In the Fed’s recent examination of the differential recovery in the US as compared to the Euro area, UK and Canada, I was surprised that immigration did not make a bigger appearance, given my views.

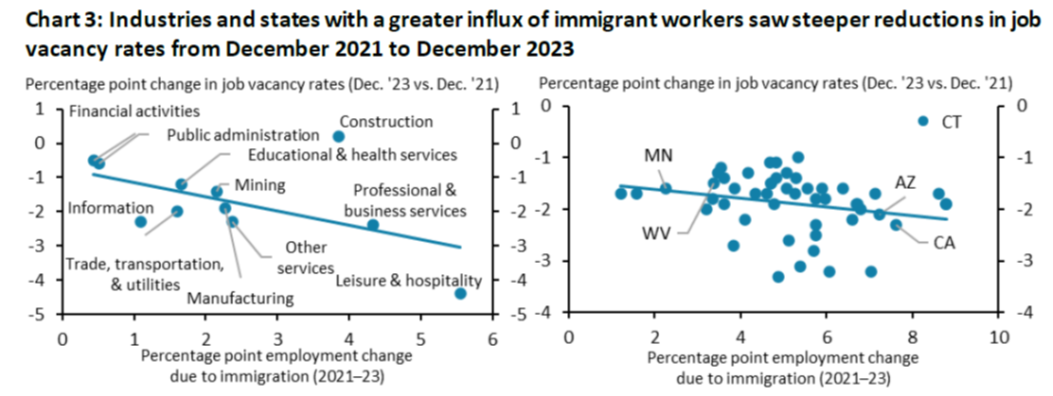

The KC Fed has just provided some insights into how immigration helped increase slack in the labor market (h/t Torsten Slok).

Source: Cohen/KC Fed (2024).

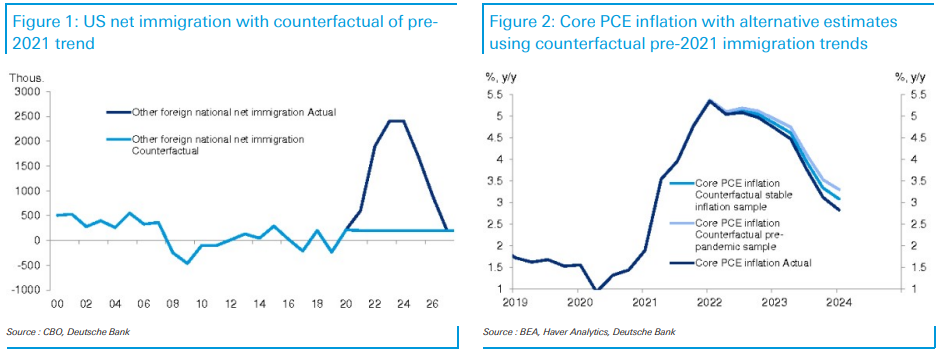

Deutsche Bank has taken a stab at assessing the impact of immigration on inflation by reference to a counterfactual.

Jim Reid at DB writes:

The conclusion [of Justin Weidner’s piece]: the labor market would have been substantially tighter if not for the uptick in immigration. A tighter labor market in the absence of immigration would have led to higher inflation. Using two inflation models, our economists find that core PCE inflation likely would have been 25-50bps higher (see second chart below), though they admit to meaningful uncertainty around these estimates. Immigration was clearly not the only disinflationary force for the US economy over the past year – to be sure, core PCE inflation fell 200bps in 2023 – but it was an important contributing factor

For an earlier discussion of labor force dynamics and immigration, see Edelberg and Watson (March 2024), and the longer term implications in CBO (2024).

Off topic, but related to a couple of recent topics – BofA’s aworkplace Benefits Report for 2024:

https://business.bofa.com/en-us/content/workplace-benefits/workplace-benefits-report-overview.html

The report shows several areas of improvement in workers’ outlook, including employment satisfaction and retirement prospects.

The gender gap has widened, which may help to explain why mire men than women express satisfaction with employment. Inflation remains a big concern.

“The conclusion [of Justin Weidner’s piece]: the labor market would have been substantially tighter if not for the uptick in immigration. A tighter labor market in the absence of immigration would have led to higher inflation.”

Now Trump just told a Bronx audience that he would deport 20 million brown and black people (hey I never know the Bronx abhorred so many members of the KKK). Now that would lead a massive labor shortage and some really high inflation rates. MAGA!

Exactly. On immigration GOP don’t want a solution they want the problem. It’s like with crime – the problem is a great tool to scare the sheeple into voting against their own interests.

Unemployment of late has edged up. Now this is not due to a drop in the employment to population ratio but rather a rise in labor force participation rate. But I can under the renewed interest in the Claudia Sahm rule so I decided to see what she has been saying of late:

https://stayathomemacro.substack.com/p/the-labor-market-is-strong

‘Those who want to trash today’s labor market will have a hard time doing so if they stick to the facts. In today’s post, I debunk some of the usual suspects from the haters on the right and left. Here are the main takeaways:

Recent gains in part-time work are good and necessary.

Immigrants have been key to resolving labor shortages and boosting growth.

Official statistical agencies give us the best read on people’s lives.’

Huh – takeaway two relates to this post so let me give the microphone back to Claudia:

‘The rise in unemployment in some states reveals how immigrants are helping address labor shortages.

What starts as a seemingly ‘bad news’ story of some states seeing a rise in unemployment actually has a ‘good news’ story at its core. First, why is it important to look at the states when talking about the US economy? No one lives in “the economy.” Life is local. Life is at our kitchen table and in our community. The macroeconomic data ‘roll up’ the local conditions to give a representative view of the United States. It’s important, though no one person lives it. Even policymakers tasked with decisions for the country should keep an eye on local conditions. Often, a local economy truly is only local, but sometimes, it tells us where the national economy is or is headed before the macroeconomic data. What do we see now locally? The unemployment rate has increased notably in several states.2 Specifically, as of February 2024, the unemployment rate in 21 states had risen by 1/2 percentage point or more. The average increase was 0.7 percentage point, and these states had been, on average, 6 months above 0.5 percentage point. In contrast, the national unemployment rate had increased by 0.30 percentage point signaling no recession according to the Sahm rule. It is highly unusual to have such a large, lengthy, and widespread discrepancy between the state and national unemployment data. As I argue in a Bloomberg Opinion piece, a rising unemployment rate can be good.

Although this may appear dire, the increase in unemployment rates stem partly from the strength of the economy the past few years, strength that has attracted much needed immigration to meet the demands of a hot labor market. According to the Congressional Budget Office, net immigration totaled 2.6 million in 2022 and 3.3 million in 2023, rising from an average of 900,000 a year from 2010 to 2019.

As immigrants enter the economy, especially in large numbers, it can take them time to find work — likely even longer than US-born new entrants to the labor force. Moreover, immigrants have higher labor force participation rates overall than US-born individuals. The immigration process itself can create delays in legal employment, especially for humanitarian parolees and asylum seekers. More generally, an increase in the labor force has been long understood to be a “good” reason for why the unemployment rate temporarily rises as new workers find jobs.

Several analysts have attributed some of the upward drift in the US unemployment rate since mid-2023 to an increased labor force. It often takes time for new entrants to find jobs. A rapid increase in the labor force temporarily pushing up unemployment is the main reason I gave last year for why the Sahm rule might ‘break.’ That means that US unemployment would rise to 4% or slightly above for some time, but as the new entrants find jobs, it moves back down. So, the Sahm rule would trigger but with no actual recession.

Several states have seen a notable rise in their unemployment rate without a US recession. So what’s going on? Rather than gloom and doom, it appears to be a sign of immigration. A key insight is that immigrants are not spread evenly across the country. Typically, they move to areas with large immigrant populations. And that’s exactly what we see. The top three states by immigrants as a fraction of the state population have seen large increases in the unemployment rate.’

She had more to say but you get the idea!

The devil’s in the details. Look which groups have declined the most. Who is it most likely that unskilled people with poor English skills will replace? What led to the decline in the groups most affected?

https://www.bls.gov/emp/tables/civilian-labor-force-participation-rate.htm

By decade? Oh come on Bruce – it’s not that we would take you seriously anyway? But damn – your incessant stupidity just burns.

BTW – word is that you will be writing for VDARE. Just your kind of thing. Let us know when they put up your first post.

“Who is it most likely that unskilled people with poor English skills will replace?”

Just say it – brown people speaking languages no one ever heard of. Trump says it plainly. You can too!

Wait, wait. The white rate fell more from 2012 to 2022 than the Hispanic and the black rate ROSE over the decade. Hey Brucie – we have been over this before. TRY READING your own damn links before making a false and racist claim.

Or check out this neat graph showing year by year comparisons:

https://www.bls.gov/blog/2023/expanded-data-for-detailed-hispanic-or-latino-groups-now-available.htm#:~:text=The%20overall%20labor%20force%20participation%20rate%20for%20everyone,widely%20among%20the%20Hispanic%20or%20Latino%20ethnic%20groups.

Seems those Hispanics you love to trash work harder than you ever have.

“UK has not grown in 5 years. EU little growth.”

That these nations discourage immigration – me thinks you just contradicted your opening sentence.

You have been presented with Claudia Sahm’s analysis of the data. You respond with “I donʻt think…” You don’t seem to understand how this game is played.

There are guys perched on barstools all over the world, telling anyone unlucky enough to be within earshot what they think. Those thoughts are not published in economic journals. Nor do unfortunate bystanders often walk away thinking “what insightful analysis”.

The game of economics is played with evidence and reason. Mere assertion of evidence generally does not score any more points than “I think…”

So, got any evidence?