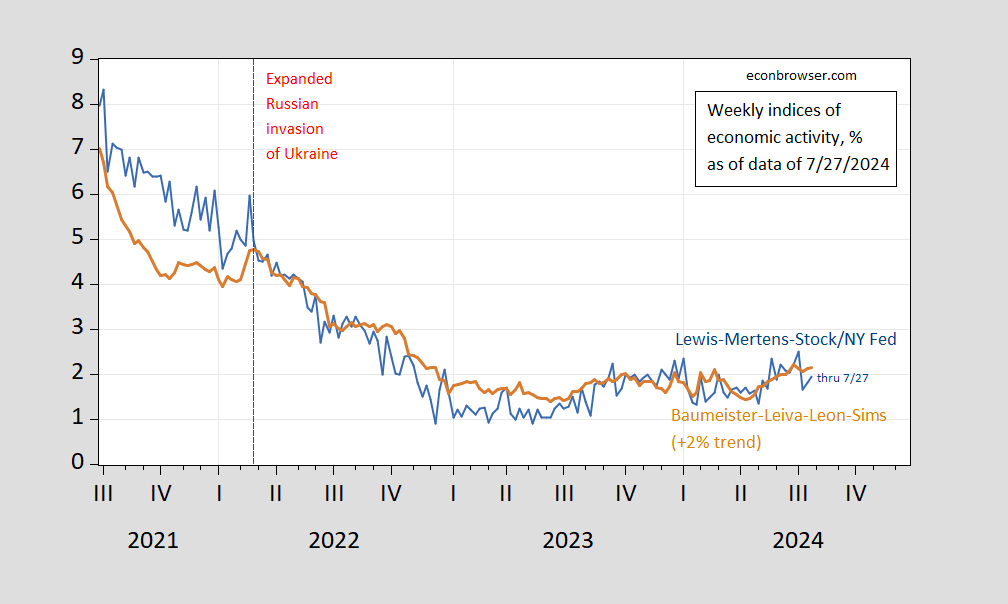

From the Lewis, Mertens, Stock NY Fed WEI, and the Baumeister, Leiva-Leon, Sims Economic Conditions Index:

Figure 1: WEI (blue), WECI plus 2% (tan), in %. Source: NY Fed via FRED, Baumeister et al.

For (certain to be revised) series through end-July, the recession has not yet arrived. No guarantees for August or thereafter.

For monthly indicators followed by the NBER’s Business Cycle Dating Committee, see here.

Not that I know anything, but what has happened today and Friday looks to me like a financial wobble, not an economic one. The trigger for the wobble is fundamental news – tech and other earnings disappointments and, sales and employment disappointments – but the speed and extent of the market reaction is because of market factors.

Recession isn’t a necessary outcome of market wobbles. Remember, I’ve been whining about the Fed risking recession to “cure” supply-side inflation with demand-side tools for ever so long, so it’s not like I’m bullish on the economy.

All by itself, a financial wobble can hurt confidence, which in turn can hurt the economy, but financial wobbles come and go, and when they go, confidence can recover. If the financial wobble turns into persistent financial stress, then it creates serious additional risk to the economy.

I suspect the view I’ve expressed is more or less what Fed staff are telling policy makers, most of whom have had similar thoughts of their own. So no between-meeting rate cut unless the wobble metastasizes. Maybe 50 basis points in September, if Menzie’s chart starts to show weakness.

Markets are pricing in more than that, but market participants tend to think the world, and the Fed, exist to make them rich. At times like this, they often bet on Fed subsidies that don’t materialize.

Give more weight to fixed-income markets, less to equities, in assessing market stress. That’s what Fed folk do:

https://fred.stlouisfed.org/graph/?g=1rhd8

If we had access to fx forward rate spreads or bank repo rates, I recommend watching them, too.

NY Fed posts its daily reverse repo auction results every business day at 1:15 EDT.

The open market posts their H4.1 every Thursday after 4:30 EDT.

Today’s rev repo auction bought less than any day last week. Surprised me.

H4,1 gives movement of assets week on week and year on year, to see tightening or easing.

This week 3 Treasury auction $125 Billion spread amount maturities greater than 10 years

The relevance of any of this to the post is???? Oh – you have no idea.

Not sure I get your point, or points.

The bank repos I mentioned aren’t the Fed’s reverses. They are overnight loans between banks, which serve as a good barometer of perceived risk in credit markets. The size of the Fed’s reverse repo auctions provide a measure of market balance – how much the Fed has to do to keep overnight rates at target.

Treasury auctions at the long end will give indications of demand for Treasuries, but the carry trade isn’t necessarily focused on the long end, given the flatness of the curve.

So we’re in the same ballpark, but please fill in the blanks a bit more.

Among the things I watch.

Many things in H4.1 to watch, more than immediately relevant here.

Of course you couldn’t be bothered to answer his question.

Do you remember what happened on April 18, 2001?

https://money.cnn.com/2001/04/18/economy/fed/index.htm

The Federal Reserve cut short-term interest rates by an aggressive half-percentage point Wednesday in a surprise move between its regular meetings meant to avert a recession. The central bank’s policy makers cut the target for the federal funds rate, an overnight bank lending rate, by a half-percentage point to 4.5 percent. They also lowered the rarely used discount rate, for loans by the Fed to banks, a half-percentage point to 4 percent. The move comes just weeks before the next regularly scheduled meeting of the Federal Open Market Committee, the policy-making arm, on May 15.

Maybe a redux is in order.

Interesting story:

https://ondemand.npr.org/anon.npr-mp3/npr/atc/2024/08/20240805_atc_chicken_business.mp3?size=4537409&d=283557&e=nx-s1-5060221&sc=siteplayer&aw_0_1st.playerid=siteplayer

It’s interesting that these companies ruin thousands of people’s lives, and some economists are always happy to create “deep/complicated” answers on how ruining people’s lives and running off with state tax breaks and onto the next batch of tax breaks someplace else is “efficient”. I wonder how Jada Thompson came up with those deep ideas on capitalistic “efficiencies”??

https://news.uark.edu/articles/12810/university-of-arkansas-reaches-1-billion-goal-tyson-foods-foundation-gift-seals-campaign-rsquo-s-success

https://agribusiness.uark.edu/directory/index/uid/jt074/name/Jada+Thompson/

Another one of life’s “perplexing mysteries”. Pays Jada’s rent though. Anyone else need a paid mouthpiece?? Jada’s not cheap but…..

“The gift is designated to the Dale Bumpers College of Agricultural, Food and Life Sciences and the Division of Agriculture, the Sam M. Walton College of Business and other University of Arkansas programs.

UA Chancellor John A. White said: ‘Tyson has done it again! This is another magnificent gift that does so much to support excellence at the University of Arkansas. Not only did the Tyson family make one of the largest gifts to the Campaign for the Twenty-First Century just a few weeks ago, but now the foundation bearing the company name has come forward with an additional commitment to help us achieve our $1 billion goal. We are grateful to the Tysons, to Tyson Foods, and to the Tyson Foods Foundation for their loyalty and support.’ ”

https://www.lonesomelands.com/new-blog/2022/1/24/university-of-arkansas-reports-on-cattle-market-after-receiving-millions-from-tyson-foods

If one ever watches Kudlow the Klown for more than a week – you get the idea he flip flops more than an iHop cook. Last week he was saying the economy was too strong to justify a rate cut. Today? He says we may be in a recession. I guess he is at least consistent with whatever Trump has tweeted of late.

Kudlow needs to invite Steven Kopits on and ask him if $73 for oil is indeed the apocalypse of all human kind. Also we need an update from Kopits on when countryside villagers of China will throw Xi off his terrace because Kopits predicted that for roughly the last 10 years and it still hasn’t materialized.

Speaking of oil, Kudlow told us that the 2003 invasion of Iraq would so increase oil supplies that oil prices would be $12 a barrel. How did that forecast work out? I’m sure Koptis could explain – snicker.

Some political cartoons:

https://www.msn.com/en-us/entertainment/comics/opinion-the-latest-political-cartoons/ss-AA1ojRrt?ocid=msedgdhp&pc=U531&cvid=7b423cfe67ef435b9b4085bea4b8f3c3&ei=17#image=1

I love political cartoons (and cartoons in general, you can guess my maturity level when I tell you I still enjoy MAD magazine and Beavis and Butthead) But some of these are very clever, thanks for the smile and the laughs.

Tim Walz for VP!

Check out Trump’s weird take on Walz:

https://x.com/pbump/status/1820810161843290160

Phillip Bump responds:

‘Gee, I wonder if Trump had the same fundraising email ready to go with other names?’

BTW – the best policy response Team Trump could come up with is that Walz believes we need to address climate change. I’m sure they have MAGA moron Bruce Hall working on this!

It really speaks to the incompetence of Trump and his campaign, that their first shot is a pathetic generic attack. They have known the 3 potential names for at least 3 days. A narrative for each, tested in swing voter focus groups, should have been ready to fire within minutes of the announcement. Trump seem so old and tired, maybe he should have slept on it first.

Remember when Byron Donalds ran his 3 bi-racial sons under the bus? After all – defending Trump’s racial attacks on Harris is more important than honoring one’s own kids. Now Trump is attacking ABC for that MEAN interview.

Meanwhile, the Trump-Vance campaign has decided to buy Donalds a new clean KKK outfit!

As long as a large percentage of Hispanic Americans are happy to vote for a man who trashes and laughs at their own race, donald trump will keep using this theme. And women who vote for a man who thinks it’s ok to grab their p*ssy arbitrarily at any moment. They seem to love a man who has zero respect for them. So why would he change his behavior?? “Conservatism” circa 2015—2024. Republican women say “Abuse us some more, big orange Daddy”.

I bet these ladies got all excited when Stormy Daniels described his 3 inch thingie with a mushroom on top!

Targeting Tim Walz, Team Trump flunks a test of self-awareness

https://www.msn.com/en-us/news/politics/targeting-tim-walz-team-trump-flunks-a-test-of-self-awareness/ar-AA1okK94?ocid=msedgdhp&pc=U531&cvid=546e3240a6ac43e3aa0153b02d58649b&ei=6

is Donald Trump’s press secretary seriously prepared to make the case against convicted felons participating in our democracy? Because if so, Leavitt might be surprised to discover that in recent months, a jury found her boss guilty of 34 felonies in his hush-money case. This is not to be confused with a different jury holding Trump liable for sexual abuse, or the case in which a court found that Trump oversaw a business that engaged in systemic fraud.

Some guy here singing train songs to people as a community service. It almost makes me feel guilty for scorning him on his Hoover excursions. Homie making me feel guilty. What up wit homie making me feel guilty??