Article today on whether it matters if dis-inversion occurs because short rates fall, or long rates rise.

Two years ago, the inversion of the yield curve—shorter-dated Treasurys yielding more than longer-dated bonds—was taken by investors as a surefire sign of recession. Now Wall Street worriers have a new concern: The yield curve is back to normal, a surefire sign of recession.

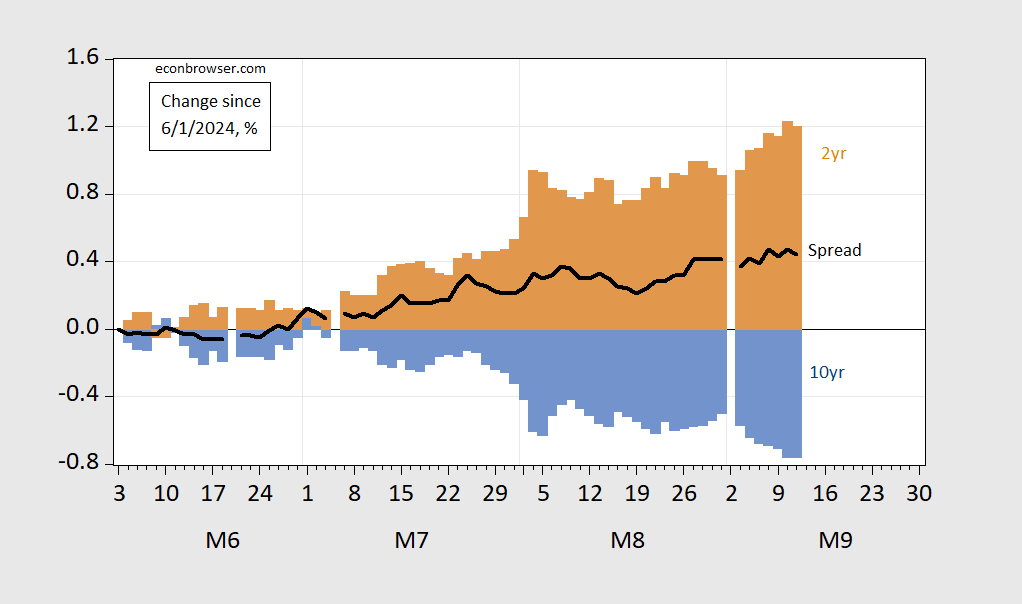

Here’s a decomposition of the 10yr-2yr term spread (2s10s) change since the beginning of June:

Figure 1: Change since June 1, 2024 in 10yr-2yr term spread (bold black), contribution to change from 10 year yield (blue bars), from 2 year yield (tan), all in percentage points. Source: Treasury via FRED, and author’s calculations.

Sure enough, slightly more than half of the steepening is associated with a decline in the short rate. Comparing to the the 2008 recession, we see a similar pattern.

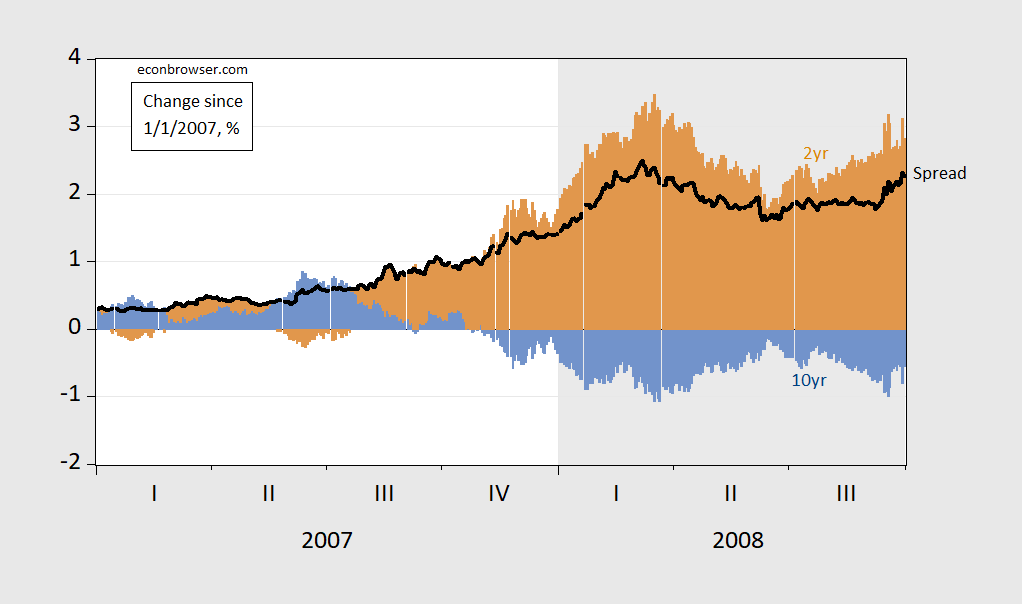

Figure 2: Change since January 1, 2007 in 10yr-2yr term spread (bold black), contribution to change from 10 year yield (blue bars), from 2 year yield (tan), all in percentage points. Source: Treasury via FRED, and author’s calculations.

The overwhelming majority of the steepening was due to the drop in the 2 year yield (i.e., a “bear steepening”).

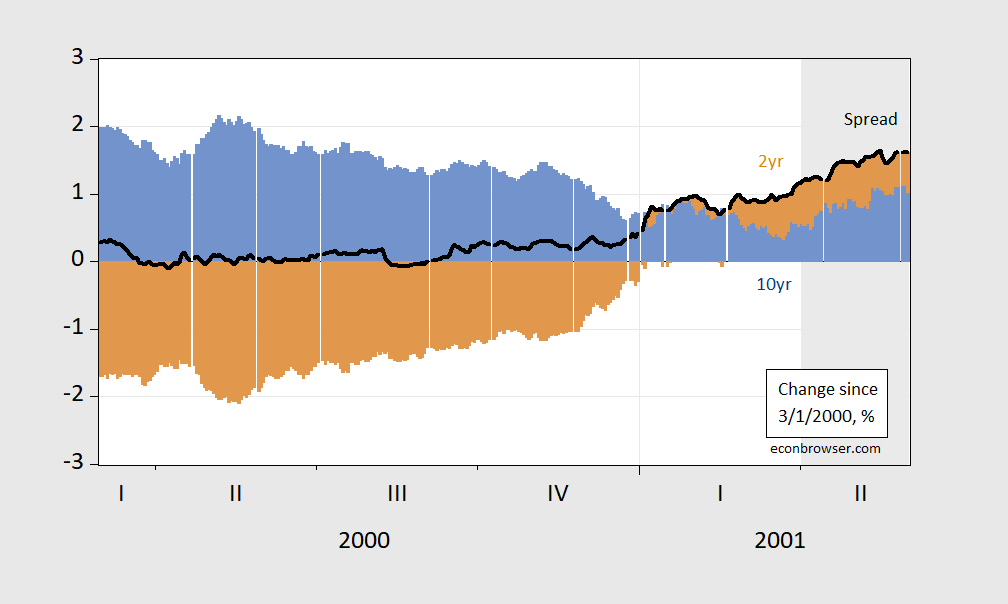

What about the 2001 recession?

Figure 3: Change since March 1, 2000, in 10yr-2yr term spread (bold black), contribution to change from 10 year yield (blue bars), from 2 year yield (tan), all in percentage points. Source: Treasury via FRED, and author’s calculations.

Here, we have might be called a “bear steepening”, where most of the term spread increase was due to the long rate rising, until just before the recession’s start, dated in April 2001 (since NBER puts the peak at March 2001).

So, none of this is to discount the possibility of an incipient recession — just that one can’t necessarily make a judgement based on whether it’s short rates falling, or long rates rising.

I am a very old yield curve junkie and a firm supporter you only look at yield curve inversions for recession signals when the short rates rise usually because the central bank is raIsing rates

The Supreme Leader of the Islamic Emirate of Afghanistan is Hibatullah Akhundzada. It is not some dude named Abdul as Trump claimed last night. Maybe this story clears things up:

Trump’s Confusing Debate Comment About ‘Abdul’ Has A Strange, Shifting Backstory

https://www.msn.com/en-us/news/other/trump-s-confusing-debate-comment-about-abdul-has-a-strange-shifting-backstory/ar-AA1qpusM?ocid=BingNewsSerp

The “Abdul” in question is Mullah Abdul Ghani Baradar. Baradar, a Taliban official and co-founder of the movement that now controls Afghanistan, was the United States’ negotiating partner when the Trump administration — led by Secretary of State Mike Pompeo and the American diplomat Zalmay Khalilzad — agreed to a February 2020 deal to withdraw from the country. The deal, known as the Doha Agreement, has been criticized for not containing enforcement mechanisms to hold the Taliban accountable to its terms. Baradar was languishing in a Pakistani jail before 2018 — when the UnitedStates and “high-levelnegotiations” were credited with his release. Contrary to Trump’s claim, he’s never been the “head” of the Taliban.

Trump failed to completely withdraw U.S. troops from Afghanistan during his presidency, but his successor Joe Biden did. The withdrawal was infamously marked by a lone ISIS-K suicide bomber who killed 13 American service members and roughly 170 Afghans at Hamid Karzai International Airport on Aug. 26, 2021. During Trump’s presidency, 45 American combat deaths were reported in Afghanistan. In the 18-month period between the signing of the Doha Agreement and the airport suicide bombing, no U.S. service members were killed in combat in Afghanistan. Trump has falsely implied this whole stretch occurred during his presidency; seven months were during Biden’s tenure. Trump’s ever-shifting story concerns a conversation he had with Baradar, the Taliban leader. During Tuesday’s debate, Trump claimed that he warned Baradar that Taliban militants should stop killing Americans — by threatening him. “I told Abdul, ‘Don’t do it anymore, you do it anymore, you’re gonna have problems,’” Trump said. “And he said, ‘Why do you send me a picture of my house?’ I said, ‘You’re going to have to figure that out, Abdul.’ And for 18 months, we had nobody killed.”

Both the Taliban and U.S. government did in fact acknowledge a call between the two in the days after the signing of the Doha Agreement. Trump has claimed that he’s spoken to Baradar “numerous” times, but, at least officially, only one such conversation took place.

Several members of both governments listened in on the conversation — and neither side mentioned Trump threatening Baradar.

Over the years, Trump’s assertion that he muscled the Taliban leader has grown more and more curious.

The claim first bubbled up in 2021. During a July speech, Trump recounted a conversation with a Taliban leader — “let’s call him Mohammed” — who Trump characterized as speaking entirely in grunts. The former president recalled threatening “your village, where I know you are,” in a call with the leader. “That’s going to be the point at which the first bombs drop.”

The following month, Trump told Fox News host Sean Hannity that in a conversation with Baradar, “I said, ‘Look, before we start, let me just tell you right now that if anything bad happens to Americans or anybody else, or if you ever come over to our land, we will hit you with a force that no country has ever been hit with before […] And your village, and we know where it is’ – and I named it – ‘will be the first one. The first bombs will be dropped right there.’”

He said something similar to conservative radio host Hugh Hewitt a few days later, saying his threat to Baradar to “hit you harder than anybody has ever been hit in world history” started with Baradar’s town.

“I believe I repeated the name of his town,” Trump told Hewitt. “‘That will be the first place that we start. And I won’t be able to speak to you anymore after that, and isn’t that a very sad thing?’ But that is the story.”

After the August 2021 suicide bombing that killed American troops, “the story” started to change, growing more and more aggressive on Trump’s part.

In September 2022, Hannity interviewed Trump again, and asked about the Baradar story.

“Didn’t you at one point tell him, ‘I know exactly where you are,’ and give him the exact coordinates where he was?”

At that point, Trump changed his story. “No, I sent him a picture of his house,” the former president claimed. “He said, ‘But why, but why, do you send me a picture of my house?’ I said, ‘You’ll have to figure that out.’”

That version of the story is most similar to the one Trump told Tuesday — but significantly different than the first version of his claim. It’s also different from other people’s claims of the exchange, to the extent there was one at all.

In July, for example, Trump ally Rep. Wesley Hunt (R-Texas) went viral with his claim that Trump was present in person, alongside Pompeo, during a discussion with “a Taliban leader.” Hunt claimed Trump threatened to “kill” the leader “if you harm a hair on a single American.”

Then, according to Hunt, “He reached in his pocket, pulled out a satellite photo of the leader of the Taliban’s home, and handed it to him, got up, and walked out of the room.” (There’s no evidence Trump was ever in the same room as a Taliban leader; his phone call with Baradar was described at the time as the first known conversation between a U.S. president and the Taliban.)

Then there’s Pompeo, who’s told slightly different versions of the story himself.

On Fox News in August 2021, the former secretary of state claimed he was “in the room when President Trump made very clear to Mullah Baradar, the senior Taliban negotiator, that if you threatened an American — if you scared an American, certainly if you hurt an American — that we would bring all American power to bear to make sure that we went to your village, to your house.”

A few days later, during remarks to the Kansas Independent Oil & Gas Association, Pompeo said he was the one who showed Baradar a satellite image of his home. He recounted the phone call between Trump and the Taliban, then separately discussed the supposed photo of Baradar’s home.

“The Taliban understood that if you touched an American, let alone killed an American — indeed, as we had phrased it, if you scare an American — that there’ll be real costs,” he said. “‘We will come to find you,’ which was a lot of fun, sitting there with Mullah Baradar, to remind him that I knew exactly where his house was — I showed him the photo — that we knew where his friends were, we knew where his village was, and we were going to hold those responsible for that American accountable.”

Harris did a masterful job of talking about her policy proposals during debate while pointing out Trump’s constant lies and disinformation – but it is astonishing to me that after almost a decade of Trump’s “big beautiful health care plan coming in two weeks -” lie – the corporate media is still pretending that Trump is a serious candidate – and they accept that Trump doesn’t have a plan – but just a concept of a plan https://www.nytimes.com/2024/09/11/us/politics/trump-obamacare.html – but sure corporate media – let’s pretend that Harris policy proposals don’t have enough details – and will have to go through a legislative process – https://kamalaharris.com/issues/

Let’s go back to 2012 when Romney kept saying we should “repeal and replace” Obamacare. When asked with what – Romney never said. But maybe he wanted to change the name of Obamacare to Romneycare even though the two plans were the same.

Trump would call any form of health care big and beautiful as long as his name is on it.

I am throwing a penalty flag on this indicator (not the dissection by the article) for cherry-picking.

It is true that the 10 minus 2 year spread un-inverted shortly before the 2001 and 2008 recessions, I.e., n=2.

But what happens when we go back earlier and make use of other treasury spreads as well? To cut to the chase, here, graphically, is the answer:

https://fred.stlouisfed.org/graph/?g=1tEaU

The 10 minus 2 year spread un-inverted early (1970, 1981) or later (1974, 1980) *during* those recessions, and a full one year before the 1991 recession.

Other spreads show similar patterns for those recessions, with the 10 year minus Fed Funds spread un-inverting even later. Further, those spreads that were available during the 1960s both inverted and un-inverted with no recession at all, as well as in 1998.

In other words, this indicator only works for the last two, or possibly three, recessions. Cherry-pick that particular yield spread and those recessions and you’re good.

Ultimately, the rhetorical basis behind the indicator is that yield curve inversions are 100% accurate. Therefore, the only question – by definition! – is whether it un-inverts before, during, or after the *necessarily* ensuing recession occurs. As I have shown above, even if we grant the premise, then all we can say is that the un-inversion happens before the recession ends. And if we don’t grant the premise (1965-66, 1998), it completely falls apart. In fact the 10 year minus 2 year is also cherry-picked because it is the only one that didn’t invert meaningfully during 1998.

We are now 26+ months past the first inversion, long after the median point by which historically a recession should have occurred. We must consider a false positive for the underlying inversion signal at this point.

While you are throwing penalty flags, head over to EJ Antoni’s twitter when he shows inflation adjusted weekly earnings starting in early 2021. Some one foolish enough to get in the mud with his MAGA trolls sensibly protested that a different picture emerges when one goes back 5 years.

So one of the trolls decided to do a longer term perspective starting back in 2010 but ending in 2022.

I’m sure you get the problem with what this troll did but I would love our host to revisit this issue.

Hey – I failed to understand the power of FRED who makes this real weekly earnings easy:

https://fred.stlouisfed.org/series/LES1252881600Q

Median usual weekly real earnings

This series goes from 1979 to today. Yes real wages have increased over the past 5 years. Something Antoni could not admit. His pathetic fan club said they growth faster under Trump than under anyone else. Not pre-pandemic unless Trump was President for the period where some of us considered Obama’s 2nd term.

Look Antoni is a lying sick dog. His Twitter fan base is much worse.

So EJ Antoni has discovered how to dramatically raise median real wages — just layoff 20 million people who make less than than the median real wage. It’s like magic.

Project 2025 no doubt!

Menzie is on Marketplace.org today.

Trump told us Tuesday that his tariffs did not raise prices. Really?

https://www.aeaweb.org/articles?id=10.1257/aer.20190611

The Production Relocation and Price Effects of US Trade Policy: The Case of Washing Machines

Aaron Flaaen, Ali Hortaçsu, Felix Tintelnot

American Economic Review

vol. 110, no. 7, July 2020

We estimate the price effect of US import restrictions on washers. The 2012 and 2016 antidumping duties against South Korea and China were accompanied by downward or minor price movements along with production relocation to other export platform countries. With the 2018 tariffs, on nearly all source countries, the price of washers increased nearly 12 percent. Interestingly, the price of dryers—not subject to tariffs—increased by an equivalent amount. Factoring in dryer prices and price increases by domestic brands, the 2018 tariffs on washers imply a tariff elasticity of consumer prices of above one.

Of course Trump does not even know what a washing machine is.

https://finance.yahoo.com/quote/DJT/

Trump Media share price fell at opening again. I guess Taylor Swift is to blame.

Springfield City Hall, school, others hit by threats tied to Haitian issue

City Hall evacuated, drivers license bureau offices closed, parents at one Springfield school asked to pick up children

https://www.daytondailynews.com/news/springfield-city-hall-evacuated-due-to-unspecified-threat/LEJGCXXHZRHT3HH3HYHABRZGT4/

Springfield City Hall was evacuated around 8:30 a.m. Thursday following a bomb threat “to multiple facilities throughout Springfield,” according to a city statement released Thursday morning. Drivers license bureaus in Clark County were also closed Thursday morning in relation to the threats, according to Clark County Clerk of Courts Melissa Tuttle. And parents of students at one Springfield school said they were told to pick up their children. A police officer outside Fulton Elementary was seen telling concerned parents that their children had been moved to Springfield High School. Springfield City Schools issued a brief statement at 10:40 a.m. Thursday. “Based on information received from the State Fire Marshal, Fulton students were evacuated from their building to Springfield High School this morning,” school officials said. “Students and staff are safe; however, the district is in the process of a controlled release to safely dismiss students to their parents.” Mayor Rob Rue said everyone who was in the City Hall building was moved out and is safe. Rue would not comment on the precise language of the threat but said it came from someone claiming to be from Springfield, and mentioned frustration with the city related to Haitian immigration issues. The city has seen significant turmoil this year, and especially this week, over public response to 10,000 to 15,000 Haitians moving to the city over the past few years. City Commission meetings are packed with upset residents, and the issue was raised during Tuesday night’s presidential debate.

More violence brought to you courtesy of Donald Trump and JD Vance. MAGA.

Germany’s Foreign Ministry mock Trump and his lies:

https://www.dw.com/en/germany-rejects-trumps-energy-claim-mocks-him-over-pets/a-70190020

They get 50% of their energy from renewable sources and are doing fine with their abolishment of hydrocarbon plants. They also don’t eat dogs – OK Fido we can go eat Brockwurst.

At a press conference on Wednesday, a government spokesman said, “We took note of [Trump’s comments] with some surprise.” “I didn’t know what the presidential candidate meant by this,” the spokesperson added, referring to Trump’s comment on German energy policy.

Huh – Trump has no idea what he meant by that either.

“Like it or not: Germany’s energy system is fully operational, with more than 50% renewables,” the German Foreign Ministry posted on X, formerly known as Twitter. “And we are shutting down — not building — coal & nuclear plants. Coal will be off the grid by 2038 at the latest.” “We also don’t eat cats and dogs,” the ministry wrote in reference to Trump’s baseless assertion that immigrants are stealing and eating pets in a US city.

Well Trump at least has Viktor Orban – who I am told has a really good recipe featuring as its center piece your former dog.

Trump does not seem to know what he means, ever. So, no surprise that none of it made sense.

It seems to me that there are three different rationales for the causation of a recession:

1. a sui generis event, like a cold, that comes and goes without explanation

2. real business cycle theory, which to my mind is driven by the differential between rising incomes and fixed asset creation, ie, really a fixed asset cycle model in which fixed assets enter the economy only with a lag during an economic upturn, leading to asset or commodity bubbles, eg, a spike in housing prices or an oil shock

3. a mistake in monetary policy by the Fed, notably by over-tightening

I don’t like 1., because it defies notions of causality.

I am mostly an RBC guy. Thus, a recession is a rebalancing of relative prices due to earlier imbalances. But I am not sure where this narrative leads us. Inflation is declining and looks under control. Oil prices are within normal ranges. Wages don’t seem out of line. We’re left with high housing prices, and certainly a reset is warranted there. But inventory remains well below pre-covid levels. https://fred.stlouisfed.org/series/ACTLISCOUUS

And it’s not as if homeowners lacked home equity, which is sky high right now. https://fred.stlouisfed.org/series/OEHRENWBSHNO

Household debt as a share of GDP is the lowest since at least 2005. https://fred.stlouisfed.org/series/HDTGPDUSQ163N

On the other hand, the US budget deficit is at an astounding 7% of GDP ($2 trn on $28.6 trn GDP). That’s bad. So maybe that’s the driver.

What else is there that would be consistent with RBC? Nothing that’s really obvious to me.

That leaves 3., a Fed mistake in monetary policy. Did the Fed over-tighten? It doesn’t feel that way.

In any event, if the notion is that we’re heading to a recession, it would be helpful to put together some narrative of the causality and resulting developments.

“it would be helpful to put together some narrative of the causality”

OK – but first you should take a basic course in macroeconomics. After all – the rest of your comment was babble speak.

“he causation of a recession”

Why do you write like an arrogant retarded monkey? Your description of real business cycle theory is STUPID. But you have been told this before and you still don’t get it?

Come on dude – you have no effing clue what macroeconomicss is about so please, please, please stop writing this retarded trash.

Does a Federal deficit somewhere near (but not quite) = 7% of GDP mean we will have a recession. Let’s check the record:

Federal Surplus or Deficit [-] as Percent of Gross Domestic Product

https://fred.stlouisfed.org/series/FYFSGDA188S

No recession in 1943. 1983? Oh wait – that was the Reagan recovery? 2009? That was the beginning of the Obama recovery. 2020? Oh wait – Nobel Prize winning economist (cough, cough) Steven Koptis says that was a “suppression” (even if he has no clue what that means).

And now our Nobel Prize winner (cough, cough) says the current deficit does suggests a RECESSION. Or was that a suppression or maybe a depression! Never mind the fact that the deficit is falling.

The issue wrt to recession is not the deficit per se, but rather contractionary fiscal policy if policy-makers decided to reduce the deficit to a more typical, say, 3% of GDP. This would represent contractionary fiscal policy of 4% of GDP. Should we do that? Or do you endorse 7% deficits indefinitely?