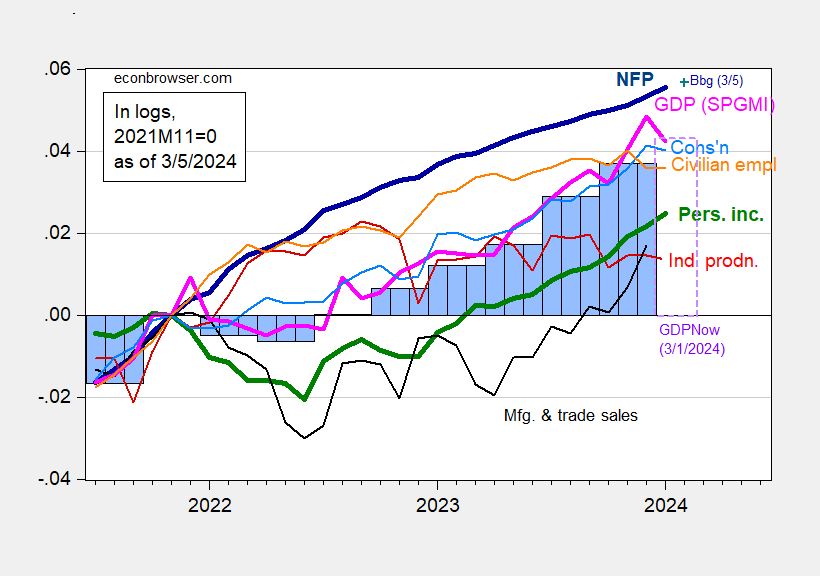

Monthly GDP declines 7.1 ppts m/m annualized Here’s a picture of key indicators followed by the NBER Business Cycle Dating Committee plus monthly GDP.

Figure 1: Nonfarm Payroll employment (bold dark blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), GDPNow for 2024Q1 as of 2/29 (lilac box), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2023Q4 2nd release, Atlanta Fed (3/1), S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 release), and author’s calculations.

While January monthly GDP was down, final sales were only down by only 4.1 ppts m/m annualized, while nonfarm payroll (NFP) employment and personal income excluding current transfers were both up that month. According to the Bloomberg consensus, nonfarm payroll employment in February rose by 190K. Hence, the economy seems to have continued growth in January.

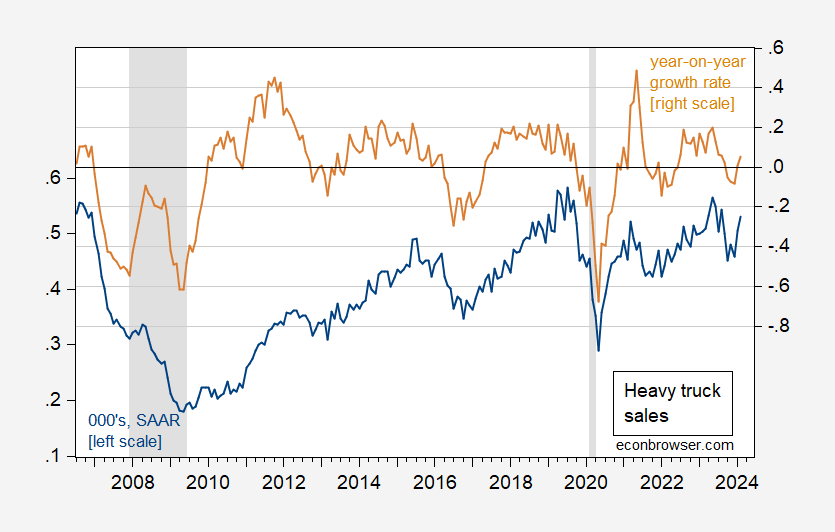

Calculated Risk points out that heavy truck sales increased in February. I’ve used this as a coincident indicator for recessions in the past (better than VMT, or gasoline consumption, for instance). Here’s the picture as of today.

Figure 2: Heavy truck sales, 000’s, s.a. (blue, left scale), and year-on-year growth rate of heavy truck sales (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA via FRED, Calculated Risk for February, NBER, and author’s calculations.

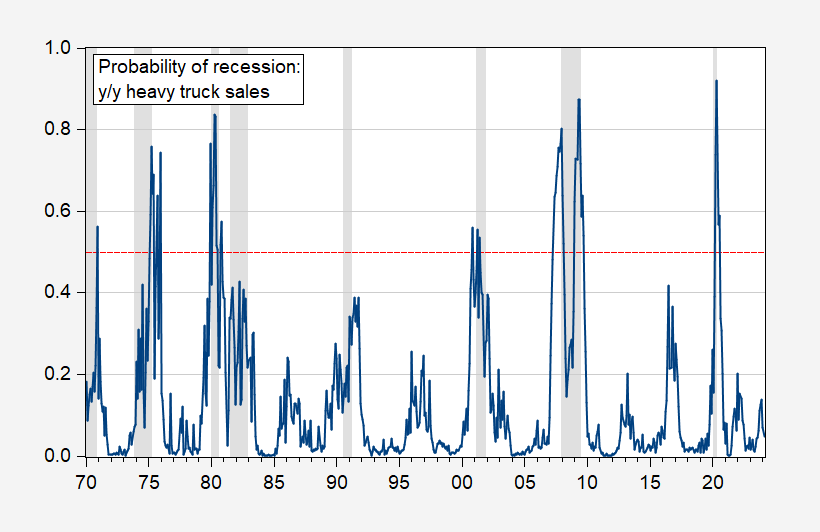

Over the 1970-2023 period, a probit regression has a pseudo-R2 of about 0.29, and indicates recessions (remember, this is as a coincident indicator) pretty well historically (except for 1990-91).

Figure 3: Estimated recession probabilities from probit regression, 1970-2023 (blue), red dashed line at 50% probability threshold. NBER defined peak-to-trough recession dates shaded gray. Source: NBER and author’s calculations.

As Calculated Risk notes:

Usually, heavy truck sales decline sharply prior to a recession. Heavy truck sales are solid.

Given the increase in heavy truck sales, I am even less inclined to consider February a start date for recession.

We’re about to do/find a “character check” or “integrity/morality check” on Nikki Haley right now. Will she support the orange abomination?? Anyone got the Vegas odds here??? Macroduck, pgi, 2slugs, baffling, Ivan, you know who you are, etc. thoughts welcome right now

You’ve posed exactly the question. Haley has run her campaign in the idea that Trump is unfit for office. Does she now: 1) endorse him; 2) fade into the background but decline to endorse him; 3) continue to say he’s unfit?

I don’t believe 3 for a minute. Th choice between 1 and 2 is the choice between primary strength and strength in the general election in some future election. That’s a judgement call for professionals. I got nothin’.

She’s not a moderate. She’s not honest. She served Trump when it was in her interest. She should never hold office again.

The morality check on Haley is already in: “Nikki Haley’s Sudden Wealth Rooted in Weapons Industry, Pro-War Advocacy Network

The former U.N. ambassador went from virtually no savings in 2017 to a small fortune in part from defense contracting and war advocacy ties…

The former South Carolina governor left the Trump administration in 2018 at a time when her parents were struggling financially and had just faced foreclosure. Those days are over. Haley now resides in a 5,700-square-foot mansion on Kiawah Island now worth close to $5 million. Haley and her husband also helped sell a strip mall once owned by her parents and worked to clear the family of previous debts.

Along the way, Haley became wealthy in large part from her ties to a network of defense interests and hawkish advocacy organizations tied to U.S. and Israeli intelligence officials.

In one of her first reported private sector jobs after leaving her last government post, Haley joined the board of Boeing, a defense contractor, a position that paid around $300,000 a year in cash and stock. Haley, according to disclosures, still owns up to $250,000 in Boeing stock.”

https://www.leefang.com/p/nikki-haleys-sudden-wealth-rooted

Speaking of corruption– After the fall of Avdivka “Ukraine counterattacked the Russians rather than falling back to new defense lines for the simple reason that there were no pre-prepared fortifications for their army even though they were supposed to have been built. This has created a significant controversy and there are hints that the money for the materials needed for the fortifications was siphoned off (stolen). Corruption in Ukraine is rampant and despite some efforts to curtail it, it is growing.

As Ukraine’s situation deteriorates, get-rich-quick and exit schemes are growing.” https://asiatimes.com/2024/03/10m-abrams-tanks-no-match-for-500-russian-drones/

Also, “U.S. Military Aid to Ukraine Was Poorly Tracked, Pentagon Report Says…

The report found that American officials and diplomats had failed to quickly or fully account for all of the nearly 40,000 weapons sent to the front…the investigation offers a first glimpse of efforts to account for the most sensitive tools of American military might that have been rushed to Ukraine in the last two years. In that time, as concerns grew that the flood of weapons would inevitably lead to arms trafficking, lawmakers have demanded strict oversight of the shipments.”

https://www.nytimes.com/2024/01/11/world/europe/us-military-aid-ukraine.html

Of course, DOD can’t track 60% of its assets either…

War is a racket –Smedley Butler

Putin’s pet poodle is barking,

Of course, there is no corruption in the putin’s russia. I am sure the kremlin would pass an audit with flying colors.

The Great Task PAC

Liz Cheney’s PAC “The Great Task” Targets Trump’s Presidential Ambitions in 2024

https://www.msn.com/en-us/news/politics/liz-cheney-s-pac-the-great-task-targets-trump-s-presidential-ambitions-in-2024/ar-BB1jsnLl

Nikki coward will do her usual waffling

VMT? Not that it matters but Stevie got left out

Off topic – voting rights:

The Supreme Court’s 2013 decision in Shelby County v. Holder is having the intended effect of reducing minority voting, according to the Brennan Center:

https://www.brennancenter.org/our-work/research-reports/growing-racial-disparities-voter-turnout-2008-2022

In states which had been required to seek pre-approval for changes to their voting rules under the 1965 Voting Rights Act, but which are no longer required to do so, the gap between white voter turn-out and non-white voter turn-out has grown consistently since the Holder decision.

Who’d have guessed?

Off topic – anti-trust policy:

I’ve noted here in comments to a series of anti-trust actions taken by Biden’s FTC and DOJ. NPR reports that the deal-making world is very focused on presidential polling because the outcome of the race will have a profound effect on anti-trust policy:

https://www.npr.org/2024/03/05/1235521824/voter-turnout-race-disparities-supreme-court?ft=nprml&f=139482413

Our troll, Johnny Mumbles, has made a lot of noise about anti-trust, monopoly and monopsony power, “greedflation” and the like, but only ever complains about Democrats when it come to placing blame.

It is improbable that anyone could get as many things wrong about economics and policy as Johnny does simply out of ignorance. Chance would help him get at least a few things right. He doesn’t.

So when you think about who to vote for – or about whether ever to believe a thing that Johnny writes – keep in mind that the business world sees Biden as the guy who is preventing anti-competitive mergers and acquisitions, while Trump would be fine with anti-competitive M&A.

I’ll happily acknowledge that the Biden administration has made some good moves on anti-trust after decades of benign neglect by Democrats (and Republicans.) Problem is that the horse is already out of the barn and the vast amount of industry concentration already in place is unlikely to be reversed.

In fact, “a development over the weekend, pushed by a bipartisan group of appropriators, … could lead to a dramatic cut in the Antitrust Division’s budget, precisely at the time when the Biden administration is elevating its work—relying on it, even—in advance of the election. While some members of Congress are furious about it, the White House seems to be resigned to the outcome.” https://prospect.org/politics/2024-03-05-congress-poised-kneecap-antitrust-division/

Get that, Tricky Ducky, a BIPARTISAN GROUP is intent on crippling DOJ’s anti-trust efforts. So much for Tricky Ducky’s phony assertion that Democrats are blameless. But in his usual role as a partisan hack, he covers up what Democrats do…and insults anyone who happens to notice.

Off topic – banking policy:

A year ago, the Fed agreed to value bank assets used as collateral at purchase price rather than market value. That was a response to the Silico Valley Bank collapse intended to avoid a chain-reaction of further collapses. That policy is now at an end.

That change, in itself, does not mean that banks will begin to fail; bank failures are the exception, not the rule. However, the standard problem with any financial rescue effort is that it reduces the usual discipline banks face in an effort to provide time for them to be able to withstand that discipline. Whether they have all shaped up adequately is not clear. Marking collateral to market amounts to a test of banks’ efforts to shape up over the past year.