I see a bevy of economists (a lot on the right, see here) saying we’re in a recession, or soon to be in one. What do predictive models say?

Miller (2019) showed the maximum AUROC probit model for predicting recessions at the 3 month over the 1954-2018 period uses the 10yr-Fed funds spread. Updating his regressions, assuming no recession as of August:

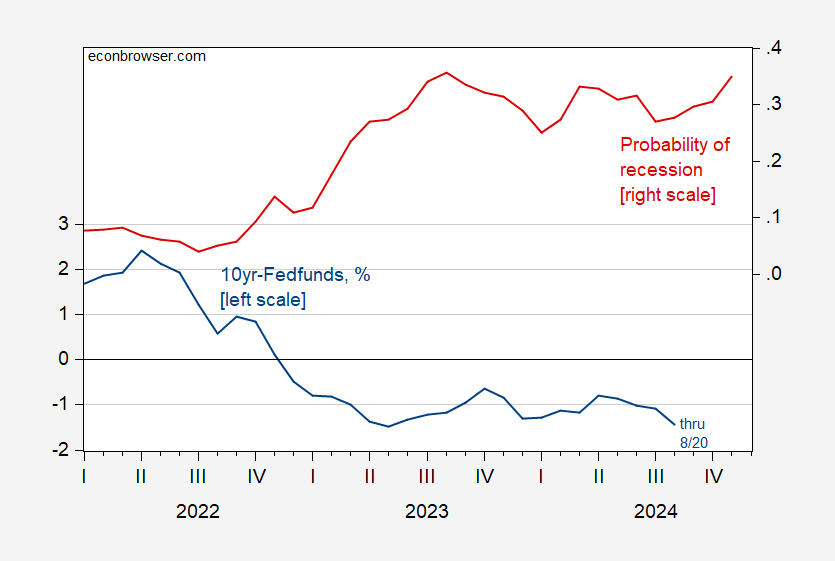

Figure 1: 10 year – Fed funds spread, % (blue, left scale), estimated probability of recession (red, right scale). Interest rate data for August through 8/20. Source: Treasury, Fed via FRED, and author’s calculations.

The McFadden R2 from this regression is 0.15, and puts the November recession probability at 35%. (Adding in the Chicago Financial Conditions Index raises the McFadden R2 to 0.31, but yields a recession probability of 0.07 for November).

Note that this is not conjunctural analysis (are we in a recession now?), but forward looking.

Is a bevy of economists or a bevy of Trump toadies. How many of these people would also assure their Faux News viewers that tariffs will not raise import prices?

They wish, they wish, that dick was a fish. [the rest is to racy for this blog]

As Moses likes to write… a little off subject but…

https://marginalrevolution.com/marginalrevolution/2024/08/moms-against-price-gouging.html

Comments are interesting, too. A lot of “theory vs. practice”.

First little Brucie confuses fruit with smart phones (Apple sauce is expensive when one grinds up a couple of $1100 phones to make it) and now Uber as a substitute for beef?

Brucie – you have yet to respond to the take downs of your Meat Institute trash. @2slug is right. You are a dishonest hit and run artist who never engages in a real discussion. So WTF are you still posting such worthless comments?

Johnny Cochrane actually mentions monopoly power in his stupid little essay? Wow – it took that long winded gas bag three snide and pointless rants about the Roman Empire to finally mention the real issues. And as I pointed out – he failed basic finance miserably.

Yea he mentioned the cost of capital which is about 8% for food processors. But it seems even under normal times Tyson Food’s profit relative to assets is closer to 40%. Yep – Cochrane can’t even do simple research.

Ah but Bruce’s Meat Institute by linked to an Aswath Damodaran piece that showed the return to SALES was 6%. Little Brucie fell for it not realizing the fact that the asset to sales ratio for food processors is something near 15%. OK – Brucie boy failed preK arithmetic but what’s Cochrane’s excuse for being dumber than a retarded rock?

Cochrane’s closing sentence with this?

Supply and demand, cause and effect, logic, evidence and experience be damned.

How Jonny – why couldn’t you cite a lick of evidence on the issue of the “cost of capital” for the food processing sector? I did and it undermines your BS totally.

Oh wait – little Brucie thought he found evidence as provided by the Meat Institute but little Brucie does not know the difference between return to sales versus return to assets!

Well, you went on a long 3-part rant to avoid Special K’s position that food processors were “gouging” Americans.

https://www.nytimes.com/2024/08/15/business/economy/kamala-harris-inflation-price-gouging.html

So what if Apple’s assets are higher or lower? It’s still all about net profits to Special K. You want to make it all about return on assets rather than return on sales? Why? Special K doesn’t differentiate. She says 25% net profit is gouging for food; well, it “gouging” for iPhones.

Or it isn’t for either. People don’t have to buy iPhones, but they do. People don’t have to buy Tyson’s chickens but they do. They have choices. Or do you think people are forced to buy their products? I bet you have no qualms about your $10 lattes.

So, once again, Apple’s net margin history:

https://www.macrotrends.net/stocks/charts/AAPL/apple/net-profit-margin

Tyson Foods, net margin history (I picked Tyson because in processes beef, pork, and chicken)

https://www.macrotrends.net/stocks/charts/TSN/tyson-foods/net-profit-margin

Take off you commissar’s hat and tell me which one is “gouging”. Is 26% gouging or is 0% gouging? Can you do it for less and stay in business? C’mon, man! Your dishonesty reeks. I bet you are drooling all over Big K’s feet right now.

“you went on a long 3-part rant to avoid Special K’s position that food processors were “gouging” Americans.”

Brucie finally attempt to respond and he got nothing right – again. The 3-art rant was Cochrane’s not mine. No – I presented actual economics which you have not responded to at all. Then again economics has never been your thing.

And you still do not know that Apple the publicly traded company makes computer and smart phones and not fruit? Hey Bruce – turn off your retarded ChatGPT as it clearly has no effing clue what any of this about? And stop wasting our time with your infantile whining? DAMN!

God you are beyond dumb:

Tyson Foods Net Profit Margin 2010-2024

I already explained to the dumbest troll ever that one should be looking at the operating margin and why. I already provided the history of Tyson Food’s operating margin over time which exceeded 12% during 2021 and 2022. And I have already noted its tangible asset to sales ratio is less than 20%. So tell me Brucie – can you do preK arithmetic? NO? OK, the return to capital exceeded 60%. And I already told you that any financial economist worth his salt would put its cost of capital at only 8%.

I criticized Cochrane for not doing the real work. Brucie tried but he is too stupid to do it correctly. So I did it for the both of you. And the case that Tyson Foods is reaping very high returns on a persistent basis is overwhelming.

But poor little Brucie is so lost in his little sand box that he does not know how much the other kiddies are laughing at him.

Brucie – this is simple. You are a clueless retarded joke. Economics is something you will never be able to do. So do move onto something more productive – just as running through center city wearing nothing more than your soiled panties.

Let’s just imagine dinner time in Bruce Hall’s basement. Chowing down on computers and smart phones while trying to order a pizza using one’s fried chicken. Yea – this troll is so dumb that he thinks looking over his underwear is the same as watching the TV.

One has to wonder why his mommy has not banned Brucie from the internet before he seriously hurts himself.

BTW – I know how to review the financial filings per their 10-Qs via the SEC website. Too bad you do not.

If you did, you might see that the ONLY quarter where this company had a temporary loss was the quarter where they had a one-time charge for “goodwill impairment”. Take this out and do the accounting correctly over a long period of time and you will see its operating margin = 7.5% which translates into a 40% return to assets.

But yea – this is all over Bruce Hall’s little brain that does not know the difference between fruits and computers.

Like I said – the dumbest troll God ever created!

Bruce Hall links to a NYTimes article with the title What Does the Evidence Say? But once again Brucie does not read his own link. This discussion was all over the map but never really provided a shred of evidence on this:

‘The Harris campaign announcement cited meat industry consolidation as a driver of excessive grocery prices, but officials did not immediately respond on Thursday to questions about the evidence Ms. Harris would cite or how her proposal would work.’

Well I have been citing economic papers on the meat processing sector even as this half baked NYTimes bad reporting could not. Bruce Hall has shown over and over again he lacks the basic economic training to grasp the clear evidence that this sector is making enormous profits over any extended period of time.

Hey Brucie – keep it coming as you are one funny if not retarded little boy. But please, please, please – learn to READ your own damn links!

“It’s still all about net profits to Special K. You want to make it all about return on assets rather than return on sales? Why? Special K doesn’t differentiate.”

Her name is Kamala Harris you racist little twit. And where did she say something as stupid as it is all about profits relative to sales? Oh she didn’t. YOU did.

Brucie – I get it must be mocked by your fellow KKK members for being the dumbest one in the club. But this lying about what Kamala Harris did or did not say? Oh wait – you adore Trump who does this BS routinely. Carry on.

Another Trump crime?

He has been trying to convince Netanyahu to not cut a deal on a cease fire until after the election:

https://www.msnbc.com/rachel-maddow-show/maddowblog/trumps-interactions-israels-netanyahu-draw-fresh-scrutiny-rcna167580

https://x.com/ProjectLincoln/status/1825942029467254816

The Lincoln Project is all over this. When Flynn violated the Logan Act – a lot of Trump Republicans advocated we repeal the Logan Act. Yep – they have no standards.

A clear violation of the Logan Act on par with how Nixon in 1968 undermined LBJ’s efforts to end the Vietnam with a peace treaty. LBJ called Nixon a traitor. And we know Trump is a serial traitor.

I have seen lot of right wing dishonesty and two faced BS on economics over my long life time but this hit job on Harris wanting to do something to counter the market power in the food sector takes the cake.

First of all to pretend sectors like food processing is perfectly competitive is simply stupid. The evidence is clear on this topic even if right wingers like John Cochrane choose to close their minds to it. Yes price controls on perfectly competitive sectors create shortages but when market power exists, smart attempts to offset market power not only lowers prices but also increases production. This is Econ 101. If John Cochrane does not get that, he should stop pretending he is an economist.

OK he knows finance. Which means he should know that his precious “cost of capital” for the food processing sector is 8% whereas the return to capital for some of the large food processors is near 40%. Now that is evidence of massive market power. But little Jonny Cochrane cannot do his homework.

But here is where these right wingers are incredibly two faced. They have spent the last three years Biden bashing over allegedly high food prices. I guess it would be too much work for these clowns to talk about the relative price of food. Truth be told nominal food prices relative to wages have not quadrupled or even gone up by 4%. But yea – food prices would be lower if we enforced the anti-trust laws. That would have been true 5 years ago.

But wait – now these right wingers are telling us food prices are not that high after all. Markets work and people should be happy when egg prices temporarily rise during a bird flu shortage. My head is spinning at how fast they rhetoric has just turned. Jonah Goldberg the other day tried to tell us the relative price of eggs has fallen over the past 45 years. No Momma’s Boy, they are up slightly. And maybe these right wing two faced liars should check at how companies like Cal-Maine, JBS, and Tyson Foods are finally be sued for persistent abuses of market power.

But noooo! Food prices are OK and markets work perfectly. Why the flip – oh yea it is time to bash Kamala Harris for being a dumb proponent of Marxism. Sorry dudes but she is advocating a smart use of competition to help us finally get a decent price for our eggs and bacon.