See here.

with a 4.2% contraction in the US money supply (M2) since Mar-22, all signs are pointing to a recession late this year. There have only been four contractionary episodes of the money supply since the Fed was established in 1913. With a lag, they all produced a RECESSION.

That’s true:

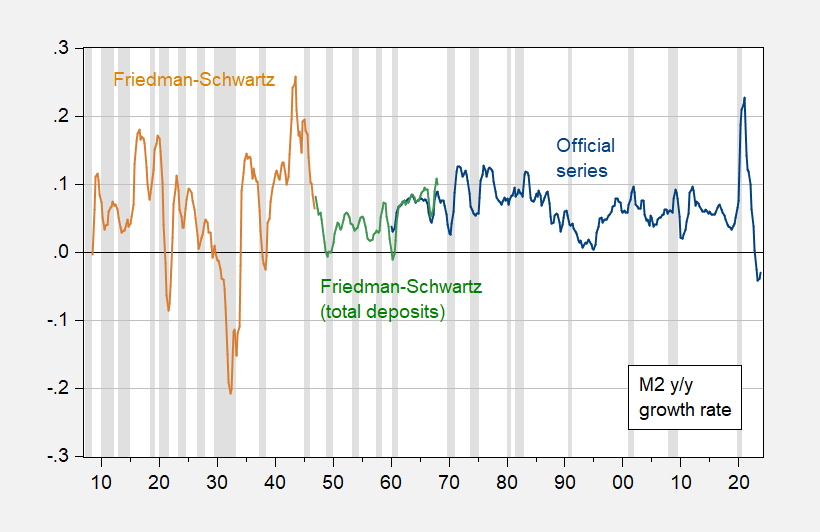

Figure 1: M2 from Friedman-Schwartz (tan), total deposits in commercial banks (green), and M2 from FRB (blue), year-on-year change. 2024Q1 is based on average of first two months. NBER defined peak-to-trough recession dates shaded gray. Source: NBER MacroHistory database (m14144a, m14145a), FRB via FRED, NBER, and author’s calculations.

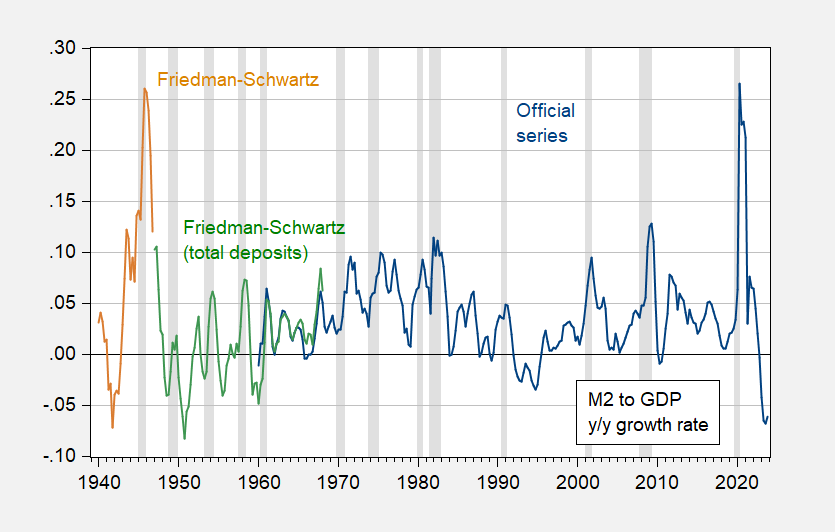

On the other hand, one might think M2 to economic activity (supply relative to one determinant of demand) might be more appropriate.

Figure 1: M2 from Friedman-Schwartz (tan), total deposits in commercial banks (green), and M2 from FRB (blue), all divided by GDP, year-on-year change. 2024Q1 M2 is based on first two months, and GDPNow as of 4/5. NBER defined peak-to-trough recession dates shaded gray. Source: NBER MacroHistory database (m14144a, m14145a), FRB via FRED, BEA via FRED, Ramey, Atlanta Fed, NBER, and author’s calculations.

Not sure about the correlation in that case. Lots of negative growth rates without recessions pre-1960, mid-1990’s, and 2010.

Addendum:

Others who think there’s still a high likelihood of recession:

In Hanke’s chart, the 1920s episode and the second episode in the 1930s show recession leading money supply. So half of Hanke’s cases don’tactually show what he claims they show. In your chart, Menzie, recession always precedes contractions in money supply relative to GDP. So simply based on the evidence and a little “post hoc, ergo Granger”, recession causes monetary contraction. And frankly, that makes sense.

“In Hanke’s chart, the 1920s episode and the second episode in the 1930s show recession leading money supply.”

Hanke would have known this if the QTM nitwit ever read Friedman and Schwartz. Some of these monetarists are pretend to follow Milton Friedman but none of them could tie his shoe laces.

Yet another question has been raised regarding presidential polling accuracy:

https://www.politico.com/news/2024/04/07/voter-age-biden-trump-2024-election-00150923

Biden is polling well among older voters, who typically lean Republican, while Trump is polling well among young voters, who typically lean Democratic. We can all think of reasons that might actually be true, but these days, Politico emphasizes the possibility that polls are simply wrong.

Speaking of reliability problems, PredictIt still has Biden winning. He’s up a penny today at 52 cents vs 45 for Trump. However, OddsTrader has Trump at 52.38 cents vs Biden’s 44.44.

One thing that may limit the accuracy of betting markets, is that markets reflect information, and polls are a big chunk of the information available about likely election outcomes. If polls are less accurate now than in the past, betting markets are probably less accurate, too.

Also, the reduced accuracy of polls doesn’t explain the disparity between betting market results. An explanation for that disparity seems more likely to be a sampling problem. Do some markets serve a more international clientele, for instance, or have political hacks decided to “Game Stop” some platforms? Dunno.

Steve Hanke reminds me of Princeton Stupid Steve with their strange devotion to the QTM, Could it be that “velocity” is stable?

https://fred.stlouisfed.org/series/M2V

Velocity of M2 Money Stock

Didn’t think so. Now could someone inform the two Steves?

He’s obviously proueeeeeeeeeewwwwd to be a prior member of the Reagan administration. You don’t “inform” people like this. You let them get super-glue in their undies listening to their own misguided echo.

I almost picked up Moore’s and Laffer’s $4 book the other day just as a farce to quote parts here on the blog and give you and Prof Chinn some laughs. But then decided on a morality basis I shouldn’t reward that kind of garbage even on the used/resale book market. Did I make the right choice??

it would not even serve as a good substitute for toilet paper. useless.

Yes, you made the right choice.

Yes, you made the right choice.

neither velocity nor the demand for money function are stable.

you yanks have a poor education system

So we have 4,300 companies in the stock market and 11,200 owned by private equity.

https://www.cnn.com/2024/04/09/investing/premarket-stocks-trading/index.html

As we regulated how predatory capitalism can become on the stock market; the predators simply moved away from a system where they were lightly regulated to a place where they can do whatever they want. Robbing and predation was always their game and they will find a way to play it. What government needs to do is to ban any use of tax-advantaged or public funds in the unregulated markets. Disgusting swindling and predation will always find a place – but it should not have a place in endowments, pension funds or anywhere else that is not heavily and immediately taxed.

The following is from a July 25. 1982 discussion of how Reagan got rid of his initial set of incompetent economic advisers replacing this charlatans with the likes of Martin Feldstein:

‘Though more outspoken than most, this lament is heard widely in right-wing circles in Washington, and has to do with the exodus of most, if not virtually all, of the supply-side economic theorists who rode into power with Ronald Reagan a year and a half ago. The list does not, however, include the departure announced Thursday of Murray L. Weidenbaum, chairman of the Council of Economic Advisers. Mr. Weidenbaum, who will return to teaching, is a garden variety conservative. The supply-siders who left ahead of him were not.

Gone, in the past six months, are Martin Anderson, the President’s domestic policy adviser described as Mr. Reagan’s principal conservative theorist, as well as Norman B. Ture and Paul Craig Roberts, the Under Secretary and Assistant Secretary of the Treasury, respectively, and Steven H. Hanke, a senior economist from the Council of Economic Advisers. Unlike traditional conservatives, all were associated with an ideological commitment to stimulating the economy through tax cuts, a goal that took precedence over concern about the deficit’s size. They also advocated – like almost everyone in the Reagan Administration – shrinking the government’s size.’

Yea – Hanke was on Team Reagan in 1981 and early 1982 that gave us that toxic mix of fiscal irresponsibility and Volcker’s tight money. Why anyone would take him seriously is bad me.

Moses got me curious when he noted he could pick up some book by Art Laffer and Stephen Moore for a mere $4. I presume this is the 2018 Trumponomics which I saw via Google could be picked up for a mere $3.67 (goodreads). OK that is still way over priced. But Google also let me know about this piece which is free to read:

https://www.huffpost.com/entry/stephen-moore-is-not-a-real-economist_b_5a1b6135e4b0250a107c00ba

Stephen Moore Is Not A Real Economist

You say it’s way overpriced, but it has all sorts of uses, really. You can use the pages for paper-mache with your kids, for that fun school thing where you make new paper out of cut-up old paper, for cutting up into ransom notes… all sorts of things! Don’t use it as toilet paper, though; actual toilet paper is both softer and cheaper per sheet.