As of August, incorporating latest capacity utilization and production data, I’m tempted to say no, even incorporating at face value the preliminary benchmark revision to employment.

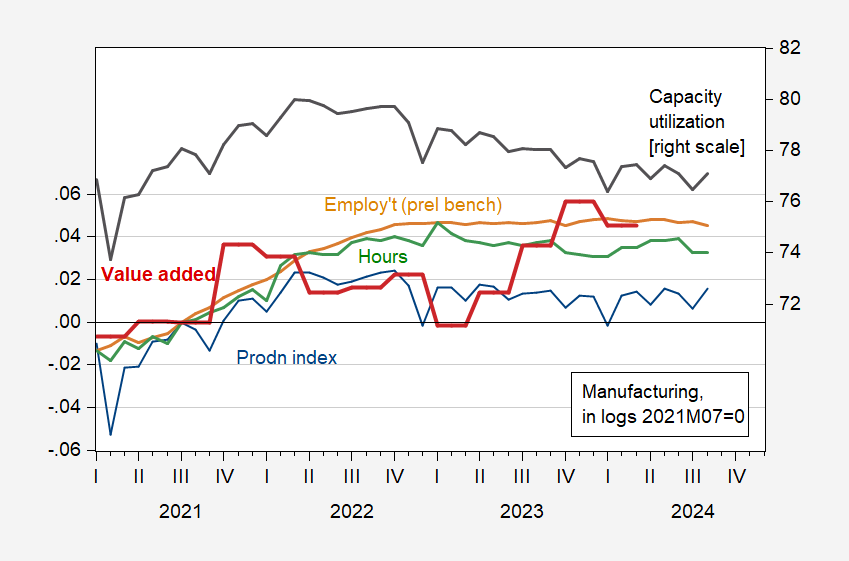

Figure 1: Manufacturing production (blue, left scale), implied employment from preliminary benchmark (tan, left scale), aggregate hours (green, left scale), and real valued added (red), all in logs, 2021M07=0, and capacity utilization in manufacturing, in % (black, right scale). Source: BLS via FRED, Federal Reserve, BLS, BEA via FRED, NBER.

Note that 2023Q4 value added was higher than in 2021Q4. Unfortunately, we don’t have data further than 2024Q1 (these data will be reported by on 9/27).

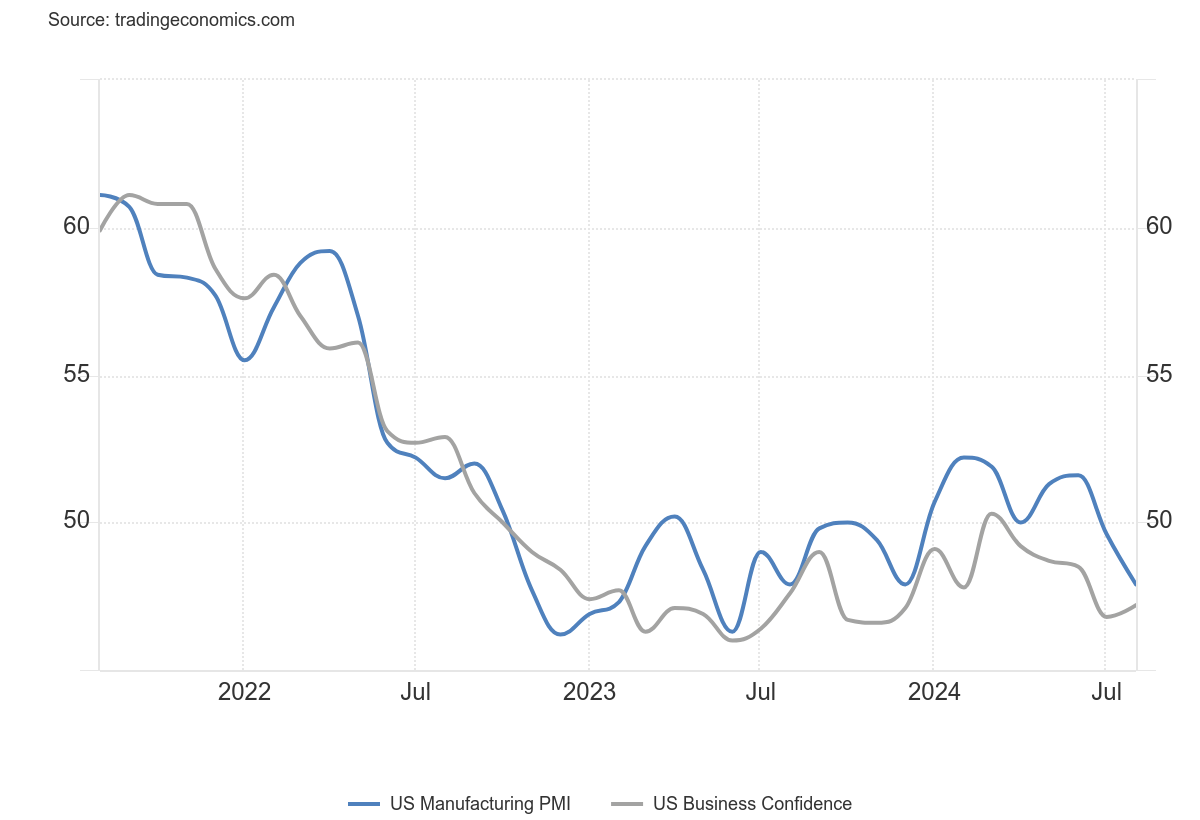

The data in support of a slowdown in manufacturing comes from diffusion indices, such as the ISM manufacturing PMI.

Source: TradingEconomics.com. Blue is S&P, gray is ISM.

“The data in support of a slowdown in manufacturing comes from diffusion indices, such as the ISM manufacturing PMI.”

This is all one gets if one reads that Twitter account ala fake PhD. EJ Antoni. Of course some might say presenting a balanced analysis of this matter makes you a MARXIST.

must be groucho MARX!

Only slightly off topic – inflation expectations and the 59 basis-point cut:

So, we’ve had us a 50 basis-point rate cut. Why 50 rather than 25? The Taylor rule gives us good reason for the move we’ve had. So does the coming in the economy evident in some data. There are other recent developments worth noting, as well. I’m late to the game on thus, but has anyone else noticed the recent slide in medium-term inflation expectations?

Here’s a picture of the 5-year TIPS breakeven against the 5-year-5-year (five-year inflation expectations starting five years from now):

https://fred.stlouisfed.org/graph/?g=1tWUr

A big one-day drop in the 5-year breakeven happened on August 2, the same day as some pretty disappointing jobs data, and the 2nd quarter had already turned out a steady slide in the 5-year breakeven. It is now below 2%, and that’s CPI-based. If we had a PCE-deflator-based TIPS series, it would probably be even further below 2%.

Delong suggests the risk of secular stagnation as an explanation. Delong often likes secular stagnation as an explanation, but here, it fits. He also recognizes that low inflation expectations weaken the power of monetary policy. Bernanke’s gift to policy makers was the rule that to avoid losing power in rate policy, you go early and go big. In its limited way, that’s what the FOMC has done.

Bombshell Report Says GOP Candidate Mark Robinson Called Self ‘Black Nazi’ On Porn Site

The North Carolina gubernatorial nominee, known for his sexist and transphobic rhetoric, also allegedly spied on women in showers and digs transgender porn.

https://www.huffpost.com/entry/mark-robinson-porn-site-black-nazi-transgender-porn_n_66ec837fe4b0e7776c3e602f

North Carolina GOP gubernatorial nominee Mark Robinson said Thursday that he’s not dropping out of his race after a CNN report uncovered years of disturbing comments he made in a forum on a porn website, including referring to himself as as a “black Nazi,” describing being sexually aroused by secretly watching women in showers, and calling himself a “perv” who likes pornography featuring transgender people ― a sharp contrast to his present-day transphobic rhetoric.

And finally his party has decided he is too toxic. Like he wasn’t toxic before this?

Stein has been polling between 5 ppts and 13 ppts ahead of Robinson, so he was looking sunk even before this news came out.

The good news here is that low GOP turnout in NC could help Harris there. Wins in NC and Georgia would mean Harris doesn’t even need Pennsylvania.

The Nazi connection can’t hurt Democrats in general, but swing voters may not even notice outside of NC.

~~~ In certain social circles this is referred to as “MAGA’s ‘new normal’ ” Outside of America it makes people mouth-vomit.

Is that clear enough for you people who make excuses for voting for donald trump by saying he’s “pro life”?? I really feel sad for some of you “fundamentalist” people. DEEPLY sad.

Main potential effect would be if GOP voters in NC get so disgusted that they decide to sit this election out. In that case Trumps endorsement/selection of Robinson could cost him NC.

Okay, I am going to quibble slightly. Two points:

1. From a reference point of 2022, manufacturing remains in a shallow recession. From a 12 month vantage point, it has rebounded since the beginning of this year. Overall the trend seems flat.

2. The ISM index is well known as a leading indicator. Further, some years ago the ISM itself published a note indicating that values below 48, not 50: were most associated with recessions. By that standard, the ISM index accurately forecast the shallow downturn in later 2023 and the 2024 shallow recovery. Now it appears to be forecasting another shallow downturn (so far).

Macroduck: “you go early and go big. In its limited way, that’s what the FOMC has done.”

Go big — in a limited way. Is that like jumbo shrimp?

Trump said it was a “big cut”. First time Macroduck ever agreed with Trump?

Going big would have been lowering interest rates to r-star and by that metric, it was far from being big.

Yes it was late and not nearly down to where we should be. But indeed it will not give the Biden economy an extra boast before the election. So the political goal of the delay – helping GOP/Trump – was a success. Trump will cry bloody murder anyway and if he gets a chance he will throw his little puddles under the bus; after his tariffs kill the economy (someone will have to take the blame and its not going to be him).

The part that confuses me is that we have seen a boom in manufacturing construction over the last 2 years, but manufacturing employment is trending down. Are all these new factories over-automated? Or are they replacing other factories that are going under?

That’s the puzzle that I can’t solve on US manufacturing right now.