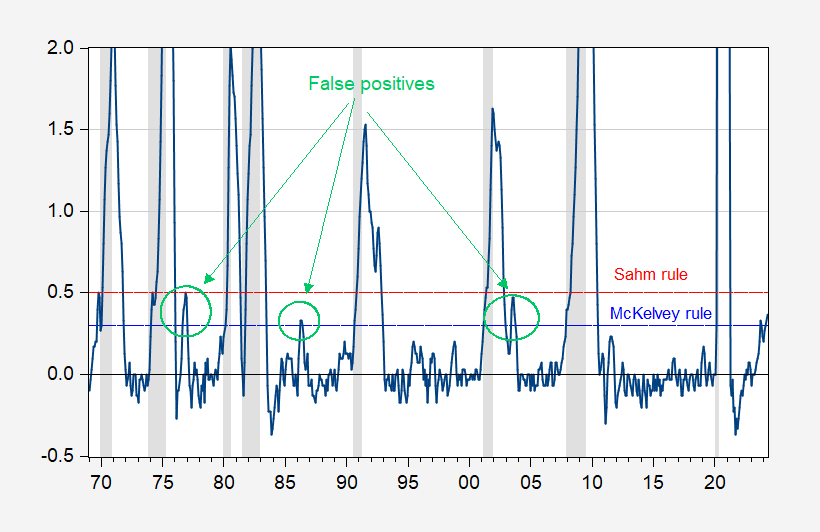

Di Martino Booth points to the McKelvey rule, which uses a 0.3 ppt threshold instead of the Sahm 0.5 ppt threshold. This indicator does seem to signal a recession as shown in the figure below.

Source: DiMartino Booth (2024).

Notice there are no false negatives. However, this graph (apparently) uses revised data. In real time, one would get a different set of results, as shown in Figure 1 below.

Figure 1: Real time 3 month moving average of unemployment rate relative to lowest rate in previous 12 months, in ppts (blue). NBER defined peak-to-trough recession dates shaded gray. Source: FRED, NBER.

Using the real time data, there are three false positives (circled in green). So when the real-time indicator signals a recession using a 0.3 ppts threshold, it’s important to realize this indicator has yielded false positives.

Stephenson’s Restaurant in Kansas City closed, in 2016?? Oh man that hurts my heart. My Dad loved that restaurant. They’re killing everything man, We loved that place. Going up to Iowa soon. Wanna shake some prof’s hand

https://www.kansascity.com/news/local/article72924307.html

The famous TV host, JOhnny Carson, Played this son for his son, This song will always hit you in your heart Menzie, Like a knife to your heart, Memories, Memories coming back in your mind.,

https://www.youtube.com/watch?v=3c_8VUL5jks

The “real time” Sahm Rule recession indicator currently shows a 0.37% increase in the relevant unemployment rate metric. Going back over 60 years, that has only occurred 12 times, 8 of which were true positives and only 4 were false positives.

In other words, even now based on that indicator, the US is more likely than not in a recession.

But it isn’t just the Sahm Rule. Virtually any indicator relying on employment, unemployment, or underemployment metrics from the Household Survey will show that the US is already likely in or very close to a recession.

The root cause is that there has been a very large divergence between the Household and Establishment Surveys in the past 24 months. The former shows only a 2.1% gain in employment, while the latter shows a 4.6% gain. This divergence between the two measures, on a YoY population-adjusted basis presently at about 1.7%, has only been matched, and usually only for a month or two, 8x in the past 50+ years.

The divergence may have to do with the birth and death of new businesses since the pandemic. I have also read an interesting article, the link to which I’ve forgotten, that attributes it to how well the surveys have dealt with immigration post-pandemic. Or it could just be lots of random noise because of the relatively small size of the Household Survey.

FWIW, initial jobless claims, which are actual hard data and not just a survey, and have a 50+ year history of leading the unemployment rate, show the US is far from recession.

As to the Sahm/McKelvey rules, a lower threshold is, more often than not, a useful indicator of impending recession. Sahm devised her rule to indicate that recession had begun, with the aim of allowing Congress to know when income support is a good idea. Using a lower threshold could, more often than not, help the Fed to know when to lower rates.

As to the birth/death plug, I’ve cobbled together a comparison between it and the net effect of business birth and death in the Business Employment Dynamics data for the past few quarters (as promised). Hope it’s readable after posting:

Birth/death CES BED Difference

Q3 2023 3k -19 22

Q2 2,589 117 2,472

Q1 3 107 -104

Q4 2022 1443 114 1,329

Q3 479 153 366

Q2 617 208 409

There is a 3,719,000 difference between CES and BED in the most recently-reported 4 quarters. There may be some technicalities of which I’m unaware which explain this difference – please jump in if you know.

I haven’t been able to find either series in FRED, so the math is all by hand (you listening, FRED?), but I have done the same quarters in 2013-2014 and 2017-2018, just to see if this difference is normal. It doesn’t seem to be. In 2012/3, the CES added 388,000 more through births-minus-deaths than did BED. In 2017/8, the CES added 932,000 more.

So anyhow, in these three periods, the CES birth/death plug adds considerably more than the BED reports actual count, but in the most recent period, the difference is much bigger.

As I’ve noted before, business applications data argue for an increase in firm births:

https://fred.stlouisfed.org/graph/?g=1nSKJ

Bankruptcy filings have not, until recently, suggested similar high rate of firm death. The Business Employment Dynamics data are, however, pretty convincing.

Crud. Ignore the table.

The US may already be in recession as job cuts accelerate, research CEO says

Wait – the payroll survey says employment is rising. So where did this come from? The Kudlow show?

Yes – the unemployment rate has increased but that is due to a rise in labor force participation.

UN General Assembly backs Palestinian bid for membership

https://www.msn.com/en-us/news/world/un-general-assembly-backs-palestinian-bid-for-membership/ar-BB1maJFb?ocid=msedgdhp&pc=U531&cvid=bdd4c40d8a4a48eaa9db01b16f0cc886&ei=7

Palestine should be a member of the UN. Good for the majority. Shame on the US for voting no.

Faux News is not reporting that Donald Trump is a sex god?

https://www.msn.com/en-us/news/other/stormy-daniels-s-testimony-shows-trump-is-a-sex-god-gutfeld/ar-BB1m730a?ocid=BingNewsSerp

Fox News host Greg Gutfeld claimed that pornography actress Stormy Daniels’s testimony in Donald Trump’s trial only proved the former president is a “sex god.”… “Stormy claims that she blacked out in this tryst with Trump, but she wasn’t on any drugs or alcohol,” Gutfeld said. “You blacked out without drugs or alcohol. Some of us call that sleeping. Now, it could be that she really blacked out after having sex with Trump, which is a compliment. Truly, he screwed the brains out of her — that makes him a sex god.”

I mean – come on! Stormy Daniels has already said it was the worst sex she ever had. Then again something that looks like a mushroom and is only 3 inches can do even the least little thing – God like!

Looking at the part time jobs (discussed a few blog entries prior), FRED Series: LNS12032194 as a percent of the civilian workforce, FRED series: CLF16OV, recessions started when the percentage equaled 3.3% on average, however, if we subtract the sample standard deviation from the mean, we get 2.6%. As of the April 2024 nonfarm jobs report, the current percentage is about 2.66%. Using a Markov switching model, the mean of lower regime level is 3.0% with the mean minus the standard deviation also equal to the arithmetic 2.6% as stated earlier in a previous sentence. If the model is consistent, we could be in trouble if the May nonfarm jobs report shows an increasing percentage of part time workers to the civilian labor force.

Month******Part Time*Recession=1

1957M08*******3.7%**** 1

1960M04*******4.0%**** 1

1969M12*******2.6%**** 1

1973M11*******3.0%**** 1

1980M01*******3.5%**** 1

1981M07*******4.4%**** 1

1990M07*******4.2%**** 1

2001M03*******2.3%**** 1

2007M12*******3.0%**** 1

2020M02*******2.7%**** 1

mean** 3.3%

sd***** 0.7%

mean -sd** 2.6%

mean + sd** 4.0%

Off topic – China again:

The de-dollarization story, focused on China and Russia, secondarily on the rest of the BRICS, is – as one of our banned trolls liked to say – a matter of narrative. China is either flexing its muscles by creating an alternative financial system to the one dominated by the US$, or it is trying to overcome a vulnerability. The two are simply different ways of describing the same behaviors.

Here is a Brookings paper which approaches Chinese behavior as overcoming a weakness:

https://www.brookings.edu/articles/is-china-financially-decoupling/

The issue raised is that China is accumulating real resources overseas through foreign direct investment.

Having raised the issue of story-telling, I will say there are some problems with the way the author, Robin Brooks, tells his story. He argues that gross exports, rather than net exports, drive reserve accumulation. Huh? He also doesn’t bother to normalize export levels, not by comparisons to a GDP or in any other way. It’s bothersome.

However, if we squint and suspended judgement, Brooks gets around to making sense. He’s telling a story about direct foreign investment. DFI inflows to China are down. What’s unclear is whether DFI outflows are up, but Brooks notes that increased outward direct investment would help explain China’s lack of reserve accumulation.

What Brooks is getting at is that China appears to be gobbling up real foreign assets instead of reserves. That seems right. Brooks couches this in terms of China trying to reduce its vulnerability to the U.S. But hasn’t China been gobbling up real foreign assets for decades? Timber in Canada. Water in the U.S., minerals and timber in South America. Minerals in Africa.

I kinda wonder if this isn’t another case of telling a de-dollarization story because that’s the hip thing to do. In this case, Brooks has a perfectly good story even without tying a de-dollarization bow on it.

So, is China accumulating real overseas assets at a faster-than-usual rate? Don’t know. If so, is it the public sector or the private sector doing the accumulating? Don’t know, and it really changes the story if it’s private accumulation.

One last question: Is the rate of return on China’s overseas investment higher than for domestic investment? ‘Cause mal-investment is a huge problem at home. Maybe DFI is a way of improving returns.

Its probably a little overthinking to look at it as a deliberate policy to de-dollarize. It always makes sense for a country that is accumulating huge foreign reserves to begin putting some of it into other types of assets than government bonds.

To most of the world, US has been the choice for long-term parking of wealth in assets, because of its extremely low chance of revolutionary political change and confiscation of assets. Trump, (the king of bankruptcy) has made that a bit shaky, particularly for bonds and particularly for China.

Not an economist. But GDPNow seems to have a much rosier picture about economic growth?

>The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 4.2 percent on May 8, up from 3.3 percent on May 2. After recent releases from the US Bureau of Economic Analysis, the US Census Bureau, the Institute for Supply Management, and the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth increased from 3.2 percent and 4.1 percent, respectively, to 3.9 percent and 6.8 percent, while the nowcast of the contribution of the change in real net exports to second-quarter real GDP growth decreased from -0.05 percentage points to -0.10 percentage points. [May 8th estimate]

https://www.calculatedriskblog.com/2024/05/q2-gdp-tracking-3.html

I’m personally worried that a recession would blow Biden’s chance at re-election.

Biden is not getting re-elected bub, not sure how you missed that memo.