From the paper abstract:

We study the extent to which the perceived cost of losing the exorbitant privilege the US holds in global safe asset markets sustains the safety of its public debt. Our findings indicate that the loss of this special status in the event of a default significantly augments the debt capacity for the US. Debt levels would be up to 30% lower if the US did not have this special status. Most of this extra debt capacity arises from the loss of the convenience yield on US Treasuries, which makes debt more expensive following its loss and provides strong incentives to repay debt.

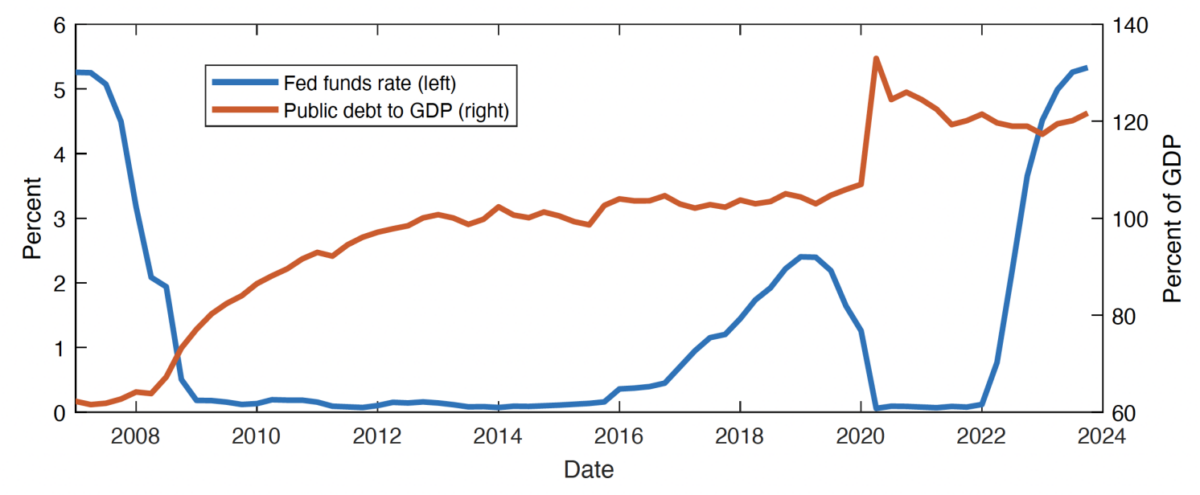

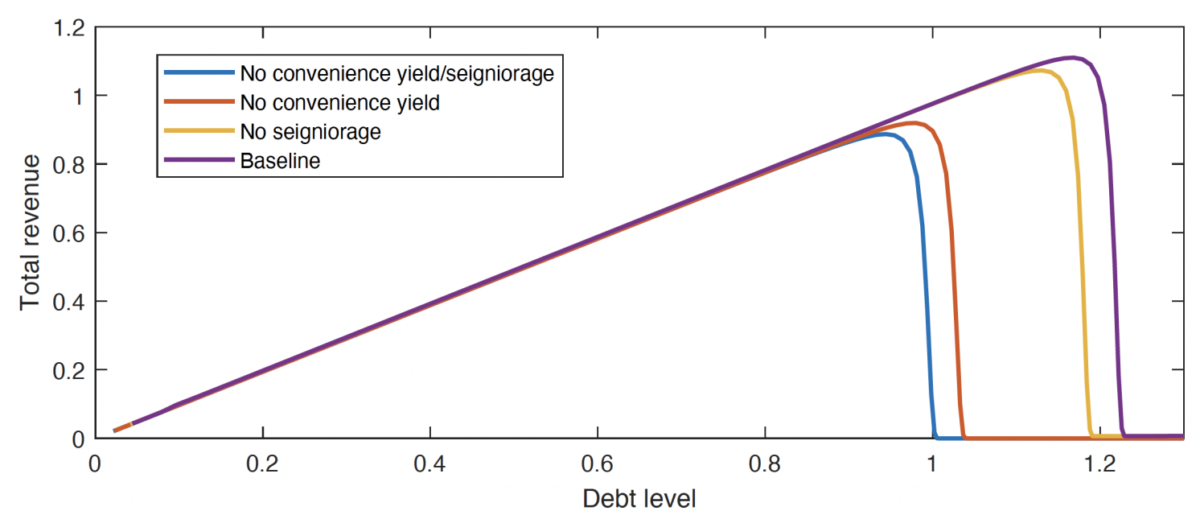

Two graphs are key (taken from the VoxEU post on this paper):

From the conclusion:

. The special status of the US increases the maximal debt that can be sustained in equilibrium by approximately 22% of GDP. The majority of this increased debt capacity arises from the convenience channel: an economy where US debt doesn’t offer a non-pecuniary benefit to holders features a maximum debt level 18% lower, whereas an economy without foreign seigniorage features a maximum debt that is only 3% lower.