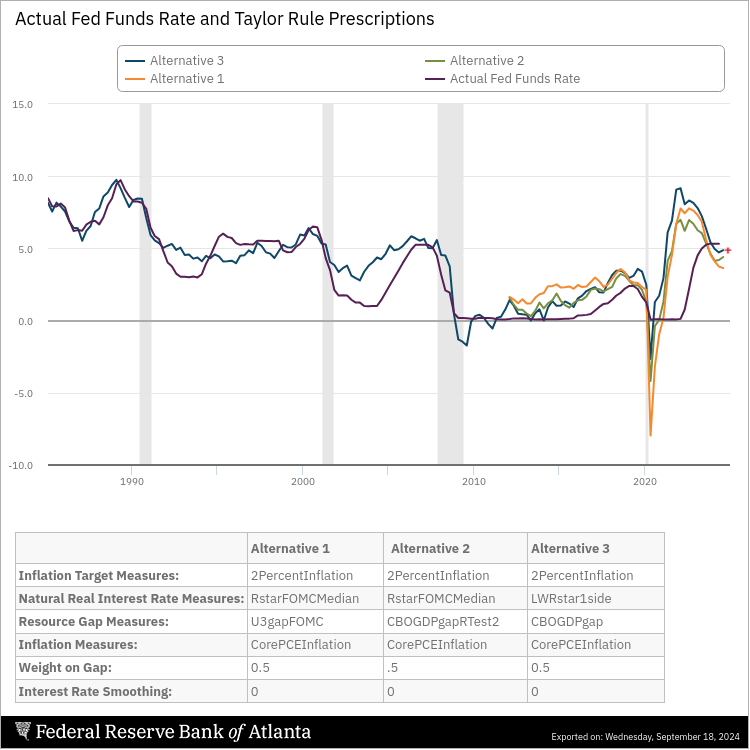

At the press conference for today’s FOMC meeting, there was a lot of talk about how the 50bps drop was dramatic. That focused on the change, rather than the level…Consider what some measures of the Taylor rule (which refers to the level of the Fed funds rate) indicate.

Source: Atlanta Fed, accessed 18 Sep 2024. Red + by author, indicating current Fed funds rate at 4.83%. No smoothing included, so think of this as a “static” Taylor rule.

I think Alternative 1 as a FAIT-like Taylor rule (with no smoothing), Alternative 2 as a more traditional Taylor rule using an output gap, while Alternative 3 uses a estimated r*.

By this measure, we’re “catching up” with where we should be. One can play around with the measures (in the Atlanta Fed’s great Taylor rule utility) to get a slightly different picture (e.g., assume the r* is 2%). Still, I think Alternative 3 is pretty reasonable.

Some one call John B. Taylor and ask him to say the obvious “we have held interest rates too high for too long”.

Nothing bad to say, today, openly, about my “favorite” central banker. Nope…….

West Coast Teamsters break with national chapter in endorsing Harris

https://www.msn.com/en-us/news/politics/west-coast-teamsters-break-with-national-chapter-in-endorsing-harris/ar-AA1qNiQL?ocid=msedgdhp&pc=U531&cvid=651b1d3ad9464dc7b6b965e256dbf8cf&ei=15

West Coast Teamsters announced their endorsement of Vice President Kamala Harris on Wednesday, just minutes after national Teamsters leadership declined to issue a presidential endorsement. The move represents a sharp break within the powerful union’s membership in liberal states like California, where former President Donald Trump remains a widely unpopular political figure. The union’s national headquarters released internal survey results earlier in the day that showed close to 60 percent of its members backed Trump.

Teamsters Joint Councils 7 and 42 — which are made up of 39 local unions representing 300,000 members in California, Nevada, Hawaii and Guam — wrote in a statement that Harris and her running mate Minnesota Gov. Tim Walz have a history of supporting expanded labor protections for workers, like the proposed Protect the Right to Organize Act and a Minnesota law that will ban employers from forcing workers to attend anti-labor meetings. “Teamster members work and live in cities as well as in rural communities, come from diverse backgrounds, and have different views, but Joint Council 7 and 42 Teamsters refuse to be divided by extremist political forces or greedy corporations that want to see us fail,” said Teamsters Joint Council 7 President Peter Finn. “As Teamsters we will stand together to have a strong voice on the job, provide for our families, and serve the communities where we work.”

Good for the West Coast Teamsters. Now if they can explain WTF is wrong with the teamsters in the rest of the nation.

Additional Locals supporting Madame President have been in states which count (electorially -if that’s a word) are Michigan and Wisconsin in addition to NY Locals

https://www.rollingstone.com/politics/politics-news/teamsters-wont-endorse-candidate-councils-back-kamala-harris-1235106293/

I’ve had a look at the market response to today’s news. (Like I’m some big smarty-pants, right?) Stock and bond prices spiked on the FOMC policy announcement, then fell. I will now speculate as to reasons.

Ahead of the announcement, money market futures priced in 2/3 odds of a 50 basis point funds rate cut. Machines took that pricing as an input. Immediately upon the announcement, machines repriced to 100%. Done.

Then, all the other news spewing out if the Fed begins to be digested. Nothing unexpectedly dovish was spewed, so there was no additional impulse to buy at the day’s low. Other machines, and people, responding to price action (Keynes’s “beauty contest”) and to the lack of unexpectedly dovish news, sold to take advantage of the spike.

Now, to my way of thinking, the Summary of Economic Projections was hawkish, but I don’t know that it was hawkish relative to expectations.

So the gist is, the only big bid today was in response to going from 62% odds of a 50 BP cut to 100%. Automatic, just math. The rest of the evaluation, as reflected in prices, was that the outlook is as-expected to a tiny bit hawkish.

You will be glad to know that Trump Media fell again. Closed at $15.62 a share.

Ha ha ha ha ha ha ha! HA HA HA HA AHHHHAAA HA HA!

Made my day… along with the YouGov poll showing Harris with a 4% lead.

Sounds like the old saying “Buy on the rumor, sell on the news.”

Gold jumps to record high after US Fed delivers 50 bps rate cut

https://www.msn.com/en-us/money/markets/gold-jumps-to-record-high-after-us-fed-delivers-50-bps-rate-cut/ar-AA1qNaCH?ocid=msedgdhp&pc=U531&cvid=98d8a19096794f749880d3ce450e1773&ei=19

(Reuters) – Gold prices rose to an all-time high on Wednesday after the U.S. Federal Reserve cut interest rates by 50 basis points, sending the dollar lower. Spot gold was up 0.9% at $2,592.39 per ounce as of 02:17 p.m. ET (1817 GMT). U.S. gold futures settled 0.2% higher at $2,598.60. “Gold surges to all-time highs but bond yields have also jumped higher. A 50 bps is good for gold,” said Tai Wong, a New York-based independent metals trader. “Gold is in a bull market; it is likely to move higher. The velocity of that move will depend on Powell’s tone.” The U.S. central bank kicked off what is expected to be a steady easing of monetary policy with half a percentage point cut on Wednesday. Policymakers see the Fed’s benchmark rate falling by another half of a percentage point by the end of this year and another full percentage point in 2025. Lower interest rates decrease the opportunity cost of holding non-yielding bullion and weigh on the dollar, making gold cheaper for investors holding other currencies. Following the Fed’s cut, the dollar fell 0.5% – to its lowest since July 2023 against its rivals.

Personally I would have led with the story about exchange rates. But of course this probably indicative of the next MAGA moron tweet from fake PhD EJ Antoni on how this means HYPERINFLATION.

FOMC statement today: The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.

If the risks are in balance, doesn’t that imply that they should be at the “neutral rate”, neither expansionary nor contractionary, which they have said is 2.5% to 3.5%? They are way behind the curve.

I suspect Macroduck will agree. I certainly do.