Coincident index for February out today.

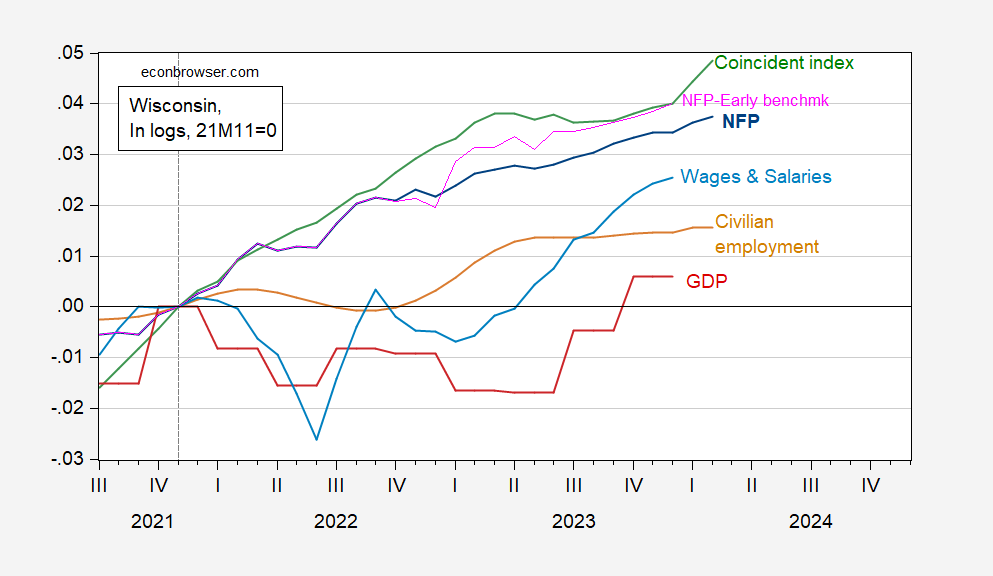

Figure 1: Wisconsin Nonfarm Payroll Employment (dark blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), real wages and salaries linearly interpolated, deflated by national chained CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed [1], [2], and author’s calculations.

The coincident index for February further reinforces the January surge in activity.

CROWE February forecast by Junjie Guo indicates 2024Q4 y/y growth (median) at 1.3%. The Wisconsin DoR February forecast is 1.6% y/y.

Thinking back to the Wisconsin GOP’s January assertion:

“From an economic recession to cheerleading for DEI, Governor Tony Evers has dragged Wisconsin down over the course of his tenure. …”

I will observe that the Philly Fed’s state-level business cycle dating methodology, relying upon coincident indexes, indicates no recession occurred during Governor Evers’ tenure. While this is not the only way to determine a state level recession, the Wisconsin GOP, in its brief statement, did not forward an explanation for how they made their determination.

Big news from FRED!!!

https://fredblog.stlouisfed.org/2024/04/introducing-ai-fred/

As of April 1, there is no longer any need to wait for some official data releases. The St. Louis Fed, using artificial intelligence, will generate economic data pre-real-time:

“FRED provides data updates as soon as possible after the source publishes them, but there’s always a little delay. The FRED Blog has not only closed that gap, but it is now releasing data before the source releases them.”

So far, only 8 AI-generated data series are available, but even those 8 confer substantial benefits on those with an interest in detail.