That’s the title of an article by S. Ganguly for Reuters.

Nearly two-thirds of strategists in a March 6-12 Reuters poll of bond market experts, 22 of 34, said the yield curve’s predictive power is not what it once was.

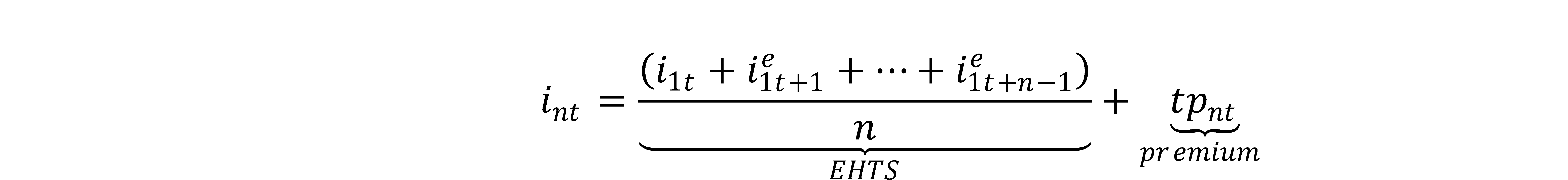

Here’s a picture of spreads, up to March 14th.

Figure 1: 10 year minus 3 month Treasury spread (blue), 10 year minus 2 year (tan), both in %. March for data through 3/14. Source: Treasury via FRED, and author’s calculations.

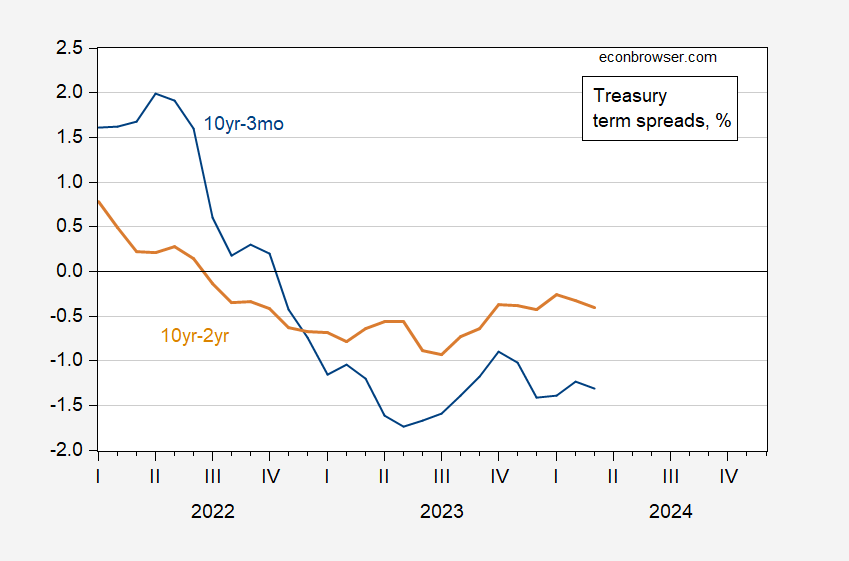

For comparison’s sake, note that the Great Recession was preceded by an inversion that started a year and a half before the NBER defined peak.

Figure 2: 10 year minus 3 month Treasury spread (blue), 10 year minus 2 year (tan), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, NBER, and author’s calculations.

We are currently about a year and a half from when the 10yr-2yr spread went negative, So I would say it’s still too early to say we’re safe, despite the apparent strength of the economy right now (well, as of February’s data).

Why do some economists discount the inversion’s predictive power this time around?

“If you have these two things going on together – insatiable demand for the long-end from real money like pension funds and the Fed keeping front-end rates higher because of the resilience of the economy – the curve will stay inverted for a while.”

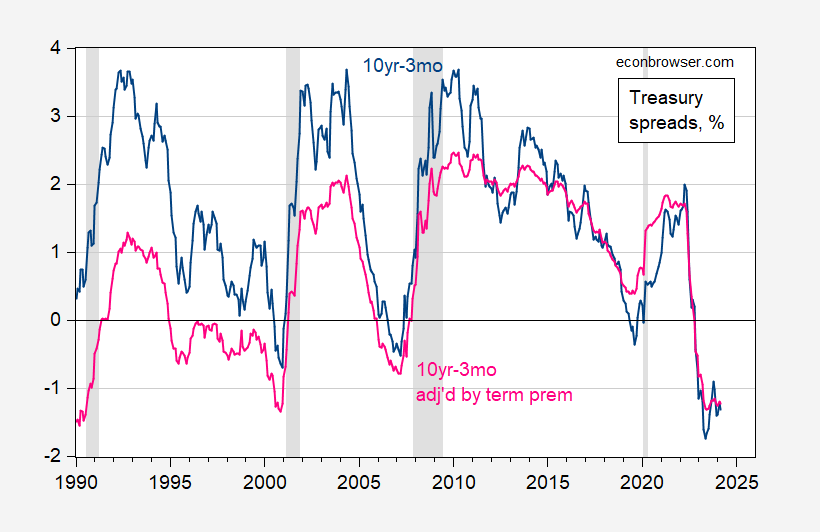

I interpret this meaning the typical correlation between inversion and recession breaking down because the term premium on long bonds is smaller than usual. Consider:

then the 10 year- 3 month term spread is:

With the tp term smaller than usual, then the pure EHTS rate might be higher than for a typical inversion.

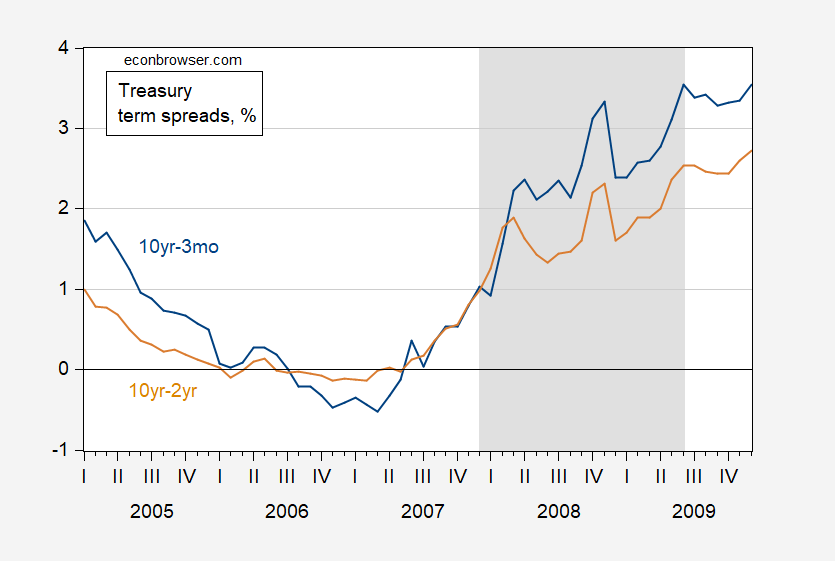

While the low or negative term premium argument sounds plausible, adjusting the spread by an estimated term premium (Kim-Wright 10 year from FRED, series THREEFYTP10), doesn’t seem to change our view of how inversions correlate with subsequent recessions.

Figure 3: 10 year minus 3 month Treasury spread (blue), 10 year minus 3 month adjusted by estimated Kim-Wright term premium (pink), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, Kim-Wright via FRED, NBER, and author’s calculations.

Hence, I join Cam Harvey (who brought to prominence the yield curve as recession predictor) who says it’s too early to drop the recession call.

Low term premium on long-duration debt could simply indicate a high uncertainty about the economic outlook.

Point estimate of funding cost + point estimate of future inflation + term premium = nominal rate.

Anything that isn’t in those two point estimates ends up in term premium, including uncertainty about outcomes. If peceptions of risks are not distributed evenly around those point estimates, but are skewed downward, then low or negative term premium is the result. “Insist demand for the long end” needs to be explained. It does not explain away curve inversion.

Crud. “Insatiable demand for the long end”.

Well, I consider myself a “semi-educated” man, Just a Bachelor’s and such a so severe disappointment to my father, I just “let down” my Dad so much. but I seem to remember just like a small small strand, That “great educated men” never hold TOO strong to their own ideas, but still hold some small remaining doubt. Never getting too stuck in their own thing, Always keeping open “I could be wrong about this” That’s how I take this post and Chinn and Hamilton, always taking new ideas in their mind.

I think that’s pretty great myself.

The notion that the curve doesn’t predict recession this time* means is that the Fed hasn’t induced a recession this time. It would be an historical oddity for the most rapid series of Fed hikes on record to be associated with continued growth, but it could happen. If the most rapid rate hike cycle in Fed history doesn’t cause a recession, it does raise questions about the mechanism by which inflation was snuffed out.

If the Fed has quelled inflation, shouldn’t the jobless rate be more Sahm-like than it is? Isn’t that how rate policy is assumed to work? If the mechanism by which the Fed controls inflation is by reducing final demand, which reduces labor demand, don’t we have good reason to think something else uas cased inflation to slow? If we live in a structurally low-inflation economy – one in which a sub-4% jobless rate isn’t inflationary – did we need the Fed to risk a recession?

Dollar strength helps, and is partly due to Fed rate policy, but also partly due to the U.S. growing well while other economies grow poorly or shrink. Fiscal policy tightening helps, and the Fed gets no credit there. Oil prices falling helps – thanks mostly to China, not the Fed except for some increment of dollar strength. Supply chains being put right accounts for much of the slowing of inflation, and the Fed gets no credit.

Lots of fodder for research in this stuff.

*”This time is different.” Heaven help us.

The drinking guy, and semi-fool mentally slow guy in the room (that’s me, like I had to explain) says, “fiscal policy and interest rate policy aren’t the same, and if we divide the two in our analysis, we will understand neither”

—the anti-Satan, anti-LarrySummers

“This time is different” usually isn’t – but who knows, maybe this time ….

I think there are too many factors driving the short and the long bond rates to expect the two to be able to define a rock hard rule about their correlation to the weird and soft concept called a recession. Maybe a cheese soft rule, but not a rock hard one.

Menzie, Ed Leamer reminds me of my Dad, I think Ed reminds you of your Dad also?? If I’m wrong and “taking presumptions” I apologize. I think Ed Leamer is so awesome. Give me just ONE YT link Menzie, Give me just this one please:

https://www.youtube.com/watch?v=RDcYtfTbFmc&t=22s

: )

Not for a suppression, no.

The world’s stupidest troll keeps reminding us of how utterly stupid he is.