The WSJ April survey is out (responses April 5-9):

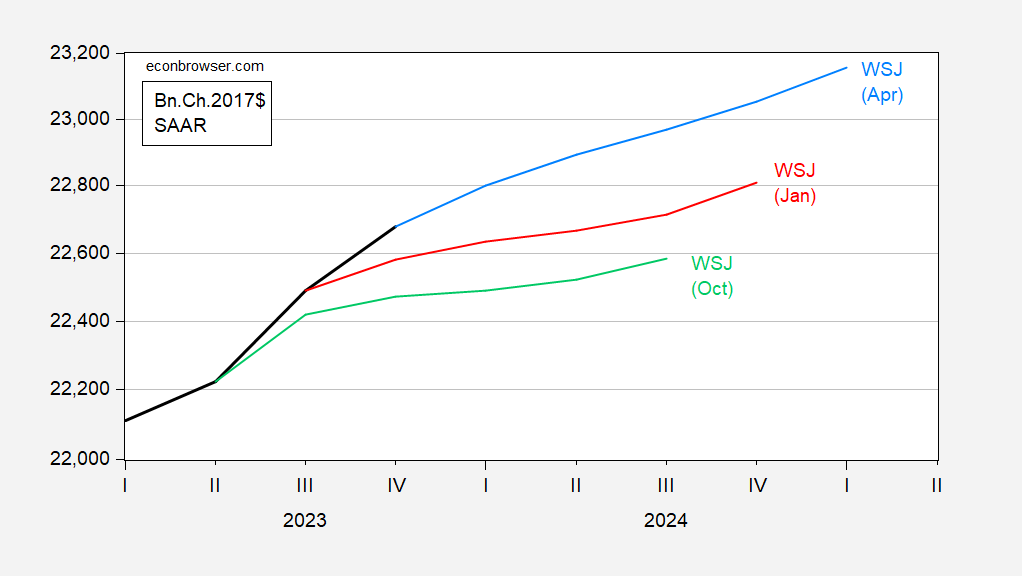

First, the level of forecasted GDP over the last 3 surveys (7 months):

Figure 1: GDP (bold black), WSJ April 2024 mean forecast implied level (blue), January 2024 (red), October 2023 (light green), all in bn.Ch.2017$ SAAR. Source: BEA 2023Q4 3rd release, WSJ surveys (various issues), and author’s calculations.

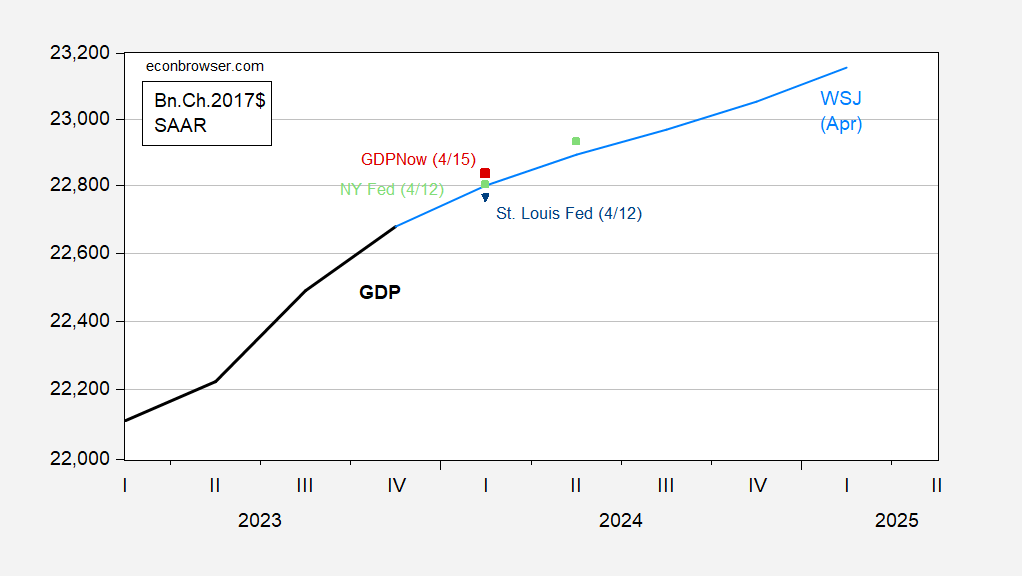

Currently, the mean forecast for Q1 is exceeded by two of the most recent nowcasts (Atlanta, NY Feds):

Figure 2 [upated]: GDP (bold black), April WSJ mean (light blue), GDPNow (4/15) (red square), NY Fed (light green square), St. Louis Fed (blue inverted triangle), all in bn.Ch.2017$ SAAR. Source BEA via FRED, Philadelphia Fed, Atlanta Fed, NY Fed, St. Louis Fed via FRED, and author’s calculations.

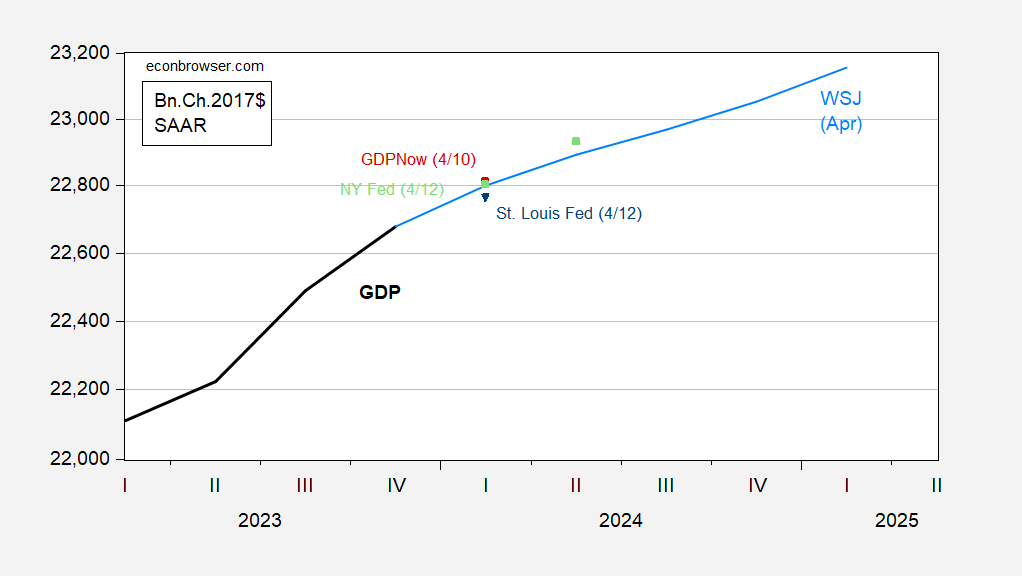

Figure 2: GDP (bold black), April WSJ survey mean (light blue), GDPNow (4/10) (red square), NY Fed (light green square), St. Louis Fed (blue inverted triangle), all in bn.Ch.2017$ SAAR. Source BEA via FRED, Philadelphia Fed, Atlanta Fed, NY Fed, St. Louis Fed via FRED, and author’s calculations.

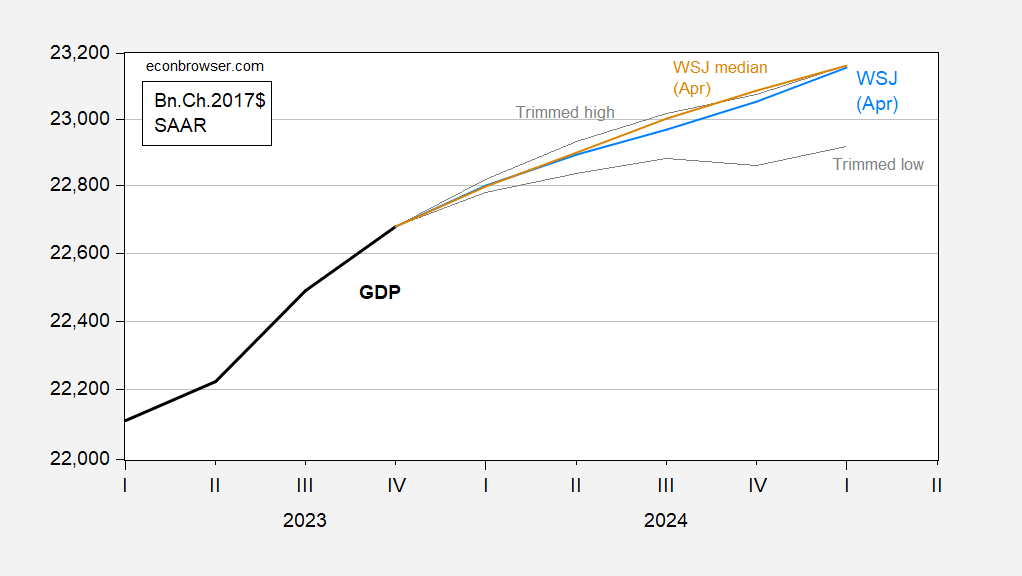

The mean and median forecasts are for no negative quarters of growth. Even the trimmed lower bound (taking off the bottom 6 forecasts for 2024) doesn’t show two consecutive negative quarters.

Figure 3: GDP (bold black), WSJ April 2024 mean forecast implied level (blue), median (tan), 20% trimmed high/low for 2024 (gray), all in bn.Ch.2017$ SAAR. Source: BEA 2023Q4 3rd release, WSJ surveys (various issues), and author’s calculations.

Trimmed low is Mike Cosgrove/Econoclast, high is Song Won Sohn/SS Economics. Median is Satyam Panday/S&P Global Ratings.

The highest growth rate forecast is perennial optimist James Smith/EconForecaster (3.3% if 2024 q4/q4). Andrew Hollenhorst & Veronica Clark/Citigroup and Amy Crew Cutts/AC Cutts both forecast negative growth in Q2-Q3.

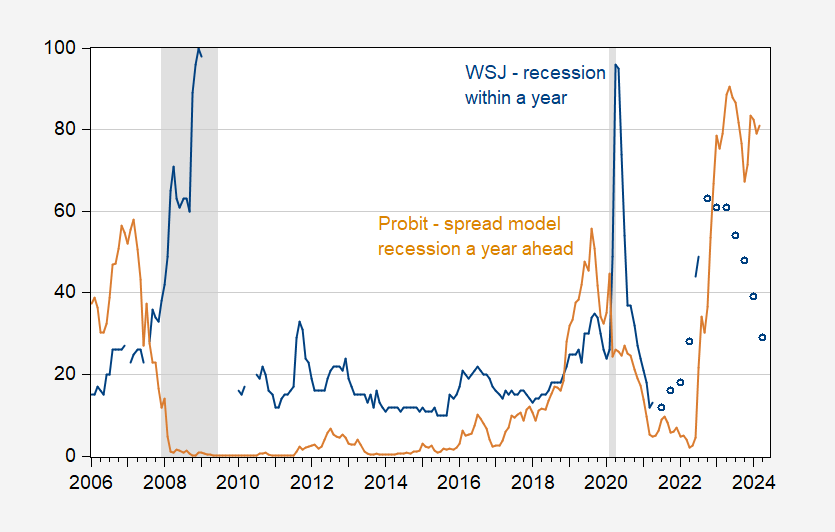

As for recession (recall, NBER does not define a recession by the two-quarters-consecutive-negative-GDP-growth rule-of-thumb), economists views diverge substantially from a purely statistical prediction (probit) based on the 10yr-3mo term spread and the WSJ survey.

Figure 4: WSJ survey probability of recession within one year (blue), and probit based 10yr-3mo spread recession in one year (tan), both in %. Probit estimates based on 1986-2018 (pre-pandemic). NBER defined peak-to-trough recession dates shaded gray. Source: WSJ, NBER, author’s calculations.

Note that in the run-up to the 2007-09 recession, the probit model lead the survey measure, while probit and survey rose in tandem through end-2022, diverging thereafter.

In other news – Trump Media stock continues to sink like a stone!

https://finance.yahoo.com/quote/DJT/

DJT has filed to issue more shares. Absent a new use for the money to be raised, this is pure dilution. If DJT were priced out of the reach of mom-and-pop investors and the board’s aim was wider holding of shares, dilution would make sense. At just under 28 bucks, that isn’t the case. This looks like an effort to create money out of nothing by fooling rube investors. What it shows is that “the king of debt” isn’t an equity guy.

Here’s the story:

‘The company filed documents with the U.S. Securities and Exchange Commission that open the door for the future potential sale of millions of shares. The document, called an S-1, relates to warrants held by investors that can be transformed into shares of stock, as well as shares held by company insiders.’

The transformation of warrants or stock options into stocks need not involve the sell of new shares. Many companies go out into the market and have the warrant holder purchase existing stocks from other people. Of course at the current depressed price, this form of exercise would create little value for the warrant holder.

CNN has a decent story on this dog of a stock which is now trading at just over $26.60 a share:

https://www.cnn.com/2024/04/15/investing/trump-stock-new-shares/index.html?utm_source=business_ribbon

Trump stock tanks after announcing massive share sale

Trump Media & Technology Group’s stock is tumbling again after the company announced a potentially massive new influx of shares. The struggling company is rapidly losing money, and a new stock offering could help it stay afloat. But there’s a downside to going back to the market with more shares: The addition of 21.5 million shares for sale announced Monday would add more than 15% more stock to the publicly available shares of the Truth Social owner. That would substantially devalue existing shareholders’ stakes — including that of former President Donald Trump. And it means that millions of shares could be sold off. This filing seeks to register all shares related to the merger that took Trump Media public, including those that are tied to warrants. Warrants give the holder the right to buy shares of a company’s stock at a set price. “The belief is that they’re going to exchange the warrant for a share of stock and then immediately sell that stock,” said John Rekenthaler, vice president of research at Morningstar.

Matthew Tuttle, chief executive of Tuttle Capital Management, says that management would be “stupid” not to sell more stock, even though the move will upset shareholders.

Upset average shareholders? Management is robbing them blind. A shareholder lawsuit is in order.

From that S-1. I know this is a lot of blah, blah, blah but the bottom line is that they are about to engage in a massive dilution. I would not be surprised if this did led to a shareholder lawsuit:

TRUMP MEDIA & TECHNOLOGY GROUP CORP.

Up to 21,491,251 Shares of Common Stock Issuable Upon the Exercise of Warrants

Up to 146,108,680 Shares of Common Stock

Up to 4,061,251 Warrants to Purchase Common Stock

This prospectus relates to the issuance by us of up to an aggregate of 21,491,251 shares of our common stock, $0.0001 par value per share (the “Common Stock”), which consist of (i) 566,742 shares of Common Stock that are issuable upon the exercise of warrants originally issued to ARC Global Investments II, LLC (“ARC”) in a private placement in connection with the initial public offering of Digital World Acquisition Corp. (“DWAC” or “Digital World”) (the “Placement Warrants”), (ii) up to 369,509 shares of Common Stock that are issuable upon the exercise of warrants originally issued in connection with the conversion of Digital World Convertible Notes (as defined below), immediately prior to the consummation of the Business Combination (as defined below) (the “Convertible Note Post IPO Warrants”), (iii) up to 3,055,000 shares of Common Stock that are issuable upon the exercise of warrants originally issued in connection with Digital World Alternative Warrants (as defined below), (iv) up to 3,125,000 shares of Common Stock that are issuable upon the exercise of warrants to be issued in connection with the conversion of Digital World Alternative Financing Notes (as defined below) (the “Alternative Financing Notes Post IPO Warrants” and, together with the Convertible Note Post IPO Warrants and the Digital World Alternative Warrants, the “Post IPO Warrants”), and (v) up to 14,375,000 shares of Common Stock that are issuable upon the exercise of warrants originally issued in the initial public offering of DWAC (the “Public Warrants” and, together with the Placement Warrants and the Post IPO Warrants, the “Warrants”). We will receive the proceeds from any exercise of the Warrants for cash.

This prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus or their permitted transferees (the “Selling Securityholders”) of (a) up to an aggregate of 146,108,680 shares of Common Stock (the “Resale Securities”), consisting of (i) 1,133,484 shares of Common Stock originally issued to ARC (the “Placement Shares”) in a private placement in connection with the initial public offering of Digital World at a price of $10.00 per unit, each unit consisting of one share of Common Stock and half a warrant exercisable at $11.50 per share of Common Stock (the “Digital World Convertible Units”), (ii) up to 14,316,050 shares of Common Stock originally issued as Founder Shares (as defined below) to ARC in connection with the initial public offering of DWAC at a price of $0.0017 per share, which share amount assumes a conversion ratio (2.0:1) pending litigation and/or out of court agreement between TMTG and ARC and consists of (x) 10,980,000 shares of Common Stock held by ARC (including 3,579,480 shares of Common Stock being held in the escrow pending the litigation); (y) 95,000 shares of Common Stock transferred to certain Selling Securityholders by ARC for no consideration (including 30,970 shares of Common Stock being held in the escrow pending the litigation) and (z) 3,241,050 shares of Common Stock transferred to certain Selling Securityholders by ARC for an approximate price of $0.0029 (including 1,056,582 shares of Common Stock being held in the escrow pending the litigation) (collectively the “Founder and Anchor Investors Shares”), (iii) 744,020 shares issued to holders of Digital World Convertible Notes, consisting of (x) 625,270 shares of Common Stock issued to certain selling securityholders upon the conversion of the Digital World Convertible Notes into Digital World Convertible Units, each at a price of $10.00 and (y) 118,750 shares of Common Stock issued to certain Selling Securityholders upon the conversion of the Digital World Convertible Notes into Digital World Convertible Units, each at a price of $8.00 (collectively the “Conversion Shares”), (iv) 965,125 shares of Common Stock issued upon the conversion of promissory notes issued pursuant to the Convertible Note Compensation Plan (as defined below) (“DWAC Compensation Shares”), (v) 690,000 shares of Common Stock issued to TMTG director and officers as compensation immediately prior to the consummation of the Business Combination (“TMTG Compensation Shares”), (vi) up to 6,250,000 shares that are issuable upon the conversion of Digital World Alternative Financing Notes into Digital World Convertible Units at a conversion price of $8.00 (“Alternative Financing Shares”), (vii) 7,116,251 shares of Common Stock issuable upon exercise of the Placement Warrants and the Post IPO Warrants at a price of $11.50 per share (the “Private Warrant Shares”), (viii) 143,750 shares of Common Stock issued to the underwriters in connection with the Digital World IPO (as defined below) (the “Representative Shares”) and (ix) 114,750,000 shares of Common Stock held by President Donald J. Trump (“President Trump Shares”) consisting of (y) 78,750,000 shares of Common Stock received by President Donald J. Trump upon the consummation of the Business Combination in exchange of Private TMTG (as defined below) shares held by President Donald J. Trump and (z) 36,000,000 Earnout Shares (as defined below) which may be earned by President Donald J. Trump based on the performance of our shares of Common Stock and for no additional consideration and (b) up to 4,061,251 Warrants consisting of (i) 566,742 Placement Warrants, (ii) up to 369,509 Convertible Note Post IPO Warrants, and (iii) up to 3,125,000 Alternative Financing Notes Post IPO Warrants. We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus.

The number of shares of Common Stock being offered for resale in this prospectus exceeds the number of shares of Common Stock constituting our public float. The Resale Securities represent approximately 256% of our public float and approximately 107% of our outstanding shares of Common Stock as of January 31, 2024 (after giving effect to the issuance of shares of Common Stock upon exercise of the Warrants). Despite the closing price being $32.59 per share of Common Stock as of April 12, 2024, ARC and the Selling Securityholders may still experience a positive rate of return on the shares of Common Stock purchased by them due to the lower price per share at which their shares of Common Stock were purchased as referenced above. The sale of the Resale Securities being offered pursuant to this prospectus, or the perception that these sales could occur, could result in a significant decline in the public trading price of our Common Stock. While the Selling Securityholders may, on average, experience a positive rate of return based on the current market price, public stockholders may not experience a similar rate of return on the Common Stock they purchased if there is such a decline in price and due to differences in the purchase prices and the current market price. For example, based on the closing price of $32.59 per share on April 12, 2024, ARC and other Selling Securityholders may receive potential profits of up to $32.58 per share. The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of Common Stock or Warrants, except with respect to amounts received by us upon exercise of the Warrants for cash. We believe the likelihood that warrant holders will exercise their Warrants and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our shares of Common Stock. If the trading price for our shares of Common Stock continues to be over $11.50 per share, we believe holders of Warrants will likely exercise these Warrants. In addition, to the extent the Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the Warrants will decrease. The Warrants may be exercised for cash or on a “cashless basis.” See “Description of Securities — Warrants” for further discussion. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of Common Stock or Warrants. See the section titled “Plan of Distribution.”

Our shares of Common Stock and Public Warrants are currently listed on the Nasdaq Global Market (“Nasdaq”) under the symbols “DJT” and “DJTWW,” respectively. On April 12, 2024, the closing price of our Common Stock was 32.59 per share and the closing price of our Public Warrants was 13.69 per Public Warrant.

The sale of the Resale Securities, or the perception that these sales could occur, could depress the market price of our Common Stock. Despite a decline in price, our Selling Securityholders may still experience a positive rate of return on the shares of Common Stock purchased by them due to the lower price per share at which such shares of Common Stock were purchased as referenced above. While these Selling Securityholders may, on average, experience a positive rate of return based on the current market price, public securityholders may not experience a similar rate of return on the shares of Common Stock they purchased if there is such a decline in price and due to differences in the purchase prices and the current market price. For example, based on the closing price of $32.59 per share on April 12, 2024, ARC and certain other Selling Securityholders may receive potential profits of up to $32.58 per share of Common Stock.

DJT does have a use for the money raised by issuing new stock. Truth (sic) Social intends to go into the streaming business. This ends to be an expensive business to enter, generating losses in the early years even for firms which eventually succeed. Intended content includes political screeds, religious programming and famly-friendly content. I suggest “Donny and Stormy Go to Court” to check all three boxes.

Meanwhile (as Colbert would say), Trump has been ordered to show that the company which provided the $175 million bond in his NY civil trial is financially qualified to provide such a bond. Proof is due today, of the State may begin seizin his assets.

Mondays, ya know?

The Good Book tells us we’re not even supposed to wish our enemies bad. It’s so hard to do the right thing sometimes, isn’t it??

Politico s running a sory indicating that Lighthizer is under consideration to become Treasury Secretary f Trump wins the presidency and that he’ll push for dollar devaluation. The “nuances” reportedly haven’t been worked out. Politico notes that Lighthizer was a weak-dollar guy during Trump’s administration and yas in tye past argued for a Plaza Accord sort of arrangement.

The logic discussed is a bit loopy. Lighthizer believes that tariffs aren’t enough to achieve his trade goals, so would use the threat of tariffs to coerce a currency bargain that would achieve his trade goals. Europe, China and Japan all read the U.S. press, so how’s this “let me win” negotiating approach going to work? Also, Trump didn’t go for Lighthizer’s currncy plans last time.

If you combine the current labor shortage, with “tough on asylum seekers”; then any attempt to create more jobs in the US will push inflation up. The classic Fed defense against that is to increase rates. Trump would almost certainly fire any Fed chair who increased rates. So you would get inflation and a total loss of market confidence in the Fed. How would that end?

Trump could only refuse to re-appoint he Fed chair at the end of his (in this case) term. Can’t fire ’em. But I take your point.

Way, way off topic – NY Fed staff have tackled the issue of insurance company risk from climate change:

https://www.newyorkfed.org/research/staff_reports/sr1066

They begin by creating a CAPM-style beta for climate risk, based on equity price response to physical events. Pretty clever.

A problem which the authors identify in researching climate risk is that the historical record of physical events and resulting insurance claims not be a good representation of the future – climate change risk is new, and not well represented in the historical record.

I see how the CAPM approach gets around the problem of a new risk – structural change – in the short term when assessing risk of individual firms. Assume market participants know stuff and that they are rational. One result is an estimation of individual firm’s risk of capital shortfalls. This could be a valuable regulatory tool.

I don’t see much promise here for getting risk pricing right across insurance as an industry or an economic function. All the inputs remain historical, and what with tipping points, we have no reason to think we or market participants in aggregate can accurately predict the severity or frequency physical events over even the medium term.

A separate exercise undertaken in the paper is to estimate insurance firms exposure to “transition risk” – essentially, how much fossil fuel exposure do they have?

When rubbing these two parts of the study together, a troubling result emerges:

“We document that insurers’ market-based transition climate beta aligns with their holdings of corporate bonds that are exposed to transition risk. In other words, insurers who have a larger share of their corporate bond investments in industries that face greater risks related to climate transition, have higher exposure to transition climate risk based on our measure. This correlation is significantly positive after controlling insurers’ characteristics and after adding the insurer fixed effects.”

If I read this correctly, it says that insurers which have high exposure to physical events also have high exposure to transition away from fossil fuels. Capital adequacy ain’t looking so good for those firms.

By the way, when the fossil fuel industry winds up their toy Congressmen to argue against regulators assessing climate risk, this is exactly the sort of knowledge they don’t want us to have.

Since Robert Engel was a co-author, we knew they would reply on:

“Dynamic Conditional Beta,” Journal of Financial Econometrics, September 2016

I admittedly haven’t got far in Kwak’s and Bright’s book yet, but when I do get to sitting down to read it, it reads very well and is a pleasant ride. It’s like what Shoestring Hobo might have called an “open box ride”, or maybe “finding a Cadillac”. Those who know, know.

Tom Cotton calls for the murder of peaceful protestors:

Republican Suggests Protesters Would Be Thrown Off Bridge in Home State

https://www.msn.com/en-us/news/world/republican-suggests-protesters-would-be-thrown-off-bridge-in-home-state/ar-BB1lFW6C

https://finance.yahoo.com/quote/DJT/

Trump Media stock price update – less than $23 a share. Yea – this Ponzi scheme is falling apart. MAGA!

How many people have died in Gaza?

https://time.com/6909636/gaza-death-toll/

The Science Is Clear. Over 30,000 People Have Died in Gaza

The first shock was the number of people killed in Israel—1,200 in a day, Oct. 7. But in the months since, the world has been taken aback by the number of deaths reported out of Gaza: 30,000 through the end of February. Because the death count is compiled by the local Ministry of Health (MOH), an agency controlled by Hamas, which governs Gaza, the tally has been subject to skepticism. Israel’s U.N. ambassador and online pundits have purported that the numbers are exaggerated or, as a recent article in Tablet alleged, simply faked. Actually, the numbers are likely conservative. The science is extremely clear.

This estimate was from over 6 weeks ago so the number of Gazans who have died has gone up. That the Bibi government dismisses this is disgusting. Then again our Princeton Steve is peddling that no Palestinian has died. Well no one that matters to Princeton Steve as he clearly could care less about the lives of Palestinians.

Four Native American Tribes Ban GOP South Dakota Gov. Kristi Noem From Their Land, Now Barred From 15% Of Land In Her State

https://www.msn.com/en-us/news/us/four-native-american-tribes-ban-gop-south-dakota-gov-kristi-noem-from-their-land-now-barred-from-15-of-land-in-her-state/ar-BB1lJqxI?ocid=msedgdhp&pc=U531&cvid=1e6cba0995ce4caab94f44420007bfbd&ei=18

Four Native American tribes banned South Dakota Gov. Kristi Noem (R) from their land after she had made comments linking tribal leaders to Mexican drug cartels. Earlier this year, three tribes barred Noem from visiting their lands. Last week, the Standing Rock Sioux Tribe, whose reservation spans North and South Dakota, the Rosebud Sioux Tribe and the Cheyenne River Sioux joined other tribes in banning Noem. In February, the Oglala Sioux Tribe banned the South Dakota governor from the Pine Ridge Reservation after the tribe’s president, Frank Star Comes Out, responded to her remarks about the U.S.-Mexico border in a statement addressed to her. In early February, Noem said she wanted to send security personnel to Texas to help in deterring migrants at the U.S.-Mexico border. She claimed that cartels had been invading South Dakota’s reservations. Noem replied to Star Comes Out in a statement that declared that she had better results when working with the Trump administration. The South Dakota governor is now legally barred from entering about 15% of the state’s lands. She argued during recent community forums that those leaders had been more focused on profiting from those cartels rather than parenting their children on Native American reservations.

If the citizens of South Dakota are decent people – they would ban this racist POS from 100% of the state.

Banned subject is extremely stupid and intolerant of people different than her mirror image. Only approach with long rifle scope with hopes of improving Bismarck gene pool.

IMF forecast on Russia:

https://www.reuters.com/world/imf-sees-slow-steady-2024-global-growth-china-inflation-pose-risks-2024-04-16/

Higher oil prices helping Russia out.

Chapter 2 of the IMF report is about the transmission of monetary policy through mortgages and housing:

“Chapter 2 investigates the effects of monetary policy across countries and over time through the lens of mortgage and housing markets. Monetary policy has greater effects where (1) fixed-rate mortgages are not common, (2) home buyers are more leveraged, (3) household debt is high, (4) housing supply is restricted, and (5) house prices are overvalued. These characteristics vary significantly across countries, and thus the effects of monetary policy are strong in some and weak in others. Moreover, recent shifts in mortgage and housing markets may have limited the drag of higher policy rates up to now in several countries. The risk that households may still feel the pinch should be taken seriously where fixed-rate mortgages have short fixation periods, especially if households are heavily indebted.”

This should be good.

in case anyone is interested, the unexpected beat in March retail sales and the sizable upward revisions to January & February has turned first quarter PCE goods sharply positive…as previously reported, the 1.3% real (2017$) drop in January PCE goods looked like it had dug a hole we wouldn’t get out of…..but February’s seasonally adjusted sales were revised from $700.7 billion to $704.5 billion, while January’s sales were revised from $696.7 billion to $697.954 billion..

core retail sales were also up 0.7% in March.. adjusting them with core CPI goods changes, we can estimate that real retail sales excluding food and energy will have increased around 0.9%…adjusting grocery store sales and gas station sales with appropriate price indices leaves both up 0.4%…reweighing and averaging those real sales estimates back together, and excluding food services, we can then estimate that the income and outlays report for March will show that real personal consumption of goods rose by nearly 0.8% in March, after rising by a revised 0.6% in February but after falling by a revised 1.1% in January..

with estimates of the percentage changes in PCE goods for all three months of the first quarter, we can also estimate the contribution that PCE goods will make to 1st quarter GDP…. the February income and outlays report gave the change in real PCE goods (2017$) for the 4th quarter months as down 0.2% in October, up 0.4% in November, and up 0.7% in December…based on the revisions to retail sales in the March retail report, we now estimate real PCE goods for January at –1.1%, PCE goods for February at +0.6%, and real PCE goods for March at +0.8%…to simplify our calculations, we’ll now convert those percentage changes in real PCE goods into an index, and set October with an index value of 1.000…thus Nov = 1.0040, Dec = 1.0110, Jan = .9999, Feb = 1.0059, and March = 1.0139.…hence, to estimate the growth rate of 1st quarter PCE goods, we have this: ((( .9999 + 1.0059 + 1.039) / 3) / ((1.0000+ 1.0040 + 1.0110)/ 3)) ^ 4 = 1.040126.…that means that PCE goods rose at about a 4.01% annual rate in the 1st quarter…since PCE goods has usually been around 23% of GDP, that means that the contribution of PCE goods to first quarter GDP should be around 0.92 percentage points…