Reader Bruce Hall wishes for any discussion of the impact of trade policies include displays of the manufacturing sector’s progress, over the maximally long period. Here, without further ado, is what I could gather quickly.

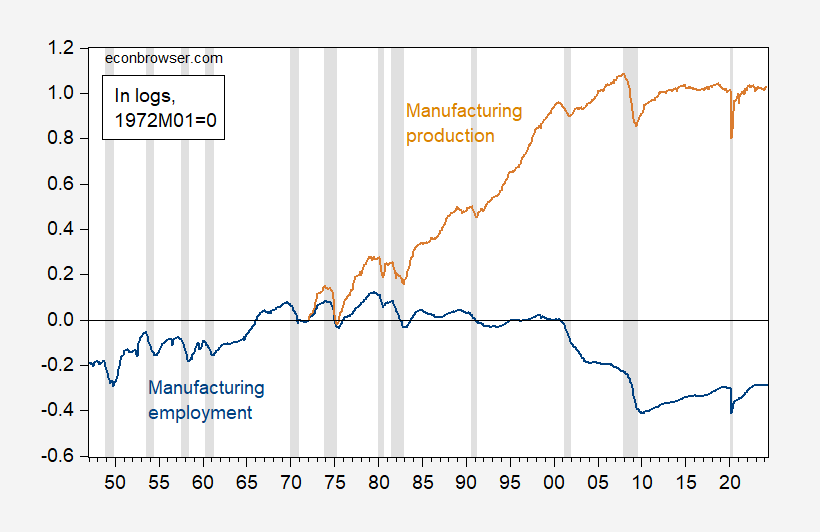

Figure 1: Manufacturing employment (blue), and manufacturing production (tan), both seasonally adjusted, in logs, 1972M01=0. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Federal Reserve via FRED, NBER, and author’s calculations.

and for a shorter period:

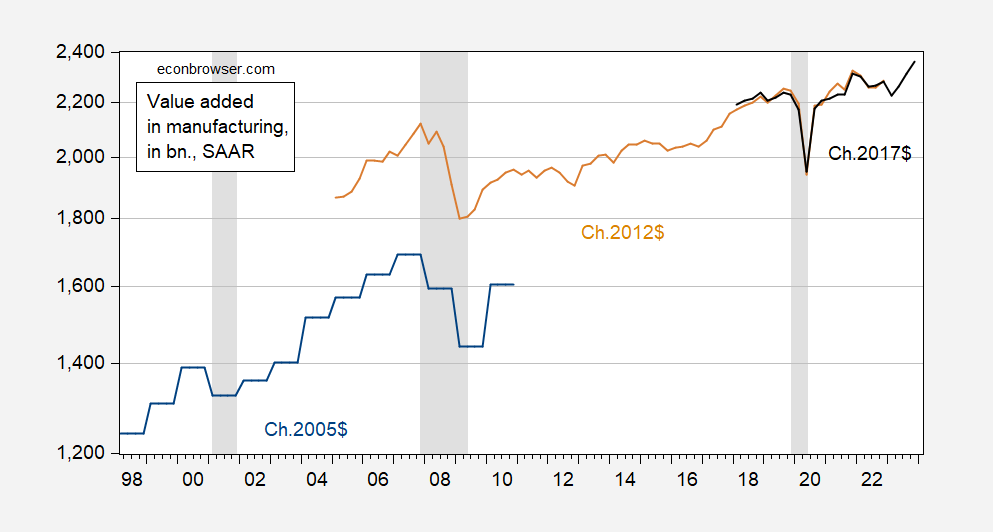

Figure 2: Value added in bn. Ch.2005$ (blue), in bn.Ch.2012$ (tan), in bn. Ch.2017$ (lack), all SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA via FRED, NBER, and author’s calculations.

While total manufacturing employment is just above pre-trade war levels, and (gross) manufacturing production is just about even, real value added is far above. And value added is far above what it was when China joined the WTO.

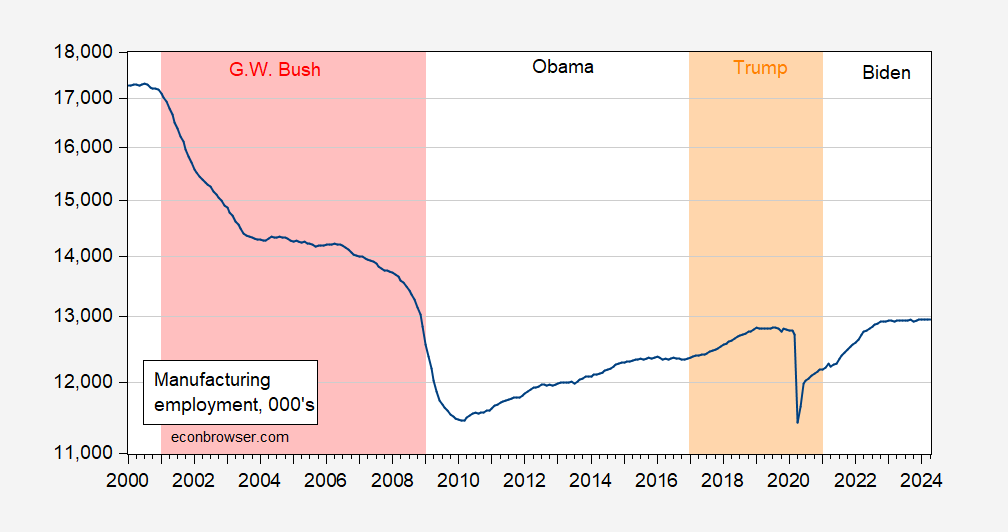

Addendum: When did big employment reductions occur:

Figure 3: Manufacturing employment, 000’s, s.a. (blue). Source: BLS via FRED.

I think the one thing that is beyond debate. Bruce Hall babbles a lot of meaningless nonsense. Not clear is whether some retarded AI has taken over his computer or whether he is just cutting and pasting Truth Social tweets.

“When did big employment reductions occur”

It is labeled Bus43 but it is also the period when trade was opened up with China. You note that. I have noted that. Paul Krugman has noted that. David Autor dubbed this period the China shock.

I say this only because Steven Koptis keeps suggesting we have all ignored that. Which of course is a disgusting lie. Then again Stevie has “do you know who I am”!

Speaking of trade war:

https://cepr.org/voxeu/columns/how-geopolitics-changing-trade

China Depression, clear as day.

Btw, given you thought the Trump trade war as bad for manufacturing, you should have the same expectation for the trade war Biden announced today, I would think.

Steven Kopits: Trump applied tariffs to about $420 bn worth of goods (2018$) Biden applied tariffs to about $18 bn (2024$). Can you do math?

“Can you do math?”

That’s an easy question. NO, no he cannot.

And here’s the interesting thing. You would think the rise of China should force US manufacturing into higher productivity areas. But that’s not what the data says, with US manufacturing productivity down from both 2011 and pre-covid days.

https://fred.stlouisfed.org/series/OPHMFG

Manufacturing Sector: Labor Productivity (Output per Hour) for All Workers ROSE during the period when China started exported a lot more goods to the US. A person with a functioning brain would not challenge “the rise of China should force US manufacturing into higher productivity areas”. But you did. Then again your brain stopped functioning decades ago.

Steven Kopits: And here I thought China entered the WTO in 2001, when we granted PNTR. Shouldn’t we calculate output/hour relative to 2001? Why 2011, of all dates?

You might note a downturn in output per hour in manufacturing starting …about 2018Q2. Gee wonder what happened then? Standard theory regarding outsourcing/offshoring and value chains suggests that productivity (in the absence of distortions) will reduce productivity levels.

“You would think…”

Why? I mean, maybe YOU would think it, but someone more familiar with the workings of the economy would not. Anything “you would think” but which is not consistent with the data is probably not what those with a wider understanding would think. Isn’t that what the pattern of your comments shows?

So please, why would you think that?

Here’s the index of weekly payrolls for manufacturing:

https://fred.stlouisfed.org/graph/?g=1nWZU

This index accounts for both employment level and hours. As of April, the index was at its highest level on record. How that squares with the decline in factory employment is a mystery to me. Anybody?

An interesting series. That it is not seasonally adjusted can be taken care of by presenting the data on an annual basis rather than monthly. When I do that – Bruce Hall’s original chirping falls apart. Yes this series rose just after Trump took office but no faster than during the Obama recovery (which Trump caught the tail winds). But the year after the stupid trade war started was clearly downward. And this series has been growing strongly under Biden.

Brucie’s response? Change the subject and muck up the discussion so no one remembers his original chirping.

Krugman is doing an interesting defense of the Biden targeted tariffs:

https://www.nytimes.com/2024/05/14/opinion/china-imports-tariffs-biden.html

Basically he is saying that unless we make sure alternative energy produce substantial numbers of jobs in the US, we may fail to build the political support that would ensure it’s sustained. So cheeper Chinese batteries, cars and solar panels would help in the short term but also fail in the long term (when the oil industry begin talking bout how it’s killing the jobs they provide in the US).

In either case we have to worry about competitiveness of US in the long term. If we get saddled with an expensive electric grid (say $80-100 MWh) and other countries build grids that deliver electricity at half that price (solar and wind at $40-50 MWh), the US will be much less competitive. Remember that the plants you build now will determine the price you pay the next 25-40 years until that plant is retired.

Also remember that the fuel cost of your plant is unpredictable for hydrocarbon plants but ZERO for wind and solar. After the solar/wind plant is build, the cost of electricity is the cost of locked in loan payments. For hydrocarbon plants its the loan payments AND the cost of fuel. Those who have experienced gasoline prices in the past decade know how unpredictable fuel cost can be. Price stability in itself is worth an extra cost for many businesses. Not surprising that a lot of companies are buying into the green energy and carbon neutrality concept.

“Preparing for the Second China Shock” is an interesting title since Princeton Steven “do you know who I am” Kopits claims that people like Krugman never recognized the first China shock. Stevie indeed is one arrogant stupid liar.

To understand what I’m talking about, it helps to review some economic and intellectual history.

China’s exports of manufactured goods to the United States surged beginning in the 1990s. I think it’s fair to say that most economists, myself included, weren’t initially too worried by this development. There’s an old line in economics that if another country wants to sell you a lot of useful stuff at low prices, you shouldn’t protest — if anything, you should send them a note of thanks.

OK, even the most orthodox of economists knows that it isn’t that simple. Cheap imports may make a nation as a whole richer, but they can also hurt significant numbers of workers. There was in fact a fierce debate in the 1990s about whether imports from low-wage countries were a major reason for rising U.S. income inequality, with most economists — again, myself included — agreeing that imports were a cause of rising inequality, but not the main cause.

It has also been clear for a long time that trade deficits can be damaging if the economy is persistently depressed, with insufficient demand to produce full employment. This wasn’t a big issue for most of the initial era of surging imports from China, but it did become an important consideration after the 2008 financial crisis, which kept U.S. employment depressed for years. For what it’s worth, during that era I became quite hawkish on China, unsuccessfully urging U.S. policymakers to threaten tariffs unless China acted to reduce its trade surplus by increasing the value of the yuan. But that concern gradually faded away.

However, the economic debate shifted after the 2013 release of a study by David Autor, David Dorn and Gordon Hanson, titled “The China Syndrome,” which later became more widely known as “the China shock.” The authors estimated that Chinese imports had displaced around 1.5 million U.S. manufacturing workers between 1990 and 2007. That in itself isn’t that big a number in an economy as large and dynamic as ours: In fact, in America, around 1.5 million workers are laid off or discharged for one reason or another every month.

But what Autor et al. pointed out was that many U.S. industries are highly localized geographically, so the job losses due to imports, while they looked small on average, were devastating to many communities. I like to use the example of the furniture industry, which probably lost several hundred thousand jobs to Chinese imports. Nationally, that’s a rounding error. But the furniture industry was concentrated in the North Carolina Piedmont region, so the import surge ripped the heart out of local economies like that of the Hickory-Lenoir-Morgantown metropolitan area.

A little history that Princeton Steve denies and some economics that is WAY over Bruce Hall’s pea brain.

Thanks for the NYTimes. For those who cannot get past that damn firewall, here’s the rest (not that Bruce Hall will understand a word):

So the first China shock was a real problem, and even generally pro-free-trade economists — economists who have no sympathy for crude, Trump-style protectionism — now worry about the effects of rapid increases in imports.

But wait: Why do I say the first China shock? Because there’s now clearly a second China shock building.

This new shock largely reflects China’s weakness rather than its strength. The Chinese economy is in trouble. Consumer spending is very low as a share of national income, and the high levels of investment spending that used to fuel the economy have become unsustainable as a declining working-age population and slowing technological progress lead to diminishing returns. China was able to mask these problems for a while with a huge housing bubble and a bloated real estate sector, but that game appears to be up.

The obvious solution is to transfer more income to households, strengthening consumer demand. But Xi Jinping, China’s leader, seems weirdly unwilling to do the obvious, still focused on production rather than consumption. I’ll leave it to China experts to explain this reluctance — is it geopolitics? Fear that the Chinese people will become lazy?

Whatever the ideology or strategy behind China’s refusal to increase consumer spending, the only way out given that refusal is to run giant trade surpluses, dumping the stuff China produces but can’t or won’t consume in other countries’ markets.

But what the Biden administration is basically saying is: No, you don’t get to do that. You’re too big a player in the world economy to dump the results of your policy failures in other countries’ laps.

Why can’t the United States just accept cheap goods from China? The concerns about community disruption caused by the first China shock still apply. But there’s also a new issue: climate change. The goods being subjected to new or increased tariffs are mainly products associated with the transition to green energy; electric vehicles have been getting the most press, but giant batteries — which are now starting to play a crucial role in solving the problem of renewable energy intermittence (the sun doesn’t always shine, the wind doesn’t always blow) — are an even bigger deal.

Why not just buy cheap Chinese batteries? Political economy. Given the existential threat posed by climate change, the political coalition behind the green energy transition shouldn’t be fragile, but it is. The Biden administration was able to get large subsidies for renewable energy only by tying those subsidies to the creation of domestic manufacturing jobs. If those subsidies are seen as creating jobs in China instead, our last, best hope of avoiding climate catastrophe will be lost — a consideration that easily outweighs all the usual arguments against tariffs.

So in imposing these new tariffs, Biden’s people are doing what they must. I don’t see any alternative.

Another little piece on the batteries is the fact that new Sodium Ion batteries have a large number of advantages and likely will replace the Lithium based batteries for industrial scale use (and possibly in cars).

https://newatlas.com/energy/natron-sodium-ion-battery-production-startt/

“While its energy density lags behind lithium-ion, advantages such as faster cycling, longer lifespan and safer, non-flammable end use have made sodium-ion an attractive alternative, especially for stationary uses like data center and EV charger backup storage”.

“Natron says its batteries charge and discharge at rates 10 times faster than lithium-ion, a level of immediate charge/discharge capability that makes the batteries a prime contender for the ups and downs of backup power storage. Also helping in that use case is an estimated lifespan of 50,000 cycles”

The US has a huge supply of the type of Sodium used for making batteries and could become a major world supplier of this type of batteries. However, China has gotten a head start on us and could corner the markets if we don’t help out our domestic producers. As a sideline; if you give that Tesla battery a 10 times faster discharge it would become a rocket.

Which is why I questioned the value of employment in manufacturing and alluded to the impact of automation. I realize pgl cannot comprehend how such an important metric as manufacturing employment could be irrelevant to the importance of manufacturing, but it is. Remember, this tiny debate started with the post about manufacturing employment.

https://news.mit.edu/2020/robots-help-firms-workers-struggle-0505

Interestingly, Joe Biden’s push for unions is obviusly a bit of archaic pandering. He should be pushing domestic policies that make the US more competitive with its political adversary. Government bureaucracy is the heaviest burden for US manufacturing to carry… something Chinese manufacturers don’t worry about because, well, state owned or state supported. One study:

https://www.nam.org/wp-content/uploads/2023/11/NAM-3731-Crains-Study-R3-V2-FIN.pdf

Bruce Hall: Then why not pay attention to the green line in Figure 1 in this post, when discussing the impact of the trade war. It tells an even more obvious story than employment.

But it is not the story Kelly Anne Conway wants Brucie boy to tell. He after all is her very obedient puppet.

“Robots help some firms, even while workers across industries struggle

Study finds manufacturing companies that are quick to automate can thrive, but overall employment drops.”

I’m not sure why Brucie dusted off this from 4 years ago. If production fell by more than employment after the Trump trade war started as your graph noted, maybe these robots were programmed by the likes of Bruce Hall!

Come on Brucie – you misrepresented the employment data and now you change the subject by saying what you lied about is not important? Dude – you “debate” in bad faith a lot but DAMN!

“Government bureaucracy is the heaviest burden for US manufacturing to carry… something Chinese manufacturers don’t worry about because, well, state owned or state supported.”

So Bruce Hall is now endorsing full blown Soviet style run businesses in lieu of a market economy with a few sensible regulations. Hey Brucie – maybe you can dig up Lenin’s 5 year Economic Plan as a role model for Trump’s new economic team.