Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its March 2024 meeting and, in the Summary of Economic Projections (SEP), continued to project a range for the FFR between 4.5 and 4.75 percent by the end of 2024. In contrast with experience through December 2023, futures markets summarized by the CME FedWatch Tool on the day following the meeting were in accord with the FOMC projections and also predicted a range for the FFR between 4.5 – 4.75 percent by the end of 2024.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. In this post, we analyze four policy rules that are relevant for the future path of the FFR, update the policy rule prescriptions through the March 2024 SEP, and include futures market predictions.

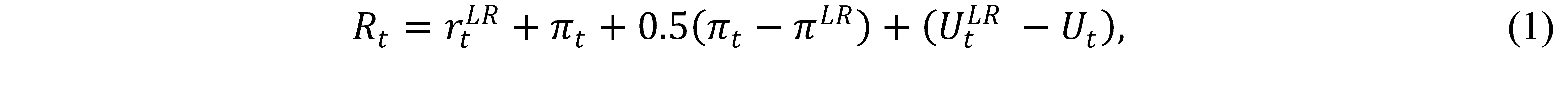

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

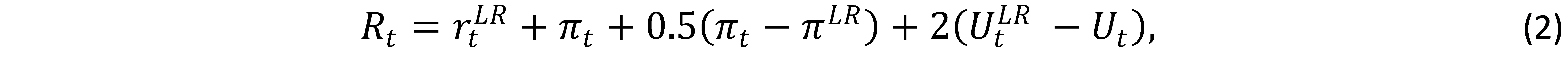

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

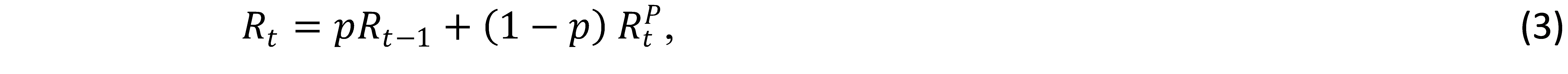

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

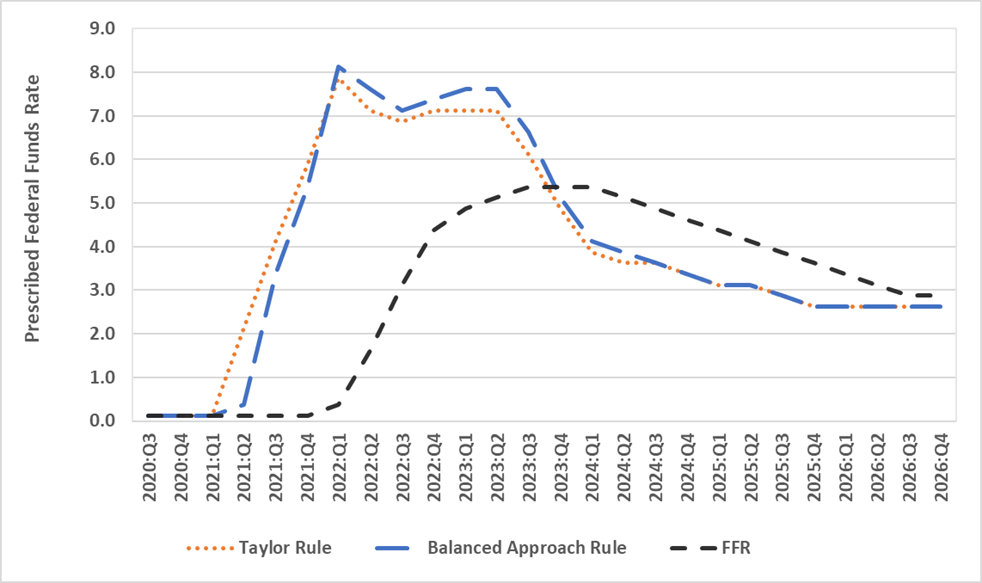

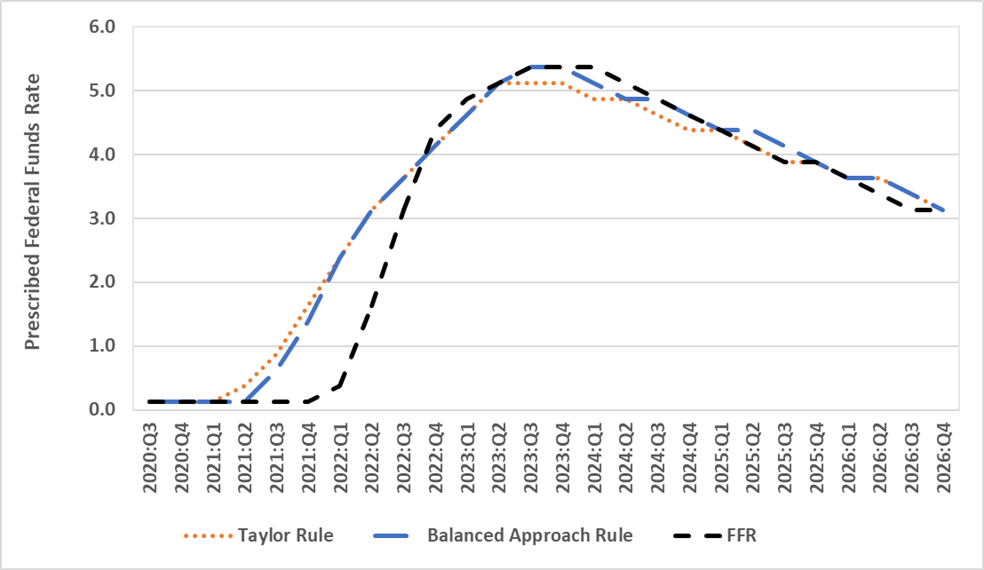

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to March 2024 and the projected FFR for June 2024 to December 2026 from the March 2024 SEP. Figure 1 also depicts policy rule prescriptions. Between September 2020 and March 2024, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between June 2024 and December 2026, we use inflation and unemployment projections from the March 2024 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1: The Federal Funds Rate and Policy Rule Prescriptions. Top panel: Non-Inertial Rules; Bottom panel: Inertial Rules.

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are much higher than the FFR in 2022 and 2023 and are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. In contrast, the policy rule prescriptions for 2024 through 2026 from the March 2024 SEP are consistently lower than the FFR projections. The inertial rules in Panel B prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the March 2024 SEP are very close to the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

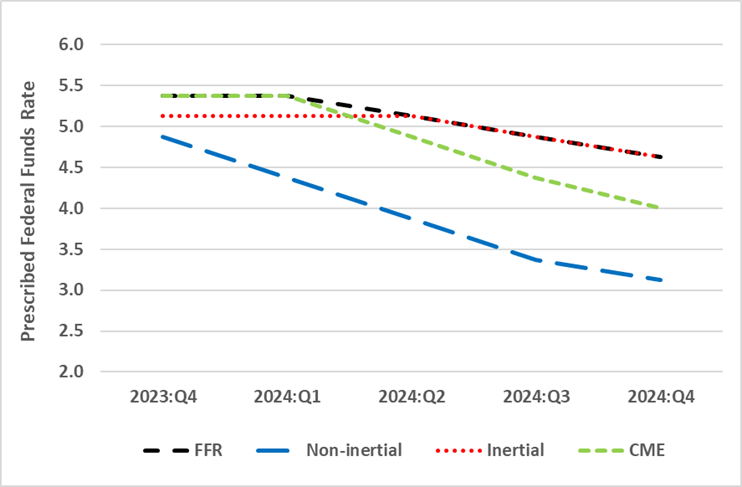

It has been widely reported that market participants have been predicting a steeper downward path for the FFR than the FOMC. This is illustrated in Figure 2, which depicts the median predictions from futures markets described in the CME FedWatch Tool on February 1, 2024, the day following the January 2024 FOMC Meeting, through the end of the CME prediction horizon in December 2024. The futures market predictions fall below the projected FFR from June 2024 through December 2024. This is described in more detail in our February 9, 2024, Econbrowser post.

Figure 2: The FFR, CME FedWatch Tool, and Policy Rule Prescriptions in December 2023. Top panel: Taylor Rules; Bottom panel: Balanced Approach.

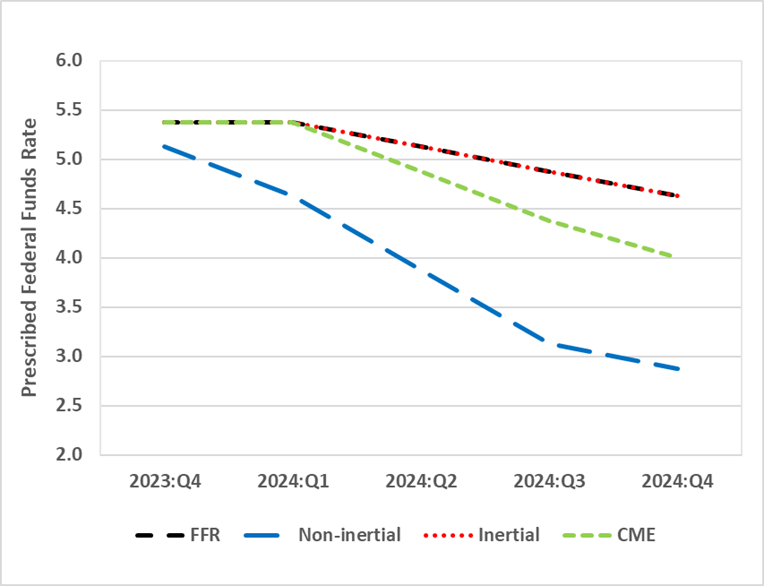

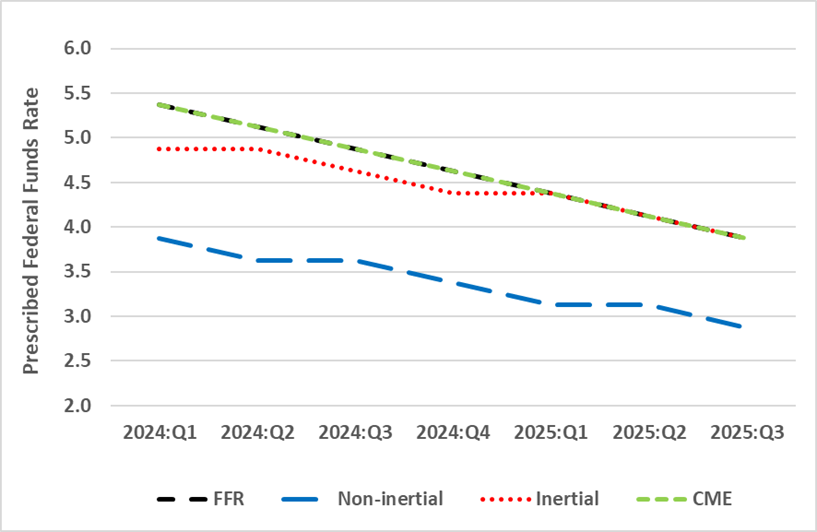

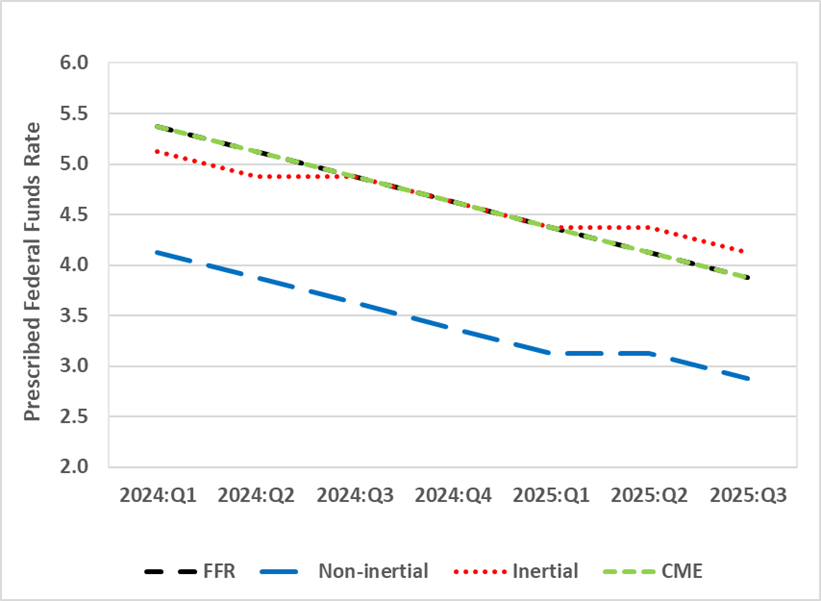

Futures markets are no longer predicting a steeper downward path for the FFR than the FFR projections. Figure 3 depicts the median predictions from futures markets described in the CME FedWatch Tool on March 21, 2024, the day following the March 2024 FOMC Meeting, through the end of the CME prediction horizon in September 2025. The markets are completely in accord with the FOMC, as the futures market predictions are identical to the FFR projections. The change from December 2023 to March 2024 is entirely due to the change in the CME predictions, as the FFR projections through December 2024 are unchanged. The markets have caught up to the Fed and not vice versa.

We add to this discussion by including prescriptions from policy rules. Figure 3 shows that, for both the Taylor and balanced approach rules, the prescriptions from the inertial policy rules for March 2024 through December 2025 are close to the (identical) FOMC projections and CME predictions. In contrast, the prescriptions from both non-inertial policy rules are considerably below the FOMC projections and CME predictions for the same period. Comparison between futures market predictions and policy rule prescriptions depends on the choice between inertial and non-inertial rules but not on the choice between Taylor and balanced approach rules.

Figure 3: The FFR, CME FedWatch Tool and Policy Rule Prescriptions in March 2024

Top panel: Taylor Rules; Bottom panel: Balanced Approach.

This post written by David Papell and Ruxandra Prodan-Boul.

Off topic, and just for fun – Keynes as a currency trader:

https://www.cambridge.org/core/journals/journal-of-economic-history/article/abs/if-youre-so-smart-john-maynard-keynes-and-currency-speculation-in-the-interwar-years/EDE2AA44C9394C69B54283D052B96B1E

His Sharp ratio wasn’t great.

” the ½ percent neutral real interest rate from the current SEP.”

Now what was Larry Summers saying about this rate? Oh yea – he thinks the real natural rate is closer to 1.5%. Some at the FED have suggested it is closer to 1%. In any case, the FED should lower nominal interest rates this year.

Larry Summers has been a conclusion justifications for a long time. But he is too full of himself to understand how embarrassing that is for him as a proported academic scientist.,

I have too much time on my hands…

Off topic – China, the Philippines and the U.S.:

Pardon the source, but it’s worth some thought:

http://www.foxnews.com/world/wwiii-could-start-philippines-dispute-south-china-sea-china-not-respecting-treaties-expert-says

Talk of war isn’t simply hyperbole on the part of pundits. China’s mouthpiece news outlet has threatened the Philippines with war:

https://www.memri.org/reports/chinese-media-outlet-warns-world-war-iii-may-break-out-south-china-sea

Fox News treats the U.S. warning to Beijing against military action as new, but we’ve been warning Beijing for nearly a year, based on a treaty that has been in place since 1951:

https://apnews.com/article/china-beijing-antony-blinken-philippines-manila-5b56ae40db4ddbcd5b98e67f1007c0fd

And what do you know, Yellen goes to China while the U.S., the Philippines and Japan are engaged in a joint military exercise in the South China Sea, and she isn’t trying to smooth feathers. China seems to take Yellen more seriously than Blinken or Austin (maybe I’m projecting), and her record for getting the attention of Chinese leaders is good.

Biden has just called Xi, and both sides tried to sound as if the relationship has improved from rock bottom. That’s not unusual – “get better” or “get worse” are really the only options, and “worse” would be bad for everybody.

Next-to-worst-case, China says “give us Taiwan and we’ll back off the Philippines.” That would be a dumb deal, but there’s an election in November.

In other news – share prices for Trump Media keep falling:

https://www.msn.com/en-us/money/markets/truth-social-nasdaq-djt-plummets-to-open-week/ar-BB1lhy7M?ocid=msedgdhp&pc=U531&cvid=d0d73095477e418fb28e87beab82579b&ei=12

But another report emerged noting that Congressional Republicans aren’t buying in. So far, only two lawmakers—Rep. Larry Bucshon (R-Ind.) and Rep. Marjorie Taylor Greene (R-Ga.)—have picked up shares. And reports even noted that Greene—one of the former president’s biggest enthusiasts in Congress—has already dropped her shares, perhaps sensing potential trouble ahead.

Trump Media’s audit firm is exactly what you’d expect:

https://fortune.com/2024/04/08/donald-trump-media-accounting-firm-bf-borgers-audit-deficiency-truth-social/

A 100% deficiency rating from an audit watchdog, and a bucket full of regulatory troubles.

Not sure it’s still true, but reports from early days indicate Trump Media is the most expensive U.S. traded stock to short. Over a buck a day per share. Why that’s the case, I can’t say. But assuming it’s still true, that means Trump media, which has now lost it’s entire issuance bounce, has been under less shorting pressure than could have been the case. Even so, at a dollar a day you’d have made a killing shorting the thing near the high.

Supply and demand is why Trump Media is expensive to short. It may be short sellers’ demand for shares to borrow that’s propping up the stock at the level it is now. It’s a penny stock at best, based on the fundamentals I have seen.

This may be their third financial auditors. From their 10K filing:

During the submission period for the 2022 Form 10-K, Digital World’s management had provided all Digital World Board meeting minutes up until December 31, 2022. This was consistent with both Digital World’s prior practice and Marcum’s requests in previous audits. Thus, Digital World’s new management understood Marcum’s request for review to only relate to the Digital World Board meeting minutes for fiscal year 2022, which were duly submitted. In April 2023, Digital World’s submitted all available Digital World Board meeting minutes for fiscal year 2023. Since Marcum did not make any follow-up requests on such minutes, Digital World’s management incorrectly concluded that the request had been fulfilled. A copy of Marcum’s letter of resignation is filed as Exhibit 16.1 to this 10-K. On August 8, 2023, Digital World engaged Adeptus as its independent public accounting firm to audit its consolidated financial statements for the fiscal years ended December 31, 2023, 2022 and 2021 and to review its quarterly consolidated financial statements beginning with the first quarter of the 2022 fiscal year.

Marcum is a 3rd rate firm and almost no one has ever heard of Adeptus. Even the bottom of the barrel was too good for Trump so he hired these new clowns.

But most of BF Borgers’s clients, such as Lingerie Fighting Championships Inc., a mixed martial arts league, are significantly smaller than Trump’s media business.

Trump was probably attached by the idea that this client did lingerie as in woman’s clothing. Something tells me that almost anyone of their fighters could take Trump in less than 15 seconds.

I’m not going to provide a link to any of the youtubes that come up when one Googles ‘Lingerie Fighting Championships’ as watching a couple of them was rather embarrassing for someone who actually appreciates boxing and martial arts. Something tells me that our host would not allow such youtubes anyway.

Now if one is into hot chicks doing fake wrestling while wearing practically nothing – go for it. Just Trump’s style.

The Cleveland Fed has an interesting Excel spreadsheet download that may compliment this post. The spreadsheet allows for some DIY computations.

https://www.clevelandfed.org/indicators-and-data/simple-monetary-policy-rules

https://twitter.com/EliotJacobson/status/1776630175855530072

‘Global sea surface temperatures seem to not understand that they have passed their peak and should be going down. The mean date for the Spring SST maximum is March 22nd.’

My takeaway is that there is some chance the Fed will be keeping the FFR too high in 2024, with the gap growing progressively from Q2. The projected FFR appears to hew closer to inertial rules. The downside of such an approach is that the Fed will be late too adjust, with a tendency to allow an inflation overshoot on the upside, and the risk of too tight policy and a recession on the downside. This is not entirely inconsistent with Hanke’s view, I think.

Wait – our resident monetarist is saying monetary policy is too tight. Maybe you have not noticed but GDP/M2 is near 1.35 – way above Stevie pooh’s alleged mean reversion nonsense.

Let me add that these P&P analyses have become some of my favorites at Econbrowser. Very clear, easy to follow, with a comprehensible view of appropriate monetary policy. I can form a view of monetary policy when I read them.

Wait – you are finally reading something economic related for a change? Did the earth stop rotating or what?

But P&P never mentioned Kopits’ new groundbreaking economics terminology. What up wit dat??