From the Fed today:

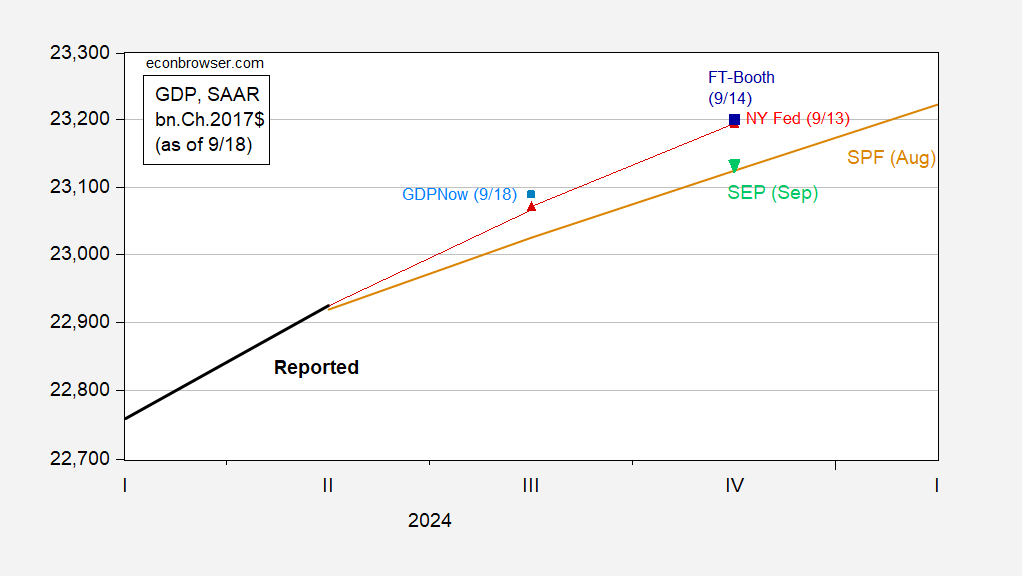

Figure 1: GDP (bold black), Summary of Economic Projections median (inverted light green triangle), GDPNow as of 9/18 (light blue square), NY Fed nowcast as of 9/13 (red triangle), FT-Booth as of 9/14 (blue square), and August median SPF (tan), all in bn.Ch.2017$ SAAR. Levels calculated by iterating growth rate on levels of GDP, except for Survey of Professional Forecasters. Source: BEA 2024Q2 2nd release, Atlanta Fed, NY Fed, Philadelphia Fed, Federal Reserve September 2024 SEP and author’s calculations.

Goldman Sachs tracking at 3% q/q AR (vs. 2.9% for GDPNow). Note that the median q4/q4 growth rate from the SEP (2.0%) was essentially the same as in the June SEP (2.1%). September SEP low/high range is 1.8%-2.6%, with central tendency ranging from 1.9% to 2.1%.

Table 1. Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, September 2024

So they project real GDP growth = 2% for the first three years of Harris’s first term in office plus falling interest rates, inflation, and unemployment rates.

No Trump will tell you he would get 4% growth by getting rid of windmills and placing tariffs on everything. MAGA!

The SEP shows that the Committee expects to leave the funds rate above neutral through 2025, and the projected neutral rate is now 0.1 ppt higher than in June, 0.3 ppt higher than in March, 0.4 ppt higher than in December. These guys remain hawkish relative to fundamentals, with presets on the Atlanta Fed’s Taylor rule utility showing neutral at a funds rate between 3.6% and 4.8%.

When asked to comment on the neutral rate at a post-FOMC-meeting press conference earlier this year, Powell essentially told the reporter to shut up. I didn’t notice any mention of the neutral rate today. Those 40 bps aren’t the end of the world, but they’re not chicken feed, either.

Pricing for the funds rate at coming FOMC meetings has edged lower, mostly because the possibility of only a 25 BP cut today has been erased. December futures centers on an additional 75 basis points in cuts – nearly 50% odds – with 17% odds of a full 1% cut, 34% for only 50.

I was wondering if President Harris would ask Yellen to stay on as Treas. Sec. or whether Dr. Yellen would be replacing Powell as FED chair in early 2026. Too bad we cannot have her serve in both roles.

Overseas, Yellen is treated as the real deal. She is a diplomatic resource of considerable power. I don’t get the same impression from Blinken. Maybe he’s hobbled by House Republicans. Maybe he has the harder parts of the diplomatic task list.

Anyhow, while I’d love to see someone who has a profound understanding of economics at the helm of the Fed, I think we need her more at Treasury.

Not an insider, so my view here is naive. On the other hand, insiders tend to be to “inside” to make the best decisions.

I saw a couple of press reports (yea those morons) talking about how this 50 basis point cut was historic. That did not sound right. What about the COVID period? Or 2007 to 2008? Or 2001? Etc. Maybe those reporters could have checked this account out before babbling their usual ill informed silliness:

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

Well, Forbes skimmed over the important information here:

“In 2019, the U.S. and Chinese were in conflict over trade—a so-called “trade war”—and the Fed was concerned that the conflict would harm the economy and push up unemployment rates.”

There was a great deal of stress evident in financial markets ahead of the 2019 rate cuts. Was that due to tensions with China? Possibly, but I don’t recall the connection being made at the time. And at that time, I made occasional trips down the street to Maiden Lane to check on what they were thinking.

Here, too, Forbes leans into China and ignores domestic issues:

“Disastrous economic readings from China in early 2016 caused stock markets to panic and forced the Fed to pause more rate hikes for a full year.”

Take a look at corporate yield spreads in 2016:

https://fred.stlouisfed.org/graph/?g=1tTi7

See how junk spreads in particular widened? If FRED allowed disaggregation by sector, you could see that the oil patch was the major source of spread widening. Oil prices had plunged and oil sector default risk was climbing. Was that China’s fault? Only partly; the oil sector had other problems. Financial stress wasn’t widespread, which is probably why the Fed paused hikes, but didn’t cut.

The Forbes story shows an embarrassing lack of depth.

I didn’t find “unprecedented” because I got tired of correcting factual errors. What, exactly, does Forbes think is unprecedented?

My best of friends Macroduck, It has been a good 34 years since Forbes magazine was worth a damn. Don’t get me started Sir.