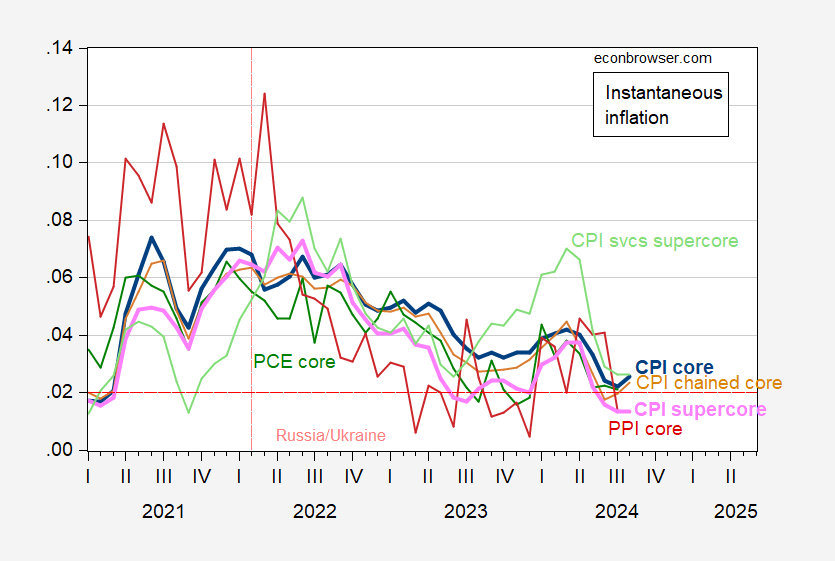

With August CPI release, we have core, chained core, supercore, and services supercore (via P. Skrzypczynski). PPI comes tomorrow.

Figure 1: Instantaneous inflation for core CPI (blue), chained core CPI (tan), supercore CPI (pink), services supercore (light green), PPI core (red), and PCE core (green), per Eeckhout (2023), T=12, a=4. Source: BLS, BEA, Pawel Skrzypczynski, and author’s calculations.

While instaneous core has risen, supercore has stabilized.

We won’t have a Taylor rule update from the Atlanta Fed until after the FOMC meeting – no new PCE deflator data – but for now, standard settings put the “appropriate” funds rate at between 3.40% and 4.75%, compared to the current effective fed funds rate of 5.33%. Today’s CPI data don’t seem likely to change that much.

I’d love to see Trump’s reaction to a 50 basis point cut.

“I’d love to see Trump’s reaction to a 50 basis point cut.”

Trump: Very unfair to me! Vary unfair to me!

The market opened down a bit which some cable babbling claimed was because core inflation was still too high. It seems the market is rallying now.

VoxEU has published a howl against “degrowth” research, as it currently stands:

https://cepr.org/voxeu/columns/no-solid-scientific-basis-degrowth

This is a literature survey, and to a substantial degree, probably a fair one. How would one use standard techniques of economic analysis to study something that has never been tried? By analogy, we know that estimates of the budget and growth effects of changes in tax policy are often badly wrong, and there is a long record of taxation on which to base those projections. So “degrowth” estimates are all wild speculation, because they can’t be otherwise.

We should understand that, and Jeroen van den Bergh and Ivan Savin make it clear, but we needn’t blame “degrowth” researchers unless they do a bad job with what they have. The authors appear to blame “degrowth” researchers for failing to do the impossible.

Where I think the authors of this review show their own bias is in praising “degrowth” studies which take into account political feasibility, and declare “degrowth” non-viable. That’s not economics. That’s Larry Summers telling Obama that a large enough fiscal package is politically non-viable, and then admitting to Chistina Romer that he was wrong. These two a steeped in the social side of environmental research, but that doesn’t excuse condemning other authors for failing to adopt their own political assumptions. We need to know what is economically possible, what is economically beneficial, what is economically inevitable, and then we can deal with politics.

And, oh, by the way, demographic trends throughout much of the world make falling output likely, with or without policy aimed at managing that outcome. A bias against “degrowth” is kinda like a bias against climate change. Fingers jammed in ears, shouting “no, no, no, no!” until a thirty-year drought has the West on fire, Phoenix at 100+ degrees for weeks on end and northern ice melting faster than anyone had guessed just 5 years ago.

Your good buddy was on Faux Business News touting his Great Replacement Theory this morning. And of course he is again accusing the BLS of lying.

Kevin Drum attempts to provide an informative post but …

https://jabberwocking.com/inflation-remains-well-controlled-in-august/

Inflation remains well controlled in August

‘CPI inflation rose 2.3% in August:’

Hey Kevin – could you learn to write. ‘CPI prices rose by’ or ‘the inflation rate was”. Dude – you are normally better than that. BTW your reader Rick Jones asks the correct question. Damn!

Speaking of inflation, or deflation in this case:

https://fortune.com/2024/09/09/china-economy-deflation-consumer-inflation-price-wage-spiral/

The financial press us full of this kind of story because of the latest data dump.

There is also this useful warning about deflation in highly indebted economies:

https://www.cnbc.com/video/2024/09/05/analyst–chinas-deflationary-spiral-is-the-last-thing-we-want.html

Big worry. For everybody.

The Chinese should study up on the Debt Deflation Theory introduced by Irving Fisher and most recently discussed by Ben Bernanke.

“Macroeconomics of the Great Depression: A Comparative Approach”, Bernanke, Ben, Journal of Money Credit and Banking, February 1995.

https://fraser.stlouisfed.org/title/journal-money-credit-banking-1169/macroeconomics-great-depression-a-comparative-approach-2399