That’s from ZeroHedge. Contra, here are some data.

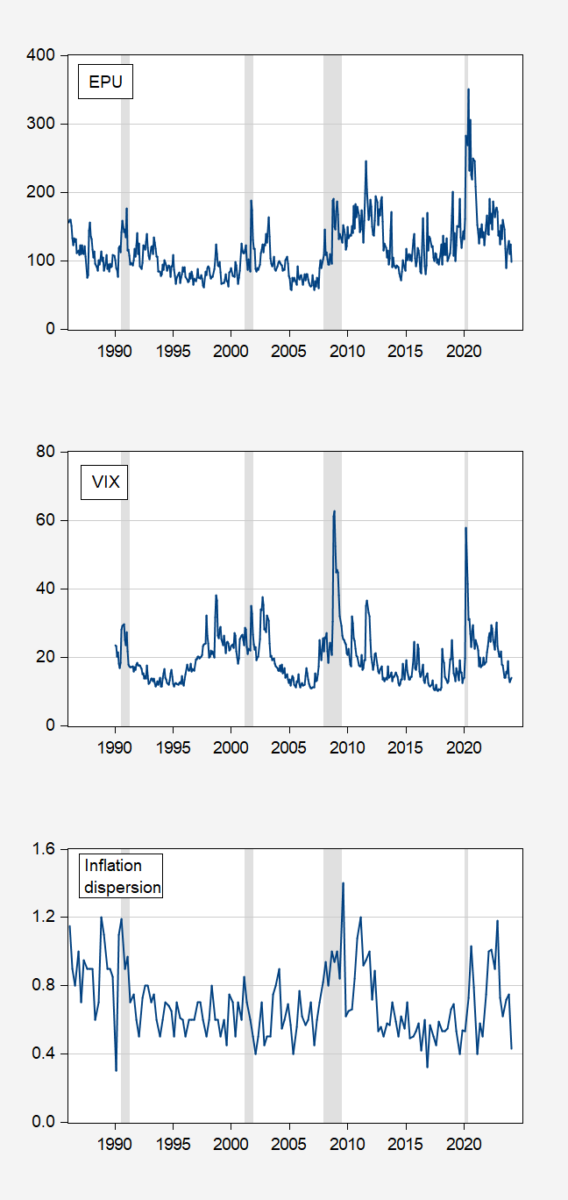

Figure 1: Top panel Economic Policy Uncertainty index, Middle panel VIX, Bottom panel 75p-25p 1 year ahead inflation dispersion in %. Inflation dispersion is interpolated from quarterly data. NBER defined peak-to-trough recession dates shaded gray. Source: policyuncertainty.com, CBOE, Philadelphia Fed SPF, NBER.

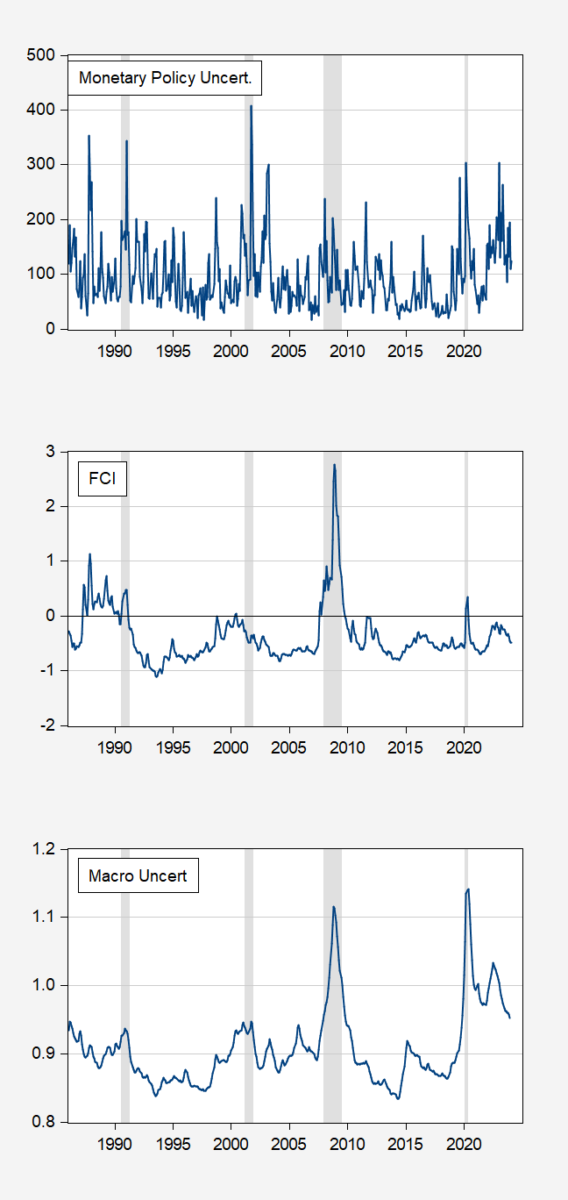

Figure 2: Top panel Baker, Bloom, Davis Monetary Policy Uncertainty index, Middle panel Chicago National Financial Conditions Index, Bottom panel Jurado, Ludvigson, Ng 1 year ahead macroeconomic uncertainty index. NBER defined peak-to-trough recession dates shaded gray. Source: policyuncertainty.com, Chicago Fed, JLN via FRED, NBER.

It may be the case that we are now experiencing unprecedented uncertainty. However, this uncertainty is not apparently reflected in the available indicators.

Economic Policy Uncertainty Always is not good indicator for many expectations to make decisions in additionally variables. That’s means if you want to analyse any data for forecasting you can use a real data structure in economic such like all data in CB in any countries

Hassan Tawakol Ahmed Fadol: The graphs also include JLN and VIX.

Menzie, you weren’t hard enough on the author, or on ZeroHedge.

For instance:

“Right now, the U.S. government is adding around $600 billion per month to the national debt…”

Funny… FRED says the Treasury added about $1.9 trillion to total public debt in 2023, an average of $22.8 billion per month. At $600 billion per month, that figure would be $7.2 trillion.

How could Brandon Smith (propriety of Prepper Beef and author of “How Patriot Freedom Fighters Can Beat F-16s With AR-15s”) get his math so wrong? Possibly by mistaking gross issuance of Treasury debt for net issuance. Treasury rolls over hundreds of billions in debt every month. Only a small fraction of monthly debt issuance represents additions to total debt.

Of course, making a mistake like that is a lot easier if you thing beef is a great hedge against chaos or that rifles are capable of engaging successfully against modern jet fighters. This is the sort of thinking we get from the troll choir.

This is the stuff people read and believe. Tyler Durden could know better, but may not. He probably doesn’t care.

A promising development for fusion power – better magnets:

https://phys.org/news/2024-03-high-temperature-superconducting-magnets-ready.html

“A promising development for fusion power”

My bet is, nuclear fusion will see the same issues as nuclear fission:

1) The first non experimental fusion reactor will only be available in 2040 or later, then PV and wind power, which are low tech, will clearly dominated the market, fusion comes too late.

2) There is no evidence that fusion power will be cheaper.

It will be very hard to make an argument of why we would replace solar and wind with fusion. They are all clean energy, so it comes down to price. Why would we want the cost of having a sun power plant on earth when we can just harvest energy from the sun power plant already up and running on the sun?

“It will be very hard to make an argument of why we would replace solar and wind with fusion.”

If fusion were as cheap as wind or PV, then a baseload power plant has of course a market. But this competitive cost in case of fusion is unlikely.

The energy density of fusion is advantageous. It has a very small footprint with enormous output potential. Large cities benefit from this density if energy. Ok ncebit is solved, fusion will be cheap to produce is my best guestimate.

If I saw that headline, not knowing it was on ZH, I would have assumed it was the uncertainty tied with a 2nd orange abomination presidency.

That is what I would have expected. And the evil that Putin unleashed in Europe.

If you read the text associated with the Economic Policy Uncertainty I dex at (if I recall correctly) Trading Economics, it is Russia’s invasion and the global rate cycle which caused to most recent spike in policy uncertainty.

Speaking of Russia’s bad behavior, George Kennan’s big idea is getting a new lease on life:

https://www.foreignaffairs.com/russian-federation/americas-new-twilight-struggle-russia

This is not actually news to anyone paying attention. Containment is the defacto foundation for U.S. foreign policy toward Russia, with hints of it also in the policy toward China.

A question which is undoubtedly occupying policy thunkers in the bowels of Main State, the Pentagon, Langley and Fort Meade is what direction China and Russia will take when Xi and Putin are gone. Our ability to see into the political future is limited, and Xi’s purges make it harder. Not sure whether there is a stable list of players around Putin.

Mentioning Kennan got me to read past the second paragraph. Mild appraisal of the shift once Nitze came to the fore kept me reading.

However, the tone went back to primacy of military affairs where the long telegram and Kennan himself urged diplomacy and mediation rather than an arms race.

One which the U.S. is scarcely fit to run.

I was just doing my “night owl” thing here playing online. Some of it constructive, some of it escapism to relax. And I noticed James Kwak has a “new” book out now and I didn’t even know it. James Kwak is one of my favorite writers, so I have zero doubt this is a great book and zero doubt the guy he co-authored it with also is an awesome dude. Check it out folks. I will as soon as I find the space in my budget. Which won’t be too long into the future I think:

https://www.barnesandnoble.com/w/the-fear-of-too-much-justice-stephen-bright/1142815132?ean=9781620970256

Maybe Menzie can invite Mr. Kwak on for a guest-post. That would be so much fun.

Does immigration bring down wages?

https://jabberwocking.com/does-immigration-bring-down-wages/

OK – this has always been a hot topic and Kevin Drum suggests no.

To quote Charlie Brown – Good Grief! – are the conservatives really trying to sprout off about “uncertainty” like they did with Obama in 2011! “House Majority Leader Eric Cantor says that “job-destroying regulations” have left “a cloud of uncertainty hanging over small and large employers alike,” preventing them from hiring new workers. Representative Michele Bachmann says that small businesses are “scared to invest in new jobs because of economic uncertainty.” Sarah Palin, how would you rescue us? “I’d eliminate the uncertainty in the economy.” Mitt Romney: Obama’s policies “have done the one thing employers can’t deal with … created more uncertainty.” https://www.bloomberg.com/view/articles/2011-09-19/republicans-complain-of-economic-uncertainty-while-vowing-revolution-view

If you want uncertainty – think about the chaos that would be a second Trump term – deporting millions of workers – https://www.axios.com/2024/02/11/trump-promise-deport-millions-migrants-reality – bizarre tariffs and trade wars https://www.vox.com/policy/2024/2/9/24064244/trump-economy-china-tarriffs-today-explained and massive corruption to pay off his personal legal bills https://www.vox.com/24073920/trump-financial-new-york-trouble-fraud-e-jean-carroll-civil-suit-damages-debt