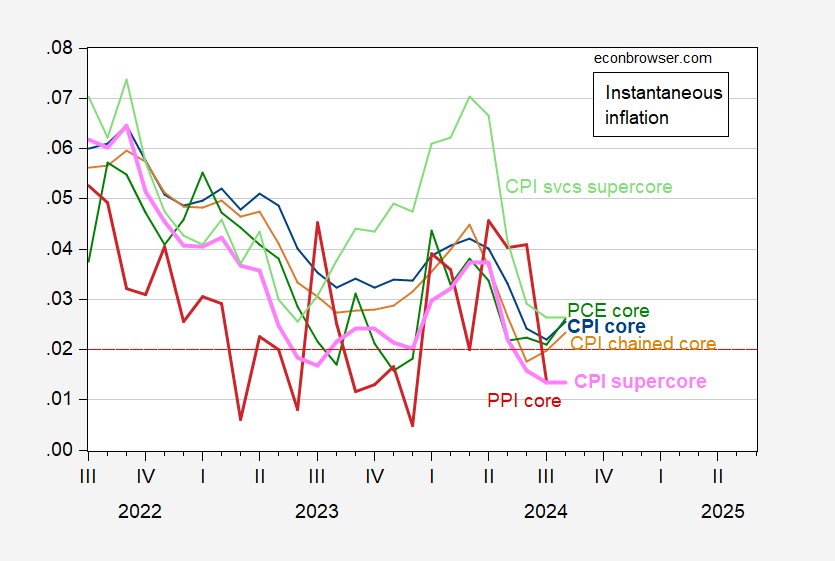

With the PPI release, and Cleveland Fed PCE nowcast as of today:

Figure 1: Instantaneous inflation for core CPI (blue), chained core CPI (tan), supercore CPI (pink), services supercore (light green), PPI core (red), and PCE core (green), per Eeckhout (2023), T=12, a=4. August observation for PCE deflator is nowcast as of 9/12/2024 (yoy measure). Horizontal red dashed line at 2% PCE inflation target (for CPI should be about 2.5%). Source: BLS, BEA, Pawel Skrzypczynski, Cleveland Fed, and author’s calculations.

CPI up and PPI down? Retail margins rising?

It seems the WSJ oped folks have found someone more dishonest than EJ Antoni – good old Phil Gramm. Kevin Drum reads the lies so we don’t have to:

https://jabberwocking.com/surprise-the-wall-street-journal-misleads-on-social-welfare-spending/

Surprise! The Wall Street Journal misleads on social welfare spending.

It contained a blizzard of statistical claims but not a single one was sourced to anything. Here are three of them:

Means-tested social-welfare spending totaled $1.6 trillion in 2023. This is only the case if you use pandemic-level figures, which were temporary and highly inflated. According to the OMB, social welfare spending in 2019 came to about $1.1 trillion. Half of that was Medicaid and the other half was everything else.

Since funding for the War on Poverty ramped up in 1967, welfare payments received by the average work-age household in the bottom quintile of income recipients has risen from $7,352 in inflation-adjusted 2022 dollars to $64,700 in 2022. Gramm is seriously claiming that poor households in the US, on average, receive $64,700 in welfare benefits? The Congressional Budget Office puts it at $16,300 in 2019.

With the explosion of means-tested transfer payments, the portion of prime work-age persons in the bottom quintile who actually work has fallen to 36% from 68%. I have no idea where Gramm got this. According to the CBPP, the share of low-income people who work has been steadily between 60-70% for half a century. Other research supports this.

Yea – lies on the order of Donald J. Trump! I guess Bruce Hall is going to have to work a lot harder to keep up with this! MAGA!

Trump rejects second Harris debate

https://www.msn.com/en-us/news/politics/trump-rejects-second-harris-debate/ar-AA1qtmBd?ocid=msedgdhp&pc=U531&cvid=25a8f331e7d14310beb4bcc339b5659a&ei=16

Republican presidential nominee Donald Trump on Thursday said there will not be another debate against his Democratic rival, Vice President Kamala Harris. The former president in a Truth Social post claimed that he won his first debate against Harris on Tuesday night. He cited as evidence the fact that Harris’ campaign had challenged him to another debate shortly after the first one ended. in fact, numerous conservative commentators and some of Trump’s own supporters have said Harris outperformed him. But Trump in Thursday’s post wrote, “When a prizefighter loses a fight, the first words out of his mouth are, ‘I WANT A REMATCH.'” “Polls clearly show that I won the Debate against Comrade Kamala Harris, the Democrats’ Radical Left Candidate, on Tuesday night, and she immediately called for a Second Debate,” Trump wrote. Multiple post-debate polls actually show audiences by a sizable margin believe Harris won.

I had a discussion this morning with a couple of people who watched the Trump debacle Tuesday night as to whether Trump would want a 2nd debate. He certainly needs one. But maybe he is too chicken one person suggested to me.

Well – he is a complete coward. He won a prize fight? Does this MORON think he took on Money Mayweather? Maybe Trump did and Mayweather hit Trump so brutally, he lost want few marbles he still had.

I would make chicken noises right now but JD Vance wants to diversify his diet beyond cats and dogs and my neighbor has hens he does not want stolen!

Just a follow-up thought about the yield curve and recession. Mostly, in predicting recession the curve is diagnostic – it represents market participants thinking about future economic activity, future inflation and future monetary policy. To some extent, though, yields are also causative. The housing market tends to lead the economy, and borrowing costs lead housing activity.

Here’s a picture of mortgage spreads (30 vs 10) and the yield curve (10 vs 2):

https://fred.stlouisfed.org/graph/?g=1tGxB

The yield spread between 30-year (and 15-year) mortgages and ten-year Treasuries remains quite wide, but has narrowed from a year ago. As you can see from the picture, narrowing in the mortgage spread follows the shift in the Treasury curve toward less inversion.

The mechanics of the narrowing in the mortgage spread is related to the curve flattening, specifically to the decline in shorter-dated yields. Market participants expect a great many recent mortgages to be refinanced as rates drop – which is to say, duration of recent mortgages is seen to be short. Hedging of mortgages has shifted to shorter-duration Treasuries, to better match the expected duration of mortgages.

Point is, it’s the decline in yields on shorter Treasuries that is currently driving the decline in mortgage rates. That gives the Fed particular power in driving mortgage rates in the near term.

Y’all know this, but I’ll point it out just the same. Lots of home owners are locked into their current home by high current mortgage rates, relative to the mortgages they already have. Lots of prospective buyers are locked out of the market by the combination of high sticker prices and high mortgage rates. Under just about any circumstances, the more the Fed cuts rates, the more these two problems will ease. With mortgage rates currently sensitive to shorter-term Treasury rates, the Fed has even more than its usual power to affect the housing market.

Macroduck: “With mortgage rates currently sensitive to shorter-term Treasury rates, the Fed has even more than its usual power to affect the housing market.”

Which is all the more reason for the Fed to cut rates 50 basis points in each of their next three meetings — if not more. Inflation is whipped. Food is down, energy is down, new and used autos are down, medical care is down. The only thing left propping up inflation is housing and high Fed rates just make it worse. The Fed needs to act now, not gradually over the next two years.

I do believe that housing is a huge issue that could lead to a bad economy. and a quarter or even half point drop will not really change the market. mortgages will be impacted by a minimum of 1% drop in rates. anything less will be ineffective. people won’t refinance until the number drops to at least 1%, and buyers will not purchase until rates drop that much. so if the fed is interested in making an impact, there is a minimum change necessary to do so. I would like a larger drop, but a larger drop will result in house price appreciation as well. so 1% before the end of the year would be good, followed by a pause to see the effect. quarter point drip will not be very effective at all.

widespread media reports compare the year over year CPI change of July (+2.9%) to that of August (+2.5%) and infer or conclude like CNBC says

That put the 12-month inflation rate at 2.5%, down 0.4 percentage point from the July level ‘

even FT says:

US inflation fell to 2.5 per cent in August, setting the stage for the Federal Reserve to start cutting interest rates…

the BLS encourages that nonsense by comparing the two in its CPI press release….

the only reason the 12 month CPI rate was 0.4% lower in August than July was because last August’s 0.5% CPI increase, which was caused by a 10.6% increase in gasoline prices, dropped out of the comparison….that’s what happens every time one compares successive 12 month averages; it tells you more about prices 13 months ago than about those of today…

i just hope they aren’t making monetary policy decisions based on what the change in inflation was over a year ago…

the reverse was happening when people reported the high rates last year. my guess is you had no issue with it at that time. why be asymmetrical with your complaints? I was arguing back then that while inflation was higher, it was not really problematic and it was being taken care of slowly. but scare mongers out there wanted you to believe inflation was out of control. it was not really out of control, just a bit high for a stretch.