S. Ren in Bloomberg: “It’s getting flatter, prompting worries over an ‘asset famine’ and a prolonged recession.”

Whatever the reason, an inverted yield curve has a bad rap. In normal times, notes with longer maturities offer higher rates to compensate lenders for tying up their money for an extended period. When those yields sink close to or below shorter ones, it’s an indication that investors are pessimistic about an economy’s growth prospects. In the US, an inversion was a reliable predictor of recessions, at least in the pre-pandemic days.

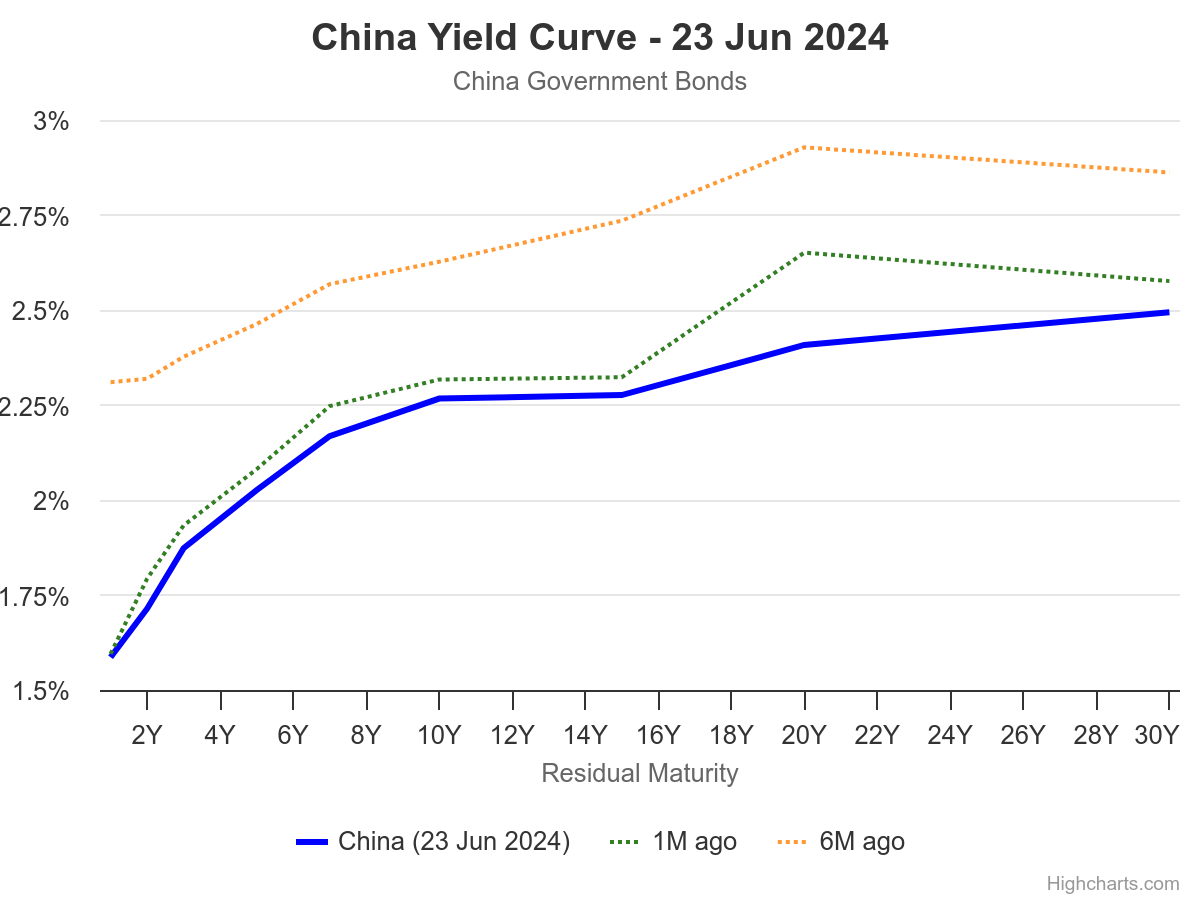

Here’s a picture of the Chinese yield curve as of today:

Source: WorldGovernmentBonds.com.

There’s no inversion at maturities 1 year to 30. However, the 10yr-3mo spread is inverted.

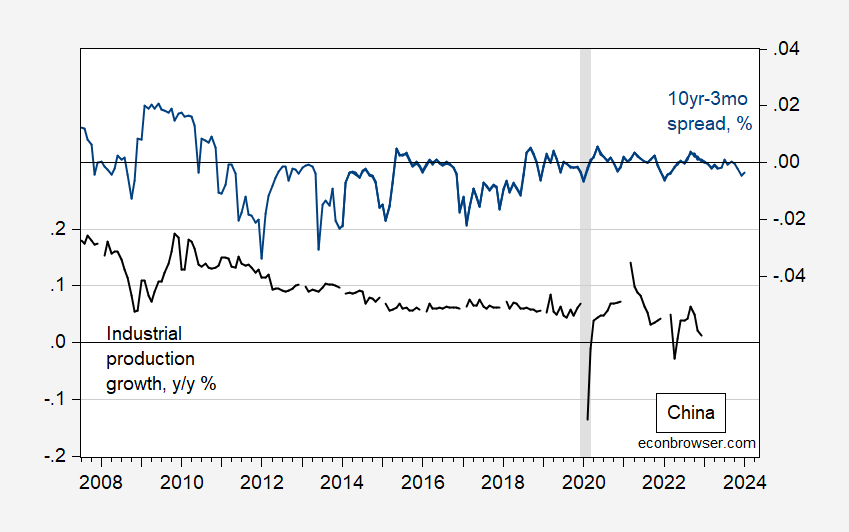

Figure 1: Chinese year-on-year industrial production growth (black, left scale), and 10yr-3mo spread (blue, right scale). ECRI defined peak-to-trough recession dates shaded gray. Source: OECD, and author’s calculations.

Chinn and Ferrara (2024) examine the predictability of Chinese recessions and industrial production growth. In the former, no results can be obtained, given the paucity of recessions during periods when long term interest rates are available (or relevant, given financial repression). For y/y industrial production growth, we obtain:

ipgrowth = 0.095 + 1.66 × spread

Adj-R2 = 0.26, NObs = 131, Sample = 2007M07-2018M12 (growth to 2019M12). Bold indicates significance at 10% msl using HAC robust standard errors.

While there’s a statistically significant positive association between the spread and growth, it’s not a major explanatory factor. This is perhaps unsurprising insofar as the long term government bond market in China is not very liquid. The long term bond yield is strongly related to expected future short rates (i.e., the expectations hypothesis of the term structure) if the long term marked is liquid.

Adding in additional financial factors — specifically the debt service ratio and foreign term spread — increases the adjusted R2 to about 0.77.

ipgrowth = 0.237 + 0.32 × spread – 0.98 × dsr + 1.44 × spread*

Adj-R2 = 0.77, NObs = 131, Sample = 2007M07-2018M12 (growth to 2019M12). Bold indicates significance at 10% msl using HAC robust standard errors.

While the spread remains marginally significant, in terms of standardized coefficients, the debt-service ratio and foreign term term spread are more impactful (7 and 3 times more than term spread, respectively).

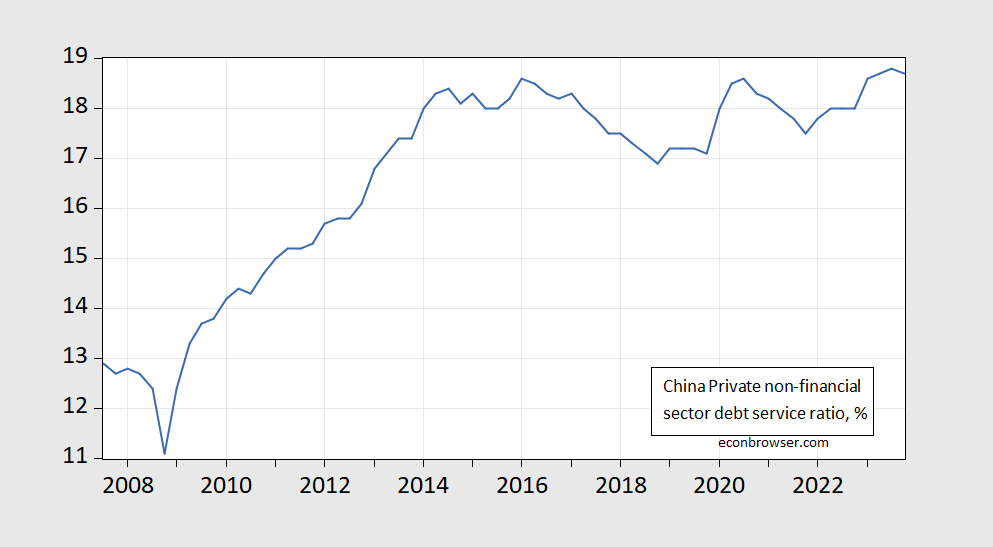

Here’s the BIS series for private nonfinancial sector debt service ratio, through 2023.

Figure 2: Chinese private nonfinancial sector debt service ratio, %. Source: BIS.

For signals of an impending recession — or recession — look to other indicators.

Earlier post on China, here.

Is being almost inverted like being almost pregnant?

China’s 10-year rate is 2% lower than the US rate. In fact, it is lower than every other major nation’s rate besides Japan’s rate.

https://www.worldgovernmentbonds.com/country/china/#title-spread

Trump and Biden: The National Debt

https://www.crfb.org/papers/trump-and-biden-national-debt

“During his four-year term in office, President Trump approved $8.4 trillion of new ten-year borrowing above prior law”

Biden? Half of that. Gee – everything we have heard from the MAGA morons has been a lie!

I am embarrassed to admit that I don’t know the matures at which Chinese policy tools directly influence the shape of the curve. China has recently announced a change in its monetary policy regime, part of which will be to control just one maturity. So there may be changes in the behavior of China’s curve – regime change, don’t you know. So past performance won’t be a reliable guide to future behavior, or to predictably.

US judge blocks Biden wage rule for construction projects

https://www.msn.com/en-us/news/politics/us-judge-blocks-biden-wage-rule-for-construction-projects/ar-BB1oOq6f?ocid=msedgdhp&pc=U531&cvid=868c1d3660e6488bb6fda898546d1bbb&ei=15

By Daniel Wiessner (Reuters) –

‘A federal judge on Monday temporarily blocked a Biden administration rule expanding the cases in which construction contractors are required to pay workers prevailing wages that apply to $200 billion of federally funded infrastructure projects. U.S. District Judge Sam Cummings in Lubbock, Texas, said the U.S. Department of Labor lacks the power to impose prevailing wage requirements when government agencies do not explicitly include them in contracts and to extend them to truck drivers who work on construction sites. “Presidents and their agencies … do violence to the Constitution when they attempt to unilaterally amend Acts of Congress to suit their policy choices,” wrote Cummings, an appointee of Republican former President Ronald Reagan. Cummings blocked the rule, which took effect last October, from being enforced nationwide pending the outcome of a lawsuit by Associated General Contractors of America, a major construction trade group. The Labor Department and Associated General Contractors did not immediately respond to requests for comment.

A New Deal-era law, the Davis-Bacon Act, tasks the Labor Department with establishing wage floors for federally funded construction projects, which are based on the prevailing wages for certain jobs in specific geographic areas. Today, prevailing wages apply to more than 1 million construction workers on $200 billion worth of projects. The Biden administration rule revived a method for calculating those wages that excludes many lower-paid workers and leads to higher wage floors, which was abandoned by the Reagan administration in the 1980s. Other trade groups are challenging those changes in a separate pending lawsuit. The rule made several other key changes including giving prevailing wage standards the “operation of law,” meaning they are always in effect and agencies no longer have to explicitly include them in contracts, and expanding the definition of “mechanics and laborers” covered by the law to include truck drivers who make deliveries to work sites. Associated General Contractors challenged those two provisions in a lawsuit filed in November, saying they went beyond the Labor Department’s powers to set the level of prevailing wages. Cummings on Monday agreed and said the rule would cause irreparable harm to construction businesses, including pricing some of them out of federal contracts, if it remains in effect. In adopting the rule, the Labor Department said it was necessary to modernize prevailing wage regulations to reflect changes in the law and the economy. That was echoed by unions and other supporters of the rule, who said it would guarantee workers fair pay and deter wage theft, particularly on the growing number of clean energy construction projects.’

OK – Biden’s position here is clear. Now Trump says he wants to cozy up to union workers so let’s put him on the spot. Does he agree with the Associated General Contractors or the workers?

The recent faux news poll showing Biden ahead of Trump has generated a good many headlines. Turns out, that’s not the only poll showing Biden leading. The 538 polling average has shifted to show Biden leading for the first time in forever:

https://projects.fivethirtyeight.com/polls/president-general/2024/national/

The press is taking notice:

https://www.politico.com/news/2024/06/24/trump-fundraising-republicans-nervous-00164588

https://www.nytimes.com/2024/06/05/upshot/polling-trump-conviction-voters.html

The press needs a regular change in story to maintain audience interest, so it’s no surprise coverage of the poll swing is heavy. It’s a horserace, after all. My own guess is that “new story” thinking will be jettisoned during and after the Georgia debate, with “Geriatric Joe” and “Demented Donald” mostly what we’ll hear from pundits. “Policy? What’s policy?”

At 5 months out from election day, less from early voting, polls are just now beginning to have any predictive ability.

I think we have found how the Biden agenda is hurting US natural gas!

Rising US labor costs threaten to derail new LNG projects

https://www.msn.com/en-us/money/markets/rising-us-labor-costs-threaten-to-derail-new-lng-projects/ar-BB1oOrPb?ocid=msedgdhp&pc=U531&cvid=9605878f56fb469e90c54bc7c13f0eb3&ei=18

HOUSTON(Reuters) – A shortage of skilled labor and nagging inflation from strong wage growth on the U.S. Gulf Coast are pressuring liquefied natural gas (LNG) developers and delaying some projects from reaching a financial go-ahead. There are five LNG plants under development in Texas and Louisiana and 16 others on the drawing board in the U.S. looking to secure investment and customers. The five under construction would add a combined 86.6 million metric tons per annum (MTPA) of the superchilled gas, enough to keep the U.S. as the world’s largest exporter for years to come. With labor costs jumping as much as 20% since 2021, busting construction budgets and squeezing projected returns for those firms still trying to attract new investors, the fate of some of the early projects has become less certain.

Only a 20% increase? Didn’t Trump tell us food prices have risen by 60%? Oh wait – he lied but yea a 20% nominal wage increase over this period is not much of a real wage increase.

Now Trump and the Heritage Foundation has a plan to support natural gas companies. Slave labor. Yea if wages are forced down to $8 an hour, these projects can make huge profits. MAGA!

The same fools who currently are complaining that they cannot build out LNG export facilities fast enough because of Biden, will be extremely happy within 3-5 years that they didn’t manage to jump both feet into that trap. LNG is a very expensive way to obtain natural gas. Global natural gas use has been topping out at about 4 trillion cubic meters and will likely go down in the years ahead. At the same time natural gas pipelines are being build all over the world to connect major producers with major users. The combination of a slipping market for natural gas with an increase in supply of the much cheeper pipeline natural gas, will have a very predictable effect on demand for liquified natural gas. The current frenzy to replace European pipelines gas from Russia has created a short term artificial demand for liquid natural gas – but that is a short term and temporary boost in demand. Replacement of natural gas with alternative energy and increased delivery of pipeline gas from the North Sea will soon reduce European appetite for expensive North American LNG. Even our current production of LNG will have a hard time finding costumers 5 years from now.

The future is alternative energy for two reasons. First it is already cheeper than even the most efficient modern natural gas facilities. Two the prices for natural gas and other hydrocarbon energy sources are extremely volatile. Natural gas prices have changed 4 fold within a few years. The price of energy from alternative sources is basically locked down as soon as you build them (your only big expense is the loan payments – “fuel” is free).

Off topic, but still market-related – the U.S. equity market is juiced:

https://www.cnn.com/2024/06/24/investing/premarket-stocks-trading/index.html

Equities tend to perform well in election years, but this year is special. Gains so far are ahead of anything seen in prior election years. CNN attribute this to the fact that both candidates are incumbents, reducing uncertainty more than in other election years. Good story – could be true.

Here’s the thing, though. At some point, uncertainty was going to decline, no matter who the candidates were. If uncertainty isn’t the right explanation, it still the case that whatever is fueling gains is likely to run its course. What goes up…

Can’t help thinking equities are setting up for a hefty decline. Shillers cyclically adjusted price earning ratio is below its historic high, but readings this high are typically followed by sizable declines in stock prices:

https://en.macromicro.me/charts/410/us-sp500-cyclically-adjusted-price-earnings-ratio

Once again, Little Marky declares that a standard analytic tool is dead, without a shred of evidence. We’re up to five such unsupported declarations. Who has gonna believe…Little Marky pretending to know stuff, or a Nobel Prize winner? Y’all can make your own choice.

More proof that Donald Trump’s second son is mentally retarded:

https://www.msn.com/en-us/news/politics/eric-trump-s-unvarnished-claim-about-dad-gets-brutal-instant-fact-check/ar-BB1oM1Ho?ocid=msedgdhp&pc=U531&cvid=2f1bba03475a48d5885a0db942fb009e&ei=28

““I think my father will go down, maybe his greatest accomplishment, will actually be kind of the unvarnished honesty that he’s really taken toward the whole system”.

An average of 21 lies a day is now “unvarnished honesty”. Or was that “alternative facts”?

CREW files bribery complaint against Trump over oil industry donations

https://www.msn.com/en-us/news/politics/crew-files-bribery-complaint-against-trump-over-oil-industry-donations/ar-BB1oOsVd?ocid=msedgdhp&pc=U531&cvid=1b75ac8e34734a0f99d03a0d701abcb0&ei=5

he watchdog group Citizens for Responsibility and Ethics in Washington (CREW) has filed a criminal bribery complaint urging the Justice Department to investigate former President Trump’s solicitation of campaign donations from fossil fuel executives.

The former president met with oil industry executives in April and asked for $1 billion in campaign contributions, The Hill reported last month.

The Washington Post, which first reported the request, also reported that the former president described the donations as a “deal” and said that in a second term, Trump would unwind Biden administration regulations on industry. A person with knowledge of the meeting who confirmed the request to The Hill denied it involved a quid pro quo agreement.

The chairs of the Senate Budget and Finance committees have also announced a joint investigation into the meeting, with Budget Chair Sheldon Whitehouse (D-R.I.) calling it the “definition of corruption.”

The former president reportedly promised industry executives he would end a Biden administration pause on new natural gas export approvals and asked attendees to “be generous” at a fundraising event in late May, although he reportedly did not request a dollar amount, according to The Washington Post.

“We cannot have government officials making important policy as a result of corrupt exchanges that benefit them, rather than what is in the interest of the American people. That’s why the law is clear that a request for a benefit, including campaign contributions, in exchange for an official act is a bribe,” CREW President Noah Bookbinder said in a statement.

“Donald Trump’s actions here follow a pattern of Trump opening himself up to corrupt influence, courting conflicts of interest, and using official positions to enrich himself–and in this case may run afoul of the criminal law.”

Off topic – Israel’s risk in war against Lebanon:

How a war will go is anybody guess – just ask all those dead Russian generals. Still, there is a good bit of chatter about how badly war against Lebanon could go for Israel. Here’s a power-grid-centric view:

https://www.haaretz.com/israel-news/2024-06-20/ty-article/.premium/israeli-official-warns-power-grid-not-prepared-for-war-with-hezbollah/00000190-361c-d1b6-a19d-b7ffa7900000

Hezbollah has the capacity to bring down Israel’s power grid, says the government’s top power-grid manager.

There have been hints America will not help them in an “excursion” (is that the happy talk lingo these days??~~”excursion”??) with Lebanon. I think this is the correct choice by American officials, if Israel wants to commit genocide in Gaza, then they have to live with the consequences. But judging from Israel’s recent intelligence/spy clusterF*cks, and the easy penetration of their “iron dome”, I don’t think it’s going to be very pretty for Israel.

In the positive column of a slaughter by Hezbollah, it might FINALLY clue in conservative Israelis that Netanyahu does not make them “safer” but that Netanyahu’s control makes Israelis’ mortality rate jump by MULTIPLES. One hopes that a “tribe” of people renowned for their high intelligence levels, finally “clues in” on this fact.

Gen Brown, Chairman of JCS made some comments on US’ ability to partake in South Lebanon. Two ideas: the U.S.’ air support during Iran’s attack was defensive counter air. The missiles lighter and compact compared to bombs against ground targets.

Second, South Lebanon is more like Iwo Jima, deep bunkers, well dispersed. The much smaller facilities in Gaza still hold.

US would be bogged down with logistics issues supplying heavy bombs, and guidance kits. Also, it could be difficult to coordinate and control ground attacks with the IDF.

Not that these are show stoppers!

When you don’t have a true free market economy, you can’t expect all barometers to have the same epilogue as they do in a free market economy.

That’s not a difficult concept, and I can’t get past the Bloomberg paywall, but if Shuli Ren is saying anything to the contrary, she’s either below average intelligence or needs to re-study how socialism functions.

Forbes is getting around to noticing something that Moses (or pgl?) told us a few days ago:

https://www.forbes.com/sites/danielmarkind/2024/06/25/china-delivers-another-economic-blow-to-russia/

This strikes me as “just business”, which is to say, not about China siding with Russia – or not – against Ukraine. China regularly makes foreign entities pay up for market access, and Russia is being made to pay up. This is is less geopolitical news, more business news in the context of current geopolitical circumstances.

But what the heck, let’s look at it through a geopolitical lens. Russia’s future is very much reduced by reliance on China, which is necessitated by the loss western market access.

I did note this story:

https://finance.yahoo.com/news/gazprom-reports-nearly-6-9-174029004.html

The state-owned Russian energy giant Gazprom reported a net loss of 629 billion rubles (nearly $6.9 billion) in 2023, the company’s largest profit downturn in decades amidst falling gas prices and a limited European market. Gazprom published its international earnings report on May 2, revealing $6.84 billion in net losses in 2023, compared to a net income of 1.23 trillion rubles (about $13 billion) in 2022. Revenue from gas sales fell by 40% in one year, the report shows.

Gazprom’s financials are supposed to be publicly available but whenever I try to access them on their website, Google tells me no for some reason. Maybe you will have better luck.

Lets not forget that Gazprom and other large companies in Russia are directly funding military forces. Putin doesn’t have enough government funding for his expansionist military adventures.

https://www.forbes.com/sites/arielcohen/2023/02/22/the-coming-hurricane-russian-energy-giant-gazprom-is-creating-an-army/

So there is a direct link between their profits and the funding of the invasion of Ukraine.

@ pgl: [ golf gallery applause ] zero sarcasm

This Power of Siberia 2 pipeline was operational back in 2019 after almost a decade of discussions and construction. Whether Russia had invaded Ukraine or not, China would be importing natural gas at lower transportation costs than the LNG shipments from places like Australia. A simple fact that applies to the costs of shipping LNG from the US to either Europe or Asia. But the concept of high shipping costs completely eludes morons like Trump and his worshippers like Bruce Hall.

China has been all business on this. They know they can squeeze Russia on price as well as commitment – and they do. They also know that natural gas is a transitional energy source until they have fully developed their alternative energy sources. So they do not want to commit to large amounts of purchases over extended time periods. Russia will not get the kind of income they had hoped from selling natural gas to China.

@ Macroduck China’s government (and certainly Chinese people in general) could certainly be argued as being VERY pragmatic. That pragmatism could be mistaken as “hatred” to all foreigners, when indeed, they give the same (bad) treatment to their fellow Chinese. That’s actually a deep insight you gave there about Chinese. NOT a blanket statement, maybe 80% of mainland Chinese?? About??

US district judge Aileen Cannon must be worried that Jack Smith is close to getting the Appeals Court to kick her off the documents case:

Mar-a-Lago search warrant was properly granted, says Trump documents judge

https://www.msn.com/en-us/news/politics/mar-a-lago-search-warrant-was-properly-granted-says-trump-documents-judge/ar-BB1oScOu?ocid=msedgdhp&pc=U531&cvid=ea2f2269225244f8b62cbbc9e111da44&ei=9

The federal judge overseeing Donald Trump’s criminal case for retaining classified documents suggested she would deny his attempt to exclude the documents the FBI seized at the Mar-a-Lago club, saying at a hearing Tuesday that the warrant for the search was properly granted. The former president’s lawyers had contended the warrant was unconstitutionally vague and the FBI affidavit, used to convince the magistrate judge to find there was probable cause for a crime at the club, contained contextual omissions. But the US district judge Aileen Cannon suggested she considered the warrant was sufficiently specific about what items FBI agents could seize at Mar-a-Lago, and told Trump’s lawyers the omissions would have made no difference on whether there was probable cause.

This issue had already been settled but Judge Bimbo had to have a hearing to conclude the obvious. Delay, delay, delay.

Bagdad 105 f. Khartoum 101. Xinjiang 104. Dodge City 100.

Seems like something is going on. But weather like this is probably good for the crops, right?

Hahaha, love the mixture there. I should check Dalian’s temps just for fun. It’s uh, it’s dark humor with the topic, but uh, I got a kick out of your choices there. But I’m biased because by Dad told me he was watching “Gunsmoke” when my Mom went into labor with me.

Highs in the low 80s right now In Dalian. But it’s pretty far north. The way I taught myself before and during my time in Dalian was to think of it in terms it was windy like Chicago and also had very near the same latitude line as Chicago. That mindframe served me well while I was there, especially in the cold months. But I love the colder cities, so that was part of why I loved it there so much. Back in southern plains heat again now. Boohoo boohoo, poor Uncle Moses.

State Employment and Unemployment Summary

https://www.bls.gov/news.release/laus.nr0.htm

I have not yet dived into the details but Kevin Drum has a post showing that the states with rising unemployment rates happen to be blue states like California. I wonder if that is because they are more willing to let immigrants move in. Which would mean faster growth as these immigrants will find good paying jobs over time. Unless of course that racist POS that was the 45th President gets back in the White House and kicks them all out.

U.S. economic and financial exceptionalism:

https://finance.yahoo.com/news/special-sauce-behind-american-exceptionalism-100000173.html

This topic is not new. It has been discussed here on several occasions. And let’s not forget how good we are at financial crisis.

16 Nobel Economists Warn Second Donald Trump Term Would Mean 1 Thing

Joe Biden’s economic agenda is “vastly superior” to Trump’s, the Nobel laureates explained in a letter.

https://www.huffpost.com/entry/nobel-economists-donald-trump-warning_n_667a9e8de4b0a7cf62440e7e

I have seen lots of stories on this letter but none of them link to the letter. Does anyone have a link?

So I’ve been reading more stories and came across this:

‘The Trump campaign staunchly rejected the Nobel economists’ position. “The American people don’t need worthless out of touch Nobel peace prize winners to tell them which president put more money in their pockets,” Trump campaign spokesperson Karoline Leavitt said in a statement to CNBC. Under Trump, the December year-over-year Consumer Price Index fell during three of his four years in office.’

Where to start? Let’s take an easy one – this last sentence. The price index fell? I guess Bruce Hall wrote this stupidity for team Trump as he never got the difference between a price index v. the rate of change of the price index. And of course Trump took money out of our pockets to line his own. But these 16 economists are “worthless”. Oh yea – he prefers Moore, Kudlow, and other a$$ kissing lying morons. MAGA!

A monster, a literal MONSTER, encourages the spreading of a terminal virus, that killed how many Americans, (elderly, children, immune weak) and then take a bow for low inflation as a result of people dying and sitting at home??? Really!?!?!?!?!? If you are MAGA, how G*DDAMNED dumb are you??? Don’t answer. we know and God will tell you one day.

Peace Prize?

Speaking of climate change, a till-now unanticipated mechanism by which warming ocean water is undermining the antarctic and other coastal ice sheets means that ice-sheet tipping points are nearer than had been expected:

https://amp.cnn.com/cnn/2024/06/25/climate/antarctic-ice-sheet-tipping-point-sea-level-rise-climate-intl

Sorry, Miami. Sorry Boston and New Orleans. Really sorry, Bangkok and Amsterdam.

“Sorry, Miami. Sorry Boston and New Orleans.”

No more Celtics or Heat in the NBA? Now if the Saints were eliminated – I’d be fine with that. Oh wait – no more Manhattan?!

@ pgl

I miss the days when Jim Mora coached the Saints and Jim Finks was the Saints GM, Two very very sharp guys. Finks made the decision to draft Alan Page when he was in the front office of the Vikings. Alan Page was another very intelligent and great human being. Sorry, couldn’t stop myself from getting wistful for these old guys from my childhood. “When men were men” (or so I have convinced myself)

“Playoffs?!?!?!?!?!”