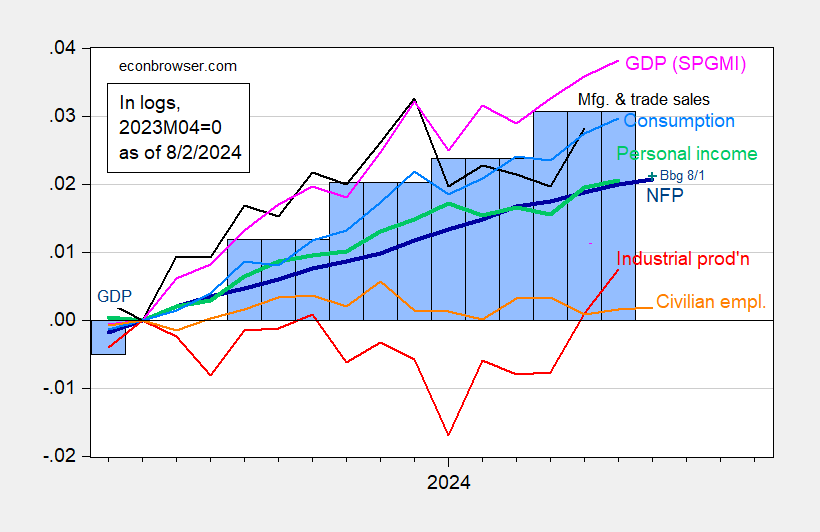

NBER BCDC key indicators, alternative indicators, weekly indicators:

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

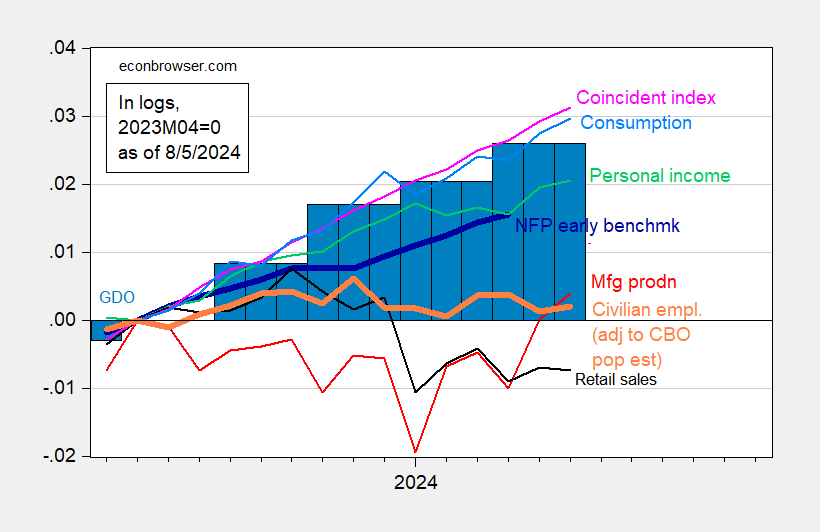

Some alternative indicators in the same format.

Figure 2: Nonfarm Payroll early benchmark (blue), civilian employment adjusted to CBO estimated immigration (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), retail sales in 1999M12$ (black), consumption in Ch.2017$ (light blue), and coincident index (pink), GDO (blue bars), all log normalized to 2023M04=0. 2024Q2 GDO uses estimated GDI. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, Philadelphia Fed, and author’s calculations.

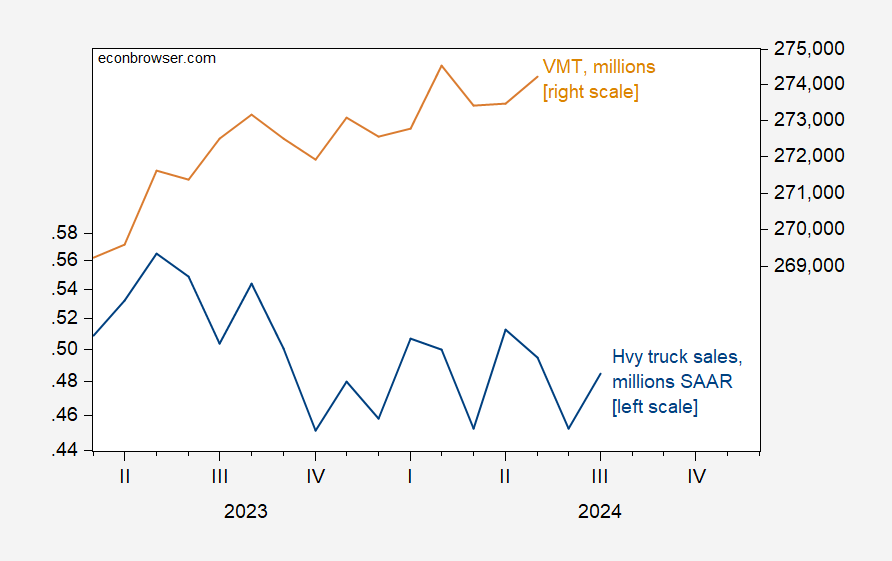

Yet more alternative indicators:

Figure 3: Heavy truck sales, in millions SAAR (blue, left scale), and vehicle miles traveled, in millions, s.a. (tan, right scale). Source: Census, NHTSA via FRED.

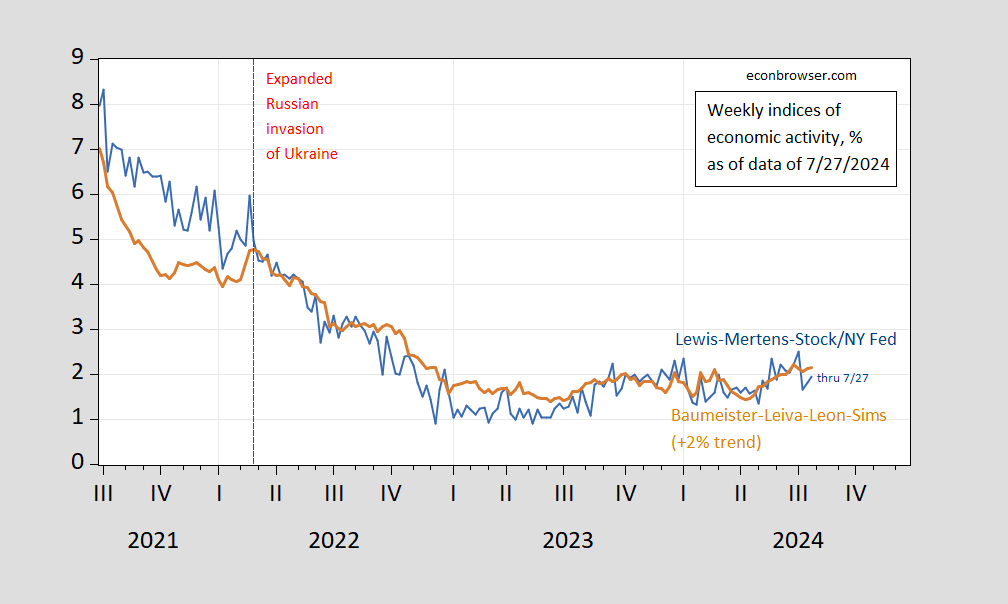

Higher frequency (weekly) indicators:

Figure 4: WEI (blue), WECI plus 2% (tan), in %. Source: NY Fed via FRED, Baumeister et al.

For a longer term perspective, across macro aggregates:

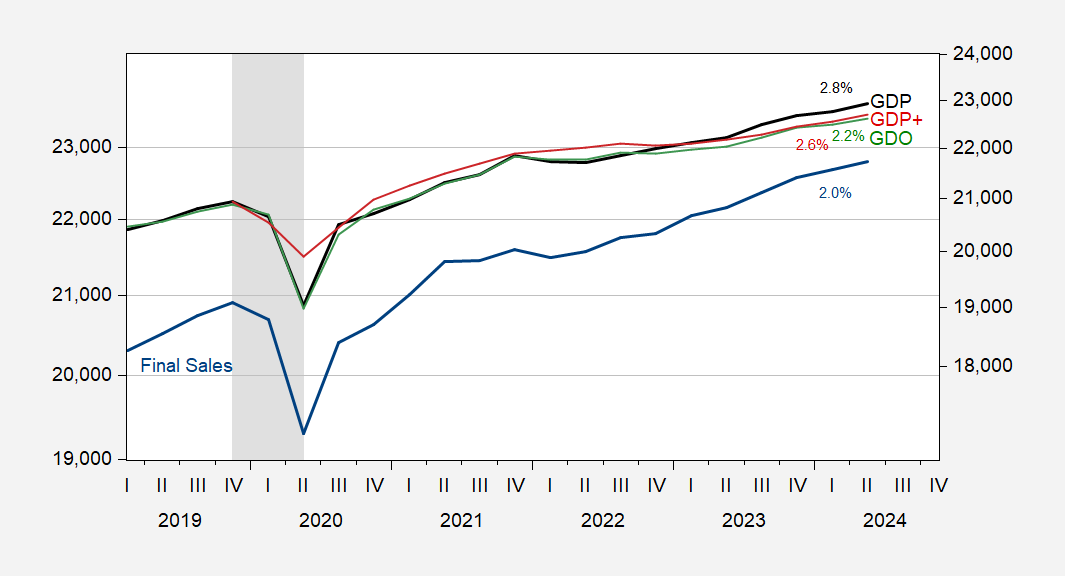

Figure 5: GDP (bold black, right scale), GDO (green, right scale), GDP+ (red, right scale), final sales (blue, left scale), all in bn.Ch.2017$ SAAR. GDP+ iterated on 2019Q4 GDP. GDI used in GDO estimated by author. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Philadelphia Fed, NBER, and author’s calculations.

Even if one thinks GDP is overestimating output, GDP+ is plugging along at 2.6% AR. Final sales, a proxy for aggregate demand, is growing at 2%. As of today, GDPNow nowcast for Q3 stands at 2.9% SAAR.

Remember yesterday’s stock market meltdown? It seems the market has recovered:

https://finance.yahoo.com/quote/%5EGSPC/

Kamala crash? No – Biden boom.

Uh, not so much. The S&P is still 100 points down from where it was over the weekend (Aug. 4) and 300 points below where it was at opening on Aug. 1. 260 points is about 5%, so significantly lower. We’ll see where it is at the end of the week, though, one day isn’t going to be enough for everyone to get (mostly) over their panic.

Wait, but the guys on FOX news said that if I bought Apple stock at 234, and it’s now at 208 that it means U.S. national productivity went down 10% over the last 3 quarters.

Your figures must be wrong Menzie. Fix this, right now, (!!!!) this instant, (!!!!) or I’ll sic Bruce Hall on you. He has rabies and when he tears up your ankle, you’ll be sorry.

Someone call Faux News and tell them that the stock price for Trump Media is tanking.

I predict 3 Stooges type comedy to ensue (if it hasn’t already):

https://provincetownindependent.org/featured/2024/03/13/kopits-declares-for-a-seat-on-select-board/

Toot!!! Toot!!!! All aboard the doofus train!!!!

“I felt it is a good time to put someone in there who understands organization, finance, and accounting,” he said.

WTF? He understands none of these. And damn – his picture is even worse than that ugly mug on LinkedIn.

Looks like I was late to the party once again. The election for 3-year seat on select board was in April. Guess who’s not on the board?? (lost the election).

I’m offended he never phoned “The Moses Herzog Consultancy on Political Strategies for Useless Municipal Seats”. I think I can get Kopits Commissioner of Sewers in the Cape Cod area, but he has to use a credit card I give him for shopping for large ticket items at Home Depot inside the next 18 hours or my offer is off the table. Tell Kopits to watch “Emily the Criminal” tonight and call me at 5:00am tomorrow.

He is sometimes cited as an expert in right-wing news sources including Breitbart, the Epoch Times, and the Washington Examiner, as well as more mainstream outlets like CNBC. “I am in the press fairly often,” Kopits said.

Stevie forgot to have them mention his appearances on Fox and Friends! All the most reliable outlets!!!

Vance delays debating Walz by claiming Dems might pull a ‘switcheroo’

https://www.msn.com/en-us/news/politics/vance-delays-debating-walz-by-claiming-dems-might-pull-a-switcheroo/ar-AA1olntT?ocid=msedgdhp&pc=U531&cvid=6b6a773056fb435b95231486197627f9&ei=10

Oh goodie – two for one! First of all J.D. like Trump is being a coward. And then there is this:

‘Amid some speculation Donald Trump might try to replace him, Republican vice-presidential nominee JD Vance was asked on Tuesday if he would debate Vice President Kamala Harris’s just-announced running mate, Democratic Minnesota Governor Tim Walz. Vance appeared to ignore or not hear the question as he headed into his plane Tuesday morning.’

Gee – Donald might indeed dump JD the clown! Switcheroo you – clown!

Hans and Franz

Aaaaaaaww, the old “dipideedoo switcharoo”. Vance has been talking about that ever since his Appalachians dealer put too much battery acid in his meth.

Speaking of our resident village idiot Kopits, does anyone know of a good link or anyone has crunched the numbers for the current price of Urals oil or the “Urals gap”, difference between Urals and Brent??? Thanks ahead of time. I thought this article was interesting:

https://meduza.io/en/feature/2024/04/15/the-price-is-right

https://oilprice.com/oil-price-charts/#prices

The Brent-Urals discount seems to be down to $9. This is interesting story on the change in the Russian tax system which may related to something I noted earlier on transfer pricing. So thanks as I have to read this more carefully.

Nikkei up 10.2%

Kospi up 3.3%

S&P up 2.1%

VIX 24.1 vs 34.6

Ten year Treasury yield up 10 basis points

Futures price in 64% odds of a 50 basis point fed funds cut at the September FOMC meeting, vs 85% at yesterday’s close.

So that was fun. But is it done?

Volatility often follows volatility, so today’s calmer behavior in financial markets doesn’t mean smooth sailing ahead. Certainly, yen carry trades aren’t all washed out because of a few day’s activity. In fact, carry is still quite positive between Japan and the U.S., so there is no reason for every carry trade to be reversed just yet.

What has happened so far looks, if anything, objectively positive for the U.S. economy, give the decline in interest rates. While credit spreads have widened, the decline in corporate borrowing costs has accelerated during the recent wobble:

https://fred.stlouisfed.org/graph/?g=1riUT

The best explanation I have seen is a minor panic attack due to the unwinding of the Yen carry-trade (because the rate differences between Japan and US is narrowing). Supposedly we are about 50% done on that unwinding. It caused a massive drop in the Japanese stock market. That drop was not due to any underlying weakness but driven by forced sales from margin calls. It presented a huge buying opportunity for those with cash and stocks reversed quickly. Europe and US markets responded with some panic, at a lower level, as the concern of contagion are always right under the surface. Information about players and risks quickly fixed the panic, and buyers went bargain hunting. The remaining unwinding of the Yen carry-trade will be likely to cause more limited but similar drops and recoveries.

You know how we’ve been promised, by right-wing science torturers and here in comments, that higher temperatures and increased atmospheric CO2 will increase food production? NASA says otherwise, at least as regards corn, soy and rice. More wheat, yes, but less corn, soy and rice, and the balance is bad:

https://www.nature.com/articles/s43016-021-00400-y

Here’s the calculation for just corn and wheat –

Latest global production figures:

Wheat 770 million tons

Corn 1,225 million tons

Combined 1,995 million tons

End-of-century projection:

Wheat +18% 909 million tons

Corn -24% 931 million tons

Combined 1,840 million tons

Net result, a combined loss of 155 million tons, an 8% decline. I don’t have access to the figures for soy and rice, but they make the result worse.

Anyone who is selfish enough to argue that 2100 is a long way off, a problem for all those pesky unborn children that other right-wing talking points claim to cherish, consider this:

“The ‘emergence’ of climate impacts consistently occurs earlier in the new projections—before 2040 for several main producing regions.”

JD Vance called Tim Walz a ‘San Francisco-style liberal.’ Walz visited the city for the first time last month, while Vance lived there for years.

https://www.msn.com/en-us/news/politics/jd-vance-called-tim-walz-a-san-francisco-style-liberal-walz-visited-the-city-for-the-first-time-last-month-while-vance-lived-there-for-years/ar-AA1olqRo?ocid=msedgdhp&pc=U531&cvid=7b98e54c4f374b15af26d5703ff3f3a6&ei=19

Look – Bruce Hall is dumber than a retarded rock but he’s not as dumb as JD Vance! MAGA!

I had some close relationships to some issues of Playboy magazine in my teens. That’s not as bad as a couch is it??

Politico on the Walz choice:

https://www.politico.com/news/2024/08/06/walz-told-harris-vp-interview-00172952

I’m calling him Coach Walz from now on. He nailed it last night at Temple.