Sharp reactions to Conference Board consumer confidence index today. Here’s some context for this movement, as well as that in the U.Michigan survey of economic sentiment.

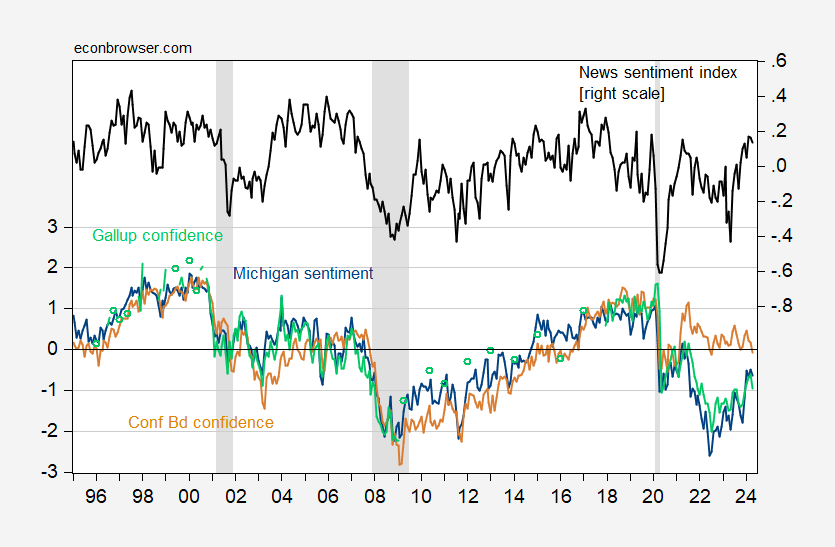

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), Gallup Economic Confidence (light green, left scale), all demeaned and normalized by standard deviation (for the displayed sample period); and Shapiro, Sudhof and Wilson (2020) Daily News Sentiment Index (black, right scale). The News Index observation for April is through 4/25/2024. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, Gallup, SF Fed, NBER, and author’s calculations.

While all indices dropped (as did the news sentiment index) in April, the Conference Board index is substantially above pandemic levels. The surprise is that this index hasn’t shown much response to the increasingly positive news sentiment (while the U.Michigan and Gallup indices have).

Slightly off topic – California demographics:

https://www.politico.com/news/2024/04/30/california-population-grows-reversing-trend-00155069

California’s population stopped shrinking in 2023. There is, as we have all seen here, a political spin-job associated with California’s demographics, so, for what it’s worth, the demographic situation has turned around.

Politico declares that California’s falling population over the Covid period “magnified the state’s affordability crisis.” Assuming this is a reference to housing costs, I gotta ask: “Huh?”. This really seems like a case of simple-minded “bad equals bad” thinking on the part of an economic illiterate – more than one, since an editor was probably involved. Maybe I’m missing something about California’s particular circumstances.

Bloomberg is right to highlight worsening expectations for the job market, since the Conference Board’s headline measure is quite sensitive to labor market expectations. Michigan’s sentiment index tends to be more attuned to financial market performance, and has also backed off in response to recent stock price decline.

The decline in job market expectations makes Friday’s BLS job report and tomorrow’s ADP jobs market report – an to a lesser extent tomorrow’s JOLTS data – particularly interesting. Has the public noticed a weakening in labor market conditions not yet reflected in other data? Are labor market expectations a reflection of changing interest rate expectations? Is the villainous Snidely Labor Market going to tie Joe Biden to the railroad track? Tune in next time…

Notorious far-right blog The Gateway Pundit declares bankruptcy over 2020 election-related lawsuits

https://www.msn.com/en-us/news/us/notorious-far-right-blog-the-gateway-pundit-declares-bankruptcy-over-2020-election-related-lawsuits/ar-AA1nBxLJ?ocid=BingNewsSerp

he Gateway Pundit, the notorious far-right blog and prolific publisher of conspiracy theories, said Wednesday that it had filed for bankruptcy protection as it grapples with litigation related to its coverage of the 2020 election. The move comes as the staunchly pro-Donald Trump website, which promoted the false notion that the 2020 election was stolen by President Joe Biden and his allies, faces multiple lawsuits over its bogus claims. One of the lawsuits, filed by two former Georgia election workers, Ruby Freeman and Wandrea “Shaye” Moss, accuses The Gateway Pundit of publishing stories that falsely accused them of election fraud, which the pair said prompted a wave of harassment and threats of violence. The judge has rejected several attempts to throw out the case, which is currently in the discovery phase ahead of a potential trial. Another lawsuit, filed by former Dominion Voting Systems executive Eric Coomer, accuses the outlet of defamation. A Colorado appeals court ruled earlier this month that Coomer’s sweeping case can proceed toward trial against Gateway Pundit and several other prominent defendants.

China’s economy is off to a rocky start in Q2:

https://www.channelnewsasia.com/business/chinas-slow-april-factory-services-activity-dents-economic-momentum-4302051

That’s as was generally expected. Choppy growth is the central forecast for China this year. Among other things, domestic tourism gave a big lift in Q1, as travel during the New Year’s celebration was quite strong; that’s a tough act to follow, so no surprise catering is single out as a drag on April growth. However, the property sector was also a drag – also not a surprise, but a serious concern.

Meanwhile, and surely more interesting, Michael Pettis has a new piece a the FT:

https://www.ft.com/content/879f5de7-cd9b-4987-9c2b-8b23cf0f3800

He argue that China’s probrm isn’t excess capacity, but instead insufficient demand. Well, sure, but I’m not convinced this is an either/or situation. If China has policy of diverting saving from households to industry, which Pettis says is the case, doesn’t that raise te possibility of excess capacity?

I have another bone to pick with Pettis, and that make me uncomfortable because I generally just read Pettis and nod along. He asserts that comparative advantage is all the explanation needed for the perfrmnce of China’s subsidized industries in export markets, without acknowledging that subsidies prevent a maret test of that comparative advantage claim. He surely knows better.

Still, the point about excess saving is a critical observation. You get overcapacity when savings need a place to go, as is clearly what happened with China’s residential construction. It’s almost as clear for China’s excess infrastructure – governent put household saving to work without adequate thought for return on public investment. Now, why woud it not be true for industrial capacity, subsidized by government mobilizing household savings?