I’ve spent the last week seeing lots of presentations on macro and international finance. Of particular interest are some papers on interest rate parity:

Pablo Cuba Borda, Federal Reserve Board

Martin Bodenstein, Fedral Reserve Board

Nils Gornemann, Federal Reserve Board

Ignacio Presno, Federal Reserve Board

We propose a model with costly international financial intermediation that links exchange rate movements to shifts in the demand for domestically produced goods relative to the demand for imported goods (trade rebalancing). Our model is consistent with stylized facts of exchange rate dynamics, including those related to the trade balance, which is typically overlooked in the literature on exchange rate determination. In a quantitative assessment, trade rebalancing explains nearly 50 percent of exchange rate fluctuations over the business cycle, whereas exogenous deviations from the uncovered interest rate parity— the primary source of exchange rate fluctuations in the literature—account for just above 20 percent. Using data on trade flows or the trade balance is key to properly identifying the determinants of the exchange rate. Thus, our model overcomes the sharp dichotomy between the real exchange rate and the macroeconomy embedded in other models of exchange rate determination.

Discussant:

Federica Romei, University of Oxford

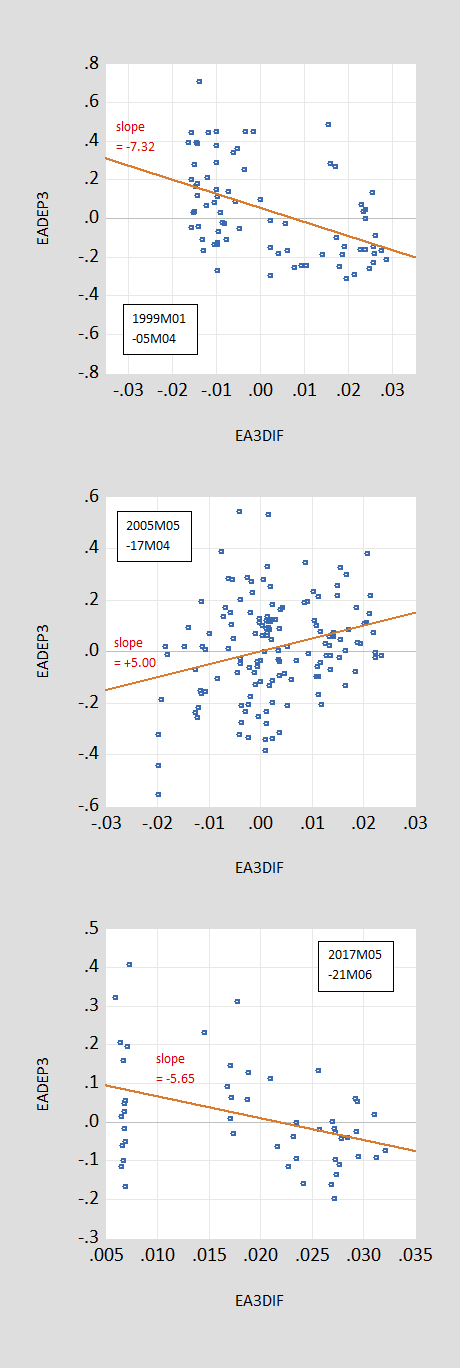

On this first paper, I noted that while the paper was trying to explain the Fama result (forward premia rates do not predict correctly exchange rate depreciation), this is not a constant. From BCCF (IMF ER 2022).

Figure 1: Ex post 3 month annualized depreciation of euro/dollar (vertical axis) against 3 month offshore US-euro interest differential (horizontal axis), for 1999M01-2005M04 (top figure), for 2005M05-2017M04 (middle figure), and 2017M05-2021M06 (bottom figure). Samples pertain to interest rate data, so 1999M01-2005M04 sample includes 3 month ex post depreciation up to 2005M07.

Tarek Alexander Hassan, Boston University and NBER

Thomas Mertens, Federal Reserve Bank of San Francisco

Jingye Wang, Renmin University of China

Canonical long-run risk and habit models reconcile high equity premia with smooth risk-free rates by inducing an inverse functional relationship between the variance and the mean of the stochastic discount factor. We show this highly successful resolution to closed-economy asset pricing puzzles is fundamentally problematic when applied to open economies with complete markets: It requires that differences in currency returns arise almost exclusively from predictable appreciations, not from interest rate differentials. In the data, by contrast, exchange rates are largely unpredictable, and currency returns differ because interest rates differ widely across currencies. We show currency risk premia arising in canonical long-run risk and habit preferences cannot match this fact. We argue this tension between canonical asset pricing and international macroeconomic models is a key reason researchers have struggled to reconcile the observed behavior of exchange rates, interest rates, and capital flows across countries. The lack of such a unifying model is a major impediment to understanding the effect of risk premia on international markets.

Discussant:

Hanno Lustig, Stanford University and NBER

Seunghoon Na, Purdue University

Yinxi Xie, Bank of Canada

This paper investigates exchange rate dynamics and its forecast errors by incorporating bounded rationality in a small open-economy New Keynesian model. Decisionmakers possess limited foresight, capable of planning only up to a finite distance into the future. This yields dynamic overshooting of forecast errors in the real exchange rate across different time horizons. It also distinguishes between short- and long-term expectation formations, where the Law of Iterated Expectations breaks. This framework provides a micro-foundation for understanding time- and forecast-horizon variability in uncovered interest parity (UIP) puzzles. Our model predictions on these UIP violations align both qualitatively and quantitatively with empirical estimates.

Discussant:

Rosen Valchev, Boston College and NBER

I found this paper particularly appealing since I, along with Guy Meredith, found a relationship consistent with this model. In Chinn and Meredith (1998).

Figure 2: Panel beta coefficients at different horizons. Notes: up to 12 months, panel estimates for 6 currencies against US$, euro deposit rates, 1980Q1-2000Q4; 3-year results are zero-coupon yields, 1976Q1-1999Q2; 5 and 10 years, constant yields to maturity, 1980Q1-2000Q4 and 1983Q1-2000Q4 (last observation corresponds to exchange rate data). Source: Chinn (2006).

Some updated results are in this 2022 post.

Update, 7/15 7am PT:

Caught another paper in EFG on Saturday:

Rohan Kekre, University of Chicago and NBER

We study the source of exchange rate fluctuations using a general equilibrium model accommodating shocks in goods and financial markets. These shocks differ in their induced comovements between exchange rates, interest rates, and quantities. A calibration matching data from the U.S. and G10 currency countries implies that persistent shocks to relative demand, reflected in persistent interest rate differentials, account for 75% of the variance in the dollar/G10 exchange rate. Shocks to currency intermediation are important, however, in generating deviations from uncovered interest parity at high frequencies and explaining the dollar appreciation in crises.

Discussant:

Oleg Itskhoki, University of California, Los Angeles and NBER

And being presented today in Macro Across and Within Borders:

Ṣebnem Kalemli-Özcan, Brown University and NBER

Liliana Varela, London School of Economics

We document five novel facts about the UIP-wedge—the difference between expected USD return on local currency assets and the actual return on the USD assets. We show that the UIP-wedge behaves differently across emerging markets (EM) and advanced economies (AE) along several dimensions: 1) The EM-UIP wedge fluctuates but always stays positive, implying persistent currency excess returns. 2) Global and local risk factors together can explain 45% of the time-variation in the EM-UIP wedge. 3) The interest rate differentials explain 70% of the time-variation in the EM-UIP wedge. 4) Survey expectations and ex-post exchange rate changes deliver similar EMUIP wedges in the data as foreign investors expect EM currencies to depreciate most of the time, pricing-in an ex-ante risk premium to hold these currencies. 5) The EM-UIP wedge comoves negatively with capital inflows. Although facts (1) to (3) are consistent with several class of models, facts (4) and (5) are harder to explain with existing models, as interest rate differentials reflect endogenous ex-ante pricing of country-specific risks and can explain a large part of the correlation between capital flows and the EM-UIP wedge.

Discussion Leader:

Charles Engel, University of Wisconsin-Madison and NBER

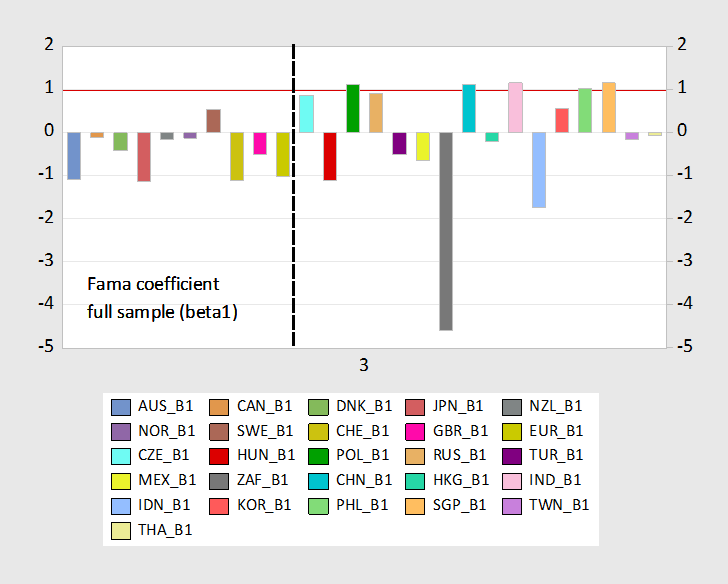

Using a longer (in many cases) sample, Jeffrey Frankel and I obtain somewhat different results regarding the Fama regression coefficients (esp. with period subsamples). The working paper is here, while the accompanying slide deck is here.

Here’re our estimates of the Fama coefficient (pre-pandemic):

Figure 3: Fama regression coefficients 1986-2019 (shorter samples for some currencies). Red horizontal line at RatEx-UIP posited value. Dashed bold line separates advanced currencies from EM currencies. Source: Table 1.1 in Chinn and Frankel (2020).

This is impressive:

“In a quantitative assessment, trade rebalancing explains nearly 50 percent of exchange rate fluctuations over the business cycle, whereas exogenous deviations from the uncovered interest rate parity— the primary source of exchange rate fluctuations in the literature—account for just above 20 percent.”

Since the connection between trade and exchange rates is obvious, and the Fama puzzle has been known at least since 1984, why are we seeing this only in 2024? (Sort of like reaching the same conclusion in 2024 as was reached by Chinn and Meredith in 1998. ;^) )

I’m not sure I understand your (Professor Romei’s?) point about the sometimes Fama puzzle. The charts show that sometimes exchange rates run in the direction predicted by interest-rate differentials, sometimes they don’t. Sure enough true, but is that a criticism of Borda, Bodenstein, Gornemann and Presno? Seems like it shouldn’t be. Seems like it fits with their finding that rate differentials only explain 20% of exchange rate fluctuation.

As for Hansen, Mertens and Wang:

“We argue this tension between canonical asset pricing and international macroeconomic models is a key reason researchers have struggled to reconcile the observed behavior of exchange rates, interest rates, and capital flows across countries.”

Yep. When the world doesn’t behave according to your model’s predictions, you have the wrong model. Economics has been struggling with the Fama puzzle at least since Fama pointed it out. Uncovered interest-rate parity provides a poor explanation for exchange rate behavior. Could it be that the unshakable dominance of highly financialized models is the problem? I know this is a stretch, but highly financialized models of the mortgage industry turned out to be mistaken a decade and a half ago. Remember the cupola? Models of inflation which lean heavily on money aren’t worth much, either.

Borda, Bodenstein, Gornemann and Presno bring the real economy unto their model (shudder…) and seem to get good results. Real economic shocks add complication to financial models, but they apparently matter.

Wouldn’t it be funny if the whole brouhaha over Biden’s debate performance was a case of mistaking noise for signal? Funny, funny, funny. The leadership ofthe most powerful country in the world depending on pundits and political hacks thinking they know something, when they actually don’t. Funny, funny, funny:

https://news.northeastern.edu/2024/07/09/biden-debate-performance-voter-preferences/

Is surveys of the same people before and after the debate – done to assure that changes in the same don’t skews the results – 94% of those who said they supported Biden before the debate still supported him after. Among those who said they supported Trump prior to the debate, 84% still did after.

Wait…so Trump was more damaged by the debate than Biden? That’s not “the story”. That’s not “Biden’s age is a problem.” So it can’t be true, right?

Of course, we will never know the actual truth of the matter. Be assured, though, that the public record will contiue to show that Biden smooched the pooch at the debate. ‘Cause the people who maintain the public record, who write the first draft of history, don’t admit mistakes.

It is funny!

Joe and Jill are Henry and Margaret from Shakespeare.

Hey troll – if you are going to cite the Bard, please admit you are referring to Richard III. And BTW – Shakespeare would be highly insulted by your pathetic little attempt at humor. You are nothing more than a sad joke.

I referred to Henry VI, and Margaret of Anjou.

Real history, and Shakespeare dramatized the history.

Henry VI is a Shakespeare play, which PBS ran a British production 6 or 7 years ago.

The allusion to Henry tracks with a less than competent king!

Ill now thrown in the part of the history had the York prime candidate for king Richard killed after one battle in the war of the roses .

What just happened in Pa.

You do have a designated driver, right.

Hey troll – shut the eff up.

Why are conservatives such damn gold bugs?

https://jabberwocking.com/why-are-conservatives-such-damn-gold-bugs/

Kevin Drum has been reading that chapter from Project 2025 as well. Kevin may not be an economist but this post does a nice case noting why going back to the gold standard is a bad idea.

Drum’s charts are very good. A simple, graphical exploration of the data, showing the imitation of policy. In this case, two charts which together show that gold-based monetary policy would be bad for price stability and bad for overall economic stability.

You’d thing people making policy recommendations would bother looking into the facts, but gold bugs certainly never do. If they did, they’d stop making policy recommendations.

I have in the past commended the people who comment on Kevin’s post but this one was just dumb:

‘Question: Why did you pick real GDP to chart? How about nominal GDP – which is a better target.’

The goal is not to stabilize nominal income but rather to keep real GDP near potential. I guess some people don’t get the difference between tools and goals. DUH!

Byron Donalds and the Myth of the Broken Black Family

https://atlantadailyworld.com/2024/07/10/byron-donalds-and-the-myth-of-the-broken-black-family/

Keith Boykin is someone we should all follow. In this post he takes down the disgusting racist BS from Trump’s boy Byron Donalds.

The American death cult strikes again, this time at a Trump rally. Naturally.

A 20 year old registered Republican. But did that stop the MAGA crowd from blaming Biden. Kevin Drum has a post detailing their absurdities.

Biden and Pelosi are class acts:

https://www.msn.com/en-us/news/politics/nothing-else-is-appropriate-nancy-pelosi-praised-for-class-act-response-to-trump-rally-shooting/ar-BB1pXheM?ocid=msedgdhp&pc=U531&cvid=c02b64e05ea245cbbc82729ced1020ad&ei=12

Of course Republicans have decided to politicize this to the max with their blame the Democrats lies. What one would expect from the MAGA crowd.

The shootings at the Trump rally in Pennsylvania have generated lots of low-value press coverage (“What is a Magnetron?”), but so far, I haven’t seen anything about Pennsylvania’s role in the presidential election, which turns out to be pretty important. So I’ll do it myself.

Pennsylvania is the key state in determining who’ll win the presidential election. Over at 270-to-win, there is an assessment of the “paths to victory” for both candidates, based on polling and the views of a gaggle of professional prognosticators. It has just updated to show Trump winning 270 electoral votes; this is the first time that has been the case. That’s because 270-to-Win has just moved Pennsylvania to a likely win for Trump.

Untill just now, 270-to-Win showed three combinations of as-yet undecided states which represent potential paths to victory for Biden. Every one included Pennsylvania; Biden has to win Pennsylvania to remain president, which probably explains why Trump was there.

I don’t know if the shootings will sway voters in Pennsylvania, but the answer to that question seems more consequential than most of what the press is covering.

https://www.270towin.com/road-to-270-combinations/?mapstr=22201311146142322221130522262253301423012224231102214252&year=2024

Trump was attacked by a republican. Perhaps it is time to step away from politics rather than continue to incite violence, like he has for years. I don’t condone violence. But this action from the maga crowd does not surprise me one bit. Stop baiting the fringe. This was republican on republican violence.

Trump was saved by illegal immigrants!!!

Had he not turned his head to point a chart of illegal immigration, that shot would have hit him in the head not the ear.

Off topic, though still about interest rates:

The FOMC seems to believe that r* has risen by 0.3%, from 0.5% to 0.8%. That’s based on changes in the median estimate of the longer-run fed funds rate in the Summary of Economic Projections. In the most recent SEP, the median longer-run funds rate estimate was 2.8%, up from the 2.5% rate that has prevailed just about forever:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

That 0.3% increase is just a little larger than a single standard Fed rate hike, so may not seem like a big deal. Maybe it isn’t. But it does represent a change in thinking among Fed policy makers.

Among the smarter Fed policy makers is New York Fed President John C. Williams. Here’s what he has to say about the real neutral rate:

“Although the value of r-star is always highly uncertain, the case for a sizable increase in r-star has yet to meet two important tests. First, owing to the interconnectedness of r-star across countries, plausible factors pushing up r-star on a sustained basis are likely to be global in nature. This highlights a tension between the evidence from Europe that r-star is still very low and arguments in the United States that r-star is now closer to levels seen 20 years ago.

“Second, any increase in r-star must overcome the forces that have been pushing r-star down for decades. In this regard, recent data reinforce the continuation of pre-pandemic trends in global demographics and productivity growth.”

https://www.newyorkfed.org/newsevents/speeches/2024/wil240703

Williams goes on to point out that estimates of potential growth have not risen (the consequence of demographic and productivity estimates), which argues against a rise in r*.

By the way, exclude shelter and CPI has risen at less than a 2% annual pace in 6 of the last 7 quarters:

https://fred.stlouisfed.org/graph/?g=1qb4N

Looks like stable prices to me, except for a supply problem in a single sector. Tight monetary policy arguably makes supply problems worse.

The shelter industry, by the way, has been enjoying abnormally high profit margins because of supply constraints. That’s a structural problem, which is another thing monetary policy isn’t any good at resolving.

https://www.newyorkfed.org/medialibrary/media/newsevents/speeches/2024/jcwilliams-ecbforum-070324-slides.pdf

This PDF has the graphs that go along with Williams’s excellent paper. Note figure 2. r-star in both Europe and the US are near 1%. The European 5-year real interest rate is only slightly above its r-star but note in particular that the 5-year real interest rate in the US is above 2%.

In other words, the FED should be lowering interest rates NOW.

I have lived in pessimism for so long that I don’t easily trust good news. Neither, apparently, do those associated with this research, but it says what it says:

https://www.carbonbrief.org/analysis-chinas-emissions-set-to-fall-in-2024-after-record-growth-in-clean-energy/

China’s greenhouse gas emissions may be falling. Maybe. The authors recognize that the rapid pace of construction of coal-fire plants could mean that the recent apparent decline in CO2 emissions could be temporary. (It could be illusory – see below.) Still, this apparent drop could be good news.

So, what can we look at for corroboration of the drop this year? Coal import data is a start. Here’s Bloomberg on H1 imports:

“Coal imports have risen 13% over the year so far, well below the 93% growth recorded in the first six months of 2023.”

https://www.bloomberg.com/news/articles/2024-07-12/china-s-commodities-imports-ease-in-june-on-sluggish-economy

That doesn’t serve to corroborate a drop in emissions. Oil imports are down, though.

China’s investment in coal production was up pretty strongly in 2023, which doesn’t bode well:

https://globalenergyprize.org/en/2024/06/21/chinas-investments-in-coal-mining-reach-new-high/

So if the research shows a drop in greenhouse gas emissions is true, something weird must be going on, because coal consumption is rising rapidly. More rapidly than GDP, which really sets China apart as a bad actor.

Trump Allies Try to Bully Dems, Media to Shut Up About His Fascist Plans

https://www.msn.com/en-us/news/politics/trump-allies-try-to-bully-dems-media-to-shut-up-about-his-fascist-plans/ar-BB1pYTom?ocid=msedgdhp&pc=U531&cvid=14b6f2cdf5804063b16149dcf9a022e5&ei=14

As Donald Trump recovers from an assassination attempt and Republicans head to Milwaukee for his coronation this week, the GOP elite has rallied around a new messaging strategy: emotionally blackmailing Democratic politicians, journalists, Hollywood celebs, and numerous other Trump critics into shutting up about the former president’s openly authoritarian vows and his extreme policy agenda. Since the deadly shooting at a Pennsylvania rally Saturday, prominent conservatives have been working to blame the incident on Trump’s enemies for labeling him a “fascist” and for fanning heated “rhetoric” that, in their telling, caused the would-be assassin to shoot at the former and perhaps future American president. “When the message goes out constantly that the election of Donald Trump would be a threat to democracy and that the Republic would end, it heats up the environment,” House Speaker Mike Johnson (R-La.) said Sunday, adding: “It’s simply not true. Everyone needs to turn the rhetoric down.”

You knew this was coming. Liars gotta lie.

trump is the one who said he would be a dictator on day 1. nobody made that crap up. came from the horses mouth.

“Everyone needs to turn the rhetoric down.”

i never turned the rhetoric up. that has been faux news and trump for years. don’t ask me to turn it down. johnson simply needs to stop using the rhetoric and then blaming others. democrats are not at fault here. trump is the one instigating violence for years. if trump wants violence to end, simply ask his supporters to tone it down, instead of bragging how his supporters would smash any protesters at his rallies. you reap what you sow, maga.

This strikes me as a pretty important finance story:

https://www.ft.com/content/b5ab26ad-fe3e-483d-89b7-03edb06662fe

Private equity is having a tougher time now than in its history so far. Higher rates cut into returns and regulatory oversight is increasing, reducing gains from regulatory arbitrage. Since private equity has some pernicious managerial habits, hard times for private equity is happy news.

The “higher rates” part if the story is likely to be only partly reversed inthe future, since most central banks seem to have concluded that prolonged periods of zero rates are a bad idea.