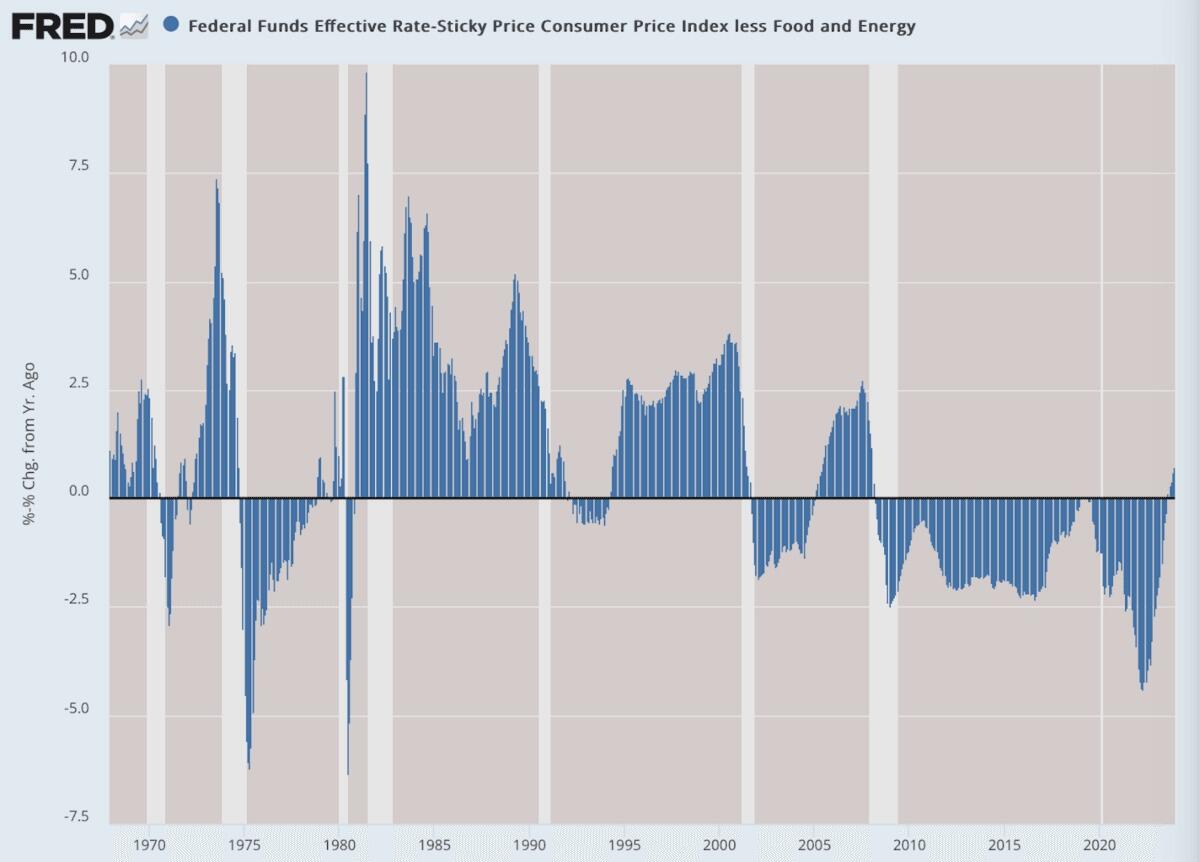

Imagine my surprise when I see a statement “rates are now barely positive according to all official inflation and rate data” in an article titled “Will the Fed Elect Biden?” and the accompanying graph:

Source: ZeroHedge. Notes: (Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

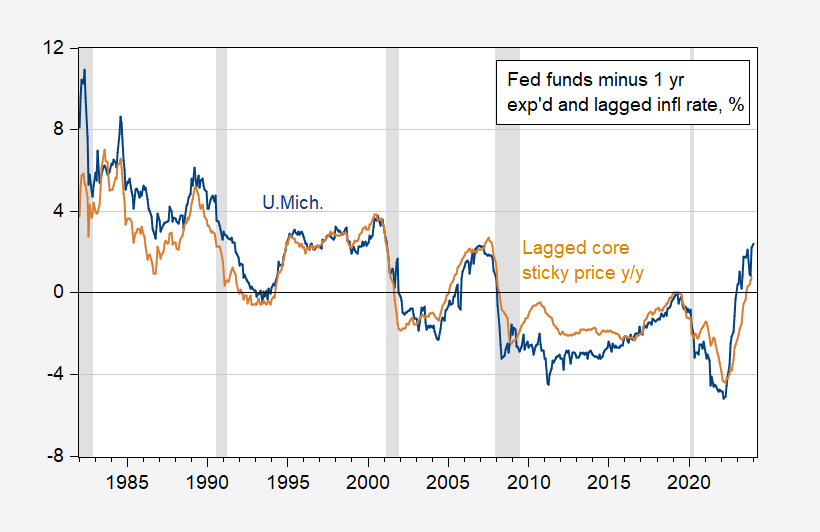

Well, the graph looks this way because it uses lagged ex post core sticky-price CPI inflation (y/y). To see how this graph would look like if one uses instead the University of Michigan’s 1 year ahead CPI inflation expectations:

Figure 1: Fed funds rate adjusted by U.Michigan one year ahead expected CPI inflation, y/y (blue), and by lagged core sticky price CPI inflation, y/y (tan), both %. NBER defined peak-to-trough recession dates shaded gray. Source: Fed, U.Mich., Atlanta Fed via FRED, NBER, and author’s calculations.

The ex ante real Fed funds rate is considerably higher, for longer period, than the oddly defined real rate provided by ZeroHedge. In fact, the ex ante Fed funds rate is higher than peak just prior to the 2007 recession, much higher than the real rate under Donald Trump. In any case, theory suggests that economic decisions are based primarily on ex ante real rates, not current rates adjusted by lagged inflation. Unless one uses adaptive expectations. All I can conclude is that either ZeroHedge or Jeffrey A. Tucker has gone fully adaptive expectations with unit coefficient. To quote: “Not that there’s anything is wrong with that.” After all, this is consistent with the Friedman accelerationist hypothesis. It’s just a bit surprising. And I’m not sure why one would choose the core sticky price measure.

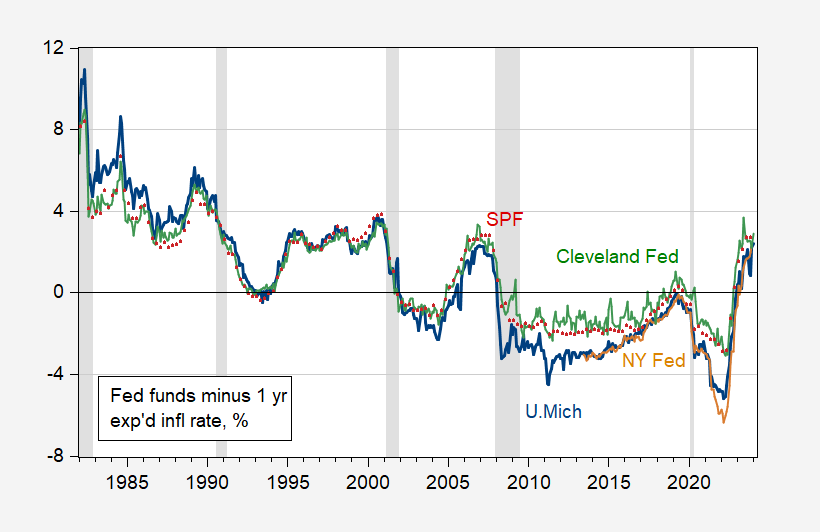

Here’s a picture of more conventional ex ante real Fed funds rates:

Figure 2: Fed funds rate adjusted by U.Michigan one year ahead expected CPI inflation, y/y (blue), by NY Fed (orange), by Cleveland Fed (green), and by Survey of Professional Forecasters (red), all %. NBER defined peak-to-trough recession dates shaded gray. Source: Fed, U.Mich via FRED,, NY Fed, Cleveland Fed, Philadelphia Fed SPF, NBER, and author’s calculations.

So, the other inflation expectations measures confirm that real ex ante Fed funds rates are well into the positive territory.

USA Today has an interesting piece on the effects of a rate cut: “No quick relief: Why Fed rate cuts won’t make borrowing easier anytime soon…While such a pivot on rates would likely BOOST THE STOCK MARKET, it’s unlikely to give Americans significant relief on mortgages, auto loans, credit cards and other types of debt any time soon, financial experts say.”

As for stock salesmen and investors in the stock market, “Since people started forecasting late last year that the Fed would lower rates in 2024, financial markets have already anticipated the move – and more. The Fed has only suggested three rate cuts this year, but the market has already priced in six.”

https://www.usatoday.com/money/

As for mortgages, a rate cut is unlikely to solve the market’s major problem–a shortage of inventory, caused in large part by homeowners unwilling to part with their 3-4% mortgages (the vast majority of mortgages) to trade up to another house selling for a higher price and with higher debt service. Any mortgage rate cut will largely be offset by higher prices, caused by a lot of demand meeting a very limited supply.

Finally, what about the lackluster effects of ZIRP and QE? What would make rate cuts any more effective this time around?

Instead of citing “neutral rates” and economic theories, could economists detail the benefits of rate cuts in today’s environment and under today’s conditions? Such an analysis should not ignore stock market effects as well as the impact on savers and reductions in their interest income. The wall Street shills here are obviously championing rate cuts and waiting for them with bated breath (for obvious reasons,) but why should the rest of us care, particularly with the risk of inflation still lurking?

So, let’s help Johnny, since he has once again gotten economists wrong.

We’ll start with reading comprehension. Or maybe with reading at all. From Johnny’s own link:

“Since people started forecasting late last year that the Fed would lower rates in 2024, financial markets have already anticipated the move… The 30-year mortgage rate in the past few months has tumbled to around 7% from above 8%…”

So the reason Fed rate cuts might not make borrowing easier is because rate cuts have already made borrowing easier; they’ve been priced into mortgage rates. Says so right there in Johnny’s own link. So if If the Fed doesn’t ease, or eases less than markets have priced in, mortgage rates go back up.

After ignoring the part of his own link that says Johnny is wrong about the effect of Fed easing, Johnny goes on to ignore even more. Johnny, pretending to have expertise, wrote this:

“As for mortgages, a rate cut is unlikely to solve the market’s major problem–a shortage of inventory, caused in large part by homeowners unwilling to part with their 3-4% mortgages (the vast majority of mortgages) to trade up to another house selling for a higher price and with higher debt service. Any mortgage rate cut will largely be offset by higher prices, caused by a lot of demand meeting a very limited supply.”

Johnny has created a special hurdle for rate cuts; they have to solve the supply problem or they aren’t worth doing. Says who? Says Johnny, because he doesn’t want rat cuts. Let’s remember, the biggest contribution to growth and jobs from the housing sector is from building new homes, not selling old ones. It would be nice if people could swap around homes that already exist, but that’s not very important jobs and pay.

Let’s clear up another of Johnny misunderstandings about how things work. Johnny is pretending that changes at the margin don’t matter. Cutting rates won’t improve housing market activity, Johnny argues, because things are either entirely rule by some threshold condition – mortgages held with 3-4% rates or because prices will fully offset changes in interest rates. Changes at the margin don’t have any effect.

Ignoring Aristotle, Daniel Bernoulli is probably the first to explore marginal analysis in economics, in his 1738 paper “Specimen theoriae novae de mensura sortis”, though Gabriel Cramer deserves some credit for suggesting the idea to Bernoulli. Jevons, Menger and Walras really got things going a little over a century later. Johnny’s claim, though he probably doesn’t realize it, is that the “marginal revolution” in economics is wrong.

Johnny’s proof that he is right and Marshall is wrong? An article in USAToday littered with “may not” and “might not”.

And let’s not miss the fact that the article does not claim no benefit to borrowers. It claims there “may not” be “much” benefit right away. The adjustment to lower rates will take time. What does that mean, really? It means the longer the Fed waits to cut rates, the longer borrowers must wait to receive the benefit of lower rates. That’s an argument for the Fed to cut rates sooner. Will stocks respond before the economy does to lower rates? Yes. Can’t do anything about that, but it Isn’t reason to wait; it’s just a fact.

Johnny recycles his “do it for the savers” plea, even though U.S. households hold about $3.4 trillion more in debt than they do in interest-bearing assets. I’ve shown him the math, but he ignores it. By he way “do it for the savers” means “help the rich by hurting the poor.”

Why does Johnny want to hurt the poor? Johnny was a recession cheerleader ahead of the 2022 mid-term elections and he’s cheering for higher interest rates now because he wants Republicans to win elections, and Trump in particular. Trump won’t help Ukraine resist Putin’s attack, and Johnny supports Putin.

Johnny gets his economics wrong because he doesn’t care about the economy. He cares about politics, and his politics favor Russian military aggression and the rich over the poor.

Nicely done which allows me to focus on Jonny’ first little complaint. BOOST THE STOCK MARKET. All caps – has CoRev returned?

Maybe little Jonny boy has never heard of Tobin’s Q. Jonny boy was all excited that Mexico’s government wants to increase investment demand but little Jonny boy does not get that a higher relative price for investment goods encourages investment. Tobin explained this quite clearly but as usual basic economics flies right over little Jonny boy’s little head.

Lower rates boost investments? It seems like they’re doing pretty darned well even with high rates! A lot of business investment is driven, not by rates, but by opportunities and needs, much as economists would like to believe that the world revolves around interest rates!

Damn are you dumb. Yes expected cash flows (opportunities) but so does the cost of capital. Anyone who took a week in a Finance 101 class knows this. But not little Jonny boy. I guess this is why his former Fortune 200 company failed. They were dumb enough to make a moron CFO.

Jonny boy’s incomplete link did not bring up the story but I found it anyway.

It was pretty good but it is not the stupid nonsense Jonny boy claimed. You captured part of what Jonny boy apparently missed but there is a lot more. Like the realization that the interest rate one pays on one’s mortgage or one’s credit card has something to do with one’s credit rating. Gee – basic finance. No wonder little Jonny boy missed that!

And the story did note that lower rates will encourage more investment – just the opposite of the incessant yappnig from Jonny boy. And then there’s:

“We lowered our year-ahead recession probability from 55% to 45% earlier this month, but 45% is still an elevated recession probability,” said BeiChen Lin, investment strategy analyst at advisory firm Russell Investments. “In a ‘normal year’, there might be only a 15% to 20% probability of recession,” he continued, adding, “Given that the markets might be underappreciating recession risk, we would caution investors not to chase into short-term equity rallies.”

I do not know Mr. Lin but he is a lot smarter than little Jonny boy.

I invited Tricky Ducky and pgly to do a cost-benefit analysis of rate cuts…they refused. Too much theory, too little practical analysis of impacts on various sectors of the economy.

Back in 2019 Austan Goolsbee wrote “Why Rate Cuts Don’t Help Much Anymore.” He called the phenomenon weakened monetary policy transmission and gave three examples, including mortgages and durable goods. Times have changed, but Goolsbee point is still valid, though they effects are different. https://www.nytimes.com/2019/08/01/business/federal-reserve-rate-cut.html

The USA Today article took a look at a number of major sources of consumer debt and found the impact of a rate cut to be small. Tricky Ducky won’t contest their analysis.

But he does take issue with my analysis of mortgages. If he had bothered to talk with any real estate agent two years ago, he could have learned that inventory was tight because people were not about to put their homes on the market, even though mortgage rates were rock bottom, because prices of upgrades were so high. High rates have exacerbated the problem. Why trade your home for a more expensive one with much higher carrying charges?

Moody’s notes that “America’s housing shortage won’t be solved for years to come.” https://www.businessinsider.com/housing-market-outlook-shortage-home-prices-mortgage-rates-real-estate-2024-1?op=1 With a persistent shortage of inventory, housing prices are likely to surge as a result of a rate cut, largely offsetting the effect of the rate cut.

Tricky Ducky also complains about how not having a rate cut will hurt the poor. Where have we heard this before? The wealthy and their economists never care about the poor except when the poor can be used to promote a policy decision that massively benefits the wealthy…in this case, lower interest rates boosting share prices. In fact, the poor benefit not just from having jobs, but also by receiving higher real wages resulting from lower inflation, something that most business-friendly economists like Tricky Ducky don’t like to talk about much… Interestingly enough, it is the Fed that cares about inflation, with some governors talking about protecting people’s purchasing power.

Tricky Ducky also conveniently ignores how lower interest rates will hurt Americans in retirement or saving for retirement–almost 100 million aged 55 and older. Individual Retirement Accounts now amount to more than $13 Trillion, mostly held by people over age 55, who can be presumed to have put the majority of their money into secure investments, which lost money in real terms over the past 10 years. But now that interest rates are finally yielding positive returns, Tricky Ducky wants to lower interest rates and return to punishing savers!

What’s needed is an analysis of the costs and benefits of rate reductions…an analysis that highlights the massive benefits to the top 1% who own a lot of stock, the effectiveness of monetary policy transmission in today’s conditions, and the harm done to people in Retirment or trying to save for retirement.

Translation:

Johnny assigned us homework, ignoring anything we have said to this point. The assignment Johtny tred to foist into us was essentially a rehash of any money and banking textbook. This is a standard debating trick. Johnny knows it. Debating tricks are all Johnny can manage.

Here’s Johnny, repeating his tired old wheeze about wealth distribution:

“The wealthy and their economists never care about the poor except when the poor can be used to promote a policy decision that massively benefits the wealthy…in this case, lower interest rates boosting share prices.”

Johnny just keeps repeating this stuff. On net, households are in debt by roughly $3.4 trillion, so on net, lower borrowing rated help households a lot. But that’s only part of the story. The rich lend. The poor borrow. Interest payments transfer wealth from borrowers to lenders. The higher the interest rate, the more the rich take from the rest in interest payments. This is the third time I made this point. Others have made it, too. Johnny simply ignores it, presumably because he has no answer. He just keeps saying “savers, savers, savers” without addressing borrowers. Repeatingly ignoring this point while repeating his own mistaken point is dishonest.

The rich hold vastly more assets than the rest. The rest mostly hold real estate. When rates fall, asset prices rise, no question. But interest payments fall when interest rates fall, and that matters more for the not-rich part of the population. Johnny’s “what about stocks?” shtick is all about making the rich less rich, nothing about making the rest of us better off. I care about the rest of us. Apparently, Johnny doesn’t. Don’t like the wealth gap? Tax the rich. Don’t screw up the economy just because you can’t understand how interest rates work.

More Johnny-mumbling:

“In fact, the poor benefit not just from having jobs, but also by receiving higher real wages resulting from lower inflation, something that most business-friendly economists like Tricky Ducky don’t like to talk about much…”

OK, Johnny is doing that “ad hominem” thing again. His argument is simply wrong, so he makes up crap about people like me. I’m analysis-friendly. I check the data, I know a bit of history, I know some economics. I put all that to work to understand the economy. Johnny simply doesn’t do that.

And his “jobs vs inflation” argument is evidence that he doesn’t bother with data or history or understanding how things work. Real household incomes fall during recessions. I’m gonna show you the picture, but you don’t need it, right? You know that household incomes fall during recessions. Real wages rise during expansions, mostly once the expansion has been around long enough to raise both employment and wages. When interest rates are too high, expansions are put at risk. When rates are too high, real in one’s fall.

Johnny’s “jobs vs inflation” claim is a claim that wages do not rise fast enough to offset inflation – do not. That’s his claim. Otherwise, households are better off even with inflation. Here’s the picture:

https://fred.stlouisfed.org/graph/?g=1fKUq

Real income rises through most of the expansion, time after time. That’s real income, corrected for inflation. When do real wages fall? During recessions, yes, but also just before the recession starts, when the real Fed funds rate has been raised.

Johnny’s bit about how job gains are good, but real wage gains are too? That’s right, but real wage gains aren’t helped by rate hikes. They end when rates get too high. It’s right there in the data that Johnny didn’t check.

If the Fed didn’t do anything about inflation, maybe we wouldn’t see that pattern, but the Fed is active in keeping inflation under control. In the non-imaginary real world in which we live, Johnny’s “jobs vs inflation” argument is wrong.

Inflation is under control now. So keeping rates high now is more likely to hurt real incomes than help them. It’s right there in the data. No matter how much Johnny lies about me, the data don’t lie.

Here’s another bit of rhetorical deceit from Johnny:

“What’s needed is an analysis of the costs and benefits of rate reductions…an analysis that highlights the massive benefits to the top 1% who own a lot of stock, the effectiveness of monetary policy transmission in today’s conditions, and the harm done to people in Retirment or trying to save for retirement.”

Johnny SAYS we need analysis, but he then pretends he knows the answer without seeing – or doing – any analysis. That’s not what ya do when you want to know the results of analysis. I should know; unlike Johnny, I actually do analysis.

“The USA Today article took a look at a number of major sources of consumer debt and found the impact of a rate cut to be small. Tricky Ducky won’t contest their analysis.”

So we you accuse both of us of not addressing your BS – you are blatantly lying. But wait – every thing you write is a lie so HEY!

Tricky Ducky mentions the poor 3 times in his comment!!! When was the last time that Tricky Ducky said anything about the poor? When was the last time he even thought about them?

But, rest assured, when the Fed is (maybe) poised to cut rates, boosting stock prices, Tricky Ducky suddenly starts pushing rate cuts…on the premise that they help the poor!!! Right on schedule for a Wall Street shill!

More “ad hominem” from Johnny. In fact, I mention the poor just about every time Johnny argues that they’d be better off if the Fed would just keep rates high even though inflation is back to target. So Johnny has lied about my position again, and engaged in an ad hominem attack again, without addressing my argument, again

This is the purest form of Johnny-mumbling. No substance, but lots of vitriol. Just like when he blames Ukraine for Russia’s invasion of Ukraine. Just like when he claims it’s Democrats, not Republicans, who promote policies that are bad for the poor. Pure Johnny.

Before she was banned, I stopped reading the yap from ltr. Then again she once and a while made a decent point. Sometime little Jonny boy is incapable of doing.

Anonymous: ltr has not been banned.

Another sign my mind is not as dexterous as it once was, when ltr is absent for weeks and I don’t even notice. Perhaps other things in my immediate surroundings are filling in on my daily aggravation quota.

“With a persistent shortage of inventory, housing prices are likely to surge as a result of a rate cut, largely offsetting the effect of the rate cut.”

Wait – you said that Goolsbee claimed that there was not bent up demand for investment demand. Oh wait – he was talking about having a lot of washing machines not houses. But little Jonny boy thinks they are the same thing. Duh!

Wolf Richter: “Eyepopping Factory Construction Boom in the US: Chip Makers on Forefront, but CHIPS Act Funds Not Even Released Yet…

Supply-chain chaos, edgy US-China relations, and scary dependence on China triggered a rethink, now showing up as investments in manufacturing plants.”

https://wolfstreet.com/2024/02/03/eyepopping-factory-construction-boom-in-the-us-chip-makers-on-forefront-but-chips-act-funds-havent-even-been-disbursed-yet/

Imagine that…Corporate America investing massively despite high rates. Given that business generally invests in response to a need or an opportunity, not a change in interest rates, would lower rates boost fixed investment much, if at all? Well, maybe some real estate investors…but we hardly need more CRE, although multi-family housing is one exception that could really use lower interest rates.

Are you too stupid not to get that post from Dr. Chinn not only clearly explaining this to you as he called you out for being the mental retard you really are? Supply side incentives were praised by someone called JohnH when it was Mexican policy but criticized when it is US policy. Dude – even mental retards know how to be consistent but not little Jonny boy.

Of course, pgl can’t remember the US supply side incentives that I criticized…but he has to have something to jabber about…true or not…

Johnny? Listen, kid, interest rates work on the supply side. You’re arguing to keep rates high, which is an argument to limit supply-side incentives.

You really need to be less obvious with this “say anything to distract from the evidence” stuff. Arguing against rate cuts is arguing against supply-side incentives. It’s that simple. Anyone who actually understands economics knows that.

Your gibberish is so all over the map that it is not worth remembering. Dude – you are nothing more than a yappy little moron. Sort of like those pathetic little muts I see when I help my daughter walk her dog.

“but we hardly need more CRE, although multi-family housing is one exception that could really use lower interest rates.”

Jonny boy has a new term – CRE. That would stand for a lot of things but I guess Jonny boy does not like Commercial Real Estate. And maybe little Jonny boy thinks were have too much single family housing too. Talk to the people in cities like LA or SF or NYC. Well maybe one should leave out NYC as Jonny’s talk would get a punch in the mouth.

But let’s look at some data:

Real Private Residential Fixed Investment

https://fred.stlouisfed.org/series/PRFIC1

Huh – those higher interest rates did lower residential investment. Something little Jonny boy has been denying. Memo to little Jonny boy – stay away from construction workers lest one of them punch you in the mouth and elsewhere.

Just so we know how large a mistake Johnny is making when he argues that cutting rates isn’t a good idea because low turn-over in existing homes won’t be solved by cutting rates, remember, the only jobs that come from selling g existing homes are in the real estate and mortgage businesses. There are over 4 times as many workers un construction as in real estate:

https://fred.stlouisfed.org/graph/?g=1fCOn

I’d be happy to cook up a similar chart for mortgage brokers, but FRED doesn’t seem to have that series.

But it’s almost beside the point. When Johnny used a mortgage-rate-induced supply problem to argue that rate cuts won’t help, his argument was nonsensical on ots face. And even if it were true, it’s just a debating trick. I can think of a long list of problems that interest rate cuts won’t fix: falling educational attainment, guns, syphilis, scratchy sheets… None of them mean rate cuts are a bad idea.

This is what I meant when I me tooned Johnny-mumbling. All Johnny does is toss out any objection that comes to mind, no matter how silly or dishonest, because he can’t hope to convince well-informed people. He knows that. The goal – right out of the “fake science” playbook – is to create doubt among those who are less well informed. Truth doesn’t enter into it.

“I can think of a long list of problems that interest rate cuts won’t fix: falling educational attainment, guns, syphilis, scratchy sheets”

I’m glad you mentioned this list since Steve Forbes is back in the news. Did you know that according to Stevie that a FLAT TAX solves all of those problems? OK – Stevie is a right wing idiot but at least he is not as stupid as JohnH.

There is just soooo much about what Johnny has written that…how to put this nicely?…shows a lack of basic understanding of the subject he’s discussing. Here’s another example:

“Finally, what about the lackluster effects of ZIRP and QE? What would make rate cuts any more effective this time around?”

First off, why QE? I thought we were talking about rate policy? Wait! I get it. QE is another distraction, part of this round of Johnny-mumbling. The issue which Johnny himself raised, is interest rates.

As to the unterest rate part, the answer is pretty straightforward- we are now in a positive interest-rate environment, withtheneutralrate well aboved zero. Anyone who knows anything about how monetary policy works knows that, but Johnny apparently does not.

Y’all know about the Taylor rule, right? I know Johnny does, because I keep reminding him, but he just keeps ignoring it. Here’s a Taylor rule utility I pointed out to Johnny just a couple of days ago which he apparently didn’t bother to use:

https://www.atlantafed.org/cqer/research/taylor-rule#:~:text=The%20Taylor%20rule%20is%20an,output%20gap%20or%20unemployment%20gap.

Fiddle with it and you’ll see that the neutral interest rate was probably negative through some of the zero rate period. That makes it very hard for interest rate policy to be effective. People who understand these things all know that. Now, however, the neutral rate is well above zero, so rate policy is likely tobe effective. People who understand these things all know that.

Real rate is around 2%.

Princeton Stupid Steve has spoken! Well at least time there might be some support for your assertion – even if Princeton Stupid Steve once again fails to provide it.

Menzie Chinn,

Please update this blogpost once Tucker responds to your comment to his original piece. I didn’t see anything credited to you in Zero Hedge so I’m assuming it’s in the original source, the Epoch Times. Can’t wait to see his response to your views. Is this blogpost a longer version of your comment(s) in the Epoch Times article or the same?

Defending the sanctity of zero hedge while remaining quiet about the immoral invasion of Ukraine certainly explains what a turd you are econned. Your choice of complaints is illuminating if not disappointing.

I’m going to do something Econned refuses to do – provide a proper link/reference to a seminal paper:

Rational Expectations and the Theory of Price Movements

John F. Muth

Econometrica, Vol. 29, No. 3. (Jul., 1961), pp. 315-335.

https://www.parisschoolofeconomics.eu/docs/guesnerie-roger/muth61.pdf

I figured since Rational Expectations is an idea that is over 60 years old, it may be time for little Econned to catch up on it.

I presume you will for the first time in your worthless little life that you will have the courtesy to provide us a link to this alleged comment. After all – there are some 200 comments so far all of which are dumber than rocks (but not as dumb as Econned). Two of the comments are from Donald Trump. Which goes to show what kind of clowns read Zero Hedge.

Menzie Chinn,

Ot maybe you emailed Tucker your thoughts in hopes of discussing the topic in earnest? Do you mind providing that exchange in full?

I hear that when you email the editors of AER, JPE, or the JME your trash is automatically sent to spam.

You don’t need any fancy graphs. You can buy inflation adjusted, guaranteed real returns of 1.3% for I-bonds and 1.75% for TIPS.

https://fred.stlouisfed.org/series/DFII10

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed (DFII10)

I’m assuming you were using the 10-year rate. 5-year a bit less while longer term a bit more.

Providing this link as it seems the economic expert for Epoch Times is not aware of this source.

Tyler is just repeating the spin from some fellow named Jeffrey Tucker writing for the crazy right wing Epoch Times. Tucker was a journalism major at George Mason who ended up working for Ron Paul. Tucker is also a flaming white supremist and a COVID denier. So one would expect some insane right wing screed and we sure got it.

Besides the stupid way of measuring expected real interest rates (yea we get that kind of stupidity from JohnH a lot), there’s a lot more to unpack in this idiotic rant starting with:

“Everyone associated with the Biden administration has been propagandizing for months and years about the glorious results of Bidenomics. All corporate media echos this gibberish even though most people know it is completely untrue. The data is fake. When it is not fake it is not relevant. When it is relevant, the underlying reality is terrible.”

Of course this economic Know Nothing goes off on how it is impossible to have sustained investment with a low personal savings rate. Excuse me but do they not teach that is national savings that funds investment even in a closed economy full employment economy? And one would hope that someone from George Mason would get the role of the current account. Tucker follows this by accusing Biden of exploding government spending and the debt which the actual data refutes. But never mind that when we have this Bruce Hall BS:

“In the last four years, the Fed has stolen 20 cents on the dollar of your purchasing power. They sent you money in the mail and then took it away with the hidden tax called inflation. Then they raised rates to curb the inflation just when American households had run out of money to save.”

Never mind the fact that real income has risen under Biden. And is this two faced liar admitting real interest rates are positive? Of course this is when the clown decided to misrepresent not only real interest rates but also monetary policy. And he had to follow this insanity with this rightwing classic:

“And, hey, if this Fed caper doesn’t work, they always have Taylor Swift and her Pfizer-salesman boyfriend.”

I’m no fan of the KC Chiefs but maybe this Super Bowl I should cheer for them.

“In any case, theory suggests that economic decisions are based primarily on ex ante real rates, not current rates adjusted by lagged inflation.”

Oh dear – a clear and concise statement of basic economic theory that Irving Fisher ably explained in 1907. You do realize that this clear statement is about to start a fierce tirade of rants from JohnH. And even though Princeton Steve seems to have gotten the number right – he never heard of Fisher and is dumb enough to think the calculation is done by some Russian version of the Taylor rule.

The wonderful thing about political economics is that you can always find a parameter in support of whatever point you want to make. Normalize, don’t normalize, subtract, don’t subtract, include, don’t include. Most political economist even manage to come up with justifications containing fancy words that get over the low hurdle of the average Joe’s ignorance.

I can see why Tyler Durden, Donald Trump, and Econned likes this organization!

https://www.nbcnews.com/news/us-news/epoch-times-falun-gong-growth-rcna111373

How the conspiracy-fueled Epoch Times went mainstream and made millions

The conservative news outlet has amassed a fortune, growing its revenue by 685% in two years, according to tax documents.

In the runup to the 2020 election, a small news organization saw an opportunity. The Epoch Times directed millions of dollars in advertising toward supporting President Donald Trump’s campaign and published dozens of articles parroting his lies about the election — resulting in huge growth to its audience and its coffers. The strategy garnered criticism from fact-checking groups and got it banned from advertising on Facebook, but it ultimately paid off — putting the once-fringe newspaper on a path that perhaps only its leader, who claims to have supernatural powers, could have foreseen. Today, The Epoch Times is one of the country’s most successful and influential conservative news organizations. It’s powered by Falun Gong, a religious group persecuted in China, which launched The Epoch Times as a free propaganda newsletter more than two decades ago to oppose the Chinese Communist Party. Funded through aggressive online and real-world marketing campaigns and big-money conservative donors, The Epoch Times now boasts to be the country’s fourth-largest newspaper by subscriber count. (Unlike most major newspapers, The Epoch Times isn’t audited by the two major independent collectors of circulation data.) The nonprofit has amassed a fortune, growing its revenue by a staggering 685% in two years, to $122 million in 2021, according to the group’s most recent tax records. Its editorial vision — fueled by a right-wing slant and conspiracy theories — is on display in recent reports on how “Jan. 6 Capitol Hill Security Footage Challenges Key Narratives” and “Meteorologists, Scientists Explain Why There Is ‘No Climate Emergency.’” Its video series include a documentary-style film alleging widespread vaccine injury and death and an exposé of an alleged world government agenda to harm farmers, cull the population and force survivors to eat bugs. What The Epoch Times lacks in standards, it makes up for in style and form, mirroring the aesthetics of journalism — a feature that’s attracted subscribers and big-name supporters. Anti-vaccine activist and presidential candidate Robert F. Kennedy Jr. calls The Epoch Times a daily read, among his most trusted news sources. “They have a real bias against China, but on other reporting, they’re very courageous and it’s real journalism,” Kennedy said in an interview with NBC News this summer.

It all started with the Fox News strategy strategy of “give’m what they want” – using big breasted blonds displaying their rack and whispering news stories into the ears of mesmerized men. But the Dominion lawsuit discovery process indicated that the process has developed into one where Fox were forced to present as credible news whatever the listeners wanted to be the truth. Either that or lose viewers/money to those who would. Current “news” feed algorithms have put that whole process on steroids. In order to get your attention they feed you rage-news. You quickly end up with a stream of either right- or left-wing rage stories – and in order to get you to click/stay with those stories, they get more and more outlandish. With no filter or editors they also get less and less true.

Your graph of the ex ante real rate is instructive in light of JohnH’s recent claim that we had a period from 1983 to 2007 where real rates were always high and yet the economy never had a recession. First of all we had just come off a very severe recession in 1982 and we had a recession that began in 1990 (something little Jonny boy either does not realize or was too just too dishonest to admit). Also note that the FED did manage to lower the real interest rate from the late 1980’s to the early 1990’s and the period know as Bush43’s first term.

Now maybe Jonny boy was not being dishonest about real interest rates as we all know this troll has no idea how to calculate them.

pgl’s is lying yet again. What I said was that the economy grew well between 1983 and 1999 despite relatively high interest rates, even taking into account the recession in 1990-91. The Fed did lower interest rates, but for most of those 17 years, they were above what Ducky and pgly are bleating about today. You can look it up!

The bottom line: strong economic growth is not incompatible with high interest rates.

Well you rewrote your original statement. And you still missed my point? Yea you are really dumb

Johnny is again pretending to be an authority in economics, despite extensive evidence that he makes stuff up to suit his economic (or rather his political) views. He says high rates are consistent with strong growth. He’s wrong.

For starters, the folks at the Federal Reserve are explicitly in the business of using interest rates to control the pace of economic growth. Johnny wants you to believe he knows more than they do.

Until Professors Chinn and Ferrara came along and showed us how well the debt service burden does in predicting recessions, theeconomic literature was unable to find anything better than the yield curve at predicting recessions. Johnny wants you to believe he knows more than the economics profession. Oh, and the debt service burden rises in response to rising interest rates, so Johnny is wrong, even in light of new knowledge.

Johnny makes a claim about economic performance and interest rates, and then says “look it up” – it’s a debating flourish meant to boost his credibility. But nobody who knows anything about Johnny thinks he’s credible. So I took Johnny up on his offer, and looked it up, but corrected his error. Instead of any old “rates”, I used inflation-adjusted Fed funds rates against GDP growth:

https://fred.stlouisfed.org/graph/?g=1fJzI

What shows up? The real funds rate rose to around 3% in mid-2006, with recession following. The increase in rates in 2019 was followed by a period of economic and financial stress, but we can’t know if recession would have resulted in the absence of the Covid pandemic. A rise in the real funds rate in the late 1990s was followed by recession. A rise in the real funds rate in 1989 was followed by recession.

So, once again, Johnny has lied to us. This particular lie involved Johhny contradicting conventional economic thinking, Fed operational doctrine and our host, hoping you’d belive him.because Johnny backed up his idiotic claim with “you can look it up”. I did. Johnny lied.

“I’m not sure why one would choose the core sticky price measure.”

I think I know why he used this measure. He decided to follow the celebrated JohnH procedure which is to mine all possible measures and then choose the one that gave the highest result.

https://fred.stlouisfed.org/graph/?g=1fJdK

Sticky core vs regular core. You get an additional 0.7% in y/y inflation, so 0.7% less in terms of inflation-adjusted interest rates, by picking an idiosyncratic measure. So yeah,…

In all of JohnH’s mumbling over whether we had a recession in 2022 (we did not) he may have said something interesting even if this troll has no clue what he said. He tried to tell us real GDI was “perfectly flat in 2002”. This sounded wrong as I thought real income rose in 2002 and it seems I was correct:

https://fred.stlouisfed.org/series/a261rx1q020sbea

But look at 2001. It fell for 3 quarters in a row. Yea NBER called a recession for that year as they should have.

But poor little Jonny – he actually thought Bush43 was still President a couple of years ago and Saddam Hussein still ruled Iraq!

I see that I forgot to include the link to real GDI–

https://fred.stlouisfed.org/graph/fredgraph.png?g=1fJ1h

How much flatter does it have to get for pgl to acknowledge that GDI was flat in 2022? Even the 3Q blip got reversed!

Goes up for two quarter, down a bit for one, and up again. Dude – you cannot even describe a King of the Mountain course which is sort of pathetic as even the most retarded 3 year old can.

And you do not know the difference between 2022 and 2002? Yes – you are that damn dumb.

ZeroHedge is really some Bulgarian named Daniel Ivandjiiski? He’s not the character Brad Pitt played in Fight Club?

This blog is a total waste of time and its founder is a total fraud. Brad Pitt should challenge this wuss to a boxing match!

Little Jonny boy declared we do not need more “CRE” which likely means commercial real estate. OK I do not expect little Jonny boy to offer anything more than something a two year old might utter so I found this informative discussion:

https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/are-banks-vulnerable-to-a-crisis-in-commercial-real-estate

Yes remote working has lowered the demand for being in the office but the idea that we will no longer need offices to work in is dumb – even though it is less dumb than Jonny boy’s usual comment. This story, however, does note that the valuations of commercial real estate have fallen but not so much from lower operating profits or cash flows but from higher discount rates. Something little Jonny boy celebrates almost as much as he cheers for the deaths of innocent Ukrainians.

Now we do have an issue with some regional banks being incredibly exposed to the fortunes of commercial real estate, And Issue made worse by higher interest rates. The FED chair says this is a manageable problem. Maybe so but only if they ignore the stupid rants from the likes of little Jonny boy.

Jonny boy loves to accuse me of lying when I remind this pathetically stupid troll of things he said. Hey – most people would deny prior statements when they are shown to be stupid as it gets. But now this mental retard said I and Macroduck refused to take up a cost and benefit analysis of reducing interest rates. Now we have but of course Jonny boy did not understand any of the economics but what’ new?

But now Jonny boy has touted out some NYTImes piece from 2019 by Austan Goolsbee. Something else that this mental midget never understood. But hey – here’s a group that did understand what Goolsbee wrote:

https://www.hospitalitynet.org/opinion/4094894.html#:~:text=In%20other%20words%2C%20to%20summarize%20Goolsbee%27s%20general%20point%2C,there%20isn%27t%20much%20pent-up%20demand%20left%20to%20unleash.

In a recent New York Times op-ed titled Why Rate Cuts Don’t Help Much Anymore[1], Austan Goolsbee, former economic advisor to President Obama, cited a study on the effect of Federal Reserve rate cuts on demand for mortgages, stating:

Fundamentally, there wasn’t much pent-up demand for investment after years of low rates, accelerated depreciation, ‘temporary’ investment expensing, and other stimulus. The lack of pent up demand also means that cutting interest rates now is unlikely to entice businesses to invest much more.

In other words, to summarize Goolsbee’s general point, rate cuts don’t unleash the same impact on the economy they used to because at this point, ten years on, there isn’t much pent-up demand left to unleash. Companies seeking to make big investments have made them, and consumers and homeowners waiting to replace that expensive washer or dryer or to refinance a home have done so. And therein lies the problem with long economic cycles such as our current one: few people are left sitting on the sideline waiting to strike when the iron is hot because the iron has been hot for some time now.

One can read on what these hotel folks said about their own sector. Now what is being said here does not have a damn thing with what that news story Jonny originally linked to. But as I pointed out – Jonny boy either did not read his own damn link or he is lying about his own damn link. Your choice?

But there is no pent up demand over the past couple of years? Seriously Jonny boy – investment is strong now even though the cost of capital. Memo to my mentally retarded stalker. The economy now is not the economy 6 years ago.

Low rate environment vs high rate environment. This just more of Johnny hunting up any link he can find which seems, at the most superficial level, to support his position. Often, the links don’t actually support his position, but that’s not the point. He’s trying to deceive casual readers who may not know why things behave differently in a high rate environment. Heck, it’s pretty clear Johnny doesn’t understand.

Exactly. Jonny boy’s reading capacity seems to be reading the headline and nothing more.

“Low rate environment vs high rate environment.”

College freshmen get the difference between shift of the (investment) demand curve v. movement along the (investment) demand curve. It is a basic and simple concept. But like any economics or basic finance – it flies right over that excuse of a brain Jonny years.

Well, so many of today’s conservatives are backward looking (it’s forever 1979!!!), so we shouldn’t be surprised it they see macroeconomics through the lens of adaptive expectations. They have the same problem when it comes to climate change. It’s all backward looking with them. They have problems projecting change into the future…probably because they have problems with change in general. The inability to accept change is the hallmark of conservatism.

I was just reminiscing how today’s democrats beat the drum of how good it is like Paul Harvey in the late 70’s.

Are we that old L

Paul Harvey dates back to Nixon’s first term. I should know as my late father was a big fan of his (I wasn’t). In 1970 my father and I had drawn far apart on the wisdom of staying in Vietnam (actually I started protesting in 1968). Harvey came on the TV that evening and told what he referred to as his President (Nixon of course) that Vietnam was a mistake. My father stared at the TV as I told him “I get why you like this fellow. He says what he believes”.

1979? Let’s go back further. Muth wrote his paper in 1961 and Lucas applied it to macroeconomics in 1973. But it seems our Econned still has not heard of Rational Expectations!

Well, there may soon be good news for people who tell the truth:

https://www.npr.org/2024/02/06/1228720142/michael-mann-climate-scientist-in-court-suing-for-defamation

Climatologist Micheal Mann has sued some of his anti-science attackers for defamation. I’m not sure the particular people whom he has sued are funded by the fossil fuel industry, but some of his attackers are.

Fingers crossed, we may see the court decide that malicious lies are actionable. And before the troll choir goes crazy about what constitutes a lie and all that nonsense, it is lies which engage in malice which are at issue. So when Johnny says that high interest rates don’t slow growth, that wouldn’t be covered under malice. When he engages in ad hominem attacks, it might be covered.

“The trial in D.C. Superior Court involves posts from right-wing author Mark Steyn”

Bruce Hall brought this up all praising Mark Steyn and mocking this defamation lawsuit. Fortunately for us Moses was all over Brucie’s praise of the repugnant Steyn. Of course big brave Brucie retreated like the weasel he is by saying he was never a fan of Steyn even as Brucie claimed this was a trial over scientific research. Seriously?