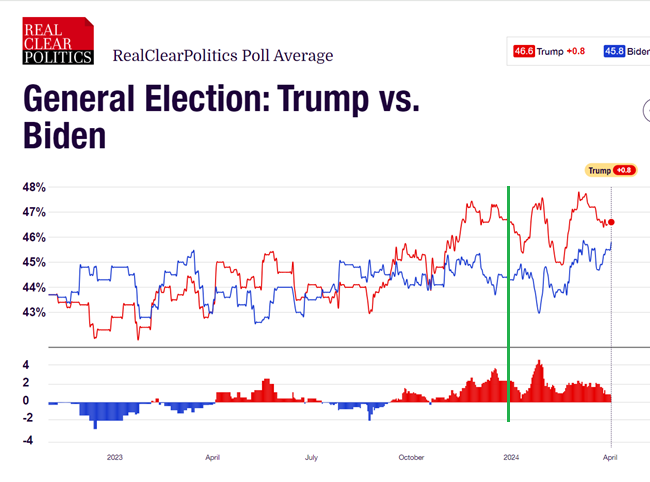

From Real Clear Politics and PredictIt, today:

Source: RealClearPolitics, accessed 4/3/2024.

The spread between Trump and Biden has narrowed recently. Polls also tabulated at FiveThirtyEight.

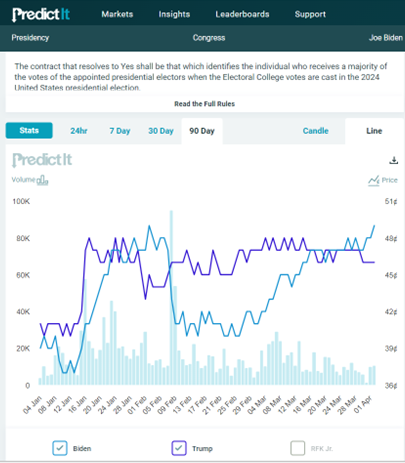

For the sample beginning at the green line in the above figure, we have PredictIt odds.

Source: PredictIt, accessed 4/3/2024. Biden (light blue), Trump (dark blue), RFK, Jr (not shown).

Betting markets hav mostlye outperformed polling in predicting presidential elections since 1988. However, prediction markets are fallable. From the November 4, 2022 NYT:

“At the moment, the bets on its site amount to a forecast of Republican control of both the House and the Senate. PredictIt’s older and more purely academic counterpart, the Iowa Electronic Markets, is showing the same essential picture.”

https://www.nytimes.com/2022/11/04/business/election-prediction-markets-midterms.html

PredictIt anticipated better Senate results for Republicans that actually occurred. So did every other major betting market:

https://www.forbes.com/sites/georgecalhoun/2022/11/14/the-un-wisdom-of-crowds-prediction-markets-failed-their-midterm-exams/?sh=398681e4179a

The forecast models at 538 also predicted a Rebublican Senate majority from the 2022 election, with the exception of the “polls alone” model, which anticipated a tie:

https://projects.fivethirtyeight.com/2022-election-forecast/senate/

So polls beat prediction markets and models in the 2022 Senate race. Control of the Senate is not, however, the same as winning the presidency, and betting markets correctly predicted that Joe Biden would win the 2020 presidential election.

One last point, about polling for the 2020 presidential election, from Wikipedia:

“Polling in the 2020 election was considerably less accurate than in the 2016 election, and possibly more inaccurate than in any election since 1996.”

While Wikipedia doesn’t discuss the nature of the inaccuracy, my understanding is that polls more often than not gave Biden a larger lead than his actual popular vote margin, which was 4 percentage points.

To sum up: 1) Neither polls nor betting markets inspire complete confidence lately, and; 2) It ain’t over till it’s over.

Menzie, I’m pretty clear in my mind now, you’re not “Christian” yes?? Most Chinese are not Christian, similar to Jews are not Christian. Can you humor your white trash Brother Moses and say two or three prayers before the 2024 election?? Your friend “Moses” would appreciate it so much and never forget it. Menzie’s loving but cynic’s prayer starts “Jesus, I don’t believe in you…. but…….

Prayer has power Menzie, try it…….

My comment should have said very ON topic

I wonder about political polling – mainly I question the sampling procedures of publicly available polling results – 1. does anyone under 65 answer their phone or respond to a text message from an unknown caller? and 2. their models are based on the 2020 census – but we did have a nationwide pandemic that resulted in a million plus excess deaths since 2020. I would look more at the primary results – much better proxy for general election.

Off topic – Trump is stirring up fear about migrants that is alarming and hateful and should be pointed out by the media – https://newrepublic.com/article/180404/trumps-ugly-hateful-rants-michigan-covered-scandal To me migrants are a great economic driver for the U.S. economy and should be welcomed and documented so they can work without fear of being deported. https://finance.yahoo.com/video/immigration-explanation-strong-us-labor-213124172.html This is America folks – do I need to point out that for most of us – our parents, grandparents, or great grandparents were immigrants to the U.S.

James, to your point about polling, I have heard it reported that telephone poll response rates have fallen from 70% to 1% of calls. Fits in with the big miss in 2020 polls.

I am contacted by phone and text frequently. I do not answer nor do I respond.

Rather than RCP (which has a history of more or less randomly including and excluding polls), or Nate Silver, I have found the poll aggregations by Dan Guild (dcg1114 at twitter) to be very sober and neutral, and I highly recommend him).

Anyone here familiar enough with international rules of war to know if this constitutes a war crime?:

https://www.972mag.com/lavender-ai-israeli-army-gaza/

A new report finds that Israel has used an AI system (“Lavender”) to choose human targets in Gaza, apparently without much, perhaps any, human intervention in the decision process. While from the “let god sort ’em out” point of view, that may seem an improvement, the Nuremberg trials established that “just following orders” is not a defense against war crimes. I can’t see why it matters that the order comes from a machine.

An AI is considered a recommender system, not part of the chain of command. Consequently, with respect to pretty much everything law-related, it’s considered on a par with a pair of binoculars – “I saw specks on the horizon, and through my binoculars, they sure looked like Palestinian tanks! Sorry!” doesn’t cut it.

Start with Geneva conventions.

Interpretted by the winner who holds the losers.

Jared Kushner Says Israel Should “Finish the Job” in Gaza So It Can Focus on Building Valuable “Waterfront Property”

Always the real estate agent!

https://www.vanityfair.com/news/jared-kushner-israel-gaza-waterfront-property

Off topic – bank accounting tricks during the rate rise:

https://www.nber.org/papers/w32293?utm_campaign=Hutchins%20Roundup&utm_medium=email&utm_content=301224878&utm_source=hs_email

In order to side-step valuing assets at market prices during the 2022 plunge in fixed-income prices, some banks shifted fixed-income assets from “available-for-sale” to “hold-to-maturity” (HTM). (I recall this was mentioned in comments here some time ago.) Only 6% of banks hedged fixed-income assets, and those banks hedged far less than all fixed-income assets. Hedging hurts margins, don’t ya know, so why not just engage in morally hazardous accounting? In general, the uglier the bank’s balance sheet, the greater the reclassification to HTM.

The authors suggest tightening bank regulations to prevent abuse of accounting rules. I suggest we dodged a bullet. Chris Dodd and Barney Frank are probably giving their respective former committees the stink eye about now.

the past couple of years fixed asset rout has me confused. on one hand, it should be straightforward to value the current market price of the asset, and use that to determine an institutions value. and if they drop in value, so be it. on the other hand, if that is a high quality bond, and the institution does not intend to sell that asset, why should they be punished so severely? somehow it seems that our accounting system should be able to accommodate both of these issues simultaneously. some of this is poor business decisions, but not bankruptcy.

THE EMPLOYMENT SITUATION — MARCH 2024

Total nonfarm payroll employment rose by 303,000 in March, and the unemployment rate changed

little at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred

in health care, government, and construction.

https://www.bls.gov/news.release/empsit.nr0.htm

The Household Survey said employment rose by 498 thousand with the employment to population ratio rising by 0.2% as it did the labor force participation rate.

But of course Team Trump has Princeton Steve and Larry Kudlow working hard to spin this as a weak jobs report.