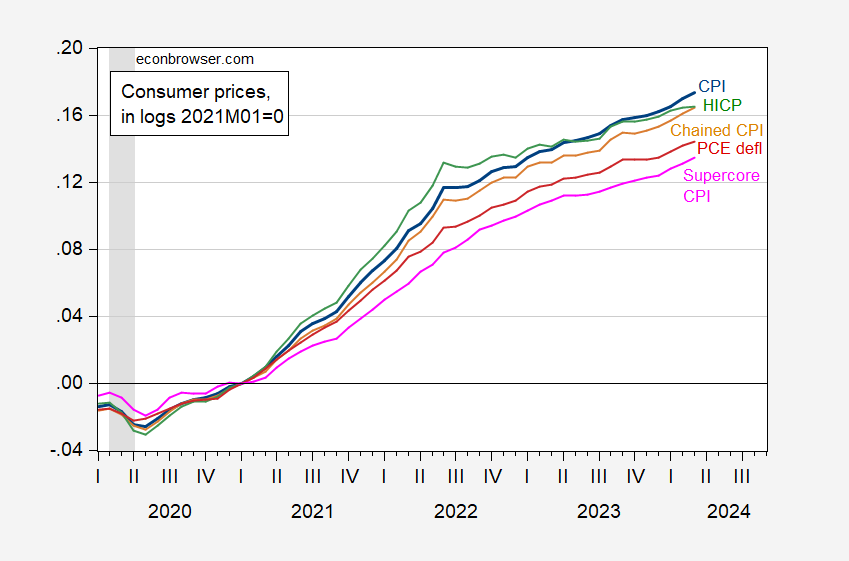

Since 2021M01, the CPI has risen 17.3% (log terms). By comparison, chained CPI and HICP have risen by approximately 16.5%. The PCE deflator has risen only 14.4% by March 2024 – but these are prices of goods and services produced, not of prices faced by consumers.

Figure 1: CPI (blue), HICP (green), chained CPI (tan), PCE deflator (red), supercore CPI (pink), all in logs 2021M01=0. HICP and chained CPI seasonally adjusted by author using Census X-13/X-11. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat, BEA via FRED, BLS, NBER, and author’s calculations.

Menzie – I found these comments by Federal Reserve Chair Powell to be highly germane to our discussion around climate change/inflation –

“A recent study from Bankrate underscores how the escalating frequency of extreme weather events, attributed to climate change, is significantly increasing the risk exposure for insurance companies. Over the past decade, the United States has incurred a staggering $1.1 trillion in damages from severe weather incidents, marking the highest figure on record. This surge in weather-related losses has directly contributed to a notable uptick in insurance costs, as outlined in the study.” (who coulda knew?) https://www.msn.com/en-us/money/markets/jerome-powell-reveals-hidden-reason-for-persistent-high-inflation-increasingly-uninsurable-economy/ar-BB1jOguW

“Experts attribute the escalating insurance premiums to various factors, including the impacts of climate change and rising prices for car parts. These factors drive up insurers’ costs, prompting them to pass on the expenses to consumers through higher premiums.”

MAGA moron Bruce Hall told us that the rise in insurance premiums was all Biden’s fault. He then tried to tell us beef prices were soaring even though beef prices today are the same as they were last July. Oh wait – some industry type said beef prices MIGHT increase by 2025. Yea – the stupidity from Bruce Hall goes on and on with no limits.

Rightly understood, the rise in insurance costs driven by climate change is not inflation. It’s a change in relative prices. Pass-through of increased insurance costs to consumer prices of other goods and services – now that’s inflation.

There are of course many ways to slice and dice inflation, but at present I think there are 3 dominant factors:

1. Gas prices are no longer going down. Their decline from $5 to $3 was a big help in decelerating inflation. That is over.

2. Shelter inflation is still decelerating, but at a rate that has slowed. I first pointed out on this blog in about November 2021 that OER followed house prices with a 12-18 month lag, and we’re heading up to something like 8%. They did peak at 8.2% in April 2023. Meanwhile house prices have rebounded somewhat,with the Case Shiller national index rebounding from a negative YoY print in May 2023 to being up 6.0% in January (vs. up 20.1% two years ago). Shelter inflation should still decelerate, but more slowly.

3. Recently transportation services (car repairs, insurance) has gone nuts, and is presently up 10.7%. This is a lagged reaction to the earlier huge increase in new and used vehicle prices. A historical look shows that these are often much more lagging than even shelter, sometimes rising right through recessions.

All three of these are important sources of the recent uptick in monthly CPI. Because two of them are historically lagging sectors, I am not that concerned. Where I might become concerned is if a continuing expansion causes wage increases to re-accelerate (as typically happens late in expansions). That hasn’t happened.

If it’s anything I hate it’s a factual party-pooper.

I have to confess I’m a little confused by this post (I’m sure my error) PCE deflator is more a measure of consumption (??) which is not really the same thing as a direct measurement of prices?? I swear if economists come up with one more index or gauge they want to argue with each other which one is the best one I’m gonna blow a gasket.

This is a year old plus, so a certain commenter on this forum will make some snarky remark about the date of the article, but all that aside, the relevant point of the article is that inflation cannot be looked at in terms of averages or a composite index when it comes to the perception of its impact and the potential political ramifications.

https://www.dallasfed.org/research/economics/2023/0110

High inflation disproportionately hurts low-income households

Aparna Jayashankar and Anthony Murphy

January 10, 2023

A MAGA hatter concerned about low income households? Excuse me Brucie but Trump’s tax cut for rich people will have a massive shift of income away from low income households to high income households so for you of all people to give a damn about income distribution is a bit rich.

But yea – this addressed inflation in 2022. It’s now April 2024. Why don’t you be a good little boy and do an update of the data. Assuming you know how.

pgl, thanks for the comment. You never fail to disappoint. And you hit the points exactly from my comment. So much fun. But seriously, grow up. Whether or not I am “concerned about low income households” is irrelevant to the point which is “the perception of its impact and the potential political ramifications.”

How does it feel to be so utterly predictable?

There were points to your attempt to abuse a simple survey into a measure of inflation? Thanks Brucie for confirming the fact that 100% of your comments are utterly worthless.

BTW Brucie boy – this was dedicated to you and yet you have not replied:

https://econbrowser.com/archives/2024/04/us-china-gdp-growth-since-1981

Oh that’s right – Brucie boy is too much of a coward when his BS is shot down.

Once again, thanks pgl. Okay, 2% growth for the US is better than 4% growth for China. I know that economists like to describe China as an “emerging market”, but given the size (comparable to the US), historical growth (including tapering growth rate) and influence of the Chinese economy, it is a bit misleading to describe it as “emerging”. It is more like “maturing” and the period of explosive growth may well be over due to counterproductive policies. Still, 2% > 4%. Of course, potential GDP relies on ceretis parabem or, basically, inertia. Not exactly unleashing the economy.

On a different note, Joe B has declared that he’d like a 22.5% tariff (would like the 7.5% tariff tripled) on Chinese steel and aluminum which, being an avid Biden fan, I’m sure you whole-heartedly endorse. Well, it is an election year and Pennsylvania is important….

However, I’m not a fan of the CCP-led state economy and it’s implication for China’s ability to assert itself around the world, so I’m okay with efforts to reduce US reliance on China as a supplier (decoupling), knowing that is neither easy nor painless. But if such decoupling reduces the number of economically harmful invasive species (animals and plants) and diseases, that would be a big economic bonus. Go, Joe!

“given the size (comparable to the US), historical growth”

China is comparable to the US? How effing stupid are you? China’s income per capita is a mere 25% of US’s income per capita as China has less land per capita, less capital per capita, etc. Something called the Solow growth model which is a foundational concept that MAGA moron Brucie Boy never grasped. Look – we know you are dumber than a retarded rock but DAMN!

Ah, per capita…. Yes that makes sense in terms of China’s absolute output of products… not. That makes sense in terms of China’s absolute military growth… not. C’mon man. Your little obfuscation doesn’t work. Per capita certainly means something to the individuals in China (but of course the concept of a living wage there is different from here), but it has nothing to do with the importance, capability, and growth of their economy since a large portion of the Chinese population are not part of the key producing sectors.

https://www.cnn.com/2024/04/15/business/china-q1-gdp-growth-intl-hnk/index.html

The good news for the CCP is that as long as the money keeps rolling in, they really don’t care if a large portion of their population are economic bystanders. The CCP is not going to voted out.

“potential GDP relies on ceretis parabem or, basically, inertia. Not exactly unleashing the economy.”

It is ceretis paribis DUMA$$. Inertia? Are you dumber than Princeton Steve or what?

BTW your unleashing BS is Cochrane’s weeds in the garden silliness – perhaps the most mocked economics blog post ever.

Yea Brucie boy – keep reminding us that you are as dumb as it gets.

The real point to be made is that China’s economy is converging upward toward the productivity of mature economies. As China applies the technology developed in and already employed by developed economies, it has the opportunity to converge toward a developed-economy productivity rate. That has nothing to do with China’s size.

By the way, in bringing up China’s size to argue it is not “developing”, are you suggesting that India has a developed economy? That’s where your point leads.

Check out Dr. Chinn’s latest post. I bet he is having fun reading Brucie’s BS.

Brucie boy is being dishonest again – this time with respect to steel tariff. From the Tax Foundation:

Section 232, Steel and Aluminum

In March 2018, President Trump announced the administration would impose a 25 percent tariff on steel imports from China

Yes – they were later lowered to 7.5% but Brucie never mentioned what Trump did in 2018. In fact, Brucie never criticized Trump for this. Why – because Brucie is a two face MAGA moron. But we have known that for years.

Oh, ho! It was big, bad Trump when he implemented the tariffs, but it’s no-big-deal Biden if he closely matches Trump.

“Unleashing the economy” is a trope employed by the business wing of the Republican Party. If you intend to use political talking points as if the represent actual economic reality, you aren’t going to win much respect.

As to “inertia”, care to explain? When I poke the “counpounded annual rate of change” button for potential GDP at FRED, the result shows considerable variability over time. And my reading on the subject suggests that data-driven estimates of capital accumulation, technological change and demographics drive estimates of potential GDP. Since you’ve declared that inertia is involved, please, let us know what resources you’ve examined in arriving at that view.

I mean, you aren’t just making stuff up, right? You based your declaration about inertia driving potential GDP on actual facts, right?

Macro, I guess I shouldn’t have used Newton’s laws of motion as a term for looking at calculated potential GDP. Inertia can mean remaining motionless or moving (or growing) at the same rate. In the case of potential GDP, I was looking at this graph from Brookings which appears to show potential GDP as a fairly linear expression

https://www.brookings.edu/wp-content/uploads/2021/02/potential-GDP-fig-1-1.png

which would seem to indicate that the calculations of the factors use for “potential” have a large amount of inertia or the line would be much more variable. Sort of like a “per capita” projection rather than some mix of changing inputs like manufacturing.

On the other hand, the CBO projection of “potential” does seem to change since the “Great Recession”.

https://www.brookings.edu/wp-content/uploads/2021/02/potential-GDP-fig-4.png

Perhaps that’s why the Brookings article stated:

Illustrating how hard it is to project potential output, Figure 4 shows that CBO consistently downgraded its estimates of potential GDP from early 2007 through February 2021 in the aftermath of the Great Recession and the subsequent recovery as well as the COVID-19 pandemic. At Goldman Sachs, economists Daan Struyven, Jan Hatzius, and Sid Bhushan argue that this trend offers evidence that potential GDP is higher than models such as the CBO’s suggest, meaning the economy has more slack. Assuming that the downward trend in the prime-age male employment/population ratio could be reversed by a strong economy, they estimate that the U.S. economy is 3 to 4 percentage points further below potential today than CBO estimates imply. Coupled with the uncertainty noted above, this result suggests that estimates of the output gap should not be taken as the sole indicator of the condition of the economy or as a foolproof indicator of impending inflation pressures.

Once again – little Brucie failed to read his own link:

Drawing upon recent household survey data, we show that high inflation is disproportionately hurting low-income households, including Black and Hispanic households and renters. It is noteworthy that the survey results do not support the recent suggestion of Nobel laureate economist Paul Krugman that low-income families “have actually been hurt less by inflation than families with higher incomes” because the wages of low-income households rose faster.

The authors were clear they were talking about RECENT data as of the report from Nov. 2021 to Nov. 2022. They were not talking in general as Brucie suggests.

And Krugman noted – as I often bring up to dim witted little Brucie boy – real income changes are more than the increase in CPI as one must consider what happened to nominal income/

Brucie has a bad habit of not reading his own links. He does this most of the time. Come on Brucie – is it too muchfor you to actually READ your own links before making one of your patently stupid comments? DAMN!

pgl, thanks for you comment: And Krugman noted – as I often bring up to dim witted little Brucie boy – real income changes are more than the increase in CPI as one must consider what happened to nominal income/

Again, you point to averages, not sectors. But that’s okay. Averages obfuscate a lot of things and that’s good, right? Because then you can claim everyone is doing well. You’ve lost sight of my original point that the increase in price levels under Biden have hurt the lowest income groups the most. But I understand: short attention span.

Second Quarter 2024,

Vol. 106, No. 2

Posted 2024-04-15

https://research.stlouisfed.org/publications/review/2024/04/15/real-wage-growth-at-the-micro-level

Until the beginning of 2021, the past decade saw consistent positive year-over-year real wage growth, showing that wage growth outpaced the rising cost of living. However, in the past two years, the U.S. has experienced high inflation combined with strong wage growth. With aggregate inflation reaching a high of 9 percent in June 2022 and average nominal wage growth soaring to 6.4 percent in 2022, most households experienced both rising wages and rising cost of living. The difference between these two values determines real wage growth. However, the contributions of these components may differ across individuals or households. The unequal impact of inflation across age, education, household size, and income is of great interest to policymakers.

You may have later data to share so I’ll wait for your next comment.

Frist sentence of their abstract:

‘This article investigates patterns in real wage growth in 2022 to determine whether wages have kept up with rising price levels’

No one denies prices rose faster than wages during this period but once again MORON, it is April 2024. And yes we have more recent data which Dr. Chinn has many times displayed which clearly shows real wages have risen since.

Seriously Bruce – do you know how to even READ this blog’s post? If so, you might know how effing stupid your comments are. But you make then anyway.

BTW – the paper by Victoria Gregory and Elisabeth Harding is a very good paper. Now it does not support MAGA boy Brucie’s BS but it is interesting read. Now Brucie could have led with this economics paper but that is not what little Brucie ever does. No – he led with some stupid survey as if that was a measure of the rise in consumer prices.

We should also note Brucie is going back to events in 2021/22 as if it that was a measure of what has happened of late. Yea – Brucie does make the dumbest comments ever.

I’m not sure if Bruce Hall even bothered to check on what his new bogus measure of inflation happened to be but I did:

https://www.census.gov/data/experimental-data-products/household-pulse-survey.html

The Household Pulse Survey is a 20-minute online survey that measures how emergent social and economic issues are impacting households across the country.

The HPS also asks about core demographic household characteristics (including sexual orientation and gender identity), as well as the following topics:

Access to infant formula

Children’s mental health treatment

COVID-19 vaccinations and long COVID symptoms and impact

Education, specifically K-12 enrollment

Childcare arrangements

Employment

Food sufficiency

Housing security

Household spending, including energy expenditures and consumption

Inflation concerns and changes in behavior due to increasing prices

Physical and mental health

Feelings of pressure to move from rental home

Transportation, including behavioral changes related to the cost of gas

Health insurance coverage (including Medicaid)

Social isolation

Participation with the arts

Impact of living through natural disasters

A lot of stuff in a 20 minute SURVEY. Note in particular that this is NOT a measure of the change in the cost of living. Also note that this survey is updated rather frequently – so Brucie boy’s attempt to tell us a survey of this type from late 2022 is some interesting measure of the actual cost of living is incredibly dishonest.

But hey – that’s Brucie’s calling in life – lying for the MAGA cause.

https://www.nar.realtor/newsroom/existing-home-sales-descended-4-3-in-march

Existing-Home Sales Descended 4.3% in March

OK – this is NAR after all and existing home sales are not the same thing as building new housing:

https://fred.stlouisfed.org/series/PRFIC1

Real Private Residential Fixed Investment

We were seeing a bit of an investment boom in 2021 but high interest rates took a bite out of that in 2022. 2023 has seen investment at this lower level but no further decline. But I’m sure NAR is praying for interest rate cuts.

Now we get Bruce Hall is the most ignorant troll ever but ceretis parabem? Not only has this MAGA moron misspelled ceteris paribus but he thinks it means inertia.

Come on Brucie – even a retarded dog knows how to use Google:

https://www.merriam-webster.com/dictionary/ceteris%20paribus

ceteris paribus

if all other relevant things, factors, or elements remain unaltered

Now let’s see if the dumbest troll ever has even a clue how this fits into actual economics.

Thanks for the spell check. Is that the best you’ve got? But, yeah, you got me. My Latin is a bit rusty despite the three years I took in the 60s. Still, you knew exactly what I meant. And by the way, that slipper potential GDP is a pretty iffy way to judge performance. I like the third chart: https://www.brookings.edu/articles/what-is-potential-gdp-and-why-is-it-so-controversial-right-now/ It shows how ceteris paribus is seldom the case.

Others, including Nobel Laureate Paul Krugman, warn against putting too much emphasis on a projected output gap in determining the riskiness of a large fiscal stimulus. They note the significant uncertainty that surrounds any estimate of potential GDP. Indeed, by CBO’s estimates, the U.S. economy was operating above potential in 2019, yet inflation remained subdued and below the Fed’s 2 percent target. Moreover, there is little historical precedent to predict how the pandemic will affect potential output or consumer and business demand once the virus recedes. Yeah, an older quote. Do you have a newer one?

C’mon man. Add something to the discussions.

Now try… try to address the issue that inflation impacting lower wage earners and seniors significantly more is not an issue for Joe Biden’s re-election.

https://www.npr.org/2024/04/06/1242873226/parents-inflation-election-2024

Of course, that doesn’t affect the Pinot Grigio/Chardonnay liberals, but it’s something to think about.

“Is that the best you’ve got?”

Brucie – are you so moronic that you cannot read more than one sentence? I also noted you have no idea what this phrase even means. And the rest of your babble proves my point.

Hey Brucie – your mother is calling. She is angry at you as you have embarrassed the family enough.

Parents are struggling with high prices this year. It may shape how they vote

Yep – the only thing Brucie ever cared about was getting people to vote for Trump the traitor. I guess this explains why this moronic troll spends so much time LYING about the numbers. But come on – those lies are as dumb as it gets.

Now one more time Brucie boy – what does ceteris paribus even means. DUH!

Do you have a newer one?

Ah Brucie – we have had a lot of comments and blog posts in the last few weeks on what the gap is now and the measurement issues involved. I guess you do not read the blog posts here after all. BTW the last person who uttered such nonsense was JohnH who also got called out in stinging blog posts from our host. That was just before that troll got banned. Not saying you should be banned as your incessant stupidity is so funny!

Yes, I do not read ever post, so if you wish to make a rational point, you can do what I do and insert a link to buttress your otherwise meaningless remarks. Then there is a focal point for discussion. Otherwise, saying, “oh we discussed that in June of 2021 and you should know that” is ridiculous.

We knew you are a pointless whiny little boy but come on. Try to at least learn economics sometime. Damn!

We have a bit of a mess in comments here regarding the effect of inflation across households. I’m not going to give a simple clarification because THAT WOULD BE DISHONEST! There is no simple clarification for such a mess of contradictory claims. And we wouldn’t want dishonesty to creep into comments, would we?

What I can do is point out some of the factors which prevent simple broad statements about the impact of inflation. Here goes:

Poor households have a different consumption basket than middle income or rich households. That’s one way in which the poor can diverge from the average when it comes to the effect of inflation.

Another way is that the poor spend a larger share of their income, so inflation has an immediate effect on more of their income.

But here’s a little secret about the poor – they all have different consumption baskets. So when we hear that the poor are affected differently than the rich, keep in mind that the poor are affected differently than the poor, too. “The poor” is still an aggregation, and averaging across “the poor” still hides a lot.

Saying that someone is hurt worse by inflation is not the same thing as saying their wages did or did not keep up with inflation. On average, incomes among lower-income households have risen more during the Covid recovery than incomes for other households. On average, incomes among lower-income households have outpaced inflation in the Covid recovery. That does not mean that individual lower-income households are better off – depends on their consumption basket.

Economies work in different ways at different times. When a scholar finds that, for a period of time one group does better and another does worse, it may very well be that things are reversed in another period. When a partisan hops on a soapbox and insists on looking at a particular period, you should ask what motive he or she may have for focusing on that period rather than some other.

The rich are, in aggregate, always materially better off than the poor. If someone says “but the poor are worse off” or “the rich are better off”, be careful of what that means in context. It may just be a statement of the nature of things.

Sometimes, we confuse perception with reality. Sometimes, there are efforts to confuse perception and reality. JohnH, whose behavior in comments got him banned, liked to conflate perception with reality. If people report that they are “stressed” by inflation, that is not the same as being objectively materially worse off. It is not a surprise that the same sort of confusion has shown up again in comments, even after JohnH was banned, but it is instructive.

I doubt any of this will change a thing in future comments, but perhaps a reader or two will be better able to wade through the next round.

https://www.bls.gov/opub/ted/2024/real-average-hourly-earnings-increased-0-6-percent-from-march-2023-to-march-2024.htm

Yes, Moses, that is the “on average” issue to which I referred. Macroduck correctly points out that Saying that someone is hurt worse by inflation is not the same thing as saying their wages did or did not keep up with inflation. On average, incomes among lower-income households have risen more during the Covid recovery than incomes for other households. On average, incomes among lower-income households have outpaced inflation in the Covid recovery. That does not mean that individual lower-income households are better off – depends on their consumption basket.

https://www.theatlantic.com/ideas/archive/2024/04/inflation-democrats-biden-interest-rates/678047/

There also has been enough written about the difficult of those on relatively fixed incomes, regardless of income level, in dealing with the 3-year price increases. For example, https://www.theday.com/nation/20220322/retirees-on-fixed-incomes-struggle-to-deal-with-inflation/

Bruce, am I as insulting to you as other commenters here?? We’re both “old guys’ with an affection and/or nostalgia to an America that no longer exists Nobody said there aren’t old people suffering now. But you know what?? There’s only one presidential candidate who is talking about taking away SS and Medicare and Medicaid. Do I have to explain to you Bruce which Pres candidate that is?? it’s the one who F’ed a Porn girl who has to attend court now. Presumably the same guy you’re working so hard to defend on this blog in every comment you make.

What the Upper-Middle-Class Left Doesn’t Get About Inflation

Liberal politicians and economists don’t seem to recognize the everyday harms of rising costs.

When the title is such utterly stupid trolling – one can be assured the rest of the article is worthless. Oh wait – Brucie’s Ph.D. is in being worthless.