Pretty clear to me:

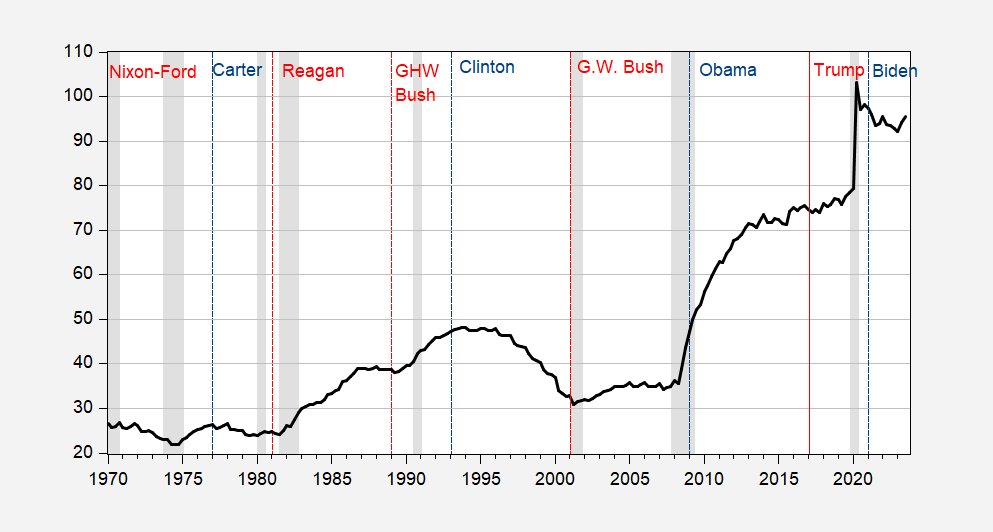

Figure 1: Federal debt held by public divided by GDP, %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, GDP via FRED, NBER, author’s calculations.

There’s a party that’s loved debt over the past 40 odd years, despite protestations. Note also debt/GDP started rising precipitously in 2008Q3 (under G.W. Bush). It’s come down since 2021Q1, although rising in most recent quarters.

Tremendous increases under republican presidents. Who would have thunk it? Looks like some democratic presidents actually brought the ratio down? Maybe im misinformed here. I better register for rick strykers latest economics class. I hope ecconned will be the teaching assistant for the course. Gonna need a lot of propganda to spin this chart as pro conservatives.

“Note also debt/GDP started rising precipitously in 2008Q3 (under G.W. Bush).”

It was already rising even before the Great Recession but of course that was all Clinton’s fault. The Reagan buildup – blame Jimmy Carter. And of course Obama/Biden …. SOCIALISTS!

All technically true. What was the root cause in 2008? What was the root cause in 2020? And why did the trend continue after 2008? And why is it projected to continue into the 30s? It’s more than just triggering events. Why hasn’t the percentage return to the 30-40% range? It’s not just tax policy or that would have been corrected under Obama. It certainly flattened in Obama’s second term and stayed relatively flat during Trump’s first three years despite tax changes, until the black swan event of 2020 during which the economy was effectively shut down as evidenced by business closings, school closings, and enforced social restrictions. While the percentage went down as the economy normalized after 2020 restrictions were abandoned, the short-term change has been back upward.

So, the question remains: Is Jaime Dimon correct?

Bruce you are simply coming up with excuses. Let me ask you why do black swan events seem to initiate under republican administrations?

Bruce Hall,

Note that the graph is in percent of GDP, and recall that such data involves both a numerator (debt) and a denominator (GDP).

Now, go back and look at the worst recessions since WWII. Driving down the denominator is something GOPers are very, very good at.

Add to that their absolute hatred of revenues, and you have the answer you’re probably not looking for: Republican’ts are Bad for your Wealth.

Hey Brucie – try doing this in terms of debt/GDP before your usual set of really asinine questions. Oh wait – little Brucie cannot be held responsible for his earlier moronic comment. Never mind – I forgot little Brucie is paid to be STUPID.

But OK Brucie – on 2008. I guess you never heard of the Great Recession. Or did you GOP masters order you not to admit Bush43’s incompetence when it came to the banking system. 2020? Oh wait – little Brucie is not allowed to mention Trump’s incompetence when it came to dealing with COVID.

But yea – Bush43 irresponsibility lowered taxes for the rich. Like Obama could just reverse that over a McConnell filibuster. Or is little Brucie’s so stupid he does not get Senate rules. And of course little Brucie forgot to mention the 2017 Trump tax cut. I bet Kelly Anne Conway gave little Brucie boy a lollipop for that.

“It’s not just tax policy or that would have been corrected under Obama.”

Love to see even a simplistic, broad-stokes explanation of why you think that’s true. Obama didn’t raise personal income tax rates, nor did Congress during Obama’s presidency. All that happened was that the Shrub cuts on the top rates, and the top rates only, expired. That was due to the law that Bush submitted and Co gess passed.

Here is picture of two different concepts. One is the top marginal income tax rate. It did not rise to pre-Reagan levels, despite what Republicans tell each other inside the echo chamber. The other is corporate tax receipts as a share of GDP. There, too, nowhere near pre-Reagan. Tax cust are the product of Republicans being in power. Republicans mostly don’t cut spending. Instead, they wait for Democrats to win.power and then insist that Democrats cut spending.

So, let’s at least try to discuss these things based on facts. Just this once, OK?

https://fred.stlouisfed.org/graph/?g=1fBDC

The severe recession of 2007-2009 was no “Black Swan”. It was predictable due to the collapse of the housing bubble. Wall Streett & Friends created the bubble to stoke demand to due to collapse of the internet bubble and subsequent recession. Also, the trade deficit with China exploded thanks to Clinton and company’s deal to make China a member of the WTO. Thus, when the bubble collapsed as all bubble do eventually. The collapse was inevitable. Only liars and fraudster would claim ignorance.

COVID 19 Situation

It was not a foregone conclusion about the deaths due to covid. All G7 countries have lower death rates from covid than the US. Let’s remember PM Sanchez of Spain, PM Trudeau, and President Macron all got re-elected and the three of them oversaw the crises. Trump was the exception. He killed a lot of Americans , mishandled the crisis, and due to that he was rightfully thrown out of offce.

“The severe recession of 2007-2009 was no “Black Swan”.”

Agreed. But remember – Bruce Hall thinks this was all Obama’s fault.

Bruce Hall I don’t have a problem with the debt-to-GDP ratio going up in 2020. COVID was an existential problem and massive government spending was needed to keep the economy and its citizens afloat. So let’s just look at 2017, 2018 and 2019. Under Trump the ratio increased. Now as you said, the ratio can go up for two reasons; increases in the deficit and/or weak GDP growth. Now you’ve been telling us that GDP growth under Trump was nothing short of heroic (fact check: it wasn’t), so you must be saying that the deficit was growing faster than GDP. That’s just arithmetic. Of course, that’s exactly what you would expect if you cut taxes and increase spending. Under Biden the ratio is still too high, but there’s been a change in the inflection point and it’s drifting down. It would drift down even faster if your GOP friends would agree to increase taxes on the wealthy.

BTW, over the long run what you want to look at is the primary deficit; i.e., the total deficit less interest payments.

I already noted how stupid JohnH’s read of this was:

https://www.wtwco.com/en-us/news/2022/11/us-pay-increases-to-hit-4-point-6-percent-in-2023-wtw-survey-finds

Jonny boy claimed that the mere fact that BLS reported a 4.6% pay increase which was close to the 4.5% projection from some stupid WTW survey proves Corporate America is dictating pay increases and labor is powerless. But wait – it seems Jonny boy did not READ his own damn link (again):

Labor market and inflationary pressure fueling higher-than-projected increases … Overall salary increases in the U.S. are forecast to rise to 4.6% in 2023, up from an actual spend of 4.2% this year, as the majority of companies react to inflationary pressures (77%) and concerns over the tighter labor market (68%). That’s according to the latest Salary Budget Planning Report by WTW (NASDAQ: WTW), a leading global advisory, broking and solutions company. While current pay budgets have risen to 4.2%, in 2022 more than two-thirds of companies (70%) spent more than they originally planned on pay adjustments for the past 12 months. As economic challenges loom large in the U.S., a fifth of organizations (21%) that are changing salary increase budgets have said they will fund increased spending by offering compensation plans and benefit programs that their employees value most. Roughly the same number (17%) will raise funds by increasing prices, and 12% will resort to company restructures and reducing staff head counts. In addition to pay pressures, three in four respondents (75%) also are experiencing problems with attracting and retaining talent — a figure that has nearly tripled since 2020. In fact, the tight labor market has been an influencing factor in the decision of nearly seven in 10 companies (68%) to increase salary budgets.

Now I get little Jonny boy flunked preK reading many times but COME ON!

The latest really pathetic and stupid comment ala Bruce Hall pretends Donald Trump is a fiscally responsible leader and the run up of the debt/GDP ratio was all Obama’s fault.

Now as you may have seen, I’m once again cheering for JohnH to take that coveted 2024 troll of the year award (Princeton Steve may have won the 2023 award even if Jonny boy deserved it) but it seems Brucie boy is stepping up to the plate big time! And we are only 5 weeks into the year!

Increase in federal debt held by the public during (beginning in Q1 of term):

Increase in Debt

Carter 231,301

Reagan I 635,620

Reagan II 721,813

Bush I 1,034,129

Clinton 1 696,686

Clinton 2 (412,453)

Bush GW 1 992,811

Bush GW 2 1,966,299

Obama I 5,213,909

Obama II 2,852,766

Trump 7,212,090

Biden 5,113,083

Leaders are Obama I, Obama II, Trump and Biden. Trump was dealing with the covid suppression: $4.4 trn of his increase came in the first three quarters of covid. By contrast, Biden has added $3.6 trn in just 2022 and 2023, when there was neither covid nor a depression. If we want to rank by fiscal probity, Clinton is best, Biden is worst. Cater is under-rated. Obama does not stack up particularly well.

If you dont want to normalize the data, steven, you are either dishonest and/or ignorant. I will let you best characterize your poor analysis skills.

Stevie pooh’s career as a consultant does not rest on his analytical skills. As everyone here knows – he has no true analytical skills. No Stevie is marketing to the MAGA morons, which is why he really needs to get more appearances on Fox and Friends.

There are many ways to conceptualize debt: as a percent of GDP, cyclically adjusted or not; in nominal dollars; or real dollars, for example. And then there’s accounting for exogenous factors like covid suppression or the Great Recession (the China Depression). And then one can attribute it to a president, or to a given term of a president, or allocated annually. For example, Biden has only been in office three years, while Obama was in office for eight.

There is little doubt that Trump’s tax cuts increased the deficit. However, how many economists want to repudiate the covid stimulus under Trump? What about Obama? In absolute terms, debt grew by $8.1 trillion under his term, almost a trillion more than Trump. (Remember when we discussed how stimulus would pay for itself? Apparently not.) I don’t think the stimulus under Obama was particularly well directed; but then, how much of that is directly attributable to Obama, as opposed to the Fed, Treasury, or Obama’s advisors? I think both fiscal and monetary policy were bad under Biden, although recovering somewhat now.

Or perhaps I should blame Reagan, because that’s when chronic deficit spending became the norm: “Deficits don’t matter.” Or should I blame Claudia Sahm, who insisted that massive borrowing was no big deal because interest rates were so low?

I don’t know, but we have a heck of a lot of debt now, with little prospect of ever repaying it.

Steven Kopits: Not sure how you would visualized real debt to real GDP, since one would likely use the same deflator — in which case it’d be the same as nominal debt-to-GDP.

“I don’t think the stimulus under Obama was particularly well directed; but then, how much of that is directly attributable to Obama, as opposed to the Fed, Treasury, or Obama’s advisors?”

Our host has called out your pathetically stupid first paragraph so permit me to educate the dumbest consultant God ever created over economic advice in early 2009. Dr. Romer called for more fiscal stimulus as did Paul Krugman. Both want it focused on more bang for the buck things like government purchases. Both wanted the FED to go harder than it did. Both were right. The problem was the Republicans who would have filibustered more focused proposals.

But of course an Economic Know Nothing like Princeton Stupid Steve likely thought the Republicans were right as Stevie’s only goal in life is being invited back to Fox and Friends.

Not as a percentage of GDP. Stevie is as dumb as Bruce Hall

See my general comment below. But there is a special case for this asinine bit of stupidity:

‘Biden has added $3.6 trn in just 2022 and 2023’

I get you are the world’s worst consultant but take a look at the post’s graph. Debt relative to GDP – dumba$$.

Oops. Picture:

https://fred.stlouisfed.org/graph/?g=1fBK9

Stevie? Stevie, when grown-ups talk about the deficit, they do what Baffling called “normalizing” and what pgl meant when he mentioned “share of GDP”. I know it seems complicated, but when we learn a kind of arithmetic called “division”, you’ll understand better.

For now, I’ll show you a picture. See, when the blue line goes up, that means something is helping the deficit become smaller as a “share of GDP”. That’s good! Now, see if you can figure out who was president at times when the blue line went up a lot. Give it a try!!!

Oh wait – Nobel Prize winning Bruce Hall used this FRED metric:

Federal Debt: Total Public Debt (GFDEBTN)

Shame on our host for doing this relative to GDP. After all – the price level never rises and real income has been flat all these years – right? Remember Bruce Hall cuts and pastes those emails from Kelly Anne Conway which means they must be accurate and well informed presentations!

If you’re taking care of your Mom. how many false accusations can you STOMACH?? at this point, please add on to FALSE accusations PLEASE ADD On

It seems Princeton Stupid Steve wants to catch up with JohnH and Bruce Hall in that race for troll of the year 2024. First this moron measures debt in nominal terms not real or relative to GDP, which only ties Bruce Hall for being as moronic as it gets.

But then he lets Trump off the hook by talking about COVID. Never mind the fact that the debt/GDP ratio was rising before 2020. Oh wait – Stevie boy has a new theory. We needed that 2017 tax cuts for the rich as Trump foresaw COVID. Gee – Stevie pooh must think Trump is a genius!

The economic history of the U.S. starting with Ronald Reagan – when GOP is in charge – “deficits don’t matter and let’s give tax cuts to rick people and cut regulations to create a speculative bubble in the stock market” Meanwhile while the Dems are in charge – “let’s do responsible governance and help everyone besides the top 1%” The economic data is clear – one example – 33.8m jobs – 16 years of Clinton, Obama; 14.8m jobs – 3 years of Biden and 1.9m jobs – 16 years of Bush, Bush and Trump https://www.hopiumchronicles.com/p/holy-moly-another-huge-jobs-report

Some of Reagan’s advisors believed in the Starve the Beast theory. Cut taxes and spending cuts will follow. Did not exactly work out under St. Reagan. Certainly flopped under Trump.

Clinton, Obama, and Biden all have a different approach. Raise taxes on the rich and curb government spending growth. But of course they are all commies so there!