Reader Bruce Hall notes the extreme jump in debt-to-GDP in 2020 was attributable in part to the public health economic lockdowns, to wit:

But the economic shutdowns certainly affected the equation’s denominator in 2020.

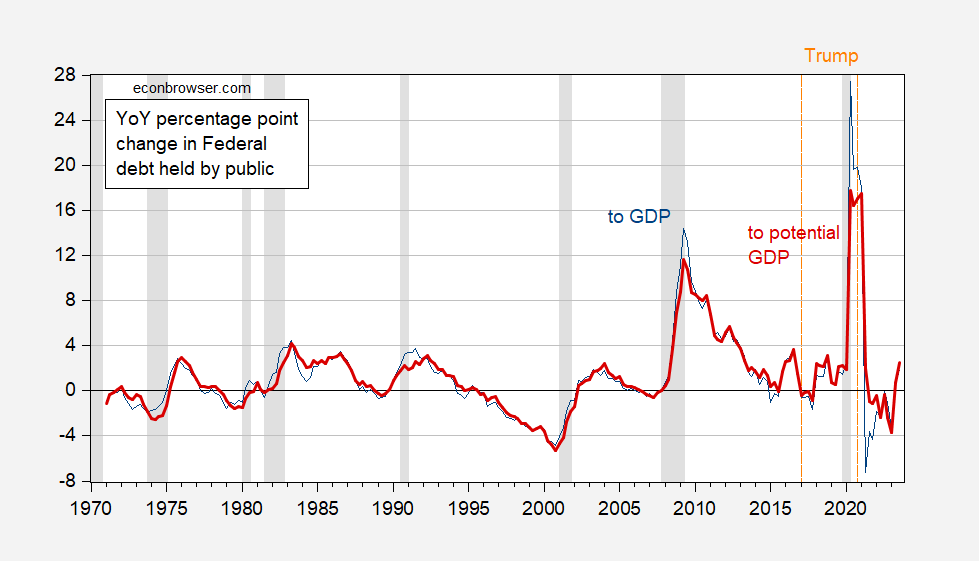

I note that using the counterfactual potential GDP as estimated by CBO does not change the picture substantively – I add the red line to the blue line shown in the previous post.

Figure 1: Year-on-Year percentage point change in Federal debt held by public to GDP ratio (blue). Year-on-Year percentage point change in Federal debt held by public to potential GDP ratio (red). NBER defined peak-to-trough recession dates shaded gray. Orange dashed lines at beginning ond end of Trump administration, dated 2017Q1, 2020Q4. Source: US Treasury via FRED, BEA, CBO (February 2024), NBER, and author’s calculations.

Menzie Chinn,

Why the focus on dept:gdp? I’ve always agreed with Jason Furman’s stance of it being rather misleading when assessing fiscal policy.

Also, the numerator was greatly impacted by the pandemic – a counterfactual of debt sans-COVID is needed as well.

Econned: Hovde mentioned debt. Agree interest payments to GDP probably a better indicator of fiscal space.

Menzie Chinn,

You mentioned it and you focused on it enough to write blog posts about it. The point is that people mention things all the time – should there be a blog post about everything? If you agree there are better measures, why entertain what some senator from a flyover state “mentioned”? Why not have an educational post on why the senator should focus on other metrics?

Econned: (1) He’s not a senator (yet); (2) It’s noteworthy just because he’s got views on what should be done on fiscal policy. I (or Jeff Frankel in a guest post) have mentioned better indicators of fiscal space in the past. I deeply regret that I have not adhered to your high standards regarding the optimal things to post on. I will try to do better in the future, so as to rise in your esteem.

Drinking now. Is it ok if I think Prof Chinn’s response to unknown is hilarious??

Menzie Chinn,

Everyone has “a” view – and you choose which ones to entertain. The sad thing is my requests/expectations of you have become embarrassingly basic over the years and the bar is so exceedingly low that it’s at the point where it’s clear you are who you are – ego takes decades to deflate and you’re still floating in the exosphere catering to your oblivious helium-filled fanboys that fill this chatroom who yearn for the attention of strangers.

https://www.brookings.edu/wp-content/uploads/2020/11/furman-summers-fiscal-reconsideration-discussion-draft.pdf

Link to Furman-Summers 2020.

Did little Econned mean this paper (the troll never said):

A Reconsideration of Fiscal Policy in the Era of Low Interest Rates

Jason Furman and Lawrence Summers, November 30, 2020

The last generation has witnessed an epochal decline in real interest rates in the United States and around the world despite large buildups of government debt. As Table 1 illustrates U.S. ten-year indexed bond yields declined by more than 4 percentage points between 2000 and early 2020 even as projected debt levels went from levels extremely low by historical standards to extremely high by historical standards. Similar movements have been observed at all maturities and throughout the industrial world. Available market data suggests that the COVID crisis has depressed real interest rates despite raising government debts, likely by increasing inequality, uncertainty and the use of information technology

Table 1 is clearly using REAL interest rates. Again little Econned never mentioned that. Oh well – something little Econned may not get but the era of low real interest rates seems to be over.

You might agree with Jason Furman but once again little Econned fails to give any indication what Furman has said on this issue. No link, no article, nothing.

Now I have read Furman and he has a rather Blanchard like view of the long-run government budget constraint consistent with Barro’s 1979 paper Sargent & Wallace’s Unpleasant Arithmetic etc. But what are these scholars saying? Does Econned even know? OK – let’s help this worthless troll out starting with the interest expense to GDP ratio:

Econned refers to what appears to be the ratio of nominal interest rates/GDP (I presume as our worthless trolls is not clear). WRONG. Furman properly focuses on real interest expenses.

And of course all of these scholars talk about the long-term primary surplus/GDP ratio. But like little JohnH, little Econned likely has no clue what that it. Furman does – Econned not so much.

I am just baffled* at those who make claims without any effort to check the fact first.

“But the economic shutdowns certainly affected …” without any evidence. Then “smack!” The data arrive.

* Apologies to baffled.

JOLTS data for January arrived today. The quits rate continued to fall, rate and level:

https://fred.stlouisfed.org/graph/?g=1hWzo

Quits are still historically high, but clearly headed lower. The history isn’t long, and changes may not be predictive, but declines in quits have historically accompanied recession. If levels matter more than changes, then fine. What seems quite likely is that some amount of leverage over wages is lost when quits decline. There’s no question that job changers improve their wages more than job stayers.

“When negotiating starting salaries, most U.S. women and men don’t ask for higher pay”

https://www.pewresearch.org/short-reads/2023/04/05/when-negotiating-starting-salaries-most-us-women-and-men-dont-ask-for-higher-pay/

But Ducky claims without any evidence that “There’s no question that job changers improve their wages more than job stayers.”

Here is no question because the data clearly show it. I’ve posted links to the data several times. Johnny has ignored the data in his response here, which is just another example of his dishonesty. It’s also an example of Johnny changing simply letting his need to stir up trouble get ahead of the rest of his brain. I didn’t claim that workers negotiate for hiher pay. I wrote that they change jobs for hiher pay.

Here’s the link to the data:

https://www.atlantafed.org/chcs/wage-growth-tracker

Hit the “Job awitcher” button. What you’ll see is that the difference between pay gains for switchers and stayers was greatest at the time when quits were highest (see the link in my comment above).

Note also that overall wage gains were also strongest when quits were highest. Firms track job turnover and respond to it. So when turnover is high employers increase wages; no need for negotiation. That’s how the labor market works. I’ve also made this point before, to Johnny. He uas ignored it, which is another instance of his dishonesty.

Poor Ducky…sticking to his disprovable assertion: “There’s no question that job changers improve their wages more than job stayers.”

Pew Poll: “For the most part, workers who quit a job last year and are now employed somewhere else see their current work situation as an improvement over their most recent job. At least half of these workers say that compared with their last job, they are now earning more money (56%).” That leaves almost half who did not improve their wages, There were lots of reasons for quitting and getting another job.

https://www.pewresearch.org/short-reads/2022/03/09/majority-of-workers-who-quit-a-job-in-2021-cite-low-pay-no-opportunities-for-advancement-feeling-disrespected/

But Ducky, being the unnuanced, black-and-white guy he is, can’t acknowledge that almost half of job changers did not improve their wages. That’s what happens when you rely on averages and aggregates–you miss much of what happening.

And then when he finds someone with information that doesn’t conform to his own preconceptions, he just calls them dishonest!

Johnny is a “U.S cup is half empty” kind of guy. Job switchers, on average, improve their paymore than those who don’t switch. Johnny’s mumbled response? Not all of them. I didn’t say all of them.

This started when I said that the decline in quits has and will slow wage gains. Check the data on quits and wages gains, both of which I’ve linked to above. Judge for yourselves, but whatever you do, never believe a word Johnny writes.

Ducky said, “ There’s no question that job changers improve their wages more than job stayers.” Now Tricky bleats, but “I didn’t say all of them.”

So Ducky, if I said that mainstream economists are corporate friendly, would you interpret that as my saying that “not all of them are corporate friendly?”

As I said Tricky Ducky, being a black and white kind of guy, doesn’t do nuance…like acknowledging that almost half of job switchers did not get a pay raise.

This is well-known and has been for decades. Oddly enough, people tend not to apply for jobs with lower pay ranges than their current jobs., and apply disproportionately heavily for jobs with higher pay ranges. On the other hand, people who are hiring tend not to offer lower wages than they think job applicants are getting in their current job – and there is a lot of information about that, laundered through for-profit third parties. So, both halves of the job seeker process have an upward effect on wages.

Thanks for the info. I was reading some Recession Cheerleader fretting over the fact that hirings has been falling. Still over 2 million more than quits with both moderating from very high levels. But hey!

I did, indeed, write that a reduction in the denominator (GDP) would affect the YoY ratio of debt to GDP. That’s part of what I wrote. The other part, not mentioned here, is the Treasury dumps (handouts) that were not covered by revenue. So, you decrease the denominator and increase the numerator in a totally atypical, one-off way and you get a spike. But, hey, Trump… (we’ll ignore the continued handouts during Biden’s first year).

Bad policy instigated by the CDC followed by throwing money at goods that were not available because of the bad policy. What could possibly go wrong?

Attempting to save lives was bad policy? Right…

Brucie social security plan was to grandpa grandma die

We do know you SUCK at fiscal policy. But at least you are worse when it comes to basic medicine. Keep the clown show coming little Brucie.