisors, said Goolsbee is a dove on the Fed and trying to keep rate cuts alive.

The fact that Jonny boy will tell any lie to justify one of his stupid rants is nothing new. But come on – one has to wonder how effing stupid troll really is. Rest assured – he is more stupid than you realize.

Funny! pgl charges that what I wrote was “as a complete misrepresentation of something Austan Goolsberg wrote.” But pgl can’t give a single example. Classic pgl.

More classic pgl–if you quote extensively from an article, pgl will respond by saying that you didn’t read the article…without saying what it was you missed…as if the author totally contradicted what he said elsewhere!

Well, pgl, what about weakened monetary policy transmission, a phenomenon Goolsbee cited in his 2019 article? The USA Today gave examples of weak transmission that cover most consumer credit. But for pgl, it’s ‘damn the torpedos; rate cut or bust,” AKA ready, fire, aim!”

Methinks that Wall Street and its shills are getting so desperate for a rate cut (and a rise in stock prices) that they’ve gone from hoping for a rate cut DEMANDING it now! And they are not about to abide any discussion of the pros and cons of a rate cut.

Oh brother. I dare you to link to my comments. Not that you understand then either

“Well, pgl, what about weakened monetary policy transmission, a phenomenon Goolsbee cited in his 2019 article?”

Our host has already called you out for not understanding the basic economics here. But hint troll – it is 2024 not 2019. And Dr. Goolsbee is an advocate of lowering interest rates to spur investment if the danger of a recession increases. Huh – it seems Goolsbee gets the loanable funds theory as well as Tobin’s Q. Tell you what – ask Bert and Ernie to explain this to you.

Loan demand is strong…even without lower interest rates. https://angrybearblog.com/2024/02/the-senior-loan-officer-survey-makes-an-important-turn#more-125614

So what’s the purpose of lowering interest rates? The economy did well with high interest rates in the late 1980s and 1990s with the exception of the recession of 1990-91. And its performance was lackluster in the 2010s, a decade with low interest rates. And USA Today notes that interest rate cuts are unlikely to help consumers anytime soon (but they will probably help the stock market!)

So where is the pressure for low interest rates coming from? Surely not Wall Street and its shills (guffaw, guffaw.)

JohnH: Re: “The economy did well with high interest rates in the late 1980s and 1990s with the exception of the recession of 1990-91.” I want to ask if you really did take any economics courses in college, as you claimed. Do you understand that the interest rate is partly an exogenous variable, and that there is a loanable funds theory which suggests that interest rates move in response to demand for credit (which is typically high when the economy is booming)?

I get what NDD wrote as do you. Jonny boy links to it but clearly has no clue what NDD said. Par for the course

Does pgl really “get” what NDD said? “The Senior Loan Officer Survey is a long leading indicator, telling us about credit conditions that typically turn worse a year or more before the economy turns down, and improve just at the economy is ready to turn up…yesterday’s report was pretty important. Because, for the first time in several years, it was almost entirely positive…Strong demand for loans, but accommodation ends.” https://angrybearblog.com/2024/02/the-senior-loan-officer-survey-makes-an-important-turn#more-125614

It looks like Wall Street is going have to wait for its “manna from heaven day,” when the Fed cuts rates. Tough day for pgl and the Wall Street shills here. But a good day for those who have invested $13 Trillion in IRAs, much of it in secure investments. And those saving for retirement, living on fixed incomes, putting money into HSAs or 529 college savings plans can breath a sigh of relief!

“But a good day for those who have invested $13 Trillion in IRAs, much of it in secure investments. And those saving for retirement, living on fixed incomes, putting money into HSAs or 529 college savings plans can breath a sigh of relief!”

much of that $13 trillion resides with wealthy folks. the average person does not sock much away for retirement=they rely on social security. those putting money in HSA or 529 are typically invested in the stock market, until a year or two away from pulling the funds from the account. your comments are sound bites, johnny, but they are not really accurate representations of what you try to argue for.

the majority of retirees do not have enough money saved in retirement accounts to have a high interest rate provide a meaningful difference in their standard of living. and those that are currently saving for retirement should be mostly invested in stocks, not bonds and income assets. your comments are simply ridiculous, johnny. they are not realistic.

“JohnH

February 7, 2024 at 12:46 pm

Does pgl really “get” what NDD said?”

I did and I explained it in such simple language that even a two year old would get it. But judging from the rest of this retarded moment, it seems Jonny boy still does not. Time for little Jonny yo pay more attention to Bert and Ernie.

Jonny boy’s response whenever someone tries to explain economics to him using basic economics is to scream LIAR. I am beginning to think Jonny boy needs Bert and Ernie to help Jonny boy with mundane tasks like learning to tie his own shoes.

It’s refreshing to hear someone talk about interest rates responding to exogenous variables…that’s certainly not the conclusion one would draw from all the boosterism from Wall Street shills about the need for a Fed rate cut. It also confirms the possibility (likelihood?) of weak monetary policy transmission in this environment.

It is obvious you have no clue what “exogenous” even means. Or the identification problem in macroeconometrics. Of course you have no clue how to tie your own shoes so please get back to watching Sesame Street.

JohnH may be worse at history than he is at economics. Let’s recall that Greenspan became FED chair in August 1986. During late 1986, a lot of people were worried that we were about to enter a recession. Everyone with any memory and half a brain realizes how we avoided the 1986/87 recession – the FED under Chairman Greenspan lowered interest rates.

Now had Jonny boy been running things back then – interest rates would have been left over 7% which would have likely meant we would have had a recession. But of course Jonny boy is too dumb to remember this episode in Federal Reserve history.

I guess MAGA members of Congress think Taylor Swift’s jet is an air safety issue:

https://www.msn.com/en-gb/news/uknews/republicans-turn-faa-hearing-into-a-rant-about-illegal-foreign-nationals-and-taylor-swift-s-supersonic-jet/ar-BB1hSsYY

Republicans on the House Aviation Committee used a hearing intended to address air travel safety concerns to pepper FAA Administrator Michael Whitaker with accusations of “illegal foreign nationals” sleeping at airports, to complain about work from home rules, and to drop a reference to Taylor Swift’s “supersonic jet.”

BLOOD, all over Republican hands. Take a bow Republicans for the spilt blood YOU caused. Some day you will answer for the deaths you caused. So enjoy your “political successes” as East Europe falls to Russia:

https://www.rferl.org/a/four-killed-in-russian-shelling-of-ukraine-s-kherson/32806138.html

Who is keeping count of the Gaza kids killed on that date?

I’m not sure that the one morally clears the other or if you’re implying women and children in “X” country are more important than women and children in “Y” country, but just for your person entertainment:

https://apnews.com/article/women-children-gaza-war-victims-un-inequality-f0f89a724543b99c2c22439e7af09405

Moses is far ahead of you in condemning this.

It seems JohnH is hanging out with Tucker Carlson in the Kremlin accusing stories like these as being “disinformation”.

Got to love how Bruce Hall is an utter coward as he inflicts this blog with another Zero Hedge blog post but then runs and hide as Brucie refuses to take a lick of blame for his own MAGA BS. OK I read the pathetic rant and it is interesting that all Brucie came away with is this line?

‘The headline data was stellar across the board, starting with the unemployment rate which once again failed to rise – denying expectations from “Sahm’s Rule” that a recession may have already started’

Gee our right wing fake Tyler Durden has declared we are in a recession and has to mock the Sahm Rule simply because the news from the labor market refutes the fake Tyler’s take. One would think Brucie would be all giddy over this. Maybe Brucie thinks if he truly kissed up to Tyler, he would have to enter Fight Club where even the teenage girls would beat poor little Brucie up.

There used to be a JohnH who would lament high interest rates on credit cards but the current version of JohnH suggests that high interest rates are now no big deal. Of course the amount of credit card debt is a big deal to some people:

https://www.msn.com/en-us/money/personalfinance/credit-card-debt-smashed-another-record-high-at-the-end-of-2023/ar-BB1hS3O3?ocid=msedgntp&pc=U531&cvid=da870d28828e4c108ad906dfd9e9e50d&ei=12

Americans are increasingly turning to their credit cards to cover everyday expenses, with debt hitting a new record high at the end of December, according to a New York Federal Reserve report published Tuesday. In the three-month period from October to December, total credit card debt surged to $1.13 trillion, an increase of $50 billion, or 4.6% from the previous quarter, according to the report. It marks the highest level on record in Fed data dating back to 2003 and the ninth consecutive annual increase. There was also an uptick in borrowers who are struggling with credit card, student and auto loan payments. As of December, about 3.1% of outstanding debt was in some stage of delinquency, up from the 3% recorded the previous quarter but still down from the average 4.7% rate seen before the COVID-19 pandemic began. “Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”