See full document here (couldn’t download from Heritage when I tried). Here’s the text for monetary policy.

“Eliminate the “dual mandate.” The Federal Reserve was originally created to “furnish an elastic currency” and rediscount commercial paper so that the supply of credit could increase along with the demand for money and bank credit. In the 1970s, the Federal Reserve’s mission was amended to maintain macroeconomic stability following the abandonment of the gold standard.7 This included making the Federal Reserve responsible for maintaining full employment, stable prices, and long-term interest rates.

Supporters of this more expansive mandate claim that monetary policy is needed to help the economy avoid or escape recessions. Hence, even if there is a built-in bias toward inflation, that bias is worth it to avoid the pain of economic stagnation. This accommodationist view is wrong. In fact, that same easy money causes the clustering of failures that can lead to a recession. In other words, the dual mandate may inadvertently contribute to recessions rather than fixing them.A far less harmful alternative is to focus the Federal Reserve on protecting the dollar and restraining inflation. This can mitigate economic turmoil, perhaps in conjunction with government spending. Fiscal policy can be more effective if it is timely, targeted, and temporary.8 An example from the COVID-19 pandemic is the Paycheck Protection Program, which sustained businesses far more effectively than near-zero interest rates, which mainly

aided asset markets and housing prices. It is also worth noting that the problem of the dual mandate may worsen with new pressure on the Federal Reserve to include environmental or redistributionist “equity” goals in its policymaking, which will likely enable additional federal spending.9Limit the Federal Reserve’s lender-of-last-resort function. To protect banks that over lend during easy money episodes, the Federal Reserve was assigned a “lender of last resort” (LOLR) function. This amounts to a standing bailout offer and encourages banks and nonbank financial institutions to engage in reckless lending or even speculation that both exacerbates the boom-and-bust cycle and can lead to financial crises such as those of 199210 and 200811 with ensuing bailouts.

This function should be limited so that banks and other financial institutions behave more prudently, returning to their traditional role as conservative lenders rather than taking risks that are too large and lead to still another taxpayer bailout. Such a reform should be given plenty of lead time so that banks can self-correct lending practices without disrupting a

financial system that has grown accustomed to such activities. lWind down the Federal Reserve’s balance sheet. Until the 2008 crisis, the Federal Reserve never held more than $1 trillion in assets, bought largely to influence monetary policy.12 Since then, these assets have exploded, and the Federal Reserve now owns nearly $9 trillion of mainly federal debt ($5.5 trillion)13 and mortgage-backed securities ($2.6 trillion).14 There is currently no government oversight of the types of assets that the Federal Reserve purchases.

These purchases have two main effects: They encourage federal deficits and support politically favored markets, which include housing and even corporate debt. Over half of COVID-era deficits were monetized in this way by the Federal Reserve’s purchase of Treasuries, and housing costs were driven to historic highs by the Federal Reserve’s purchase of mortgage securities. Together, this policy subsidizes government debt, starving business borrowing, while rewarding those who buy homes and certain corporations at the expense of the wider public.

Federal Reserve balance sheet purchases should be limited by Congress, and the Federal Reserve’s existing balance sheet should be wound down as quickly as is prudent to levels similar to what existed historically before the 2008 global financial crisis.15 l Limit future balance sheet expansions to U.S. Treasuries. The Federal Reserve should be prohibited from picking winners and losers among asset classes. Above all, this means limiting Federal Reserve interventions in the mortgage-backed securities market. It also means eliminating Fed interventions in corporate and municipal debt markets.

Restricting the Fed’s open market operations to Treasuries has strong economic support. The goal of monetary policy is to provide markets with needed liquidity without inducing resource misallocations caused by interfering with relative prices, including rates of return to securities. However, Fed intervention in longer-term government debt, mortgage backed

securities, and corporate and municipal debt can distort the pricing process. This more closely resembles credit allocation than liquidity provision.The Fed’s mortgage-related activities are a paradigmatic case of what monetary policy should not do. Consider the effects of monetary policy on the housing market. Between February 2020 and August 2022, home prices increased 42 percent.16 Residential property prices in the United States adjusted for inflation are now 5.8 percent above the prior all-time record

levels of 2006.17 The home-price-to-median-income ratio is now 7.68, far above the prior record high of 7.0 set in 2005.18 The mortgage-payment-toincome ratio hit 43.3 percent in August 2022—breaking the highs of the prior housing bubble in 2008.19 Mortgage payment on a median-priced home (with a 20 percent down payment) jumped to $2,408 in the autumn of 2022 vs. $1,404 just one year earlier as home prices continued to rise even as mortgage rates more than doubled. Renters have not been spared: Median apartment

rental costs have jumped more than 24 percent since the start of 2021.20 Numerous cities experienced rent increases well in excess of 30 percent.A primary driver of higher costs during the past three years has been the Federal Reserve’s purchases of mortgage-backed securities (MBS). Since March 2020, the Federal Reserve has driven down mortgage interest rates and fueled a rise in housing costs by purchasing $1.3 trillion of MBSs from Fannie Mae, Freddie Mac, and Ginnie Mae. The $2.7 trillion now owned by the Federal Reserve is nearly double the levels of March 2020. The flood of capital from the Federal Reserve into MBSs increased the amount of capital available for real estate purchases while lower interest rates on mortgage borrowing—driven down in part by the Federal Reserve’s MBS purchases—induced and enabled borrowers to take on even larger loans.21 The Federal Reserve should be precluded from any future purchases of MBSs and should wind down its holdings either by selling off the assets or by allowing them to

mature without replacement.Stop paying interest on excess reserves. Under this policy, also started

during the 2008 financial crisis, the Federal Reserve effectively prints

money and then “borrows” it back from banks rather than those banks’

lending money to the public. This amounts to a transfer to Wall Street at

the expense of the American public and has driven such excess reserves

to $3.1 trillion, up seventyfold since 2007.22 The Federal Reserve should

immediately end this practice and either sell off its balance sheet or simply

stop paying interest so that banks instead lend the money. Congress should

bring back the pre-2008 system, founded on open-market operations. This

minimizes the Fed’s power to engage in preferential credit allocation.MONETARY RULE REFORM OPTIONS

While the above recommendations would reduce Federal Reserve manipulation and subsidies, none would limit the inflationary and recessionary cycles caused by the Federal Reserve. For that, major reform of the Federal Reserve’s core activity of manipulating interest rates and money would be needed.

A core problem with government control of monetary policy is its exposure to two unavoidable political pressures: pressure to print money to subsidize government deficits and pressure to print money to boost the economy artificially until the next election. Because both will always exist with self-interested politicians, the only permanent remedy is to take the monetary steering wheel out of the Federal Reserve’s hands and return it to the people.

This could be done by abolishing the federal role in money altogether, allowing the use of commodity money, or embracing a strict monetary-policy rule to ward off political meddling. Of course, neither free banking nor a allowing commodity-backed money is currently being discussed, so we have formulated a menu of reforms. Each option involves trade-offs between how effectively it restrains the Federal Reserve and how difficult each policy would be to implement, both politically for Congress and economically in terms of disruption to existing financial institutions. We present these options in decreasing order of effectiveness against inflation and boom-and-bust recessionary cycles.Free Banking. In free banking, neither interest rates nor the supply of money is controlled by the government. The Federal Reserve is effectively abolished, and the Department of the Treasury largely limits itself to handling the government’s money. Regions of the U.S. actually had a similar system, known as the “Suffolk System,” from 1824 until the 1850s, and it minimized both inflation and economic disruption while allowing lending to flourish.23

Under free banking, banks typically issue liabilities (for example, checking accounts) denominated in dollars and backed by a valuable commodity. In the 19th century, this backing was commonly gold coins: Each dollar, for example, was defined as about 1/20 of an ounce of gold, redeemable on demand at the issuing bank. Today, we might expect most banks to back with gold, although some might prefer to back their notes with another currency or even by equities or other assets such as real estate. Competition would determine the right mix of assets in banks’ portfolios as backing for their liabilities.As in the Suffolk System, competition keeps banks from overprinting or lending irresponsibly. This is because any bank that issues more paper than it has assets available would be subject to competitor banks’ presenting its notes for redemption.

In the extreme, an overissuing bank could be liable to a bank run. Reckless banks’ competitors have good incentives to police risk closely lest their own holdings of competitor dollars become worthless.24

In this way, free banking leads to stable and sound currencies and strong financial systems because customers will avoid the riskier issuers, driving them out of the market. As a result of this stability and lack of inflation inherent in fully backed currencies, free banking could dramatically strengthen and increase both the dominant role of America’s financial industry and the use of the U.S. dollar as the global currency of choice.25 In fact, under free banking, the norm is for the dollar’s purchasing power to rise gently over time, reflecting gains in economic productivity. This “supply-side deflation” does not cause economic busts. In fact, by ensuring that cash earns a positive (inflation-adjusted) rate of return, it can prevent households and businesses from holding inefficiently small money balances.

Further benefits of free banking include dramatic reduction of economic cycles,

an end to indirect financing of federal spending, removal of the “lender of last

resort” permanent bailout function of central banks, and promotion of currency

competition.26 This allows Americans many more ways to protect their savings.

Because free banking implies that financial services and banking would be governed

by general business laws against, for example, fraud or misrepresentation,

crony regulatory burdens that hurt customers would be dramatically eased, and

innovation would be encouraged.Potential downsides of free banking stem from its greatest benefit: It has massive political hurdles to clear. Economic theory predicts and economic history confirms that free banking is both stable and productive, but it is radically different from the system we have now. Transitioning to free banking would require political authorities, including Congress and the President, to coordinate on multiple reforms simultaneously. Getting any of them wrong could imbalance an otherwise functional system. Ironically, it is the very strength of a true free banking system that makes transitioning to one so difficult.

Commodity-Backed Money. For most of U.S. history, the dollar was defined in terms of both gold and silver. The problem was that when the legal price differed from the market price, the artificially undervalued currency would disappear from circulation. There were times, for instance, when this mechanism put the U.S. on a de facto silver standard. However, as a result, inflation was limited.

Given this track record, restoring a gold standard retains some appeal among monetary reformers who do not wish to go so far as abolishing the Federal Reserve. Both the 2012 and 2016 GOP platforms urged the establishment of a commission to consider the feasibility of a return to the gold standard,27 and in October 2022, Representative Alexander Mooney (R–WV) introduced a bill to restore the gold standard.28

In economic effect, commodity-backing the dollar differs from free banking in that the government (via the Fed) maintains both regulatory and bailout functions. However, manipulation of money and credit is limited because new dollars are not costless to the federal government: They must be backed by some hard asset like gold. Compared to free banking, then, the benefits of commodity-backed money are reduced, but transition disruptions are also smaller.

The process of commodity backing is very straightforward: Treasury could set the price of a dollar at today’s market price of $2,000 per ounce of gold. This means that each Federal Reserve note could be redeemed at the Federal Reserve and exchanged for 1/2000 ounce of gold—about $80, for example, for a gold coin the weight of a dime. Private bank liabilities would be redeemable upon their issuers. Banks could send those traded-in dollars to the Treasury for gold to replenish their vaults. This creates a powerful self-policing mechanism: If the federal government creates dollars too quickly, more people will doubt the peg and turn in their gold to banks, which then will turn in their gold and drain the government’s gold. This forces governments to rein in spending and inflation lest their gold reserves become depleted.

One concern raised against commodity backing is that there is not enough gold in the federal government for all the dollars in existence. This is solved by making sure that the initial peg on gold is correct. Also, in reality, a very small number of users trade for gold as long as they believe the government will stick to the price peg. The mere fact that people could exchange dollars for gold is what acts as the enforcer. After all, if one is confident that a dollar will still be worth 1/2000 ounce of gold in a year, it is much easier to walk about with paper dollars and use credit cards than it is to mail tiny $80 coins. People would redeem en masse only if they feared the government would not be able control itself, for which the only solution

is for the government to control itself.Beyond full backing, alternate paths to gold backing might involve gold-convertible

Treasury instruments29 or allowing a parallel gold standard to operate

temporarily alongside the current fiat dollar.30 These could ease adoption while

minimizing disruption, but they should be temporary so that we can quickly enjoy

the benefits of gold’s ability to police government spending. In addition, Congress

could simply allow individuals to use commodity-backed money without fully

replacing the current system.Among downsides to a commodity standard, there is no guarantee that the government

will stick to the price peg. Also, allowing a commodity standard to operate

along with a fiat dollar opens both up for a speculative attack. Another downside is

that even under a commodity standard, the Federal Reserve can still influence the

economy via interest rate or other interventions. Therefore, at best, a commodity

standard is not a full solution to returning to free banking. We have good reasons

to worry that central banks and the gold standard are fundamentally incompatible—

as the disastrous experience of the Western nations on their “managed gold

standards” between World War I and World War II showed.K-Percent Rule. Under this rule, proposed by Milton Friedman in 1960,31 the Federal Reserve would create money at a fixed rate—say 3 percent per year. By offering the inflation benefits of gold without the potential disruption to the financial system, a K-Percent Rule could be a more politically viable alternative to gold. The principal flaw is that unlike commodities, a K-Percent Rule is not fixed by physical costs: It could change according to political pressures or random economic fluctuations. Importantly, financial innovation could destabilize the market’s demand for liquidity, as happened with changes in consumer credit patterns in the 1970s. When this happens, a given K-Percent Rule that previously delivered stability could become destabilizing. In addition, monetary policy when Friedman proposed the K-Percent Rule was very different from monetary policy today. Adopting a K-Percent Rule would require considering what transitions need to take place.

Inflation-Targeting Rules. Inflation targeting is the current de facto Federal Reserve rule.32 Under inflation targeting, the Federal Reserve chooses a target inflation rate—essentially the highest it thinks the public will accept—and then tries to engineer the money supply to achieve that goal. Chairman Jerome Powell and others before him have used 2 percent as their target inflation rate, although some are now floating 3 percent or 4 percent.33 The result can be boom-and-bust cycles of inflation and recession driven by disruptive policy manipulations both because the Federal Reserve is liable to political pressure and because making economic predictions is very difficult if not impossible.

Inflation and Growth–Targeting Rules. Inflation and growth targeting is a popular proposal for reforming the Federal Reserve. Two of the most prominent versions of inflation and growth targeting are a Taylor Rule and Nominal GDP (NGDP) Targeting. Both offer similar costs and benefits. Economists generally believe that the economy’s long-term real growth trend is determined by non-monetary factors. The Fed’s job is to minimize fluctuations around that trend nominal growth rate. Speculative booms and destructive busts caused by swings in total spending should be avoided. NGDP targeting stabilizes total nominal spending directly. The Taylor Rule does so indirectly, operating through the federal funds rate.

NGDP targeting keeps total nominal spending growth on a steady path. If the demand for money (liquidity) rises, the Fed meets it by increasing the money supply; if the demand for money falls, the Fed responds by reducing the money supply. This minimizes the effects of demand shocks on the economy. For example, if the long-run growth rate of the U.S. economy is 3 percent and the Fed has a 5 percent NGDP growth target, it expands the money supply enough to boost nominal income by 5 percent each year, which translates into 3 percent real growth and 2 percent inflation. How much money must be created each year depends on how fast money demand is growing.

The Taylor Rule works similarly. It says the Fed should raise its policy rate when inflation and real output growth are above trend and lower its policy rate when inflation and real output growth are below trend. Whereas NGDP targeting focuses directly on stable demand as an outcome, the Taylor Rule focuses on the Fed’s more reliable policy levers. The problem with both rules is the knowledge burden they place on central bankers. These rules state that the Fed should neutralize demand shocks but not respond to supply shocks, which means that it should “see through” demand shocks by tolerating higher (or lower) inflation. In theory, this has much to recommend it. In practice, it can be very difficult to distinguish between demand-side destabilization and supply-side destabilization in real time. There also are political considerations: Fed officials may not be willing to curb unjustified economic booms

and all too willing to suppress necessary economic restructuring following a bust.Either rule likely outperforms a strict inflation target and greatly outperforms the Fed’s current pseudo-inflation target. While NGDP targeting and the Taylor Rule have much to commend them, they might be harder to explain and justify to the public. Inflation targeting has an intelligibility advantage: Voters know what it means to stabilize the dollar’s purchasing power. Capable elected officials must persuade the public that the advantages of NGDP targeting and the Taylor Rule, especially in terms of supporting labor markets, outweigh the disadvantages.

MINIMUM EFFECTIVE REFORMS

Because Washington operates on two-year election cycles, any monetary reform must take account of disruption to financial markets and the economy at large. Free banking and commodity-backed money offer economic benefits by limiting government manipulation, inflation, and recessionary cycles while dramatically reducing federal deficits, but given potential disruption to the financial system, a K-Percent Rule may be a more feasible option. The other rules discussed (inflation targeting, NGDP targeting, and the Taylor Rule) are more complicated but also more flexible. While their economic benefits are significant, public opinion expressed through the lawmaking process in the Constitution should ultimately

determine the monetary-institutional order in a free society.The minimum of effective reforms includes the following:

- Eliminate “full employment” from the Fed’s mandate, requiring it to focus on price stability alone.

- Have elected officials compel the Fed to specify its target range for inflation and inform the public of a concrete intended growth path. There should be no more “flexible average inflation targeting,” which amounts to ex post justification for bad policy.

- Focus any regulatory activities on maintaining bank capital adequacy. Elected officials must clamp down on the Fed’s incorporation of environmental, social, and governance factors into its mandate, including by amending its financial stability mandate.

- Curb the Fed’s excessive last-resort lending practices. These practices are directly responsible for “too big to fail” and the institutionalization of moral hazard in our financial system.

- Appoint a commission to explore the mission of the Federal Reserve,

alternatives to the Federal Reserve system, and the nation’s financial

regulatory apparatus.- Prevent the institution of a central bank digital currency (CBDC). A

CBDC would provide unprecedented surveillance and potential control of

financial transactions without providing added benefits available through

existing technologies.34

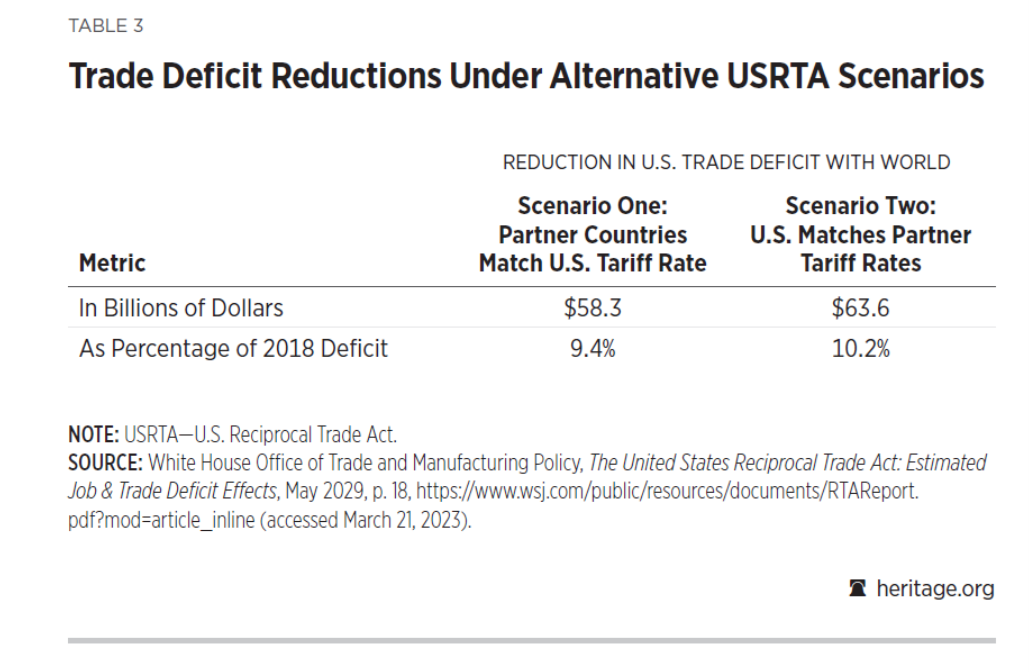

The document also has a lot to say about trade. One interesting table (3) was apparently retrieved by way of time travel (from 2029).

The idea that you can get banks to act responsibly by letting them fail more often is a complete and naive misunderstanding of todays predatory capitalism and its incentives.

The reason we have no choice but to bail out the “too big to fail” banks (and the small ones too) is the harm to society from a banking/financial system collapse. The depression to follow such an event badly harms working people and rob society as a whole of GDP/productive activities until a slow recovery has happened.

The idea that if collapses were allowed to happen, then risk taking would be curtained, is so naive it hurts to read it. Risk taking is part of predatory capitalism where the CEO is rewarded for increases in quarterly profits; not long term survival of the company. What we learned in 2008 is that when you slack on government oversight the CEO will take excessive risk and sail away from the disaster without losing much of anything. The big loser left behind are those with no power to stop (or even understand) what is going on.

If you want to prevent the the wasteful and extremely costly gyrations of the economy that comes from capitalisms fear-greed cycles and predatory inclinations; you need strict government rules and oversight. We just cannot afford to have 10-15% of the population unemployed (non-productive) for years at a time at regular intervals. Sure capitalism is the least malfunctioning economic system we have – but that doesn’t mean we should not try to prevent and fix the predictable malfunctions.

We have one alternative to “too big to fail”: Nationalize failing banks. We’ve decided not to do this, and much of how we deal with bank failure flows from this decision.

I agree with that. They should have handled the big banks the way they handled General Motors. Wipe out the equity holders, give a haircut to the bondholders, fire the management and board of directors, re-capitalize the company, and when stabilized, sell back to the public at a profit.

Instead we had Obama and his stooge Timothy Geithner bowing to the bankers and even awarding them them million dollar bonuses for failure. Talk about moral hazard.

Actually the banks were bailed out by Bush II. The GM bailout was done by Obama – and indeed done the way it should be done.

Ivan: “Actually the banks were bailed out by Bush II. The GM bailout was done by Obama – and indeed done the way it should be done.”

The original TARP bailout was authorized under Bush, just a couple of months before the Obama administration took over but they were the principal administrators. Obama and Geithner were the ones who authorized the million dollar bonuses for the bailed out bankers.

But the worst was Geithner’s handling of the Home Affordable Modification Program (HAMP), passed in 2009. Congress appropriated money to help homeowners on the verge of foreclosure. But Geithner never distributed that money even though he had billions appropriated. Instead he conned distressed homeowners to continue to make onerous mortgage payments until their last dollar was gone with the promise of relief that never came. They would have been better off foreclosing earlier before they became destitute.

Geithner’s plan for HAMP was not to save homeowners as Congress intended. It was to save the banks. Geithner said that the banks would safely handle 10 million foreclosures a year but no more. By duplicitously enticing homeowners to continue to pay their mortgages until they were broke, he could stretch out the foreclosure rate. And the promised relief if they kept paying never came.

As Geithner infamously said, he wanted to “foam the runway” for a safe landing for the banks. And he foamed the runway with the bodies of distressed home owners.

Geithner is the worst.

… O. M. G. ….

Well, at least they didn’t advocate returning to the gold standard…

They come close to advocating a return to the gold standard. Commodity money? Oh yea – Stephen Moore’s idea of sound monetary policy.

“The process of commodity backing is very straightforward: Treasury could set the price of a dollar at today’s market price of $2,000 per ounce of gold. This means that each Federal Reserve note could be redeemed at the Federal Reserve and exchanged for 1/2000 ounce of gold—about $80, for example, for a gold coin the weight of a dime.”

Wait – this is the gold standard. At least Moore would include other metals in his commodity based system. Then again this document criticize using both gold and silver.

Seriously – have these clowns read ANY economic history? Ant at all?

No, apparently not. Ideological purity requires removal of inconvenient knowledge and facts. It is scary that this kind of thing has any backers at all, let alone powerful backers.

I missed that, thanks for the catch.

It’s not just that the crazies have taken over the asylum, it’s that the ignorant and moronic crazies have taken over the asylum.

If you want price stability you just drive the country into a recession and keep it there. Instead of price increases you get income decreases – which hurt at least as much, but on a different spot. The only people who advocate price stability are those too stupid to understand that – or who have massive amounts of assets (and presume that the price stability means that their assets will hold value). The reason employment was added to the mandate was that someone realized what happens if you only focus on price stability. But these dufuses wouldn’t recognize an Econ 101 teacher if he spit them in the eye.

Besides the time travel aspect of table 3, I wonder about its significance. You can always “fix” the trade deficit by banning all trade. But why would you?

The question is not whether something will reduce the trade deficit (or any other parameter) – the real question is at what cost will it fix that specific parameter – and is the presumed gain worth the cost.

The cost of reducing free trade via tariffs, is higher cost and lower productivity. You allow less efficient (uncompetitive) US producers to make and sell something at a higher price – and hinder more efficient/competitive US producers from selling to the rest of the world (when they retaliate).

Seems like a lose- lose to me.

Targeted tariffs in response to unfair trade is another question. But Trump and these clowns have been talking about across the board tariffs.

Chinny,

believing Trump could read this let alone understand it is laughable. We do know He wants to conduct monetary policy not the Fed and HE wants to control the exchange rate.

He has no idea of how to do it and could not UNLESS the republicans control Congress and then of course do something they have always argued against.

We do know the Supreme court will make up law to support anything done.

The USA is a failed state

“A far less harmful alternative is to focus the Federal Reserve on protecting the dollar and restraining inflation. This can mitigate economic turmoil, perhaps in conjunction with government spending. Fiscal policy can be more effective if it is timely, targeted, and temporary.”

Even though Heritage wrote this as Trump’s agenda, Trump is now lying about not knowing what this document is. I pulled out this gold bug type line given how Trump’s other insane rants would lead to dollar devaluation and more inflation. Yea the Trump crowd is too stupid to know it massively contradicts fearless leader. Now Trump’s fiscal expansion was not exactly targeted and temporary.

Later we see the call for free banking. Did Richard Timberlake write this fluff?

“K-Percent Rule. Under this rule, proposed by Milton Friedman in 1960,31 the Federal Reserve would create money at a fixed rate—say 3 percent per year. By offering the inflation benefits of gold without the potential disruption to the financial system, a K-Percent Rule could be a more politically viable alternative to gold.”

Yea Friedman did propose this rule BEFORE he realized how unstable GDP/Money was. And of course the mental midget who wrote this fluff left out how Friedman sharply criticized the gold standard.

“The document also has a lot to say about trade. One interesting table (3) was apparently retrieved by way of time travel (from 2029).”

Please post that section too. It should be a load of laughs especially trying to figure out WTF this table even means.

OK I did a quick search of the full document for “trade” I think pages 765 to 825 represents the incredible “wisdom” of Peter Navarro but I haven’t taken the time to read the whole thing yet.

This is a key part of what Navarro wrote:

“To address this nonreciprocity stalemate, President Trump urged Congress in his 2019 State of the Union address to pass the United States Reciprocal Trade Act (USRTA). Under the USRTA, the President would have the authority to bring any American trading partner that is currently applying higher nonreciprocal tariffs to the negotiating table. If that trading partner refused to lower tariffs to U.S. levels, the President then would have the authority to raise U.S. tariffs to match or “mirror” the foreign partner’s tariffs”

He said his 2029 table you noted was based on his own calculations using something called the World Bank’s SMART simulator. Now maybe our host call tell us what this is but the word smart should never be associated with anything Navarro has written on international trade.

But I have an international macroeconomic question that Navarro just skips as Navarro appears to be assuming fixed exchange rates. But would this USTRA type of expenditure switching nonsense lead to a dollar appreciation completely offsetting the macroeconomic aggregate effects?

Trump claims both that he us unaware of this document and that he disagrees with some of its proposals. Not sure how that works.

Where to begin?

This:

“…the dual mandate may inadvertently contribute to recessions rather than fixing them.”

Doesn’t justify this:

“A far less harmful alternative is to focus the Federal Reserve on protecting the dollar and restraining inflation.”

The first problem is “may”. The authors go from not being certain that the current monetary policy regime does harm to arguing that policy must change because of the harm it does. That kind of slippery argumentation is not a good basis for changing policy.

The second problem is that the authors haven’t even addressed the issues of magnitudes or distribution. Assuming that the dual mandate does lead to recession (which is not evident in recent decades), is the harm done greater than the benefit of the full employment mandate? Do the less-frequently-employed who benefit most from the full- employment mandate suffer more harm from recession than they benefit from periodic full employment?

So we’re off to a sloppy start. The claim that a simple “sound money” mandate is better than the dual mandate isn’t well founded.

Then, the authors do it again:

“…the problem of the dual mandate may worsen with new pressure on the Federal Reserve to include environmental or redistributionist “equity” goals in its policymaking, which will likely enable additional federal spending.”

Let’s boil this down to its parts. The “problem of the dual mandate” hasn’t actually been established. It “may” worsen as a result of other policies, which leaves open the possibility that it may not. This is the “may” trick all over again. Then fiscal policy is pulled in, essentially to say “policies we don’t like may cost money”. That’s not a reason to adopt any particular monetary policy.

Moving on, here’s a statement that which is patently untrue:

“To protect banks that over lend during easy money episodes, the Federal Reserve was assigned a “lender of last resort” (LOLR) function.”

The lender of last resort function was established because there are financial crises. Lenders which are cautious can face runs during financial crises, just as incautious banks can. It’s a shame to start an argument with a bald-faced lie when the rest of the argument is worth considering. If the government were willing to assume control of failed banks, to provide credit through them, then our current morally hazardous form of bank rescue wouldn’t be necessary.

Wind down the Fed’s balance sheet? The Fed is already doing that, a fact the authors neglect to mention – mighty suspicious.

The ideas of shedding assets and then limiting the Fed’s ability to buy more fit nicely with the authors desire to get out of the “full employment” business, but we’re not surprised, right? The problem is that, in a low-inflation environment, monetary policy loses power. The Fed resorted to asset purchases because rate policy had lost power. Anyone who has read Keynes knows that.

If the authors want the Fed to pursue price and currency stability, they need to allow the Fed tools adequate to the job. Even if the Fed were to abandon its full employment mandate, maintaining a stable currency and avoiding deflation may be impossible at an average inflation rate near zero – and by “near zero”, I mean 2%. Aim lower and it gets harder.

Next:

“The goal of monetary policy is to provide markets with needed liquidity without inducing resource misallocations caused by interfering with relative prices…”

The authors have committed a common debator’s lie here. They have substituted their preferred outcome for generally-agreed reality (aka “question begging”). THEY want liquidity proviion to be “the goal” (singular) of monetary policy. The dual (actually “multiple”) mandate was imposed by Congress. The lawful goals of monetary policy are stable prices, full employment and financial stability. Oh, and let’s have the Fed subsidize the Treasury with regular large transfers, ’cause a lot of lawmakers seem to want that. (Funny how asset purchases are bad, but transfers are good. Kinda like how mandating that Social Security buy Treasury debt is good, but redeeming that debt is bad.)

Anyone at all familiar with the monetary policy literature knows that “liquidity provision”, however defined, is market intervention and does change relative prices. To suggest otherwise shows either ignorance, dishonesty, or both.

Stop paying interest in reserves? Sure, fine. The Fed will need to adjust its policy mechanisms, but that’s doable. But by the way, paying interest in reserves is one way the Fed tried to get around the problem of low rates. Low rates were a problem because of low inflation. I think ending the payment of interest on reserves is a fine idea, but we need a system that works, and the system works without extraordinary measures mostly when inflation is well away from zero.

Now this is just an lie run wild:

“A core problem with government control of monetary policy is its exposure to two unavoidable political pressures: pressure to print money to subsidize government deficits and pressure to print money to boost the economy artificially until the next election. Because both will always exist with self-interested politicians, the only permanent remedy is to take the monetary steering wheel out of the Federal Reserve’s hands and return it to the people.”

Yes, central bank independence is a qualified kind of independence. Yes, policy makers are appointed by politicians and bankers. But the idea that returning monetary authority to “the people” is an apolitical alternative is just nonsense. The idea that commodity-backed money returns monetary policy to the people is nonsense. This is Huckabee-level political blather, unanchored to reality.

The “free banking” and commodity-backed money paragraphs make claims about history which are untrue.

The call for a return to a Friedman rule ignores the fact that Milton Friedman abandoned his own rule when velocity destabilized.

There is no evidence the Fed has chosen an inflation target which is “the highest it thinks the public will accept”. The Fed’s target is rougly the same as the majority of inflation targeting G20 central banks. This is just another partisan lie.

Here, the authors contradict their earlier claims about the Fed’s “job”:

“Economists generally believe that the economy’s long-term real growth trend is determined by non-monetary factors. The Fed’s job is to minimize fluctuations around that trend nominal growth rate.”

The authors make this claim about the Fed’s job not as a description of NGDP targeting, but as a rationale for NGDP targeting. It’s circular, more question begging.

The whole thing is a steaming pile of partisan debating tricks.

“The whole thing is a steaming pile of partisan debating tricks”

Which is one of the biggest problems with most of this right wing crap – including Supreme Court originalist rationalization. They know what conclusions they want to end up with and then they distort reality and rationality until they think they made it there. True intellectual processes are not on the menu when you disallow the possibility that your hypothesis/conclusion could be wrong.

Couple of things. The document is 920 pages long. That means it is, among other things, a Heritage Foundation vanity project. It has over thirty authors – all those policy entrepreneurs to flatter!

The author of the monetary policy section, Paul Winfree, has little experience outside of the right-wing echo chamber. He has a degree in economics, but no particular background in monetary policy. This may explain why his contribution to this monstrosity is all right off the Heritage bookshelf – no ideas of his own and none that don’t have his employer’s stamp of approval. Worryingly, he worked for the Trump administration.

Paul Winfree has been more of a fiscal policy type. An interesting discussion of the type of Reaganesque nonsense Winfree wanted to bring to the Trump years:

https://www.politico.com/agenda/story/2017/03/six-surprises-trump-budget-000366/

Winfree did get his economics degree from George Mason which is not exactly the place where I would tell people to study monetary economics.

The Looming Debt Spiral: Analyzing the Erosion of U.S. Fiscal Space

https://epicforamerica.org/wp-content/uploads/2024/03/Fiscal-Space-March-2024.pdf

Winfree spends 12 entire pages defining the long-run government budget constraint and what he calls fiscal space. Most experts could have done this in less than 1 page. So what’s the solution according to this genius? Spending cuts. I guess increasing taxes on the rich is not something he learned at George Mason!

Speaking of leadership, who’s stupid idea was it to impose mask mandates and encourage vaccination? Huge over-reaction, huge government over-reach, right?

https://www.brookings.edu/articles/the-impact-of-vaccines-and-behavior-on-us-cumulative-deaths-from-covid-19/

Roughly 800,000 lives were saved by the early response. Many more were saved by the vaccines in total. This 800,000 is just the early response.

Thanks Menzie for pointing out that a second Trump admin would be catastrophic for the U.S. economy – I would also mention Trump’s plan to deport millions of workers and putting a 10% tariff on everything and giving more tax cuts to billionaires.

But – please – any NY Times pundits – can you do a report on Trump’s plan to eliminate all of Biden’s efforts in renewable energy and consigning our grandchildren to a hellish environment? (Remember Trump withdrew from Paris Agreement on climate change and there will now be no check on Trump’s power and the Supreme Court has knocked down the regulators in the Chevron decision – so we will have no recourse to protect ourselves.)

Attention fellow frogs – the water in the pot on the stove is just starting to boil – the extreme weather events so far this year are obvious to everyone and are on trend for what the climatologists have been predicting – https://www.washingtonpost.com/weather/2024/07/05/west-coast-heat-wave-forecast-record-highs/

Also – can I remind everyone that there are two people on the Presidential ticket – One is Biden and the other is Kamala Harris – who is a former Attorney General of California (so she knows the law); former U.S. Senator (so she knows legislation/policy) and is current VP (dealing with foreign leaders for the past three years) – she stands ready at moment’s notice to step in for Biden. Finally for all you Gov Newsom and Gov Whitmer fans (I think they are both great!) – Harris is only person besides Biden that can legally access the Biden/Harris campaign funds. Any other candidate would have to spin up a Presidential campaign and try to fund raise millions in a couple of months.

Finally – the GOP/Russian disinformation messaging is immense – anyone remember the Hillary is sick reports before the 2016 campaign? – Trump has given every indication that he plans to partner with his puppet master Putin and throw NATO overboard – (Former Trump official Nikki Haley told me so – https://www.bloomberg.com/news/articles/2024-02-12/haley-says-trump-mistaken-to-side-with-thug-putin-over-nato )

Daniel Drezner isn’t always right, but he is pretty reliable. Here, he undertakes an examination of a Trump second term, assuming that Trump means what he says:

https://www.politico.com/news/magazine/2024/07/06/trump-second-term-world-order-00164045

I did the same thing 8 years ago, when the punditry still assumed Trump wouldn’t be president, and it paid off when I got to republish the whole batch. I would recommend to anyone with an interest in testing their ability to be objective and to think through the implications of policy.

Drezner does some troubling scene-setting in these lines:

“The world is currently experiencing the greatest number of conflicts since 1945. Countries are racing to erect barriers to trade and migration while restricting civil liberties. The world is suffering from a democratic recession, with populists and authoritarians believing their mode of governance is superior. This results in part from the nasty, brutish approach to global affairs Trump helped fashion in his first term — and it’s the world Trump would inherit if reelected later this year.”

Stephen Moore was one of the co-authors of the chapter on the Treasury. I stopped reading when I read this very early on:

No President in modern times—perhaps ever—has been more fiscally reckless than has the Biden Administration. The soundness and stability of U.S. currency, the dollar, has been put at risk because of the worst inflation in four decades. American families have been made poorer by Biden’s economic strategy of taxing, spending, borrowing, regulating, and printing money. The average family has seen real annual earnings fall about $6,000 during the Biden Administration.

Of course Trump increased the deficit by more than Biden has. But why let reality get in the way. Now WTF did these liars get this claim that real earnings fell by $6000 per year? So many lies, so little time.

also biden cannot print money only the Fed can

Yea – Stephen Moore is so stupid he has never understood that Treasury does not run the FED. But keep in mind that these clowns want to put Trump of both Treasury and the FED.

So Stephen Moore pens a document this year that claims real earnings have fallen by $6000 per year citing a Heritage rag written in early 2003?

https://www.heritage.org/markets-and-finance/commentary/biden-keeps-making-claims-about-the-economy-just-arent-true-these

Biden Keeps Making Claims About the Economy That Just Aren’t True. These Facts Don’t Lie by EJ Antoni

Now Antoni wrote a lot of fluff back in early Feb. 2023 but I think the key part was:

“That reduction in inflation has been little consolation for the average American family, buckling under the weight of rising prices, particularly for necessities like food and shelter. While the rate of price increases has certainly slowed in recent months, as government deficit spending also slowed and the Federal Reserve hiked interest rates, prices are still up about 14 percent under Biden. That is substantially more than the increase in average earnings. Adjusting those earnings for inflation, called real earnings, shows that people can buy less today than when Biden took office. The average family has seen real annual earnings fall about $6,000 under Biden … While real earnings have improved slightly over the last several months, they are still below their May 2022 level, and down 5.5 percent under Biden.”

Gee Antoni’s research assistant must be JohnH! So much goal post moving and so little actual data! But yes – real earnings were growing in late 2022 and continued to grow throughout 2023.Now I get that this clown was sort on documenting what his sources were etc. but maybe our host can find a way to provide a reliable chart of “real earnings” over time. No – I do not trust a Heritage clown and I know Stephen Moore is a blatant liar.

“Some folks need killing” says the Republican candidate for governor in North Carolina:

https://newrepublic.com/article/183443/mark-robinson-north-carolina-gov-candidate-hateful-rant-killing

Why do they need killing? Because, says Mark Robinson:

“They’re watching us. They’re listening to us. They’re tracking us. They get mad at you. They cancel you. They dox you. They kick you off social media. They come in and close down your business.”

The punishment for watching, listening, canceling, doxing, closing down is death? So says the guy who may become the governor of a U.S. state. Put me down for a Godwin’s law violation. Though maybe Robinson thinks I “need killing” for that.

Speaking of the gold standard. This is a useful website:

https://www.dailymetalprice.com/metalpricecharts.php?c=zn&u=lb&d=240

Metal Spot Price Charts

Gold Price (USD / Pound) Chart for the Last 5 Years

Use this form to dynamically generate charts that show metal prices in the units of your choice and for the specified date range (if available).

Simply select a metal and a unit to display the price. Lastly choose the number of days to show in your chart. Charts and rate are based on our daily price updates.

I choose gold to show how volatile its price has been over the past 5 years. Do the same for silver and its price is less volatile. Of course wing nuts never propose a silver standard for money. Wonder why.

China’s small banks are disappearing at a rapid clip, mostly being absorbed by bigger banks:

https://www.economist.com/finance-and-economics/2024/07/04/why-chinese-banks-are-now-vanishing

This is the same thing we do in the U.S.; when a bank is on the verge of collapse, a larger bank buys its assets, takes on its liabities, while the value of equity and bonds is wiped out. This is a further outgrowth of the construction/real estate/malinvestment problem that has developed in China over decades. Things we don’t know are:

– Whether the problem can be contained.

– Whether and by how much credit provision will be impaired.

– How large the wealth effect will be.

– How many jobs will be lost.

All of which combines into the question of how great damage to the economy will be from the collapse of banks.

From where I sit, its hard to tell whether this actually makes things worse. Sick banks are a drag on the economy. The goal of absorbing them into larger, presumably healthier banks is to prevent worse outcomes.

Bloomberg’s China credit impulse index is just off its lowest level in 2 years, evidence that financial conditions ain’t great, but not that the closing of banks is adding to harm:

https://en.macromicro.me/charts/35559/china-credit-impulse-index

Here’s a representation of the underlying problem:

https://fred.stlouisfed.org/graph/?g=1pPir

I say “representation” because this is just a version of private debt to GDP. Chinese government and private debt are entangled in ways that are a mystery to most of us. I assume this picture gives a decent picture of the problem, but what do I know?

Speaking of China, the government is days away from a much-delayed economic policy gathering meant to address troubles in the economy. Some China-watchers take the delay as evidence of a lack of consensus regarding next steps:

https://www.voanews.com/a/china-looks-to-roll-out-economic-reforms-at-key-party-conclave-/7677783.html

Neil Thomas at the Asia Society Policy Institute says “I expect there’ll be further institutional reforms to more deeply embed the party and Xi’s leadership over the Chinese economy.” If true, then more of the same – not a solution in any way to China’s problems, but rather an effort to prevent China’s problems from threatening Xi’s power.

Michael Pettis is not optimistic:

https://www.globalsourcepartners.com/posts/waiting-for-the-third-plenum/teaser

Trump has distanced himself from Project 2025…..

Too cerebral for him!

He definitely did not develop it – his people did.

But he also doesn’t want to be held to account for anything with details. His policies are always: “its will be fantastic” – “best and biggest ever seen” – “you will come to me and say please stop winning, its TOO MUCH winning”.

He was the one demanding that the GOP didn’t have a party platform. Revealing the details of a plan opens you up to having to defend it. “BESTEST EVER !!!! – is like mother and apple pie – who would be against that.

“Project 2025, also known as the Presidential Transition Project, is a collection of conservative policy proposals from The Heritage Foundation”

I did not know they worked for Trump!

Anonymous: Most of the authors previously worked for Trump.

Exactly. They had to be “parked” somewhere waiting for the next Trump/GOP president, and what better place for that. Full time appointment to develop the plan for destruction of our Democracy.

Trump is now claiming he don’t even know any of those people. Not sure if its worst to believe him (in which case he has such severe dementia that he forgot half his white house inner circle) or not (which would be just another example of him lying – so why would he be telling the truth when claiming he will not do project 2025 if elected).

Yea – you are one clueless troll.

Biden is toast.

And are you butter? Come on dude – take this trolling somewhere else.