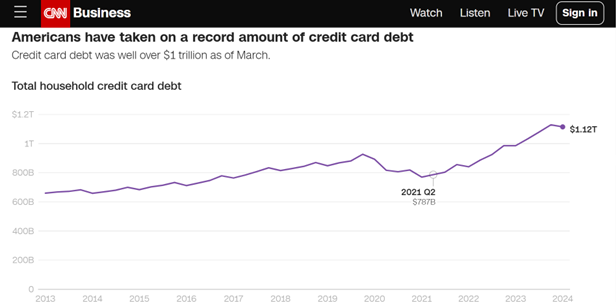

CNN published an article today, entitled “What’s really happening in America’s economy”. Most points are conventional, but one graph was interesting – credit card debt:

Source: CNN.

Besides the usual complaints that this number was not normalized by disposable personal income, or GDP, this struck me as a funny indicator to glom onto. Here’s normalized credit card debt along with delinquency rate.

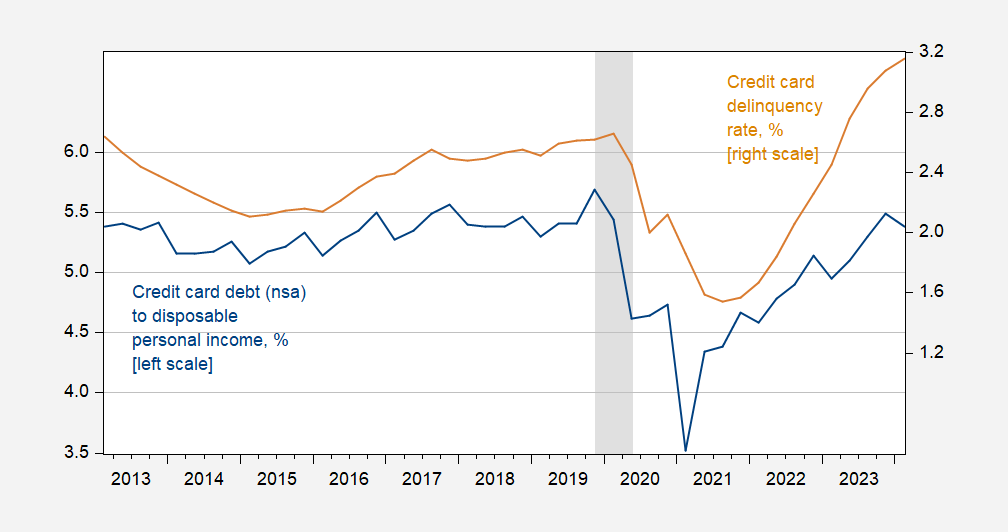

Figure 1: Credit card debt (n.s.a.) to disposable personal income, % (blue, left scale), and credit card delinquency rate for all commercial banks, % (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed; Federal Reserve Board and BEA via FRED, NBER, and author’s calculations.

So credit card debt normalized is going down in Q2, but delinquencies are rising. This suggests that something is going on, for some segments of the population, even while household debt-to-GDP and household debt service to disposable income ratios are falling.

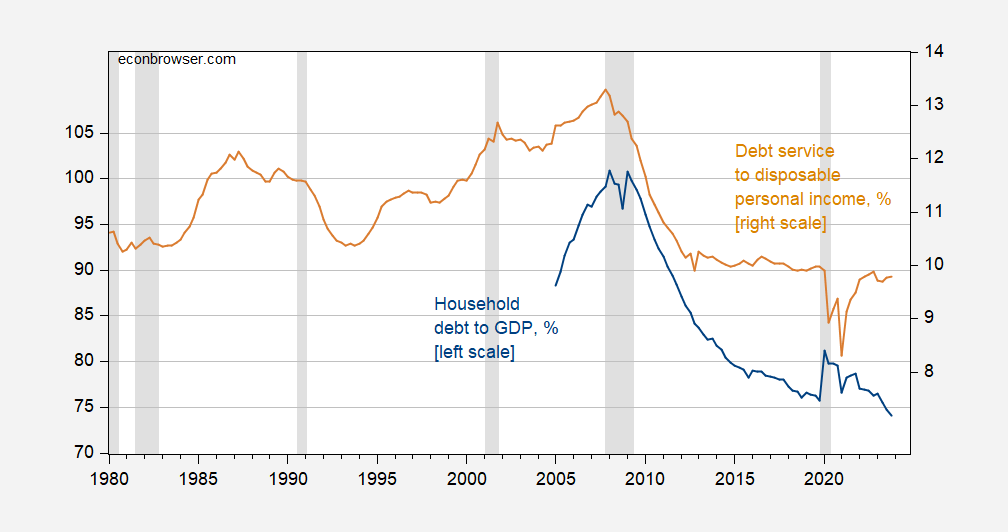

Figure 2: Household debt to GDP, % (blue, left scale), and debt service to disposable income rate, % (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: IMF via FRED, Federal Reserve Board via FRED, NBER.

Debt service might be constant even as interest rates rise due to the pervasiveness of fixed rate mortgages. So, credit woes are likely more pressing for some income segments than others.

This night owl loves the late night posts, especially before a tornado day. Got me about 6-7 super awesome books today at Goodwill, most between $2–$3 dollars, other than 1 book I decided to put into one of those “Little Free Libraries”?? https://littlefreelibrary.org/

It was both a written and audio book on the Brothers Grimm Fairy Tales. It was $4.99, two dollars more than the other books. but I wanted to “give back” to it because I had taken quite a few books out of those these last 2 years or so. Some others From Goodwill there’s a high chance I will give away but at least want to skim read first. The one I usually go to, it has Bibles (good) Children’s books (good) usually 2 waterlogged books (people using it as their personal garbage can, zero class, should sit in a jail cell for a week solid), and someone keeps putting gem cutting books in there (I guess that’s ok if it’s still a viable work trade). I hope some kids can get their hands on these Brothers Grimm stories. It’s a poor neighborhood. Not like “Ghetto poor”, but, pretty close to white trash, maybe just short, we can call it “low-level working class”. But some kid, or maybe some siblings could get their hands on it, understand most of it, learn from it, and it sparks their imagination. I just hope that’s what happens and some jerk kid doesn’t vandalize it before someone can read it. But most of the time the books seem to stay put there, so……..

This post seems to kill one of my stronger armchair economist working theories for year-end 2024. Hmmmph…..

https://www.kansascityfed.org/research/economic-bulletin/consumer-debt-is-high-but-consumers-seem-to-have-room-to-run/

Dang Man, Menzie making me feel like I’m Boomhauer on “King of the Hill”. That’s cold man, that’s cold.

Jason P. Brown is a vice president and economist at the Federal Reserve Bank of Kansas City. Colton Tousey is a senior supervisor at the bank.

At least Brown and Tousey bothered to express debt in real terms which was a glaring omission in that CNN fluff piece. And they also did this relative to income.

Yeah, I guess I was just reiterating Menzie’s thoughts with the KCFR post because I knew they could say it better than I can. But I had seriously thought consumer debt would/will cause a major issue late 2024, and Menzie’s (correct) take kind of puts a large pail of cold water on that contention.

Here’s another interesting take.

https://bondvigilantes.com/blog/2024/05/cracks-in-the-armour-of-the-resilient-consumer/

The stuff about 401k withdrawals and “Affirm” are data points I would guess that are not on many people’s radar. It still speaks to household savings being lower than we are generally being told. I saw two wicker style patio chairs and a small center table being sold for $499. That’s not including tax. Over $500 for two damned wicker chairs and a tiny 1 foot radius table. When I saw that at Home Depot this morning, I thought either I have lost my mind or the American consumer has. One or the other. Either/Or. You be the judge. I ended up spending $10.35 for two grave decorations and got the F— out of Dodge.