Readers [1] [2] inquired why there appears to be a trend break in (log) CPI at 2022M06. My best guess is the spike in oil prices.

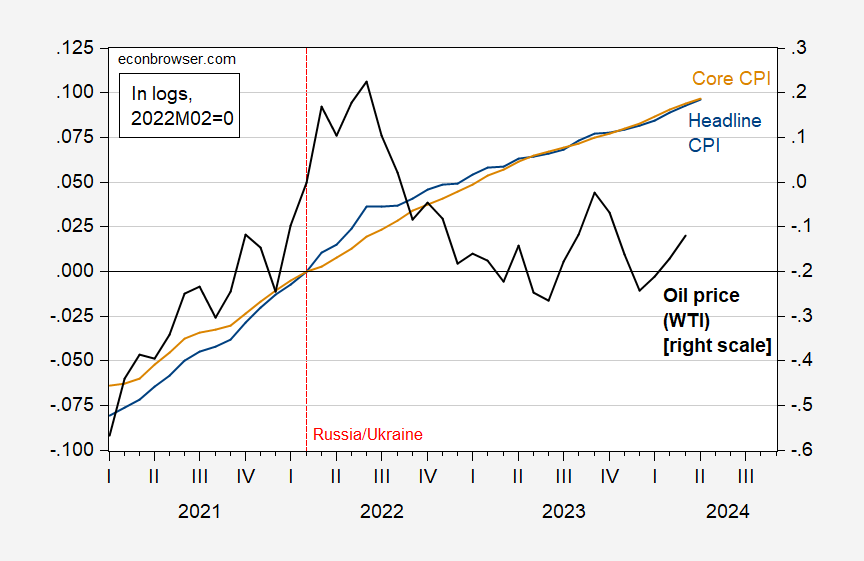

Figure 1: CPI (blue, left scale), core CPI (tan, left scale), and WTI oil price (bold black, right scale), all in logs, 2022M02=0. Source: BLS, EIA via FRED, and author’s calculations.

While the CPI trend breaks at 2022M06, matching the peak in oil prices, core CPI doesn’t such evidence. Using a unit root break test (Perron, 1997) identifies a trend and intercept break at 2022M04.

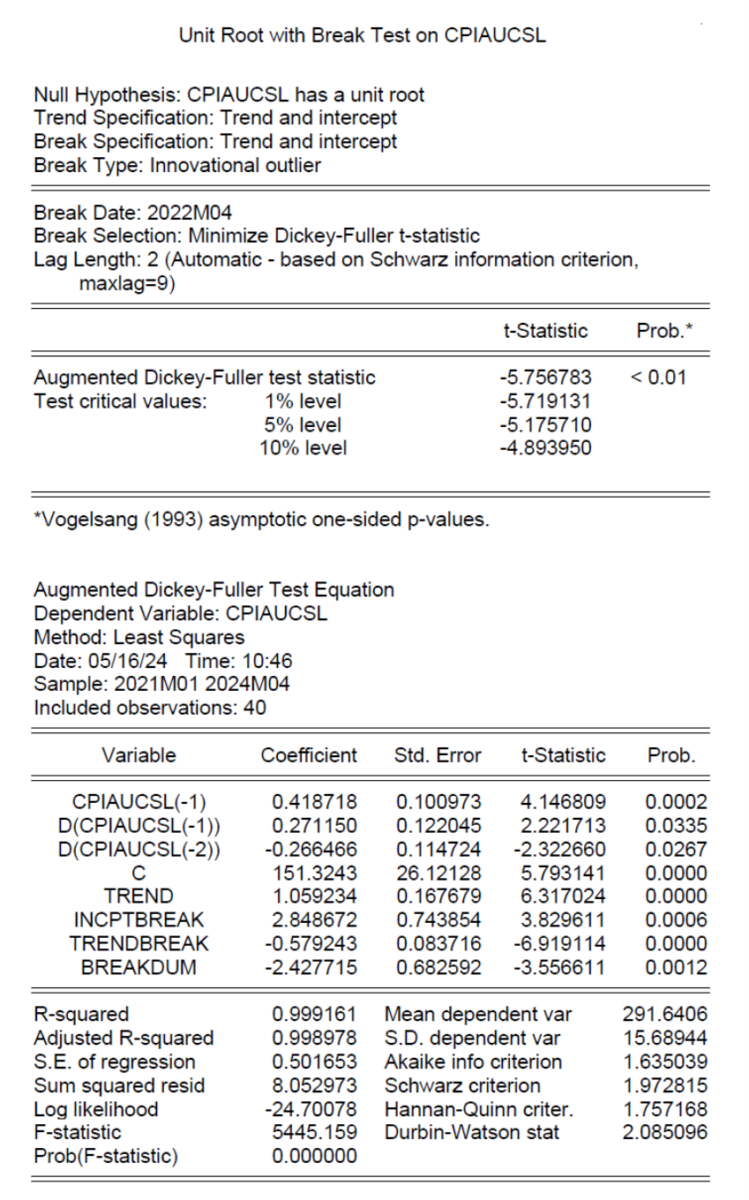

Note that there is a break in core CPI as well, although the same test finds a break at 2023M01.

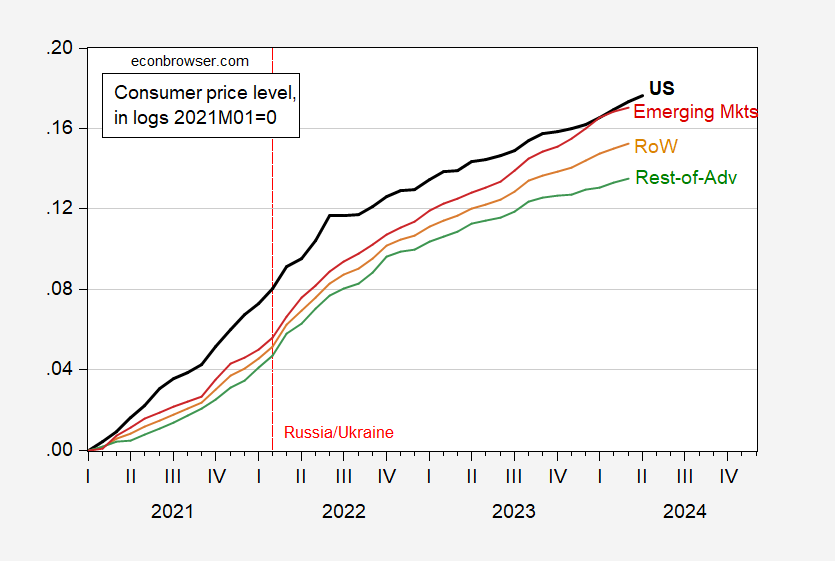

For the world, there is a similar pattern:

Figure 2: US CPI (bold black), rest-of-world (tan), rest-of-advanced countries (green), emerging markets (red), all seasonally adjusted, in logs 2021M01=0. Source: BLS, Dallas Fed DGEI, and author’s calculations.

Professor Chinn,

Using log (CPIAUCSL), I notice that the break is at 2022m05.

Usually you use log values, as you did for Figure 1 and Figure 2.

I am interested in your choice for education purposes.

Thanks

AS: I applied the Perron test default in EViews to the 2021M01-2024M04 sample. If you use a different sample or treat the lags differently, you’ll likely get a different answer. I suspect it should in any case be around 2022M04-06.

US Inflation Data Prematurely Released By Accident, Yet Traders Missed Golden Opportunity

https://www.msn.com/en-us/money/other/us-inflation-data-prematurely-released-by-accident-yet-traders-missed-golden-opportunity/ar-BB1mvFNX?ocid=msedgdhp&pc=U531&cvid=08cc84398cc1440f9f543e9637bda61d&ei=10

The U.S. Bureau of Labor Statistics accidentally released critical inflation data for April 30 minutes early on Wednesday. Yet, in a twist fit for a financial thriller, the sleeping investors failed to capitalize on this advance peek, missing out on what could have been a golden opportunity to gain from trading. On a day when microseconds can mean huge returns, the early availability of Consumer Price Index (CPI) figures should have set off a frenzy of buying and selling. The CPI data, meticulously watched by traders, highly influences global asset prices and Federal Reserve policy. Under normal circumstances, these figures are unveiled with extreme precision at 8:30 a.m. Washington time, surrounded by high security to prevent leaks. However, this Wednesday was different. “In advance of today’s CPI and Real Earnings releases, BLS inadvertently loaded a subset of files to the website approximately 30 minutes prior to the release,” the Bureau admitted in a post-incident statement. Yet the market remained oddly still, with no significant movements detected during the premature window.

Shall I pour a glass of “EMH” for anybody?? Bueller?? Bueller…….. ?? Bueller……..???

What?? You say Amos Tversky (damned Irish last names) Bourbon, vintage 1972 is better!?!?!? Ssssshhhhhh!!!!! Heretic!!!!! Roman Centurion!!!! Ernest Borgnine!!!~~eh wuhdever, take him away!!!!!!