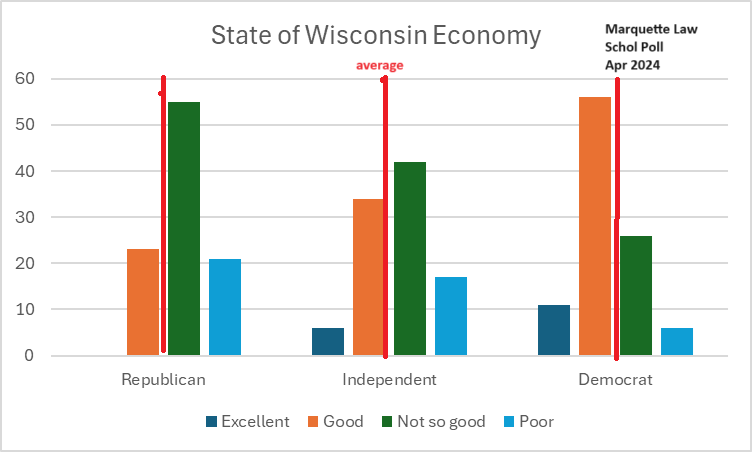

Joe Schulz of WPR: “The economy is the top issue for Wisconsin voters, but most have a negative view”:

Stephen Brown, who is moving to Oshkosh from Rockford, Illinois, said he doesn’t think the economy is as bad as Republicans say, but it’s not quite as good as Democrats say either.

While the Wisconsin economy is, by most conventional macro indicators, doing well, it is true there is a partisan divide in terms of perceptions of how well the Wisconsin economy is doing.

Source: Marquette Law School poll, April 2024.

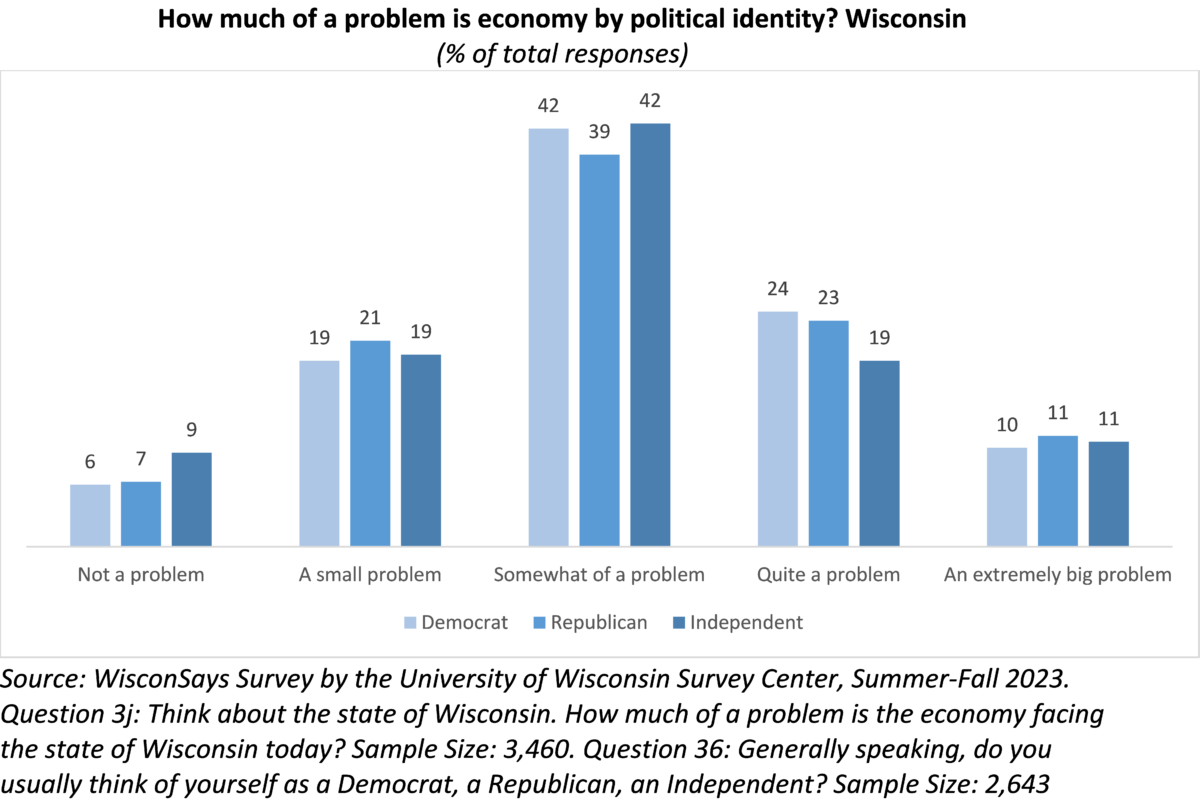

Interestingly, the WisconSays/LaFollette poll (Summer-Fall 2023) indicates that there is no partisan divide insofar as the economy is a problem.

Source: WisconSays/La Follette.

The difference in indications could arise because of timing, or because of wording (or both). My view is that the latter is more likely the source of the difference. The Marquette poll question is likely eliciting perceptions regarding the direction of the economy. The WisconSays poll question, in contrast, is likely capturing perceptions of the financial situations facing individual respondents.

A similar contrast occurs in national polls, as noted by Krugman. Since the perceived state of the economy differs from the conditions facing an individual survey respondent, the former can be heavily influenced news coverage (see Harris and Sojourner, 2024).

Republicans don’t get their opinions from facts they get them from Fox. Most are way to ignorant to look at a release of economic data and understand it. Many have been brainwashed into paranoid idiocies of evil conspiracies that falsify the data to make Biden look good or Trump look bad.

IMO – I think it is much more dependent on what media you follow and the media framing of the economy – to hear Trump/Fox News – this is the worst economy ever and gas/groceries are expensive! And the rest of the media loves their easy “grocery prices are high! interest rates are making it impossible to buy a house!” framing.

Few in the media want to bother with chasing down the human stories behind the Biden admin – “saving 426,000 Wisconsin families $30–75 per month on their internet bills thanks to the Affordable Connectivity Program”; “Canceling student debt for 44,000 borrowers in Wisconsin” ; investments in clean energy that will save users $$$ in the future; investment in rural broadband; investment in replacing lead water pipes; etc – properly functioning responsible governance is a given with the Democrats – while Trump and the GOP openly offer to redo legislation/regulations for a billion $ bride – to the oil industry – although I hope a few oil industry executives will reject committing their grandchildren to a hellish future for a few more pennies in profit and realize Trump is not in their best interest – https://digbysblog.net/2024/05/09/blatant-corruption/

(BTW – I love how circular this all is – we just take it for granted that these oil industry executives/resource extractors have a God-given right to squeeze billions in profits out of us so we can drive around in our supersize King Ranch pickups to go buy groceries – to complain about the price of groceries and gas! – and I’m not being preachy – I just think we would all be better off and healthier – if we went to the grocery store on an electric bike.)

I refuse to waste my time watching Faux News. After all – we have to endure those long winded rants from the likes of Bruce Hall, which are basically the same thing.

Blatant Corruption

Digby is correct. Now – let’s sit back and watch our two remaining trolls (Bruce Hall and Princeton Steve) defend this trash.

Did you catch how Bruce Hall claims ebikes waste energy? No data – no comparison to the energy consumed and pollution created from gas guzzling cars. It must be nice to live in little Brucie’s fact free world.

I love Digby’s close:

He served chopped steak? To wealthy oil men from whom he was asking a billion dollars?

Well – he could have served them Big Macs and French Fries!

I just think we would all be better off and healthier – if we went to the grocery store on an electric bike.

That might work for some… some of the time.

https://archive.jsonline.com/Services/image.ashx?domain=www.jsonline.com&file=31743179-mjs_weather_1.jpg&resize=660*486

I remember growing up in Milwaukee when, in winter, walking two blocks to the local A&P could get tricky going down the hill and then back up. But, sure, if you live within a block or two of a store, you don’t even need an energy-wasting ebike. Of course, these days if you pull a cart loaded with groceries around you might be mistaken for a homeless person.

As to the rest of it… somebody else should pay, right?

Poor little Brucie – he can’t take winters if the Norwegians do. They bike during the winter but not helpless Brucie.

BTW -Trump has promised Exxon et al. a complete reversal of sensible climate change policies in exchange for a $1 billion bribe. That is corrupt as it gets but I’m sure Brucie boy is applauding this corruption.

So, it was always winter when you went for groceries? Any amount of energy use is “wasteful”, even if the energy “wasted” is vastly less than for the production, fueling, maintenance scrapping of a gasoline-powered vehicle? That’s the level of thinking you bring to the debate? Not to mention the bitter little “somebody else paying” whine. You really don’t care about facts. Sad little man.

“So, it was always winter when you went for groceries?”

Brucie has not been to the grocery store since March of 2020. He makes his mommy risk her life for Brucie’s groceries.

Here’s what the FTC has said about Scott Sheffield (former CEO of Pioneer Natural Resources):

https://www.ftc.gov/system/files/ftc_gov/pdf/2410004exxonpioneercomplaintredacted.pdf

Sheffield has campaigned to organize anticompetitive coordinated output reductions between and among U.S. crude oil producers, and others, including the Organization of Petroleum Exporting Countries (“OPEC”), and a related cartel of other oil-producing countries known as OPEC+. Mr. Sheffield’s communications were designed to pad Pioneer’s bottom line—as well as those of oil companies in OPEC and OPEC+ member states—at the expense of U.S. households and businesses… Mr. Sheffield’s goal in recent years at Pioneer has been to align U.S. oil production with OPEC and OPEC+ country output agreements, thereby cementing the cartel’s position and sharing in the spoils of its market power. Mr. Sheffield has not been shy about those goals, and has instead publicly told competitors that they should be “disciplined” about capacity growth and “stay[] in line.” He further threatened: “All the shareholders that I’ve talked to said that if anybody goes back to growth, they will punish those companies.” But Mr. Sheffield did not limit himself to public signaling to U.S. counterparts— he has also held repeated, private conversations with high-ranking OPEC representatives assuring them that Pioneer and its Permian Basin rivals were working hard to keep oil output artificially low. For example, Mr. Sheffield messaged on WhatsApp … This was not a one-off event but rather part of Mr. Sheffield’s sustained and long running strategy to coordinate output reductions—Mr. Sheffield has over the past several years held repeated in-person meetings and other discussions

This represents some very blatant attempts at anti-competitive collusion all of which Steven Kopits thinks is AOK. Then again Stevie repeatedly denied there is any form of monopsony power. Yea – microeconomic and industrial organization is something little Stevie could care less about.

Trump promised to scrap climate laws if US oil bosses donated $1bn – report

Trump promised to 20 executives at Mar-a-Lago dinner to increase oil drilling and reverse pollution rules among other pitches

https://www.theguardian.com/us-news/article/2024/may/09/trump-oil-ceo-donation

Donald Trump dangled a brazen “deal” in front of some of the top US oil bosses last month, proposing that they give him $1bn for his White House re-election campaign and vowing that once back in office he would instantly tear up Joe Biden’s environmental regulations and prevent any new ones, according to a bombshell new report. According to the Washington Post, the former US president made his jaw-dropping pitch, which the paper described as “remarkably blunt and transactional”, at a dinner at his Mar-a-Lago home and club. In front of more than 20 executives, including from Chevron, Exxon and Occidental Petroleum, he promised to increase oil drilling in the Gulf of Mexico, remove hurdles to drilling in the Alaskan Arctic, and reverse new rules designed to cut car pollution. He would also overturn the Biden administration’s decision in January to pause new natural gas export permits which have been denounced as “climate bombs”. “You’ll get it on the first day,” Trump said, according to the Post, citing an unnamed dinner attendee. Trump’s exhortation to the oil executives that they were wealthy enough to pour $1bn into his campaign war-chest, at the same time pledging a U-turn on Biden’s efforts to combat the climate crisis, was immediately denounced on Wednesday by environmental groups.

“$1bn for Trump, a devastating climate future for the rest of us,” said Pete Maysmith of the League of Conservation Voters (LCV). Christina Polizzi of Climate Power told the Guardian that Trump was “putting the future of the planet up for sale”. “He is in the pocket of big oil – he gave them $25bn in tax breaks in his first term – and now it’s clear he is willing to do whatever big oil wants in a potential second term.” The former president’s exchange with fossil fuel giants also engaged the concern of groups monitoring the influence of money in politics. Jordan Libowitz of Citizens for Responsibility and Ethics (Crew), a non-partisan government watchdog, said the conversation, as reported by the Post, “certainly looks a lot like quid pro quo”. Libowitz said the encounter was “about as blatant as I’ve ever seen. Politicians often give a nudge and a wink, they don’t say raise a billion dollars for me and I’ll get rid of the regulations that you want.” He added that Crew’s legal team were looking into whether this rises to the high legal standard of bribery.

It is bribery but wait for it – Steven Kopits will defend this corruption as perfectly legal. And we know Bruce Hall is cheering Trump on. MAGA,

Biden is quadrupling tariffs on Chinese EVs to 100%. Does he really want only rich people to own EVs? It he trying to lose the election?

Don’t want to hear any more about the Trump tariffs. Biden is worse.

I’m not in favor of this idea. Of course our host might put up a post on the economic issues here. Should be interesting.

To restate:

“Don’t tell me facts. I’ve decided to believe Biden is worse than Trump.”

According to the Tax Foundation, tariff collections are lower under Biden for major categories of imports other than for China (see figure):

https://taxfoundation.org/blog/biden-trump-tariffs/

The Tax Foundation also concludes that tariffs will rise further if Trump is re-elected.

Oh, and don’t be confused by the totals stated in the article. Trump’s lower total is in part because tariffs weren’t in place when he arrived in office, as they were for Biden.

Tariffs are a tax. They’re inflationary. They’re divisive. But when comparing presidents, we really shouldn’t abandon facts.

Biden is definitely not, in any meaningful way, worse than Trump on tariffs. Trump did the most idiotic and self-defeating thing you can imagine by putting tariffs on raw materials used in making end products. Sure producers of those few raw materials (steel and aluminum) get a break, but anybody in the US using them (steel and aluminum) to make their products, get an increase in cost and become less able to compete with foreigners.

We thought it was because Trump was an idiot who didn’t know what he was doing. From what we now know about his demands for bribes (and transactional self interests), it is more likely that he demanded and got huge sums from the steel and aluminum industry and really didn’t care what he was doing to US workers and the country.

Biden’s argument for tariffs on Chinese EVs is that they are dumping EVs in order to destroy our car (EV) producers and become a foreign monopoly producing essential products for our country (the same way OPEC did). I am not able to judge the details of the price dumping argument, but it would be pretty bad if China got an OPEC like monopoly on EVs and could set prices as they pleased. A short term boast in cheep EVs followed by a long term locked-in monopoly, would not do anything good for people with limited incomes.

My guess is that the UAW will appreciate this as will anybody who have lost a job to China. At least there is a rational industrial and national security policy behind these tariffs. What they will accomplish in the long run is a bit more unpredictable. It really depends on what EU does and how well our policies are coordinated with them.

You are indeed making a rational argument for these tariffs. Does it hold water economically? I’m hoping our host gets someone who gets this to put up a blog post.

Scott Sheffield was hoping to push oil prices to $200 a barrel – the same figure Steven Kopits. No wonder Stevie has chosen to defend Sheffield’s anticompetitive antics:

https://prospect.org/power/2024-05-07-mega-donor-scott-sheffield-opec-exxonmobil/

For the past four years, the main area of inflation that has frustrated Americans the most is gas prices. The numbers have come down since their peak in 2022, but still remain stubbornly high. At first, much of the volatility was thought to be related to global disruptions from Russia’s war in Ukraine. But any outside observer could also see that the Organization of the Petroleum Exporting Countries (OPEC, led by our supposed ally Saudi Arabia) was choosing not to ramp up production and instead constrain capacity.

The Federal Trade Commission recently uncovered another underlying cause: an orchestrated plot between OPEC and an American fracking tycoon to exploit the inflationary period to push prices even higher. That was arguably even more critical to the overall price-fixing scheme, because the U.S., since the fracking boom of the mid-2010s, is the largest oil producer on Earth, and the “swing” producer with the greatest ability to move prices. This scheme cost the average American as much as $2,100 a year, according to one estimate. The orchestrator, CEO of Texas oil and gas powerhouse Pioneer Natural Resources Scott Sheffield, has used campaign contributions in Texas and Washington to amass serious influence on oil and gas policy, until now. The FTC made its discovery while reviewing a merger between Pioneer and global oil giant ExxonMobil, a deal which the commission announced it would clear last week. But as a condition for letting the merger go through, the FTC is barring Sheffield from joining the board of the combined firm, because of evidence it obtained that Sheffield colluded with OPEC at the height of inflation to fix prices. Between 2021 and 2022, Sheffield exchanged hundreds of texts, WhatsApp messages, and in-person communications with OPEC leaders to coordinate market dynamics, specifically related to slashing production and pricing. Much of the FTC documents are redacted, but in a notable exchange the commission provided, Sheffield said: “If Texas leads the way, maybe we can get OPEC to cut production. Maybe Saudi and Russia will follow. That was our plan … I was using the tactics of OPEC+ to get a bigger OPEC+ done.”His target was e xplicitly $200 a barrel; OPEC delivered on the agreement and prices soared, though never quite to that target level. OPEC is an organized cartel of Middle Eastern countries and Russia that basks in the legal immunity that a network of U.S. companies would not be granted. The alliance manages production in total coordination with one another and often uses its power to exploit global conditions. For example, OPEC has often slashed production when demand is lower to maintain the same prices and profit levels. What’s become more common in recent years though is U.S. oil barons getting in on the action by working in conjunction with their supposed competitors in the Middle East. The excess profits accrued by the industry from 2021 to 2022 reached a record high of $205 billion, which might have cost every American consumer $2,100. Sheffield’ s price-fixing scheme was the latest example of that trend. His contribution to the effects of gas price inflation in the U.S. potentially accounted for upwards of 27 percent of price increases in 2022, according to the newsletter BIG by Matt Stoller of the American Economic Liberties Project. The excess profits accrued by the industry from 2021 to 2022 reached a record high of $205 billion, which might have cost every American consumer $2,100.

Along with blocking Sheffield from sitting on Exxon’s board or in its executive suite, the FTC could still push for a criminal case against him for collusion, as Semafor reported. That would be in line with one of the first policies FTC chair Lina Khan put in place when she took over to expand the commission’s criminal referral program to more forcefully prosecute corporate crime. “The FTC has a responsibility to refer potentially criminal behavior and take that obligation very seriously,” said Douglas Farrar, spokesperson for the FTC. More important, Sheffield was singled out before his peers, an embarrassment that others don’t want to face. Since the FTC’s announcement last week, pandemonium has ensued within the industry world for regulators’ audacity to sanction one of their own.

SHEFFIELD IS AN ICONIC FIGURE IN THE OIL BUSINESS who helped jump-start the shale revolution in the U.S. over the past decade, bringing the industry new windfalls and the promise of energy independence. He’s also been a major heavyweight in Washington for the oil and gas industry across Democratic and Republican administrations. Though mostly a GOP mega-donor, it should come as no surprise that Sheffield has financed the political careers of Big Oil’s most loyal foot soldiers in Congress regardless of party, from Republican Sens. Ted Cruz (R-TX) and Lisa Murkowski (R-AK) to Democrats like Sen. Joe Manchin (D-WV) and Rep. Henry Cuellar (D-TX), who was recently indicted for taking bribes from an Azerbaijani state-owned oil company. Since 2006, Sheffield has personally contributed over $281,000 to House, Senate, presidential, and joint fundraising committee campaigns along with nearly $200,000 to PACs that has been disclosed, according to a compilation of documents from the Federal Election Commission. Pioneer employees and the company’s political action committee have separately donated $1.2 million to campaigns since 2012. With political clout, Sheffield secured favorable regulatory and tax treatment for fossil fuels and opposed climate change policies such as the cap-and-trade bill in 2010. But perhaps his greatest political accomplishment came in 2014, when he just about single-handedly managed to lobby congressional approval to lift a long-standing ban on U.S. crude oil exports. The ban had been in place for national-security purposes to ensure that the country would have enough domestic supply if geopolitical tensions erupted in the Middle East, like during the 1970s oil crisis. But the ban got in the way of booming U.S. oil production during the shale revolution, and was keeping consumer prices lower than they might be if producers could spread that demand globally. So Sheffield went to work, and got a repeal of the ban passed through Congress and signed by Barack Obama.Especially in his company’s home state of Texas, Sheffield is a political fundraising rainmaker, having delivered $290,000 to various elected officials in the state since 2005. He’s focused his attention in particular on buying up elected officials who sit on the state railroad commission, which oversees oil and gas. Next to federal regulators and the Saudi crown price, the commission is the most influential petroleum regulatory body in the world, setting policy for the largest site of U.S. energy production.

After 2020, Sheffield’s agenda became very specifically to scale back U.S. production and squeeze what might be the last golden years out of the business after peak oil. Having observed and dealt with OPEC since its founding in the 1970s, Sheffield became envious of its ability to collude, a luxury not provided to U.S. oil producers. He effectively went about trying to recreate the arrangement by pulling every possible political lever at his disposal.

When the pandemic hit, Sheffield used his connections to get a rule proposed in front of the Texas railroad commission that would have instituted quotas on production in the state. Despite his best efforts, the rule faced enormous opposition from most of the oil and gas producers, including Exxon, which were mostly skittish about a dramatic government intervention not seen since the 1970s.

When that plan failed, Sheffield then personally lobbied President Trump to use his leverage with OPEC to get them to pull back production and limit global supply. President Trump obliged, and OPEC did constrain supply, though to a lesser extent than Sheffield had hoped, as Texas Monthly reported.

That set the table for Sheffield’s ambitions once the industry roared back to life after the pandemic. As the Prospect reported, with demand for oil and gas sky-high, Sheffield and his fellow frackers saw an opportunity to slow-walk production back to life to capitalize on the high prices and extract massive profits that had been lost in 2020. Indeed, Pioneer posted its highest profits in a decade in 2021. Even in the middle of that, Sheffield said on a public earnings call in February 2022 that production would not expand. “There’s no change for us,” he told investors. “$100 oil, $150 oil, we’re not going to change our growth rate.”

Princeton Steve is criticizing the FTC over cartel like behavior by the former CEO of Pioneer Natural Resources. Well iit is more than the FTC:

https://oilprice.com/Latest-Energy-News/World-News/Lawsuit-Accuses-US-Shale-of-Cartel-Behavior.html

A lawsuit in a U.S. court is accusing American oil and gas producers, including Hess, Pioneer Natural Resources and Occidental Petroleum, of price-fixing by conspiring to reduce production. A total of nine companies are listed in the lawsuit filed by residents of Nevada, Hawaii and Maine, Reuters reports.

The lawsuit was filed in a federal court in Las Vegas. The lawsuit alleges that these companies have for years “collectively coordinated their production decisions, leading to production growth rates lower than would be seen in a competitive market”. Continental Resources, Diamondback Energy, Chesapeake Energy, Permian Resources and EOG Resources are also named in the lawsuit. In a Tuesday statement carried by Reuters, the Plaintiffs’ lawyer said the companies in question used the past three years to follow an approach of production discipline, which guaranteed that Americans would pay higher gas prices at the pump.

But Stevie has no problem with this price fixing behavior!

Is the WSJ serious?

What’s So Bad About Fixing Oil Prices?

https://www.msn.com/en-us/money/other/what-s-so-bad-about-fixing-oil-prices/ar-BB1mfiUh?ocid=BingNewsSerp

The Federal Trade Commission accused former Pioneer Natural Resources Chief Executive Scott Sheffield earlier this month of colluding with the Organization of the Petroleum Exporting Countries. That sounds sinister, but is it? Antitrust laws prohibit collusion, and mostly for good reason. It leads to a lack of competition, causing higher prices that harm consumers. The only winners are the companies involved that get to maximize their own profits at the expense of consumers. In more-recent decades, industries accused of collusion have included airlines and credit cards. Yet oil is a commodity for which that neat equation—more competition, less harm—is frequently complicated. Oil’s history is full of attempts at stabilizing prices. Petroleum is an essential commodity that has high capital needs and long lead times: That lends itself to boom-and-bust cycles that are painful for consumers, governments and companies. There is no immediate cure for price spikes or plunges because it is impossible to turn on significant new oil supply or to turn off demand for it on short notice. Storage helps, but oil must be kept underground or in specialized tanks. When done effectively, managing oil supply tames volatility. The wild boom-and-bust cycle between 1859 and 1879, for example, was followed by a period of relative price stability, when John D. Rockefeller’s Standard Oil monopoly reigned. In fact, the most stable period of oil prices was between the 1930s and 1970s when the Railroad Commission of Texas tightly controlled supply, according to analysis from consulting firm Rapidan Energy Group. At the time, Texas set the rate at which every well in the state could produce, using the military to monitor compliance and coordinating with other states. OPEC is the most recent example of supply management, though it has been less effective.

Legal considerations aside, passing judgment on price fixing ultimately comes down to whether one believes oil-price volatility causes more harm in the longer term than good. Proponents of oil supply management say that the boom-and-bust cycles are too painful. Rapidan founder Bob McNally says the only thing worse than oil supply management is the lack of oil supply management. Price swings can complicate monetary policy, make national budget planning difficult and even trigger social unrest in oil-dependent countries, he argues in the book “Crude Volatility.” Energy economist Anas Alhajji said in his newsletter that high oil-price volatility leads to a “waste of resources, higher costs, and a deterioration of efficiencies in oil production and consumption.”

But stable prices also mute market signals. High oil prices in the 1970s following the Arab oil embargo and Iranian Revolution encouraged the development of high-cost oil resources such as those in Alaska, the North Sea, Mexico and Canada, ultimately helping the world become less reliant on OPEC for oil.

And high prices in the 2010s helped U.S. producers pursue fracking aggressively. The bust that followed pushed frackers to find efficiencies. Proponents of supply management, though, say stable prices are more conducive to long-term investment than up-and-down cycles. Looking forward, price signals are also an important nudge for alternative energy sources, says Arjun Murti, partner at energy research and investment firm Veriten. There are a few reasons price fixing seems less necessary today. First, for all the alarm bells that go off when pump prices rise, volatility hurts a lot less—at least for some countries. The U.S. went from importing twice as much oil as it produced in 2006 to becoming a net exporter starting in 2020. And fuel now takes up a smaller portion of Americans’ budgets: Households on average also are wealthier than they used to be and cars are more fuel efficient. Second, fracking itself has helped supply respond faster because shale wells using the method can be brought online in a matter of months rather than years. U.S. shale has helped reduce global oil-price volatility, according to a working paper by economists at the Dallas Fed. And there is at least some evidence that demand itself has become slightly more responsive to high fuel prices—possibly because more people have the option to work from home. This applies to only a fraction of the world’s population, though. Associating “OPEC” and “collusion” with an American energy CEO sounds bad, but it is also hard to see how effective Sheffield could have been. Oil production is so scattered: There are tome of the few successful initiatives have come from consumers. In 2020, it was then-President Donald Trump himself, a champion of free markets, who helped broker an OPEC+ deal when prices had plunged. Thankfully for consumers, price-fixing isn’t only less necessary today but also a lot harder to do.

Maybe it is harder to do but that is what Sheffield was doing. And of course our resident apologist for Big Oil thinks his actions were AOK.

MAGA morons are criticizing Biden for not giving Israel cluster bombs to Israel – cluster bombs that would kill many innocent Palestinians. But this is what St. Reagan did in 1982

NYTimes: Biden Is Not the First U.S. President to Cut Off Weapons to Israel

May 10, 2024 By Peter Baker

The president was livid. He had just been shown pictures of civilians killed by Israeli shelling, including a small baby with an arm blown off. He ordered aides to get the Israeli prime minister on the phone and then dressed him down sharply. The president was Ronald Reagan, the year was 1982, and the battlefield was Lebanon, where Israelis were attacking Palestinian fighters. The conversation Mr. Reagan had with Prime Minister Menachem Begin that day, Aug. 12, would be one of the few times aides ever heard the usually mild-mannered president so exercised. “It is a holocaust,” Mr. Reagan told Mr. Begin angrily. Mr. Begin, whose parents and brother were killed by the Nazis, snapped back, “Mr. President, I know all about a holocaust.” Nonetheless, Mr. Reagan retorted, it had to stop. Mr. Begin heeded the demand. Twenty minutes later, he called back and told the president that he had ordered a halt to the shelling. “I didn’t know I had that kind of power,” Mr. Reagan marveled to aides afterward. It would not be the only time he would use it to rein in Israel. In fact, Mr. Reagan used the power of American arms several times to influence Israeli war policy, at different points ordering warplanes and cluster munitions to be delayed or withheld. His actions take on new meaning four decades later, as President Biden delays a shipment of bombs and threatens to withhold other offensive weapons from Israel if it attacks Rafah, in southern Gaza.

Inadequate support for genocide is now impeachable