I was taking a rare vacation trip (most travel is work related for me), when my wife and I decided to enter the haunted house at Tivoli for kicks (last visit, it’d been closed to renovate the wax museum to something new). Well, it wasn’t frightening at all – but that got me thinking: What would be frightening? Here’s my answer:

“Economic Policy in a second Trump term”

Consider some policy proposals:

- Replacing income tax revenues with tariff revenues. Krugman suggests that with a trade elasticity of one, you’d need 133% tariffs on all imported goods. Pretty sure likely retaliation suggests you’d need even higher rates (and still likely to hit target without catastrophic results). Clausing and Obstfeld at PIIE write:

“It is literally impossible for tariffs to fully replace income taxes. Tariff rates would have to be implausibly high on such a small base of imports to replace the income tax, and as tax rates rose, the base itself would shrink as imports fall, making Trump’s $2 trillion goal unattainable.”

- 10% tariff on all imported goods (except for Trump friends, maybe Russia), with 60% tariff on Chinese goods. Even this would have an enormous negative impact. Clausing and Lovely estimate $225 billion additional revenue, even if no negative demand response and no retaliation (income taxes raise about $2 trillion).

- Another reduction in the corporate income tax rate

- Forcing down the value of the US dollar This would require other countries to revalue (or we’d have to drop interest rates). Considering how much uncertainty (which appreciated the dollar) accompanied the Trump tariffs in 2018, I can only imagine how much policy uncertainty would ensue if we browbeat countries to revalue…See also Noahpinion.

And I haven’t even considered…

Nice discussion here about how Trump’s policies would make the inflation/output tradeoff a true nightmare.

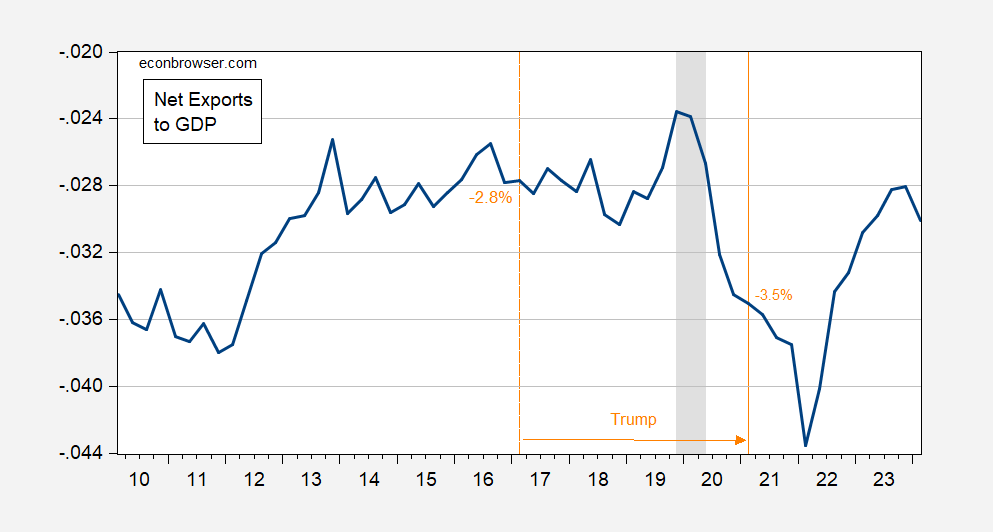

Just a reminder, here’s the US trade balance defined using NIPA data.

Figure 1: US Net Exports to GDP (blue), s.a. NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2024Q1 2nd release, and author’s calculations.

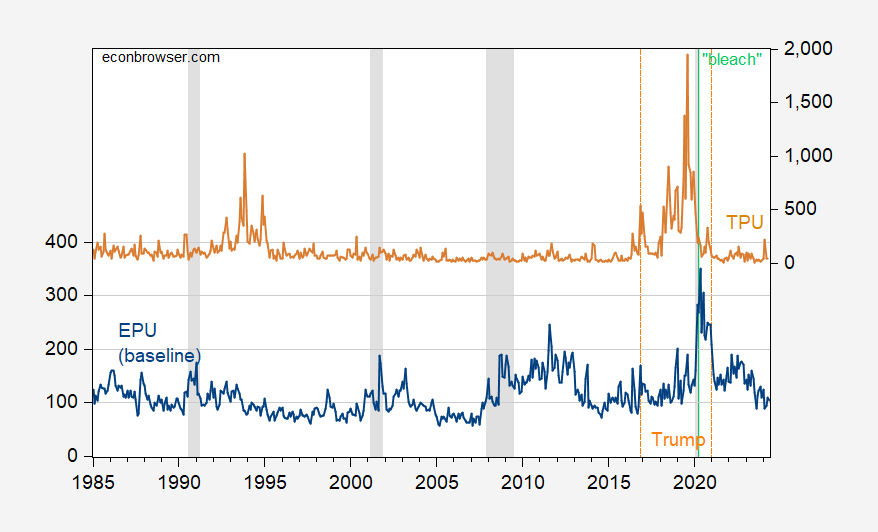

And in terms of policy uncertainty (which conservatives used to decry as slowing investment and growth):

Figure 2: Economic Policy Uncertainty (blue, left scale), and Trade Policy Uncertainty (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: policyuncertainty.com via FRED, NBER.

Loss of $2 trillion (income taxes)

Gain of $0.225 trillion (tariffs)

Now if one does arithmetic Stephen Moore style, these are exactly offsetting. And be sure – Bruce Hall confirms his results!

Kimberly Clausing, nonresident senior fellow at the Peterson Institute for International Economics since September 2022, holds the Eric M. Zolt Chair in Tax Law and Policy at the University of California, Los Angeles. During the first part of the Biden Administration, Clausing was the Deputy Assistant Secretary for Tax Analysis in the US Department of the Treasury, serving as the lead economist in the Office of Tax Policy. Prior to coming to UCLA, Clausing was the Thormund A. Miller and Walter Mintz Professor of Economics at Reed College. Her research examines how government decisions and corporate behavior interplay in the global economy. She has published numerous articles on the taxation of multinational firms

Good to hear that she has joined PIIE. I used to read her papers on the taxation of multinationals which suggested the extent to income shifting to tax havens was huge. Now some have suggested her work overstated these effects but to be fair – doing this right is very, very difficult. Of course NO ONE in the Trump White House bothered to listen as they wanted rich people to dodge taxes.

“Here, we use the same technique as in the policy brief to consider revenue but ignore the negative “offset” effects on revenue elsewhere in the system, since we assume the tariff increases are paired with equal and offsetting income tax cuts. Using the same standard import-sensitivity of 1 (which assumes that a 10 percentage point increase in tariffs reduces imports by 10 percent), figure 1 shows the resulting tariff Laffer curve; we also illustrate other import sensitivities in the figure.2 For the assumed import response to the tariff, the rate that maximizes tariff proceeds is 50 percent, and tariff revenues peak at about $780 billion. 3 When tariff rates increase beyond the peak of the curve, tariff revenues actually fall, since the negative effect of reduced imports outweighs the higher tariff rates.”

How come we never hear Art Laffer and his fellow stooges (Stephen Moore and Lawrence Kudlow) talk about this? Oh yea – the three stooges support Trump’s agenda of taxing the poor rather than the rich. MAGA!

Let’s take one portion of Noah Smith’s long discussion where he was discussing how to get a dollar devaluation to encourage higher net exports:

‘One option is deep fiscal austerity, but that’s politically tough, especially at the scale you’d have to do it in order to affect the exchange rate.’

Let’s not be shy – simply increase taxes on the very rich by quite a bit. After all, conservatives complain about the government deficit. This policy change would increase the national savings rate lowering interest rates without inflation and would thus devalue the dollar and increase net exports.

Oh wait – there’s a huge problem here. Trump’s Project 2025 is all about letting the rich not pay taxes. Never mind.

So, tax cuts for the rich and tariff taxes on everyone else.

But don’t forget. Trump is going to get China to pay for the tariffs — just like he got Mexico to pay for his wall.

a cut in interest rates does not guarantee a depreciation ( tsk tsk PGL a devaluation only occurs under a fixed exchange rate).

A blow out in the budget deficit and a large interest rate cut means much higher inflation.

what genius came up with these policies’

“a devaluation only occurs under a fixed exchange rate”

Join us, later, when you become an adult.

depreciation, devaluation. You say potato, I say potatoe!

Are you testy of late because your currency is now worth less than US$0.67?

https://fred.stlouisfed.org/series/DEXUSAL/

AND your long term interest rates are rather high!

Gentlemen a devaluation is different to a depreciation. A Government can devalue . It cannot depreciate a currency.

If the US had a decent education you would know this.

It is a bit like comparing annualised figures to annual figures.

Dude – you are getting pathetic here. Criticizing me for a word I never used. Now you abused the term but do go back to the sandbox and tell the other kiddies it was all my fault.

Sorry mate you were quoting noah. However when ever you have a floating currency there is never a devaluation.

A devaluation is done by a government and for a specific amount. A depreciation can go anywhere and the reasons are only apparent after the event.

gosh you are sensitive.

Must be the US education system. Yanks believe the sharemarket has fallen when it is clearly much higher, they believe inflation is rising when it is falling and believe unemployment is at 40 year highs when it is 40 year lows.

Now I read they believe Trump is better for democracy than biden.

I guess if I lived in such a country I would be sensitive as well and for good reason

Not Trampis

June 27, 2024 at 3:00 pm

Hey mate – why don’t you mansplain to us 2 plus 2.

Look – you on occasion make a decent point but right now you are wasting everyone’s time. Get a life and move on dude.

Trump trade advisers plot dollar devaluation

Advisers close to the former president — particularly his former trade chief Robert Lighthizer — are considering policies that would weaken the dollar relative to other currencies, which could juice U.S. exports but also fuel inflation.

That was the headline of the link our host provided that started this discussion. EXCUSE me for using the same term as it appears in the headline. OK – devaluation is commonly used for pegged exchange rate regimes whereas depreciation is the term used for floating regimes.

Now maybe your point is that the MAGA crowd is too stupid to know this. That would be fair. But otherwise you are just being a worthless little know it all.

I enjoy when Menzie shares semi-personal things with us, I think even if Tivoli didn’t “scare” Manzie or his wife. it must have been fun in some kind of artistic way in a wax museum. I took my former-GF in China outside of her home province, (she didn’t tell her parents where we were going) It was like one of the 2-3 highest mountain in China, I wanna say in was in Shandong province. It seemed it was near the end of our relationship. I seem to remember she had some kind of disappointment then, but I HOPE she had a blast/ I think the experience was new to her, and I’ll take that.

The biggest danger of an ignorant narcissist like Trump as President, is that he has no idea what the consequences of his policies would be, and he cannot be educated about it. The only people he will listen to are those who tell him that his ideas are brilliant. He is a clusterfuck circle of ignorance whose fragile narcissistic ego cannot handle being educated.

The one thing Trump is really good at, is identifying what people want him to say and then saying it – he is the ultimate populist candidate. In the old days there would be journalistic sources of information that would pull the pants down on any politician who tried the old carnival barking con man routine, so Trump wouldn’t stand much of a chance. But todays news media is about what the audience want to hear (so they will come back). Even some big traditional media like Fox don’t care about peddling lies as long as it draws in audience and news feeds/internet is a nightmare of misinformation.

Let’s imagine two crops (like sugar cane and potatoes) that grow best in different climates. Now let’s imagine two different countries that have either optimal climate for growing sugar cane, or potatoes, and suboptimal climate for the other crop. What happens when those two countries institute a 100% tariff on each others products?

The immediate price shock will almost completely stop imports of the product subjected to the tariff tax, and domestic production of that product will increase because the higher prices provide an opportunity to make money. The export of the other crop will almost completely disappear and production of that will decrease. So there will be a switch from producing the crop that is optimal for your climate to producing a crop that is suboptimal for your climate.

Because of the suboptimal climate for growing the previously imported crop, the the amount of product per work hour will be lower, so the domestic substitution will be more expensive. The results of the tariffs is that workers will be less productive, and products will be more expensive, in both countries. That sounds like a lose-lose proposition to me.

Now this is an interesting comment. Of course you do know that eminent agricultural economists and climate change experts such as CoRev ad Bruce Hall will completely miss your analysis.

I am an outhouse economist at best, and even my brain hurts thinking about this.