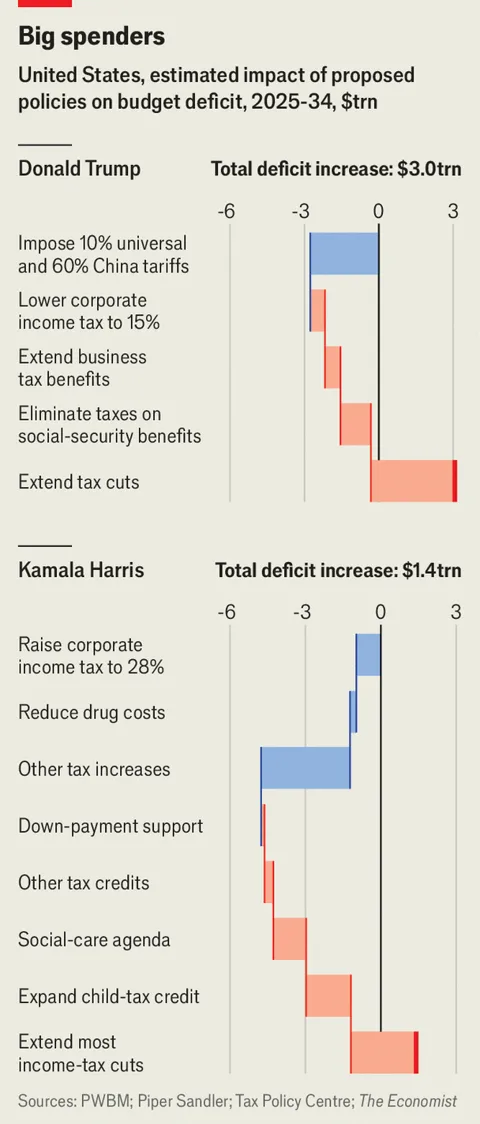

Consider this graph (based on Penn Wharton Budget Model scoring, from the Economist):

Note: With respect to tariffs, the trade war (retaliation, uncertainty, reduced aggregate demand) associated with implementing wide-ranging tariffs is omitted. So consider the Trump impact at the lower end of total deficit increase. For macro implications re: GDP growth, see here.

Two reactions:

(1) Maybe Bernie Sanders is right – Harris needs to consider even higher taxes on things like capital gains.

(2) Trump when addressing child care suggested his tariffs would pay for all of that plus eliminate the deficit. Even under the absurdly optimistic assumptions which you rightfully critique, tariffs pay for only half of his tax cuts. Now let’s be fair – Trump was likely only concerned that he help Ivanka with her child care leaving the rest of us to fin for ourselves. MAGA!

BTW Sarah Yuckabee Sanders when she stopped stuffing her fat face with enormous amounts of food called the Cheneys liberals for endorsing that RADICAL Kamala Harris.

And I thought I was making a joke about Trump’s answer to the child care issue!

Project 2025 Proposes Defunding Daycare

https://www.msn.com/en-us/news/politics/project-2025-proposes-defunding-daycare/ar-AA1qgXTz?ocid=msedgdhp&pc=U531&cvid=698d6925102d4f4fa2c4155ae12356c8&ei=5

Donald Trump gave an incoherent response last week to a question about how he would address the rising costs of child care to the point of incoherence. It turns out his allies at The Heritage Foundation already have a plan in mind. Page 486 of Project 2025 – the conservative group’s terrifying master plan for a second Trump term – states that “instead of providing universal daycare, funding should go to parents either to offset the cost of staying home with a child or to pay for familial, in-home child care.”

The lying weasel Trump will try to distance himself from Project 2025 but this is exactly what JD Vance has been saying.

Dow gets a 500-point boost

https://www.msn.com/en-us/money/markets/dow-gets-a-500-point-boost/ar-AA1qgNUF?ocid=msedgdhp&pc=U531&cvid=74406f347f984436a915bb5b3a3bfe2e&ei=10

The Kamala Boom!

Oh my – I will not be getting an invite to Fox and Friends, which is a good thing since I will not have to endure Steven Koptis sucking up to the hosts!

If only low-information undecided voters would see this, it might help. They won’t, kinda by definition.

The most likely benefit of having the Economist publish this is that in the U.S., college-educated white males are among the most likely readers. They seem set to vote for Trump in large numbers. Just a pebble in their shoes, reminding them that they’re privileged idiots, voting to maintain privilege.

“Mr Trump has talked about using cryptocurrency or drilling for oil in order to pay off the national debt—ideas that amount to utter nonsense.”

Norway imposes a 78% profits tax on oil. Now if we did the same, that might help. Of course Trump would not get his $1 billion campaign contribution aka bribe if he floated that idea.

Alleged leaders of White supremacist group charged in effort to encourage terrorism and hate crimes

https://www.msn.com/en-us/news/us/alleged-leaders-of-white-supremacist-group-charged-in-effort-to-encourage-terrorism-and-hate-crimes/ar-AA1qgX0t?ocid=msedgntp&pc=U531&cvid=708cea543be842b7a80e2dd5558cbcd1&ei=15

A federal grand jury in California has handed up charges unsealed on Monday against two men who allegedly led an online group that pushed others to attack politicians or commit hate crimes as part of an effort to bring down the US government. The men, 37-year-old Matthew Allison and 34-year-old Dallas Humber, are the leaders of an online White supremacist group called the Terrorgram Collective, prosecutors say. The collective subscribes to White supremacist accelerationism, meaning they allegedly believe violence and terrorism are necessary to start a race war, ignite the collapse of the government and prompt the rise of a White ethnostate. To that end, prosecutors allege that Allison and Humber pushed their followers to attack minority communities, government infrastructure, politicians, government officials and the leaders of private companies – some of whom, including a US senator and a federal judge, were included in a detailed list of “high value targets” for assassination. Allison and Humber are facing 15 charges, including soliciting the murder of federal officials, distributing bomb-making instructions, and conspiring to provide material support to terrorists. No lawyers are listed for the defendants in court records. Their strategy to encourage others to commit violence was effective, Kristen Clarke, who leads the Justice Department’s civil rights division, said in a news conference Monday. One Terrorgram user livestreamed himself stabbing five people outside of a mosque in Turkey, she said, and a 19-year-old Slovakian man praised the group in a manifesto before killing two people at an LGBTQ bar in Bratislava, the capital of Slovakia.

Two more MAGA supporters who may not get to vote this November.

https://kamalaharris.com/issues/

An issues page! And Harris-Walz was kind enough to include a tab on the Trump-Vance approach to issues!

pgl: “Maybe Bernie Sanders is right – Harris needs to consider even higher taxes on things like capital gains.”

One of the biggest economic distortions in the tax system is the different rates between capital gains and ordinary income. This leads to all sorts of schemes to transform ordinary income into lower tax capital gains. Making them the same would eliminate most of this wasted effort.

And while they’re at it, there’s no justification for lower rates for “qualified dividends” either. Tax all income the same. It would greatly simplify everyone’s tax planning and tax return preparation.

Exactly. I’m all for taxing all capital income at the same rate and as the income accrues.

Remember when our favorite MAGA moron Bruce Hall cited some stupid Tyler Cowen rant that the Harris plan is COMPLICATED? If you and I got to rewrite the tax code, it would be rather simple. Then again rich people would have to pay more in taxes so I guess we are MARXISTS!

I seem to remember an old GOP flat tax proposal that would tax all income the same 25% with no deductions. It was countered by: “sure as long as we let the first $25K go tax free (to cover basic survival)”. Then nobody talked about it anymore because someone did the calculations.

@ joseph

The old joke you used to hear all the time on TV and sometimes see in print was that Warren Buffett’s secretary paid a higher tax rate than he did.

I was wondering why you had THREE posts on the deficit today but it seems you were getting ahead of our favorite Ph.D. troll:

https://x.com/RealEJAntoni/status/1833235156049793042

$35.3 trillion in debt (and rocketing higher)

Could this fake Ph.D. really be as dumb as Bruce Hall? He got a Ph.D. without being able to convert nominal debt to inflation adjusted debt? Let alone do a debt/GDP calculation?

Someone call the school who gave this lying troll a degree and ask them to rescind it?

https://www.documentcloud.org/documents/25106804-nsl4a-statement

National Security Leaders for America Statement of Support for Vice President Kamala Harris

Read this letter signed by:

Admiral Steve Abbot, USN (Ret) Brigadier General Steven M. Anderson, USA (Ret) Major General Peter S. Cooke, USA (Ret) General Larry R. Ellis, USA (Ret) Sergeant Major of the Marine Corps John L. Estrada, USMC (Ret), former Ambassador Major General Randy Manner, USA (Ret) Vice Admiral Dennis V. McGinn, USN (Ret), former Assistant Secretary of the Navy General Lloyd W. Newton, USAF (Ret) Major General Marilyn Quagliotti, USA (Ret) Rear Admiral Michael E. Smith, USN (Ret)

I presume Trump-Vance will call them suckers and losers.

What’s in the “mystery meat”… “other tax increases”?

The WPBM seems to indicate a growing deficit, but makes no mention of “other tax increases”. Is this the famous (or infamous) unrealized income taxes?

https://budgetmodel.wharton.upenn.edu/issues/2024/8/26/harris-campaign-policy-proposals-2024

Also, just curious if a 33% increase in the corporate tax rate would cut corporate investment and reduce future GDP. It’s a policy that seems to be at odds with the effort to increase “made in America” by the Biden Administration.

Also, would a $25K grant for new homebuyers be inflationary by stimulating more demand in a short supply housing inventory situation?

mystery meat? Is that a redux of Ted Cruz claiming Haitian immigrants stealing pet cats for their dinner? Yea Cruz is a racist. So are you.

But come on Bruce – the Harris plain is out there if you had the intelligence to READ. But you don’t. BTW – Harris has a tab on the Trump plan too. Classic.

“Also, just curious if a 33% increase in the corporate tax rate would cut corporate investment and reduce future GDP.”

First of all – 28 minus 21 = 7 not 33. Yea Brucie flunked preK arithmetic. But no – the economics and evidence on this supply side stupidity is clear. And yea – you are STUPID.

On housing – the Harris proposal would increase supply by 3 million houses. I can that is something else you are too dumb to get.

Keep it coming Brucie – Antoni is giving you a real race for dumbest Trump troll ever.

“First of all – 28 minus 21 = 7 not 33. Yea Brucie flunked preK arithmetic. But no – the economics and evidence on this supply side stupidity is clear. And yea – you are STUPID.”

I did not write 33 percentage points….

I always suspect that you are dyslexic the way you read things into comments.

“I did not write 33 percentage points”

Little Brucie thinks he’s a clever little boy. No – your writing was designed to be misleading. I would take this up with your preK teacher but I hear she is still trying to get you to under “See Dick Run”.

Hey Brucie – call us when you learn to be honest and actually make it to first grade.

C’mon man. Just admit your response was fire, ready, aim.

BTW. The New York Times had an interest piece on KH’s tax plans today.

What We Know About Kamala Harris’s $5 Trillion Tax Plan So Far

The vice president supports the tax increases proposed by the Biden White House, according to her campaign.

6m ago

Kamala Harris, in a lavender blazer, speaking into two mics at a lectern with a crowd of people seated behind her.

Kamala Harris’s campaign said this week that she supported tax hikes that were thoroughly laid out in the most recent federal budget plan prepared by the Biden administration.Bridget Bennett for The New York Times

In a campaign otherwise light on policy specifics, Vice President Kamala Harris this week quietly rolled out her most detailed, far-ranging proposal yet: nearly $5 trillion in tax increases over a decade.

That’s how much more revenue the federal government would raise if it adopted a number of tax increases that President Biden proposed in the spring. Ms. Harris’s campaign said this week that she supported those tax hikes, which were thoroughly laid out in the most recent federal budget plan prepared by the Biden administration.

No one making less than $400,000 a year would see their taxes go up under the plan. Instead, Ms. Harris is seeking to significantly raise taxes on the wealthiest Americans and large corporations. Congress has previously rejected many of these tax ideas, even when Democrats controlled both chambers.

While tax policy is right now a subplot in a turbulent presidential campaign, it will be a primary policy issue in Washington next year. The next president will have to work with Congress to address the tax cuts Donald J. Trump signed into law in 2017. Many of those tax cuts expire after 2025, meaning millions of Americans will see their taxes go up if lawmakers don’t reach a deal next year.

Here’s an overview of what we now know — and still don’t know — about the Democratic nominee’s views on taxes.

Higher taxes on corporations

The most recent White House budget includes several proposals that would raise taxes on large corporations. Chief among them is raising the corporate tax rate to 28 percent from 21 percent, a step that the Treasury Department estimated could bring in $1.3 trillion in revenue over the next 10 years.

Because the vice president supports the Biden budget’s tax hikes, Ms. Harris has also endorsed raising a tax on stock buybacks to 4 percent from 1 percent. Democrats first approved the stock buyback tax in 2022 as part of the Inflation Reduction Act. The legislation also requires big companies to pay taxes worth at least 15 percent of the income they report to investors. The goal of the new minimum tax is to curb companies’ ability to use deductions and tax credits to shrink their tax liability to as low as zero. Mr. Biden’s budget — and now Ms. Harris’s presidential campaign — calls for increasing that minimum tax to 21 percent from 15 percent.

In his budget, Mr. Biden also put out an overhaul of how multinational companies’ foreign earnings are taxed in the United States. The goal is to bring the United States into compliance with an international agreement that aims to stop companies moving into low-tax jurisdictions to avoid paying taxes. Mr. Biden’s budget calls for increasing and reorganizing a global minimum tax. Under the plan, the tax would be assessed on income in each individual country where the company operates, rather than on its global profits overall. The rate would double to 21 percent from 10.5 percent.

The budget Ms. Harris has now adopted also disallows companies from deducting the compensation of all employees making more than $1 million.

High-earning Americans would pay more

The White House tax plan would raise taxes on high-income Americans through two avenues: First, by increasing the rate they pay on existing income taxes, and second, by more broadly reshaping the taxation of investment gains for the wealthiest taxpayers.

Ms. Harris would set the top marginal income rate at 39.6 percent, up from 37 percent. On top of that, she would also increase the rate on two parallel Medicare surtaxes to 5 percent from 3.8 percent for Americans making more than $400,000 and expand the income subject to one of them. Together, the Medicare and income proposals would create a top marginal rate as high as 44.6 percent.

Wealthy Americans would see more fundamental changes in how gains on investments in stocks, bonds, real estate and other assets are taxed. For Americans making more than $1 million a year, investment earnings would be taxed at the same rate as regular income, instead of at the lower rates for capital gains.

The White House tax plan targets what some Democrats see as a gaping loophole in the tax code: the so-called step-up in basis. Under the current law, Americans owe capital-gains taxes when an asset is sold, but not if they pass those assets on to someone else at the time of their death. That means someone who inherits assets from a deceased parent, for example, does not have to pay taxes on how much those assets appreciated since they were purchased. Instead, the person who inherits the assets has to pay taxes on the gains only from the time they were inherited — and only once they are sold.

Ms. Harris has endorsed a plan to tax the gains on those assets at the original owner’s death, though several exemptions would apply, including when a surviving spouse inherits the assets.

The tax plan would also try to tax the wealthiest Americans’ investment gains before they sell the assets or die. People with more than $100 million in wealth would have to pay at least 25 percent on a combination of their income and their unrealized capital gains — the value of the appreciation in the stocks, bonds, real estate and other assets that they own but haven’t sold. The so-called billionaires-minimum tax could create hefty tax bills for people like Elon Musk who derive much of their wealth from stock they own.

Questions still loom

Ms. Harris’s commitment to the White House budget clarifies much about how she hopes to raise revenue if she wins the election in November. But even the thick White House budget leaves several key tax questions unaddressed, including how exactly Democrats should approach the expiration of key provisions in the Tax Cuts and Jobs Act next year.

The expiring measures included a broader standard deduction, lower marginal income rates for many Americans, and a generous deduction for owners of many closely-held businesses. The White House tax plan states that Americans making less than $400,000 should not see tax increases in a deal. That means that Ms. Harris wants to extend much of the Tax Cuts and Jobs Act, her Republican rival’s signature legislative accomplishment.

Extending the tax cuts for Americans making less than $400,000 could take up much of the roughly $4 trillion cost for continuing all of the lapsing provisions.

Ms. Harris’s campaign has said she would seek to reduce the deficit. But other proposed tax cuts are piling up. On the campaign trail, Ms. Harris has rolled out spending plans and several tax cuts, including a more generous child tax credit, that the Committee for a Responsible Federal Budget estimates could cost roughly $2 trillion over a decade.

This week, Senator Chuck Schumer, a New York Democrat and the majority leader, called for the restoration of a huge tax break: the state and local tax deduction. That deduction is currently capped at $10,000, but the limit expires after next year. Fully restoring the ability of Americans to deduct their state and local taxes from their federal bills could cost roughly $1 trillion over a decade.

So the $5 trillion in tax increases embraced by Ms. Harris this week may not ultimately be enough to cover the cost of her and other Democrats’ ambitions next year.

A version of this article appears in print on , Section A, Page 17 of the New York edition with the headline: What We Know About Harris’s Plan to Raise $5 Trillion More in Taxes. Order Reprints | Today’s Paper | Subscribe

Bruce Hall

September 10, 2024 at 12:18 pm

Wait – first you claim there are no details to the Harris plan and now you note a story with lots of details. Make up your mind little troll.

Now we should never expect anything more than this childish trolling from little Brucie boy as little Brucie boy’s entire goal in life is to be one dishonest worthless troll.

Dude – you are wasting everyone’s time with your incessant garbage. Maybe one day little Brucie boy will grow up but no one is holding their breath.

I wonder why lying little Brucie did not provide this:

https://budgetmodel.wharton.upenn.edu/issues/2024/8/26/trump-campaign-policy-proposals-2024

Go to table 2. Capital stock down. Labor force down. Output down.

Yea – supply side economics at its finest.

Come on Brucie – you know you are a partisan piece of trash. But do you have to be so damn obvious about it!

Once again, pgl, you failed the reading test.

https://econbrowser.com/archives/2024/09/if-you-really-are-worried-about-federal-debt-accumulation#comment-316366

What is the “other tax increases”?

No worthless little jerk. I can read beyond whatever Kelly Anne puts in front of my face. Obviously you cannot. But thanks again for wasting our time with your stupid little rants.

You are the laziest and stupidest MAGA moron ever. Try this:

https://www.forbes.com/sites/robertwood/2024/08/28/kamala-harris-has-big-plans-for-your-taxes-here-is-what-you-could-pay/

Oh I’m sorry. I forgot you read at the level of a three year old. So I will take the highlights for baby Brucie boy:

Like President Biden, Vice President Harris wants to increase the highest marginal income tax rate for the top 1% of earners from the current 37% to 39.6%.

Tax On Unrealized Capital Gain

Higher Estate Tax

Now maybe the link you provided did not provide the details but that does not mean they are some “mystery”. This does mean you are as dishonest, as lazy, and as stupid as it gets. Then again – everyone has known that for years.

Theory suggests that increasing the corporate tax rate would reduce investment, thereby slowing output growth, but only in the most simplified models. In reality and in more elaborate models, capital investment is a shield against taxes – a fact known to most people with even a passing familiarity with economics.

Now, let’s take a look at some data. Here’s a picture of corporate tax receipts as a share of GDP and the growth rate of GDP:

https://fred.stlouisfed.org/graph/?g=1tztU

As you can see, growth was considerably stronger when corporate tax revenues were higher. Given that growth is positively correlated with corporate tax payments and that investment is a shield against tax payments, there is neither a theoretical nor an empirical case to be made against raising the corporate tax rate.

Now that I’ve cleared that up for you, you won’t be making this mistake again, I trust.

Every serious model of investment and long-term economic growth factors in the impact of a fiscal policy on real interest rates. Buth then I said serious model which we know little Brucie does not do.

Macro,

While investments reduce taxable profits, your correlationPolicymakers might say, “well, we raised tax rates from 10 percent to 15 percent, and we didn’t see the economy slow down,” Rebelo says, so they might think that raising them to 30 will have no impact, either. “But the more you raise them, the bigger the effect, because then you’re crowding out more productive entrepreneurs.”

High corporate taxes (and regulations) may actually benefit the big corporations at the expense of smaller corporations and startups. Then we hear cries of “monopolies”. https://insight.kellogg.northwestern.edu/article/does-lowering-the-corporate-tax-rate-spur-economic-growth

Nothing is ever as simple as it first appears.

“While investments reduce taxable profits”

That had to be the dumbest statement that I ever read. But then I read the rest of your comment and it just got dumber and dumber.

Brucie – since you are totally incapable of making a real point, find another hobby. Like learning to tie your shoe laces.

Brucie – did you even READ your own link? Let me help you out here:

history shows no real link between tax rates and economic growth. The economy of the United States, for example, has grown at a steady rate since 1870 (an average of about 3 percent per year)—despite ups and downs in the corporate income tax rate. “If taxes made a huge difference, we should see their impact in U.S. data, and we don’t really see it,” Rebelo says.

Wow – this just demolished your claim and made Macroduck’s point. Come on Brucie – we have been through this before. Learn to READ your own links,

Well, I see you skimmed the first part, but ignored the rest.

To reconcile these conflicting observations, the researchers designed an economic model where the effects of taxation on growth are nonlinear.

“What that means,” Rebelo explains, “is that a small tax rate change has a small impact, but a large tax rate change has a disproportionately large impact.”

The key to this model is the assumption that entrepreneurial ability follows a Pareto distribution—the statistical pattern popularly known as the 80/20 rule, whereby a small number of individuals create a huge proportion of the outcomes.

“A few companies account for most of the growth in the economy,” Rebelo notes. An obvious example is Apple with Steve Jobs as its driving entrepreneurial force.

How High Is Too High?

The notion that low corporate tax rates have negligible effects on growth can be deceiving, Rebelo says, creating the impression that you can raise taxes with impunity.

Policymakers might say, “well, we raised tax rates from 10 percent to 15 percent, and we didn’t see the economy slow down,” Rebelo says, so they might think that raising them to 30 will have no impact, either. “But the more you raise them, the bigger the effect, because then you’re crowding out more productive entrepreneurs.”

By discouraging these superstars from starting businesses, you lose out on the creation of a large number of jobs. “The more you do that, the more you slow down the economy,” he says.

So how high a corporate tax is too high?

Unfortunately, there just isn’t enough data to pin down a specific tipping point, Rebelo explains. What is clear from the data is that it is the actual tax rate that affects growth, not the change from the previous rate. For example, going from 10 to 5 percent is a huge change in proportional terms (a 50 percent cut!), while a change from 35 to 30 is much smaller, percentage-wise. Yet in the researchers’ model, the latter tax cut would have a much bigger impact on the economy.

I ignored the gibberish. Now I should do the same with your incessant gibberish as they is all you got.

Hey Brucie – please take out a full page ad in the NYTiimes when you finally grow up. Assuming the Times is still around in 2045.

“How High Is Too High?”

This indecisive junk science reminds me of that Laffer (or was it Laugher) Curve. When that nonsense first came out the late great James Tobin modeled it out and his top of the Laugher curve turned out to be a rate near 82%.

Hey Brucie – I bet you think 28% is approximately 82%. Given your single digit IQ, this would all make sense to you!

Bruce Hall has a knack of quoting people he does not know. The latest? Sergio Rebelo. Has Brucie read anything else by this economist? William Gale – who is a lead authority on fiscal matters has. Check this entire paper as it is interesting:

https://www.milkenreview.org/articles/trends-3

The States Try Supply-Side Tax Cuts by william g. gale, aaron krupkin and kim Rueben

I’ll note one relevant portion as we know Brucie is reading impaired:

‘But the Reagan and Bush tax cuts, each about 2 percent of GDP, were small potatoes compared to the tax increases during and after World War II, when federal taxes rose by more than 10 percent of GDP. That’s right, not 10 percent of taxes, but one-tenth of the entire economy. Income tax rates went up for virtually everyone, and revenues and rates stayed higher for decades. In fact, between 1944 and 1963, the top tax bracket never fell below 90 percent. According to supply-side theory, that should have killed the economy. Instead, according to Nancy Stokey (of the University of Chicago) and Sergio Rebelo (of the Kellogg School), real per capita growth rates differed little from the historical averages.’

Oh my! Brucie did not know that Rebelo’s research undermines Brucie’s BS! There is a lot more here from real economists but Brucie does not know economics. MAGA!

If you know that things are never as simple as they first appear, why do you post simplistic notions like corporate taxes reducing investment? Why do you post garbled stuff about ever-higher tax rates when the history since Kennedy has mostly been lower tax rates?

There is no straight-forward growth argument against higher corporate taxes given the current current tax rate. If we get to a 40% corporate rate and somebody proposes an increase, drag out your argument. Right now, it’s just dishonest or ignorant. Or both.

Note that the largest blue stripe in the Economist picture is “Other tax increases” in the Harris panel, while the biggest pinky-orange stripe for either Harris or Trump is extending tax cuts. Both Harris and Trump end up increasing the deficit, though Harris increases the deficit only half as much as Trump.

What can we take from this? There is plenty of room to reduce the deficit through taxation. Most of the action, either direction, is from tax policy. The “Big spenders” label misses the point, and it’s a big miss.

Harris plans to do some social spending, yes, but the big debate is over taxes. Tax imports. Extend tax cuts ($400,000 seems a little high). “Other” taxes. Corporate tax rates. We even turn social plans into tax cuts so that, absent EITC-like provisions, the poor miss out on social “spending”. How did this happen? How did “keep your hands off my pile” become THE budget issue?

Poland is showing concern at Russia’s reckless missile and drone use:

https://euromaidanpress.com/2024/09/07/polish-fm-we-may-intercept-russian-missiles-to-protect-ukrainian-nuclear-plants/

Of course, Poland has far greater concerns about Russia, what with Putin’s generally aggressive behavior toward its neighbors.

Just a thought – Russia’s war against Ukraine has been intentionally vicious toward civilian targets. Missiles and drones are a large part of the hell inflicted on non-combatants. If I were Poland’s military planners, I’d want to practice defending against missiles and drones. And I’d want Russian military planners to see me practicing and to see that I’m good at defending against them. Think “Iron Dome”.

If Poland’s leaders see Russia as a serious threat (it is), then shooting down some sloppily-aimed drones is just good policy.

So far, NATO membership is restraining Poland from shooting down Russia weapons. Remember how Putin claimed NATO membership would make Ukraine a threat to Russia? Seems a pretty flimsy argument in light of actual NATO behavior.

It appears that some of Russias drones and missiles are falling down in Romania, Latvia, Poland, Belarus and Russia itself – as a result of improved Ukrainian electronic warfare. There is definitely justification for more aggressive air defenses

I noted how Ted Cruz spread some incredibly racist lie about immigrants but it seems to I failed to give JD Vance credit for this:

A Viral Racist Lie Is How Republican Politics Works

https://www.msn.com/en-us/news/politics/a-viral-racist-lie-is-how-republican-politics-works/ar-AA1qha4T?ocid=msedgdhp&pc=U531&cvid=183e8568a16245f3b666043adf1e4d59&ei=8

Haitian immigrants are in the country legally, and they do not eat cats. On Monday, however, Ohio senator J.D. Vance, Donald Trump’s running mate, falsely claimed otherwise. “Months ago, I raised the issue of Haitian illegal immigrants draining social services and generally causing chaos all over Springfield, Ohio,” he posted on X. “Reports now show that people have had their pets abducted and eaten by people who shouldn’t be in this country. Where is our border czar?” Other conservatives quickly repeated Vance’s lie.

Yea – Vance and Cruz are just trying to be like their hero Donald Trump. And of course they share this trait with the likes of Bruce Hall.

Real Gross Private Domestic Investment

https://fred.stlouisfed.org/series/GPDIC1

I providing this data on US real investment given Bruce Hall’s fake concern over this issue. It seems Trump managed to screw up the Obama boom well before the pandemic. Notice real investment was falling a full half year before the pandemic but then collapsed in 2020. Since Biden-Harris investment has risen considerably.

Brucie boy might have known this had he read any real economics or bothered to check the BEA data (which FRED provides). But NO – Brucie boy only listens to Faux News and reads the kind of trash he features he regularly. Which is why Brucie boy will remain the number one MAGA moron.

This has to be the most juvenile thing I’ve seen for a while:

“LARRY KUDLOW: Joe Biden and Kamala Harris are completely incapable of telling the truth”

You guessed it – this was a Faux News headline. No need to bore anyone with the stupid trash Lying Larry Kudlow the Klown actually babbled.

Like you’re rubber and I’m glue LARRY? Yea – Trump and has boy JD lie 24/7. So you were ordered to say this nonsense. Good boy LARRY!

The presumption that tariff tax income can be calculated by simply taking 10% of all current imports and 60% of current imports from China is not honest – although I understand why it’s hard to do better. China has and will continue to send their products through third countries with lower rates. Furthermore, the whole tariff concept was sold to MAGA morons as a way to get jobs back to the US. In that case there will be less tariff income. They certainly will be a massive tax increase for the consumer class.

Macroduck: “Theory suggests that increasing the corporate tax rate would reduce investment, thereby slowing output growth, but only in the most simplified models. In reality and in more elaborate models, capital investment is a shield against taxes – a fact known to most people with even a passing familiarity with economics.”

This is easy to understand for anyone who has actually owed and run a business. Increasing the corporate tax rate increases the incentive to reinvest profits. Decreasing the corporate tax rate increases the incentive to withdraw profits.

Take the example of Bell Labs. Back in those days the corporate tax rate was 50%. The CEO had a simple choice — give 50% tax to the government and keep 50% as profit or reinvest 100% of profits in R&D and keep all 100%. The investment in Bell Labs blue-sky research paid off well.

Reducing the corporate tax rate decreased the incentive for R&D investment, increased the incentive for profit taking, and led to the demise of Bell Labs.

The corporate tax is an abomination and a very inefficient method of taxation. There a billions wasted each year on tax lawyers and accountants to find ever more clever ways of avoiding this tax, with shady accounting or gimmicks like funneling profits through Ireland.

The purpose of a corporation is to deliver profits to investors. Better to eliminate the corporate tax and tax the recipients of those profits directly. Corporations have many ways to hide their profits. Investors do not. There are only two ways for corporations to distribute their profits to investors — dividends and capital gains — and both of these are completely transparent to the IRS. There’s no way to hide the income. (Note that stock buybacks are just a mechanism for converting dividends to capital gains, so nothing missing there if you tax the gains).

The capital gains should be taxed each year — realized or unrealized. “What!” the Wall Street mavens cry. “You can’t tax unrealized gains.” But of course you can. That is exactly what private equity and hedge fund managers do. Their standard “2 and 20” fee structure is a 20% tax on unrealized gains they extract from their customers every year. There’s nothing unusual about taxing unrealized gains.

The best thing about taxing investors dividends and capital gains is that there is no way to conceal it as you can the corporate tax. You can set the tax rate to be whatever necessary for revenue to replace the old inefficient corporate tax. All you are doing is changing the location of taxation.

Did Wharton consider the millions of migrants that Trump will deport? “Unauthorized immigrants pay sales taxes, as does everybody else, and very significant numbers of them also have federal and state tax withholding in their paychecks,” and “The Social Security Administration estimated in 2010, for example, that such immigrants contribute $12 billion per year more to the Social Security system than they take out,” https://apnews.com/article/fact-check-immigrants-taxes-rent-vaccine-requirements-983035929946

Also the economic and social costs – as we scramble to find workers to pick our produce, build our houses, stock our groceries, care for our grandparents, etc. and other vital services and wonder where our neighbors have gone – businesses in Florida are not happy with DeSantis’ racist policies https://www.npr.org/2024/04/26/1242236604/florida-economy-immigration-businesses-workers-undocumented

Not only is Donald Trump an adjudicated rapist, proven business fraudster, and traitor to the U.S. (stolen documents) that constantly calls military personal “suckers” and “losers” – he is a a “misogynistic pig.” (see Liz Cheney quote https://www.yahoo.com/news/liz-cheney-rips-trump-j-200142940.html) – Trump is also a disgusting racist – https://www.scientificamerican.com/article/trumps-massive-deportation-plan-echoes-concentration-camp-history/

It makes me wonder if the GOP sycophantic “leaders” properly vetted their candidate? https://www.theatlantic.com/magazine/archive/2024/10/trump-gop-support-jd-vance-2024/679564/ or were they just thinking more tax cuts for rich donors and gutting of regulatory agencies?

James: No, PWBM didn’t consider deportation. On whether the GOP was just thinking more tax cuts for rich donors and gutting regulatory agencies, my answer is “yes”.

I provided their discussion of the Trump plan under that babbling and rambling from our favorite MAGA moron (Bruce Hall). Take a look at

Table 2: Economic Effects of the Trump Campaign Policy Proposals

It shows a modest decline in hours work but nothing on the possible reduction in the number of workers from a massive deportation.

Ivan: “I seem to remember an old GOP flat tax proposal that would tax all income the same 25% with no deductions. It was countered by: “sure as long as we let the first $25K go tax free (to cover basic survival)”. Then nobody talked about it anymore because someone did the calculations.”

Just to clarify, I said nothing about a “flat tax”. I said there should be no rate difference between ordinary income and capital gains or dividend income. That doesn’t preclude progressive tax rates, just that all income should be taxed the same at those progressive rates. This would greatly simplify the tax system and eliminate a lot of wasteful tax arbitrage.

I got that. You just reminded me that GOP once came up with the idea of taxing all income at the same rate – but realized how bad that would be for the rich. Then they they went full speed on the idea of taxing the kind of income that rich people have, at lower rates.