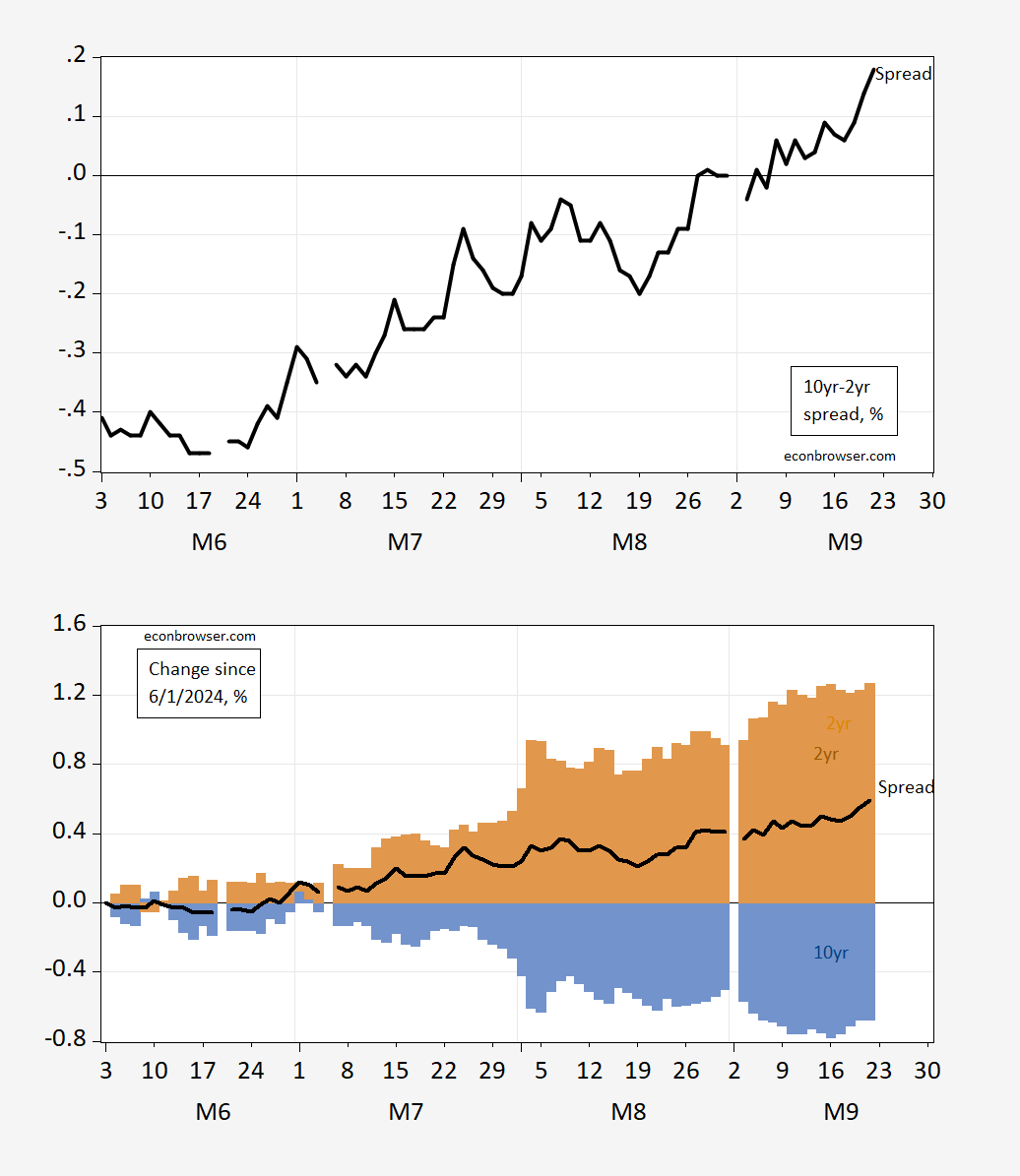

Here’s the cumulative change since 6/3/2024:

Figure 1: Change since June 1, 2024 in 10yr-2yr term spread (bold black), contribution to change from 10 year yield (blue bars), from 2 year yield (tan), all in percentage points. Source: Treasury via FRED, and author’s calculations.

What does this mean? Who knows (as recounted in this FT article). Not sure too much can be inferred, as I conclude from looking at previous instances of bear- and bull- steepening.

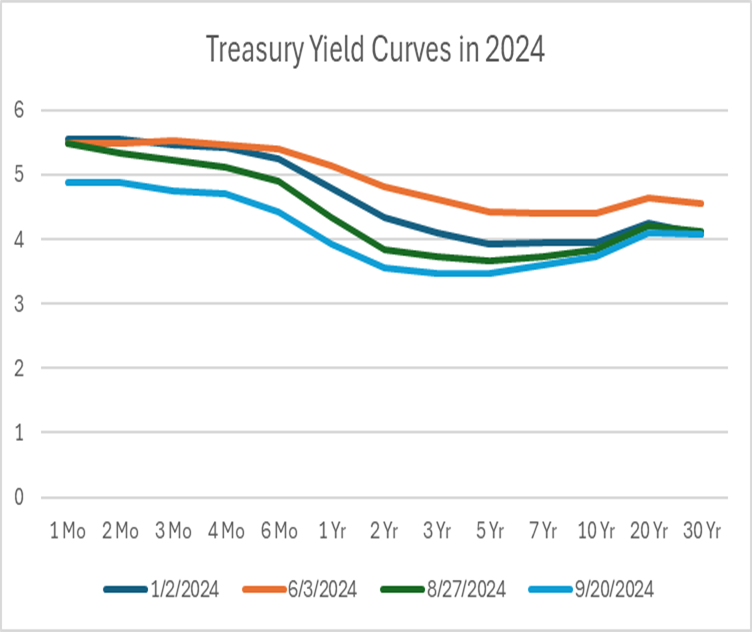

Here’s another depiction of what’s happened to spreads, along the entire spectrum.

Source: US Treasury.

By the way, here’s another FT article on the length of the inversion…

Electricity That Costs Nothing—or Even Less? It’s Happening More and More

A surge in wind and solar power means many businesses and consumers around Europe can get paid for plugging in. The U.S. could be next.

https://www.wsj.com/business/energy-oil/electricity-that-costs-nothingor-even-less-its-happening-more-and-more-53f16e49?st=UW4wJf&reflink=desktopwebshare_permalink

KERKDRIEL, the Netherlands—For much of the spring and summer, Jeroen van Diesen got paid for using electricity. Sometimes his neighbors came over to power up too, generating even more cash. Van Diesen’s situation reflects the strange, new dynamics of electricity that could soon become the norm in many parts of the world: A big increase in wind and solar power has pushed wholesale prices to zero or below for many hours of the year, spurring a sea change in the way people use power—based on whether the sun is shining or the wind is blowing.

Most people pay a fixed price for each kilowatt-hour of electricity they consume throughout the day. The price is set by their power company and only changes at infrequent intervals—once a week, a month or even only once a year. Van Diesen, a software salesman, recently signed up to receive electricity from two providers that charge him the hourly price on the Dutch wholesale power market, rather than a fixed price that resets monthly or annually. When the price of electricity falls low enough, smart meters in his house begin charging his two electric cars.

Wholesale prices swing wildly each hour of the day, and even more so as a larger share of electricity flows from wind and solar installations. Because the generation costs of wind or solar farms are negligible, market prices will be near zero when there is enough renewable power to cover most of a region’s electricity demand. Electricity market dynamics get weirder when renewable-energy producers don’t have an incentive to stop feeding power into the grid, usually because of government subsidies. Then grids can be flooded with excess power, pushing prices into negative territory.

This is similarly driving a strong market for utility scale batteries (energy storage). Fill them up at negative prices – sell it back at positive prices.