Consumers, CEO’s, or economists?

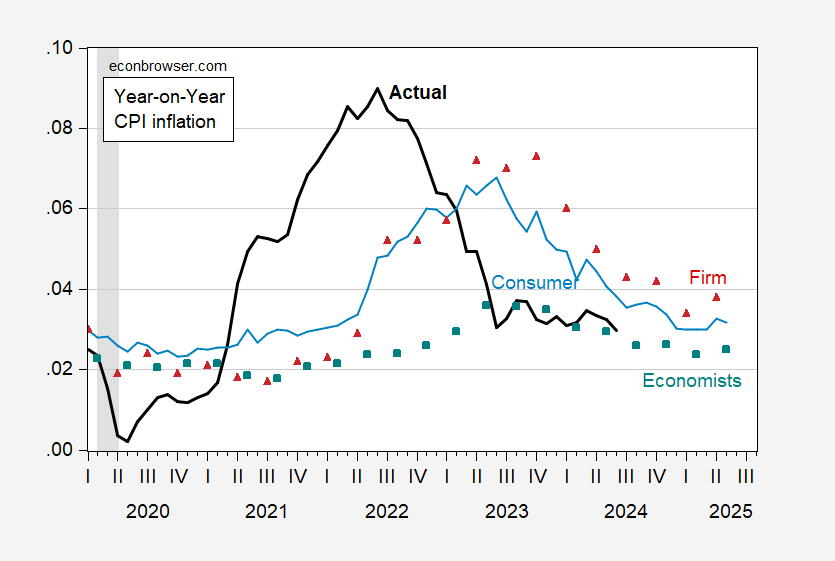

Figure 1: Year-on-Year CPI inflation (bold black line), corresponding 1 year ahead inflation expectation from NY Fed consumer survey (blue line), from Coibion-Gorodnichenko firm survey (red triangle), from Survey of Professional Forecasters (teal squares). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER.

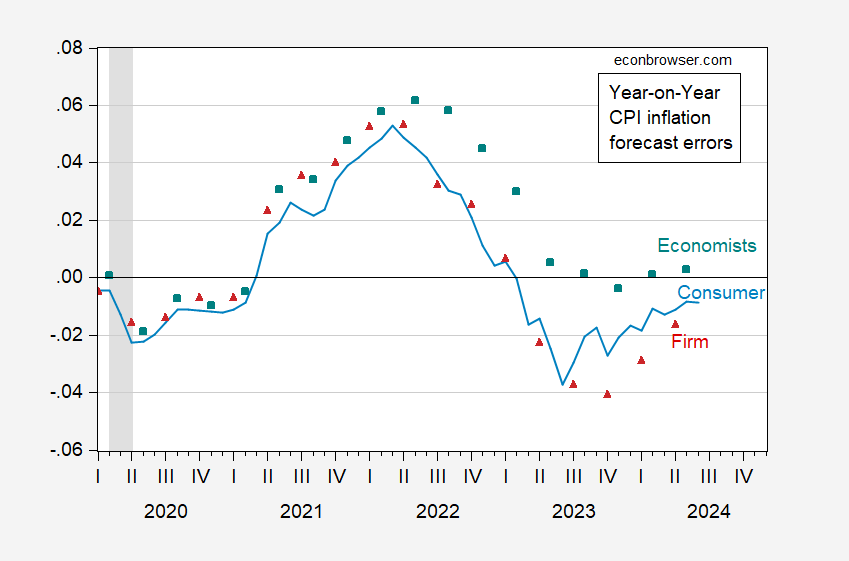

The forecast errors look as follows:

Figure 2: Forecast errors for Year-on-Year CPI inflation and corresponding 1 year ahead inflation expectation from NY Fed consumer survey (blue line), from Coibion-Gorodnichenko firm survey (red triangle), from Survey of Professional Forecasters (teal squares). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER, and author’s calculations.

While professional forecasters missed the inflation surge, they have hit the actual inflation from May 2023 onward.

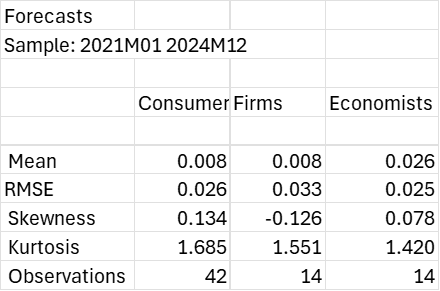

While economists were substantially biased in their expectations in this period, underpredicting y/y inflation at the one year horizon, the root mean squared error (RMSE) of economists forecasts was lower than that of firms, and about the same as that of consumers. Of the three measures, only the firm expectations fail to reject the no-bias null.

On the other hand, firm CEOs overpredict inflation into the latest period.

In terms of adjusting forecasts in response to errors, consumers are the slowest (as measured by the AR(3) of errors, at near unity). Firms are next, at 0.89, and economists fastest at 0.81.

On topic, but only by one blog post. Poorly tracked immigration is messing up the Sahm rule, but we can get around it, in a sloppy sort of way. There is an official unemployment rate for native-born workers:

https://fred.stlouisfed.org/graph/?g=1rfnt

Unfortunately, it isn’t seasonally adjusted, but it doesn’t look like that’s going to matter. The 3-month average native-born unemployment rate is 4.2%. A year ago, it was 3.7%, so we are right at the 0.5 ppt threshold. Last year, the Q3 average was 3.8%, while the Q3 average so far this year is 4.4%. That’s a 0.6 ppt rise, so we’d need a fair drop in September’s rate to avoid a recession signal in my bastardized Sahm Rule.

The native-born rate only has history enough for two recessions, but it worked for both.

I know this misses a lot. Recessions aren’t when native born workers have a harder time finding jobs. Recessions are a broad-based slowing in economic activity, and immigrant workers are supporting economic activity. But the Fed is gambling that the Sahm rule is wrong when inflation is no longer a big problem. Moses has a word for this: coward.

Good catch! I won’t bother creating a link for the graph, but FRED also has an identical link to the foreign-born unemployment rate. To avoid seasonality, you can measure the YoY change (note: *not* the YoY% change, which introduces distortions).

The YoY change in the unemployment rate for foreign born workers has been consistently higher since September 2023. This adds to the evidence that much of the increase in the unemployment rate has been among recent immigrants. And since the Household Survey has likely drastically undercounted them, the raw number of both employed and unemployed immigrants is considerably higher.

Initial and continuing jobless claims only ticked up a small % YoY in the past couple of months. In other words, the sharp increase in the unemployment rate is mainly not caused by people who are filing unemployment claims.

Most of the metrics in the Establishment Survey, by contrast, are flat (e.g., manufacturing) or positive (construction and goods producing jobs generally).

Uh Oh.

Nikkei 225 down 10%. Futures trading suspended.

Kopsi down 8%. “Sidecar” trading suspended.

Nasdaq futures down 3.5%.

VIX above 20, highest since Q1 last year.

Dollar sharply weaker.

Too early to say financial stress is now a problem, but the symptoms are worrying.

On Friday, I wrote this:

“I’m mildly curious as to the effect on spreads and carry trades from the anticipated simultaneous BOJ tightening and Fed easing, but so far, I’m not aware of any trouble.”

I would like to amend that statement – both the “mildly” part and the “not aware of any trouble” part.

The spectacular drop in the Nikkei isn’t all that relevant to an unwinding of carry trades, but other things are. Dollar weakness. U.S. stock market losses. The rebound in yields today after Friday’s and this morning’s drop.

The financial press is crediting today’s happy ISM services data for the bounce in yields, but it’s entirely conventional for financial journalists to tie market moves to economic data without any proof ofthe cause.

When big carry trades are reversed, liquidity problems can result. Fed easing is helpful in those situations, but is a blunt instrument. Liquidity facilities have become a standard part if the Fed’s toolkit over the years, and are likely to be offered if liquidity problems become serious.

As to the drop in the Nikkei, I can only speculate. Signs of weakness in tech and in the U.S. and Chinese economies, along with the prospect of higher interest rates in Japan, could combine to cause downwaed overshoot. Maybe?

I think Japan has had a rise in fear over the past few weeks, prior to issues in the usa markets. I don’t think the losses in Japan were out of the blue. they just needed a catalyst of sorts to push them over the edge.

As of a month ago, funds futures were pricing no chance of a 100 basis point reduction in the Fed funds rate by the November Fed meeting. As of Friday’s close, more like 50/50 odds. As of 2.15 AM, Eastern, August 5, 76% odds of the Fed cutting by 1% as of November 7.

Overnight markets are thin, so tend to exaggerate.

I think the answer is no-one did anywhere

One last thing. The FOMC typically has a call on Mondays. If some jackass journalist reports that the Fed has had an “emergency meeting” because of market turmoil, as has happened in the past, the “emergency” part is made up.

goolsbee was in the media hinting that the fed would take necessary action. just my thoughts, but I think he was messaging that the fed would cut rates before September if they felt that was necessary. probably to simply help calm the market. I will go on record that I said the fed should have cut rates in the last meeting, and to wait until September was a bad move. they were in a wonderful position of still navigating the soft landing. in one day, they have been put in the precarious position of needing to navigate a recession. the fed was doing well, until they weren’t.

quit listening to trump, who actually wants a recession. powell needs to understand if he keeps rates high, trump wins and he is fired. if we get a recession, he is fired. if he preserves the economy, he keeps his job. otherwise he will join the millions of unemployed that he helped to create.

I’m trying to remember who kept telling us economists suck at forecasting inflation while corporate board rooms know everything. Oh yea – he got banned for insulting the economists at the Univ. of Wisconsin.

Remember how a bunch of Republicans voted against the Inflation Reduction and CHIPS Acts, but then took credit for the jobs they created? Well, turns out some of them intend to defend these laws against fellow Republicans’ efforts to overturn them. Jobs, ya know:

https://www.bloomberg.com/news/articles/2024-08-05/red-state-republicans-say-they-ll-defend-biden-era-green-jobs?re_source=postr_story_2

Georgia is singled out. No wonder Trump keeps throwing fits at Georgia Republicans.

Georgia, North Carolina and Michigan all have a big stake here. Michigan would love 12,000 jobs. Harris needs to remind those swing states how many good paying jobs will be eliminated by trump if they elect him. he has declared economic war on those states. keep that in the news. Georgia, North Carolina and Michigan. Trump is coming after your good paying jobs. He has made that explicitly clear with his war on green energy jobs.

Got gasoline yesterday at $2.83. Not too bad, hoping it might drop again next 3 days or so.

Crude oil at $73 now, where’s Steven Kopits to tell us the world is ending at $73 crude??

This data on the predicted inflation is interesting, but I cannot make a real good conclusion from the results. This is a big ask, but perhaps a grad students could conduct a short little study here. Let’s put these predictions into a cash model. If you think rates are rising, you do one simple investment. If you think rates are falling, you do other simple investment. And so on for predicting rates hold steady. Keep it simple, move into short bonds (cash with current interest), long bonds, or SP500. If you started with $10k, what would your resulting investment be today? Which group of predictors, if one acted on them, would produce the most value today? It is not simply a concern of how much error, but how impactful is that error. Is it worse to over predict or under predict inflation, investment value wise?